-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

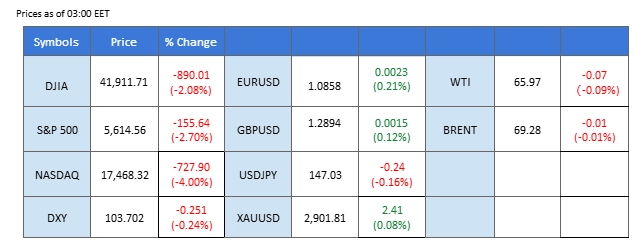

Market Summary

U.S. equities suffered a sharp selloff in the last session, with all three major indices closing significantly lower. The Nasdaq led the decline, plunging 4% below the 18,000 mark, as concerns over Trump’s trade policies and the potential for escalating trade tensions rattled investors.

Adding to market unease, Elon Musk’s DOGE-backed economic advisory group has been lobbying for government spending cuts, raising fears of a broader economic slowdown. Meanwhile, U.S. Treasury yields continued to decline, weighing on the U.S. dollar, which has been consolidating since last Friday. Investors are now turning their focus to tomorrow’s U.S. CPI data, which could provide fresh direction for the greenback.

Safe-haven assets outperformed amid heightened market uncertainty, with both the Japanese yen and Swiss franc strengthening. In commodities, gold traded steady, while oil prices extended losses, plunging to fresh lows as concerns over a deteriorating global economic outlook deepened.

The risk-off sentiment also weighed on cryptocurrencies, with Bitcoin (BTC) sliding below the $80,000 mark for the first time since Trump’s election victory in November. Ethereum (ETH) also broke below its critical $2,000 support level, signaling further weakness in the digital asset market.

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

Market Overview

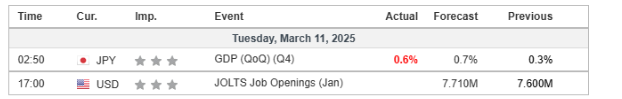

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

The Dollar Index remains subdued following last Friday’s weaker-than-expected U.S. jobs report, as multiple factors continue to pressure the greenback. Investor scepticism over Trump’s trade policies has added to the bearish sentiment, with concerns mounting over the administration’s push for government spending cuts, which could further slow economic growth. With the U.S. dollar struggling to find support, market participants are now turning their attention to tomorrow’s CPI release, which could provide fresh direction for the currency and broader market sentiment.

The Dollar Index trades sideways, followed by a bearish trend, signalling a potential technical rebound for the index. The RSI has gained to above the oversold zone, while the MACD has a golden cross at the bottom, suggesting that the bearish momentum is easing.

Resistance level: 105.45, 106.50

Support level: 102.55, 101.35

Gold, a traditional safe-haven asset, also faced an unexpected selloff despite broader market turmoil. Instead of benefiting from risk-off sentiment, gold came under pressure as institutional investors liquidated positions to raise cash and meet margin calls, triggering a decline across multiple asset classes.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 50, suggesting the commodity might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 2900.00, 2925.00

Support level: 2870.00, 2835.00

The EUR/USD pair continues to trade within its ascending triangle formation, with a breakout to the upside signaling a potential bullish move. The pair has been supported by a weaker U.S. dollar, which remains under pressure following recent soft economic data. Meanwhile, resilient eurozone economic indicators have provided additional strength to the euro. Traders are now focusing on today’s U.S. JOLTS job openings data, which could influence the pair’s price action by shaping expectations around the U.S. labor market and Federal Reserve policy outlook.

The pair was traded in a strong bullish momentum but has been subdued lately despite forming an ascending triangle pattern. The RSI has dropped out from the overbought zone while the MACD has a deadly cross on top, suggesting that the bullish momentum is easing and may cause a bearish trend reversal for the pair.

Resistance level: 1.0956, 1.1075

Support level: 1.0805, 1.0670

The USD/JPY pair remains in a sustained downturn since January, with the latest price action testing the 147.00 support level. A decisive break below this level would reinforce the bearish outlook for the pair. Japanese economic data released earlier showed mixed results—household spending fell short of expectations, while GDP growth exceeded forecasts. Despite the mixed data, broader safe-haven demand amid market uncertainty has continued to support the yen, keeping downward pressure on the pair. Traders will closely monitor risk sentiment and upcoming U.S. economic releases for further direction.

The pair has been trading in a downtrend and has reached a new low since last October, suggesting a bearish bias. The RSI is poised to break into the oversold zone, while the MACD continues to edge lower, suggesting that the bearish momentum is gaining.

Resistance level: 149.48, 151.35

Support level: 143.80, 140.45

The USD/CHF pair extended its downtrend, slipping to a three-month low, as heightened safe-haven demand buoyed the Swiss franc amid growing market uncertainty. Investors remain cautious over Trump’s trade policies, which have added pressure on the U.S. dollar. With the greenback struggling after soft economic data, USD/CHF continues to trade with a bearish bias. Market participants will be watching upcoming U.S. inflation data and geopolitical developments for further direction.

The pair has been trading lower from its peak in February. A break below the short-term support level at 0.8765 should be a bearish signal for the pair. The RSI has been close to the oversold zone while the MACD remains low, suggesting that the pair remains trading with bearish momentum.

Resistance level:0.8810, 0.8910

Support level: 0.8700, 0.8605

The global equity market suffered a sharp selloff, with tech stocks leading the decline as the Nasdaq plunged nearly 4%—its steepest drop since 2022. Investor sentiment deteriorated amid escalating concerns over Trump’s tariff hikes, spending cuts, and widening budget deficits, compounded by geopolitical tensions and trade war fears. Wall Street’s fear gauge surged, signaling heightened uncertainty. This downturn starkly contrasts the initial optimism surrounding Trump’s presidency, when expectations of tax cuts and deregulation fueled market gains, but recent policy turmoil has eroded those hopes.

Nasdaq is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 29, suggesting the index might enter oversold territory.

Resistance level: 19900.00, 20550.00

Support level: 19355.00, 18405.00

Oil prices extended losses for a second consecutive day as fears of a global economic slowdown, driven by U.S. tariffs on Canada, Mexico, and China, weighed on energy demand expectations. Adding to the pressure, OPEC+ signaled plans to increase oil production from April, though Russia’s Deputy PM Alexander Novak noted that the group could reverse this decision if market conditions shift. With risk-off sentiment dominating, investors continue to offload high-risk assets, including crude oil.

Crude oil prices are trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 34, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 66.95, 71.50

Support level: 63.70, 60.45

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!