-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

Non Farm Payroll (NFP) is a monthly report released by the US Bureau of Labor Statistics that measures the number of jobs added or lost from the previous month in the non farm sector. It is a critical economic indicator as it provides insights into the performance of the labor market, including the overall employment rate, job creation, and wage growth.

The non farm payroll report is considered one of the most closely watched economic releases by investors, policymakers, and economists globally. The report impacts multiple markets, including currencies, stocks, and bonds, making it a crucial element in investment decision-making.

* NFP, a crucial economic report, reflects changes in US employment, excluding specific sectors.

* Methodology involves BLS sample surveys, providing insights into employment levels, wages, and workweek hours.

* NFP impacts financial markets, influencing investor confidence, stock valuations, currency rates, and bond yields.

* Reports are released on the first Friday of each month at 13:30PM GMT.

* Understanding NFP aids economists, policymakers, and investors in forecasting, decision-making, and preventing economic downturns.

* Strategies for forecasting NFP include analysing economic indicators, historical trends, and government policies.

* Trading NFP has pros (volatility opportunities, quick profits, macro insights) and cons (high risk, market uncertainty, emotional stress).

Non Farm Payroll (NFP) is a valuable monthly economic report that shows the changes in employment levels for the US population, excluding farm workers, government employees, and non-profit organisations. The methodology used in calculating NFP is through sample surveys conducted by the Bureau of Labor Statistics (BLS) across all states and sectors of the US economy. Data is collected from businesses of all sizes, with different types of legal structures, and over a time period of one week during the month. The reports are then analysed and published on the first Friday of every month.

The non farm payroll data is a key indicator of economic health and labour market conditions. It provides a detailed overview of the national employment levels, including job losses and job creations, unemployment rate, average hourly earnings, and average number of hours per workweek. The numbers and trends presented in NFP can signal important changes in the US economy and global markets, influencing financial institutions and investors around the world.

The Nonfarm Payroll report is an essential indicator of the American economy’s health, making it a critical tool for investors and financial markets. When NFP releases positive figures, it suggests that the economy is growing, which can give investors increased confidence in investing. Meanwhile, negative data can result in market volatility and may lead to a weaker dollar.

The stock market is particularly responsive to NFP since it can indicate whether consumer spending will increase. If the job market is healthy, it is also a good sign for the housing industry, as homebuyers are more likely to make purchases if they feel secure in their jobs.

The impact of NFP on currency exchange rates is also significant, especially for the US dollar. If the job market is down, there may be less demand for the dollar, which can lead to a decline in value. On the other hand, if NFP shows an increase in employment, it can boost demand for the dollar, which may lead to its appreciation.

Bond yields may also fluctuate based on NFP data, as investors tend to move away from bonds when the job market is strong. When unemployment is high, investors may seek out the safety of bonds, which can result in lower yields.

The Non Farm Payroll report is typically released on the first Friday of each month by the U.S. Bureau of Labor Statistics (BLS). The release time is set at 8:30 AM Eastern Time (ET). This regular schedule provides consistency for market participants, allowing them to prepare and react swiftly to the new data.

While the BLS aims to release the NFP report promptly on the scheduled date, external factors can occasionally influence the timing. One such factor is public holidays, particularly if they fall on a Friday. In such cases, the report may be released on the following Friday.

The non farm payroll report, also known as NFP, is a vital economic indicator that plays a key role in economic forecasting. Economists and policymakers use NFP data to evaluate the labor market conditions and assess the health of the economy. By analyzing trends in employment levels, economists can make informed predictions about future economic growth and make crucial policy decisions.

For example, if NFP data indicates a strong increase in job creation, economists may predict a rise in consumer spending and overall economic growth. This information can then be used by policymakers to adjust monetary policy accordingly, such as raising or lowering interest rates to control inflation and stimulate economic growth.

Conversely, if the NFP data shows a decline in employment levels, economists may predict a slowdown in economic activity, which can lead to a decrease in consumer spending and investment. Policymakers can then take action to prevent a recession from occurring by using fiscal policies like stimulus packages to boost the economy.

Overall, NFP data is a key tool for economic forecasting and can provide valuable insights for investors and policymakers alike. By carefully analyzing the non farm payroll report, economists can make informed decisions about the state of the economy and predict future trends with greater accuracy.

The Nonfarm Payroll (NFP) report is a key factor that investors analyze when making investment decisions. The release of NFP data impacts the valuation of stocks, currencies, and commodities in the financial markets.

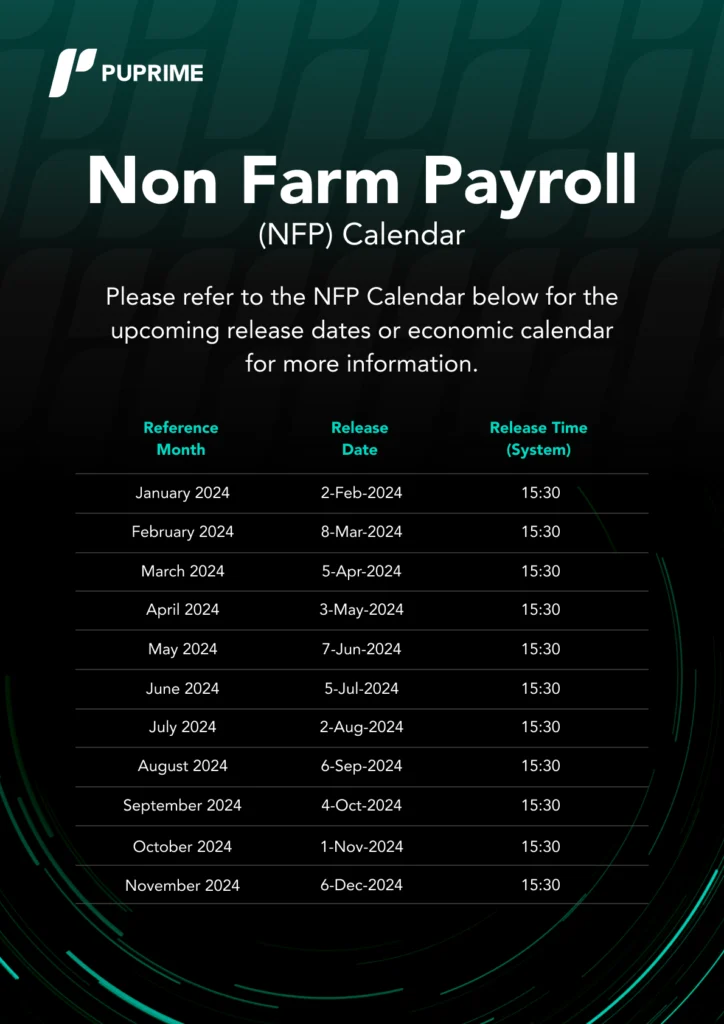

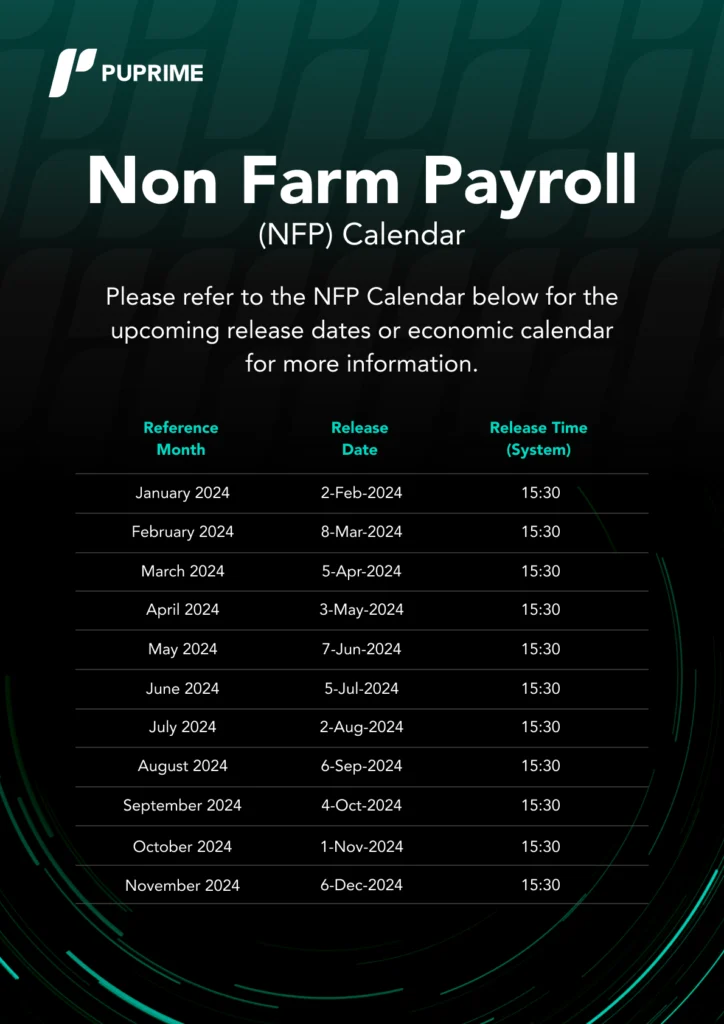

Investors utilize the NFP calendar, which shows the expected release dates of upcoming NFP reports, to plan their trades and adjust their portfolios accordingly. The calendar helps investors identify the best times to enter or exit positions and mitigate potential losses.

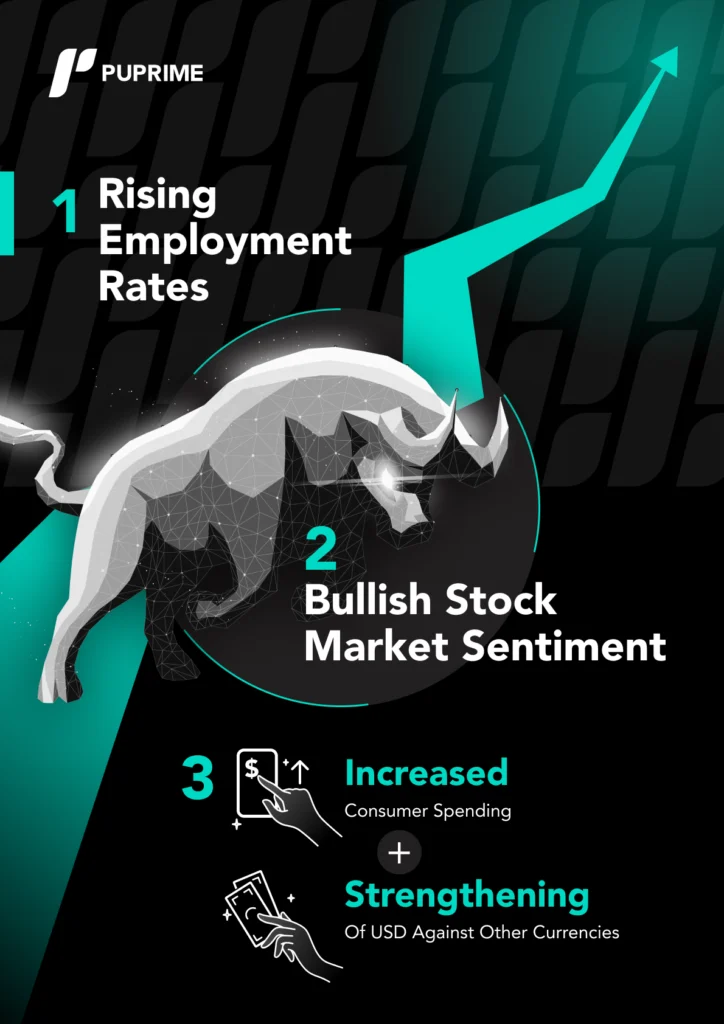

For example, if the NFP report suggests a strong employment market, investors may anticipate an increase in consumer spending. This, in turn, could lead to a rise in stock prices for companies that benefit from higher consumer spending.

On the other hand, if the NFP report indicates weak employment growth, investors may expect lower consumer spending and a decrease in stock prices.

The impact of the NFP report varies across different asset classes. In the stock market, a positive NFP report may lead to bullish sentiment, whereas a negative report may have a bearish effect. In currency markets, a strong NFP report may lead to a strengthening of the U.S. dollar against other currencies, while a weak report may lead to a depreciation of the dollar.

In summary, the NFP report plays a crucial role in driving investor sentiment and shaping investment decisions across various asset classes. It is essential for investors to keep track of NFP data releases and utilize this information to plan their trades and adjust their portfolios accordingly.

As financial markets eagerly await the monthly unveiling of the Non Farm Payrolls (NFP) report, the ability to forecast these critical employment figures becomes a key skill for investors, traders, and economists. Forecasting the exact Non Farm Payrolls (NFP) figure with precision remains a formidable challenge; nevertheless, strategic analysis and thorough research methodologies provide valuable tools for predicting and interpreting trends within the NFP data. In this part, we explore the art of NFP forecasting and offer strategies to enhance your predictive prowess.

Economic Indicators: Look at other economic indicators that are considered leading indicators of employment trends. These may include initial jobless claims, ADP employment report, and the ISM (Institute for Supply Management) manufacturing and non-manufacturing indexes.

Historical Trends: Analyze historical NFP data to identify patterns or trends. Look for seasonality, trends, or cycles that may provide insights into future movements.

Government Data and Policies: Consider other government data and policies that may impact employment, such as fiscal and monetary policies, tax changes, and trade policies.

Market Expectations: Understand market expectations and consensus forecasts. If the actual NFP data deviates significantly from these expectations, it can lead to market reactions.

Technical Analysis: Some traders use technical analysis to identify potential trends or turning points in the market. However, NFP data is known for its potential to cause sudden and sharp market movements, making it challenging to rely solely on technical analysis.

Global Economic Conditions: Consider global economic conditions, as they can influence the demand for U.S. goods and services, impacting employment.

Survey and Analyst Estimates: Pay attention to surveys and analyst estimates. Various financial institutions and economic research firms provide their own forecasts for NFP data.

Having equipped yourself with the essential tips and strategies for predicting the Non Farm Payrolls (NFP) data, it’s time to put your newfound knowledge to the test! Our exclusive NFP prediction promotion offers you the chance to showcase your forecasting skills and potentially win up to $150 USD. Click the link below to participate in this exciting challenge and turn your insights into tangible rewards.

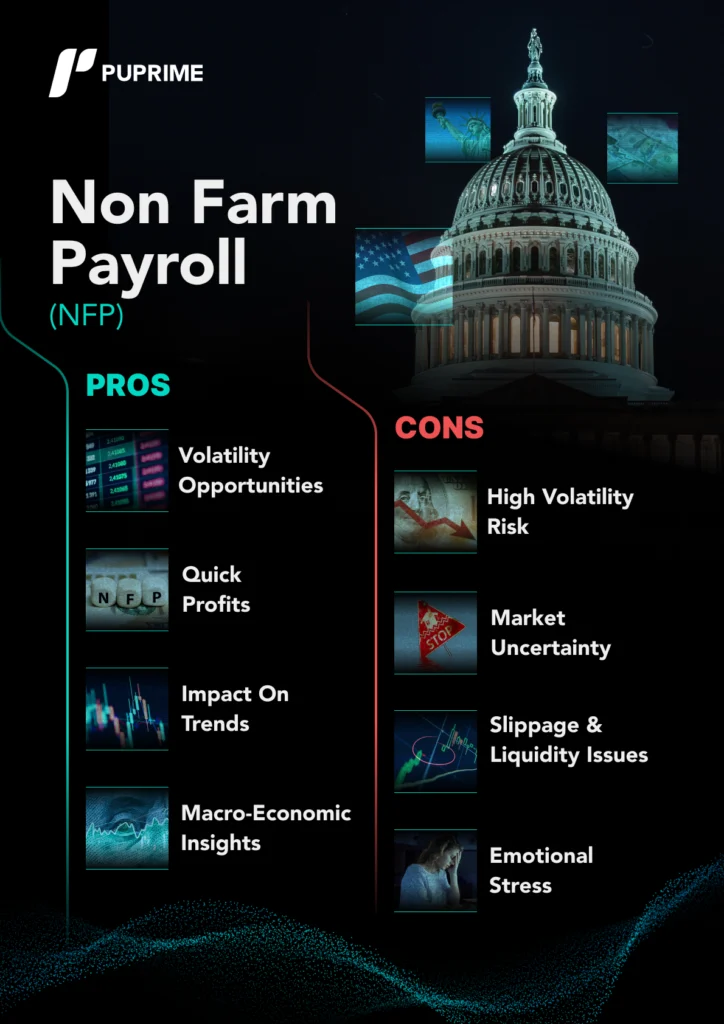

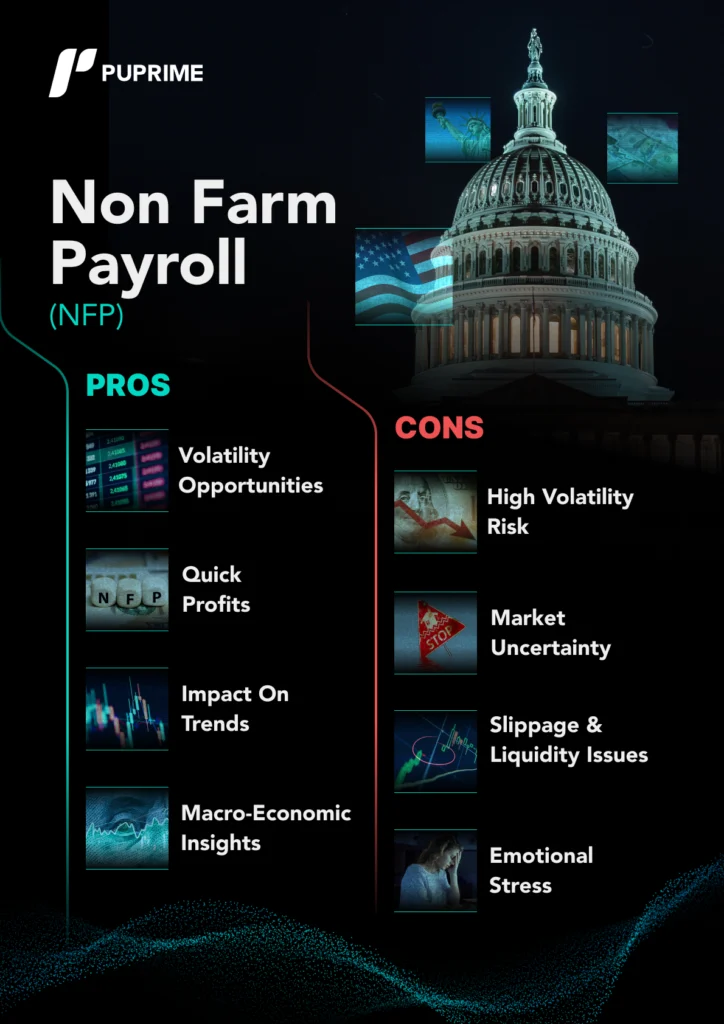

Trading the Non Farm Payroll (NFP) report can be both lucrative and challenging, and it’s essential for traders to carefully weigh the pros and cons before deciding to engage in this form of trading.

Volatility Opportunities: The release of the NFP report often leads to increased volatility in financial markets. For skilled and well-prepared traders, this volatility can present significant trading opportunities, especially in currency, bond, and equity markets.

Quick Profits: Due to the heightened volatility, traders can potentially make quick profits if they correctly predict market movements following the release of the NFP data.

Impact on Trends: The NFP report can influence the prevailing market trends, providing traders with insights into the overall health of the economy. Successfully anticipating and reacting to these trends can lead to profitable trading strategies.

Macro-Economic Insights: The NFP report offers valuable macroeconomic insights, including information on employment trends, wages, and overall labor market conditions. Traders who understand these factors can make more informed decisions about the broader economic environment.

High Volatility Risk: While volatility presents opportunities, it also comes with increased risk. Sudden and sharp price movements can result in significant losses for traders who are not adequately prepared or do not employ proper risk management strategies.

Market Uncertainty: The NFP report can sometimes lead to market uncertainty, with unexpected data releases causing confusion and erratic market behavior. Traders may find it challenging to predict market reactions accurately.

Slippage and Liquidity Issues: During periods of high volatility, traders may experience slippage, where orders are executed at a different price than expected. Additionally, liquidity can be compromised, making it difficult to enter or exit trades at desired prices.

Emotional Stress: The pressure associated with trading around the NFP release can be emotionally taxing. Traders may succumb to impulsive decisions or heightened stress, leading to poor decision-making and potential losses.

In conclusion, the non farm payroll report is a critical component of economic analysis and investment decision-making. As we have noted throughout this article, NFP provides valuable insights into labor market trends and overall economic health, shaping market sentiment and informing policy choices.

Understanding the methodology behind NFP is essential for investors and economists alike, as it provides a framework for interpreting the data and anticipating market movements. The impact of NFP on financial markets cannot be overstated, with positive or negative data releases often resulting in significant price fluctuations across stocks, currencies, and commodities.

As we move forward, it is important to keep an eye on the NFP calendar and stay abreast of data releases, as this information can help investors adjust their portfolios and make informed trading decisions. Ultimately, the non farm payroll report serves as a vital indicator of economic health and is a key tool for investors and policymakers seeking to navigate today’s complex financial landscape.

Join PU Prime’s Official Telegram Channel.

Step into the world of trading with confidence today. Open a free PU Prime live trading account today to experience real-time market action, or refine your strategies risk-free with our demo account.

NFP stands for Non Farm Payroll, which refers to a monthly report published by the U.S. Bureau of Labor Statistics. It provides data on the number of employees in the non farm sector of the economy, excluding agricultural, private household, and nonprofit industries. NFP is considered important because it serves as a key economic indicator, reflecting the overall health and vitality of the labor market. The report is closely monitored by investors, economists, and policymakers as it provides insights into job creation, unemployment rates, wage growth, and economic trends, influencing financial markets and policy decisions.

NFP is calculated through a survey called the Current Employment Statistics (CES) survey, which is conducted monthly by the U.S. Bureau of Labor Statistics. The survey collects employment data from a sample of businesses and government agencies across various industries. These establishments provide information on their employment levels, hours worked, and earnings. The NFP report includes data on job gains or losses in the non farm sector, average hourly earnings, and the unemployment rate. The methodology used aims to provide a representative snapshot of employment trends and labor market conditions.

The release of the NFP report has a significant impact on financial markets. Positive NFP data, indicating strong job growth and a robust economy, generally leads to positive market reactions. Stocks may rally, currencies can strengthen, and bond yields may rise. Conversely, negative or weaker-than-expected NFP figures can result in market volatility and pessimism. Investors closely analyze the NFP data to gauge the overall economic health, assess market sentiment, and make informed investment decisions.

NFP plays a crucial role in economic forecasting and contributes to the analysis of economic trends. By providing insights into job creation, the unemployment rate, and wage growth, NFP data helps economists and policymakers assess the overall health of an economy and predict future trends. The report assists in understanding labor market dynamics, planning for economic growth, and formulating monetary and fiscal policies. NFP is an essential tool for economic forecasting and informs decisions that affect industries, businesses, and individuals.

NFP has a significant influence on investment decisions across various asset classes. Investors closely follow the release of the NFP report and use the data to assess the strength of the labor market and its potential impact on different markets. Positive NFP data can lead investors to favor stocks, as it suggests a growing economy, while negative NFP figures may prompt investors to seek safe-haven assets like gold or government bonds. The NFP calendar, which indicates upcoming release dates for the report, is an essential tool for investors to plan trades and adjust their portfolios based on anticipated market movements.

In conclusion, NFP is a crucial economic indicator that provides valuable insights into labor market conditions and economic trends. The non farm payroll report plays a vital role in financial markets, influencing investor sentiment and shaping investment decisions. It is used by economists and policymakers for economic forecasting and policy-making purposes. Understanding NFP and its methodology is essential for investors, traders, and anyone interested in gaining a comprehensive understanding of labor market dynamics and their implications for the broader economy.

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Non Farm Payroll (NFP) is a monthly report released by the US Bureau of Labor Statistics that measures the number of jobs added or lost from the previous month in the non farm sector. It is a critical economic indicator as it provides insights into the performance of the labor market, including the overall employment rate, job creation, and wage growth.

The non farm payroll report is considered one of the most closely watched economic releases by investors, policymakers, and economists globally. The report impacts multiple markets, including currencies, stocks, and bonds, making it a crucial element in investment decision-making.

* NFP, a crucial economic report, reflects changes in US employment, excluding specific sectors.

* Methodology involves BLS sample surveys, providing insights into employment levels, wages, and workweek hours.

* NFP impacts financial markets, influencing investor confidence, stock valuations, currency rates, and bond yields.

* Reports are released on the first Friday of each month at 13:30PM GMT.

* Understanding NFP aids economists, policymakers, and investors in forecasting, decision-making, and preventing economic downturns.

* Strategies for forecasting NFP include analysing economic indicators, historical trends, and government policies.

* Trading NFP has pros (volatility opportunities, quick profits, macro insights) and cons (high risk, market uncertainty, emotional stress).

Non Farm Payroll (NFP) is a valuable monthly economic report that shows the changes in employment levels for the US population, excluding farm workers, government employees, and non-profit organisations. The methodology used in calculating NFP is through sample surveys conducted by the Bureau of Labor Statistics (BLS) across all states and sectors of the US economy. Data is collected from businesses of all sizes, with different types of legal structures, and over a time period of one week during the month. The reports are then analysed and published on the first Friday of every month.

The non farm payroll data is a key indicator of economic health and labour market conditions. It provides a detailed overview of the national employment levels, including job losses and job creations, unemployment rate, average hourly earnings, and average number of hours per workweek. The numbers and trends presented in NFP can signal important changes in the US economy and global markets, influencing financial institutions and investors around the world.

The Nonfarm Payroll report is an essential indicator of the American economy’s health, making it a critical tool for investors and financial markets. When NFP releases positive figures, it suggests that the economy is growing, which can give investors increased confidence in investing. Meanwhile, negative data can result in market volatility and may lead to a weaker dollar.

The stock market is particularly responsive to NFP since it can indicate whether consumer spending will increase. If the job market is healthy, it is also a good sign for the housing industry, as homebuyers are more likely to make purchases if they feel secure in their jobs.

The impact of NFP on currency exchange rates is also significant, especially for the US dollar. If the job market is down, there may be less demand for the dollar, which can lead to a decline in value. On the other hand, if NFP shows an increase in employment, it can boost demand for the dollar, which may lead to its appreciation.

Bond yields may also fluctuate based on NFP data, as investors tend to move away from bonds when the job market is strong. When unemployment is high, investors may seek out the safety of bonds, which can result in lower yields.

The Non Farm Payroll report is typically released on the first Friday of each month by the U.S. Bureau of Labor Statistics (BLS). The release time is set at 8:30 AM Eastern Time (ET). This regular schedule provides consistency for market participants, allowing them to prepare and react swiftly to the new data.

While the BLS aims to release the NFP report promptly on the scheduled date, external factors can occasionally influence the timing. One such factor is public holidays, particularly if they fall on a Friday. In such cases, the report may be released on the following Friday.

The non farm payroll report, also known as NFP, is a vital economic indicator that plays a key role in economic forecasting. Economists and policymakers use NFP data to evaluate the labor market conditions and assess the health of the economy. By analyzing trends in employment levels, economists can make informed predictions about future economic growth and make crucial policy decisions.

For example, if NFP data indicates a strong increase in job creation, economists may predict a rise in consumer spending and overall economic growth. This information can then be used by policymakers to adjust monetary policy accordingly, such as raising or lowering interest rates to control inflation and stimulate economic growth.

Conversely, if the NFP data shows a decline in employment levels, economists may predict a slowdown in economic activity, which can lead to a decrease in consumer spending and investment. Policymakers can then take action to prevent a recession from occurring by using fiscal policies like stimulus packages to boost the economy.

Overall, NFP data is a key tool for economic forecasting and can provide valuable insights for investors and policymakers alike. By carefully analyzing the non farm payroll report, economists can make informed decisions about the state of the economy and predict future trends with greater accuracy.

The Nonfarm Payroll (NFP) report is a key factor that investors analyze when making investment decisions. The release of NFP data impacts the valuation of stocks, currencies, and commodities in the financial markets.

Investors utilize the NFP calendar, which shows the expected release dates of upcoming NFP reports, to plan their trades and adjust their portfolios accordingly. The calendar helps investors identify the best times to enter or exit positions and mitigate potential losses.

For example, if the NFP report suggests a strong employment market, investors may anticipate an increase in consumer spending. This, in turn, could lead to a rise in stock prices for companies that benefit from higher consumer spending.

On the other hand, if the NFP report indicates weak employment growth, investors may expect lower consumer spending and a decrease in stock prices.

The impact of the NFP report varies across different asset classes. In the stock market, a positive NFP report may lead to bullish sentiment, whereas a negative report may have a bearish effect. In currency markets, a strong NFP report may lead to a strengthening of the U.S. dollar against other currencies, while a weak report may lead to a depreciation of the dollar.

In summary, the NFP report plays a crucial role in driving investor sentiment and shaping investment decisions across various asset classes. It is essential for investors to keep track of NFP data releases and utilize this information to plan their trades and adjust their portfolios accordingly.

As financial markets eagerly await the monthly unveiling of the Non Farm Payrolls (NFP) report, the ability to forecast these critical employment figures becomes a key skill for investors, traders, and economists. Forecasting the exact Non Farm Payrolls (NFP) figure with precision remains a formidable challenge; nevertheless, strategic analysis and thorough research methodologies provide valuable tools for predicting and interpreting trends within the NFP data. In this part, we explore the art of NFP forecasting and offer strategies to enhance your predictive prowess.

Economic Indicators: Look at other economic indicators that are considered leading indicators of employment trends. These may include initial jobless claims, ADP employment report, and the ISM (Institute for Supply Management) manufacturing and non-manufacturing indexes.

Historical Trends: Analyze historical NFP data to identify patterns or trends. Look for seasonality, trends, or cycles that may provide insights into future movements.

Government Data and Policies: Consider other government data and policies that may impact employment, such as fiscal and monetary policies, tax changes, and trade policies.

Market Expectations: Understand market expectations and consensus forecasts. If the actual NFP data deviates significantly from these expectations, it can lead to market reactions.

Technical Analysis: Some traders use technical analysis to identify potential trends or turning points in the market. However, NFP data is known for its potential to cause sudden and sharp market movements, making it challenging to rely solely on technical analysis.

Global Economic Conditions: Consider global economic conditions, as they can influence the demand for U.S. goods and services, impacting employment.

Survey and Analyst Estimates: Pay attention to surveys and analyst estimates. Various financial institutions and economic research firms provide their own forecasts for NFP data.

Having equipped yourself with the essential tips and strategies for predicting the Non Farm Payrolls (NFP) data, it’s time to put your newfound knowledge to the test! Our exclusive NFP prediction promotion offers you the chance to showcase your forecasting skills and potentially win up to $150 USD. Click the link below to participate in this exciting challenge and turn your insights into tangible rewards.

Trading the Non Farm Payroll (NFP) report can be both lucrative and challenging, and it’s essential for traders to carefully weigh the pros and cons before deciding to engage in this form of trading.

Volatility Opportunities: The release of the NFP report often leads to increased volatility in financial markets. For skilled and well-prepared traders, this volatility can present significant trading opportunities, especially in currency, bond, and equity markets.

Quick Profits: Due to the heightened volatility, traders can potentially make quick profits if they correctly predict market movements following the release of the NFP data.

Impact on Trends: The NFP report can influence the prevailing market trends, providing traders with insights into the overall health of the economy. Successfully anticipating and reacting to these trends can lead to profitable trading strategies.

Macro-Economic Insights: The NFP report offers valuable macroeconomic insights, including information on employment trends, wages, and overall labor market conditions. Traders who understand these factors can make more informed decisions about the broader economic environment.

High Volatility Risk: While volatility presents opportunities, it also comes with increased risk. Sudden and sharp price movements can result in significant losses for traders who are not adequately prepared or do not employ proper risk management strategies.

Market Uncertainty: The NFP report can sometimes lead to market uncertainty, with unexpected data releases causing confusion and erratic market behavior. Traders may find it challenging to predict market reactions accurately.

Slippage and Liquidity Issues: During periods of high volatility, traders may experience slippage, where orders are executed at a different price than expected. Additionally, liquidity can be compromised, making it difficult to enter or exit trades at desired prices.

Emotional Stress: The pressure associated with trading around the NFP release can be emotionally taxing. Traders may succumb to impulsive decisions or heightened stress, leading to poor decision-making and potential losses.

In conclusion, the non farm payroll report is a critical component of economic analysis and investment decision-making. As we have noted throughout this article, NFP provides valuable insights into labor market trends and overall economic health, shaping market sentiment and informing policy choices.

Understanding the methodology behind NFP is essential for investors and economists alike, as it provides a framework for interpreting the data and anticipating market movements. The impact of NFP on financial markets cannot be overstated, with positive or negative data releases often resulting in significant price fluctuations across stocks, currencies, and commodities.

As we move forward, it is important to keep an eye on the NFP calendar and stay abreast of data releases, as this information can help investors adjust their portfolios and make informed trading decisions. Ultimately, the non farm payroll report serves as a vital indicator of economic health and is a key tool for investors and policymakers seeking to navigate today’s complex financial landscape.

Join PU Prime’s Official Telegram Channel.

Step into the world of trading with confidence today. Open a free PU Prime live trading account today to experience real-time market action, or refine your strategies risk-free with our demo account.

NFP stands for Non Farm Payroll, which refers to a monthly report published by the U.S. Bureau of Labor Statistics. It provides data on the number of employees in the non farm sector of the economy, excluding agricultural, private household, and nonprofit industries. NFP is considered important because it serves as a key economic indicator, reflecting the overall health and vitality of the labor market. The report is closely monitored by investors, economists, and policymakers as it provides insights into job creation, unemployment rates, wage growth, and economic trends, influencing financial markets and policy decisions.

NFP is calculated through a survey called the Current Employment Statistics (CES) survey, which is conducted monthly by the U.S. Bureau of Labor Statistics. The survey collects employment data from a sample of businesses and government agencies across various industries. These establishments provide information on their employment levels, hours worked, and earnings. The NFP report includes data on job gains or losses in the non farm sector, average hourly earnings, and the unemployment rate. The methodology used aims to provide a representative snapshot of employment trends and labor market conditions.

The release of the NFP report has a significant impact on financial markets. Positive NFP data, indicating strong job growth and a robust economy, generally leads to positive market reactions. Stocks may rally, currencies can strengthen, and bond yields may rise. Conversely, negative or weaker-than-expected NFP figures can result in market volatility and pessimism. Investors closely analyze the NFP data to gauge the overall economic health, assess market sentiment, and make informed investment decisions.

NFP plays a crucial role in economic forecasting and contributes to the analysis of economic trends. By providing insights into job creation, the unemployment rate, and wage growth, NFP data helps economists and policymakers assess the overall health of an economy and predict future trends. The report assists in understanding labor market dynamics, planning for economic growth, and formulating monetary and fiscal policies. NFP is an essential tool for economic forecasting and informs decisions that affect industries, businesses, and individuals.

NFP has a significant influence on investment decisions across various asset classes. Investors closely follow the release of the NFP report and use the data to assess the strength of the labor market and its potential impact on different markets. Positive NFP data can lead investors to favor stocks, as it suggests a growing economy, while negative NFP figures may prompt investors to seek safe-haven assets like gold or government bonds. The NFP calendar, which indicates upcoming release dates for the report, is an essential tool for investors to plan trades and adjust their portfolios based on anticipated market movements.

In conclusion, NFP is a crucial economic indicator that provides valuable insights into labor market conditions and economic trends. The non farm payroll report plays a vital role in financial markets, influencing investor sentiment and shaping investment decisions. It is used by economists and policymakers for economic forecasting and policy-making purposes. Understanding NFP and its methodology is essential for investors, traders, and anyone interested in gaining a comprehensive understanding of labor market dynamics and their implications for the broader economy.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.