-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

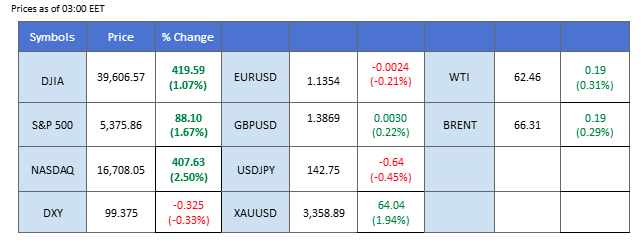

Market Summary

U.S. equities extended their rally overnight, with the Dow Jones reclaiming the 40,000 mark and the Nasdaq jumping on tech sector strength, as Netflix surged 4.5% and Nvidia gained 3.6%. The rebound erased the previous session’s losses, buoyed by signs of progress in U.S.-China trade talks after President Trump reported constructive government meetings on tariff de-escalation.

Adding to the bullish tone, Federal Reserve officials hinted at potential rate cuts, citing concerns that Trump’s aggressive tariff measures could weigh on job creation and economic growth. The dovish Fed stance—seemingly in alignment with the administration’s pressure—further improved risk sentiment in the equity space.

Despite the market’s upbeat mood, uncertainties continue to linger, keeping safe-haven assets resilient. Gold held firm near elevated levels, while safe-haven currencies like the Japanese Yen and Swiss Franc remained supported as investors sought refuge amid geopolitical and policy unpredictability.

Meanwhile, in the crypto space, bullish momentum appears to be stalling following a strong run-up. Bitcoin and other major tokens showed signs of cooling, suggesting a potential technical correction may be on the horizon as enthusiasm fades in tandem with broader market caution.

Current rate hike bets on 7th May Fed interest rate decision:

0 bps (95.2%) VS -25 bps (4.8%)

Source: CME Fedwatch Tool

Market Overview

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

The Dollar Index extended its losses, as markets now broadly expect the Fed to cut rates from 4.5% to 4.25%. Waller downplayed the inflationary impact of tariffs, stating they would likely lead to a one-off price adjustment, not sustained inflation. He noted that weaker demand, falling employment, and reduced household wealth could offset any price pressures. Combined with ongoing geopolitical trade risks, dollar demand remained weak.

The Dollar Index is trading lower following the prior retracement from the resistance level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 36, suggesting the dollar might experience technical correction since RSI rebounded from oversold territory.

Resistance level: 100.15, 102.95

Support level: 97.15, 95.85

Gold prices continued to rise, buoyed by a weaker dollar and a dovish tone from the Fed. While inflation concerns eased, Fed officials signaled potential rate cuts if trade tensions deepen. However, optimism over renewed US-China trade dialogue capped gold’s upside, as investors stayed cautious in the absence of concrete progress.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 53, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 3375.00, 3495.00

Support level: 3275.00, 3200.00

The GBP/USD pair slipped below the fair-value-gap (FVG) in the last session, hinting at a potential break in bullish structure and raising downside risks. Sterling was pressured by disappointing UK PMI data and the IMF’s downgrade of UK 2025 growth to 1.1%, citing tariffs and energy costs. While BoE Governor Bailey downplayed recession risks, buoyed Sterling. On the U.S. side, the dollar regained traction as President Trump renewed calls for a unilateral tariff plan, helping ease trade tensions. Fed Governor Waller added that tariff-driven inflation may be short-lived, reducing the need for aggressive policy moves. With UK fundamentals under strain and the dollar stabilizing, GBP/USD may remain heavy unless fresh catalysts emerge.

Price is now kept below the fair value gap around 1.3300, but the lack of follow-through suggests a bearish bias. The RSI continues to flatten near the 50 level, reflecting waning momentum, while the MACD edges lower toward the zero line, indicating that bullish momentum has vanished.

Resistance level: 1.3340, 1.3420

Support level: 1.3300, 1.3270

The USD/CAD pair has broken out from its recent consolidation range, bouncing off support and suggesting a bullish bias in the near term. The upside momentum was fueled by a resurgent U.S. dollar, driven by improving risk sentiment after President Trump’s optimistic remarks on trade negotiations with China. Additionally, Fed officials signaling a potential rate cut—in response to concerns that tariff headwinds may impact the labor market—has helped to ease tensions between the central bank and the White House, further supporting the greenback. On the Canadian side, the focus shifts to the upcoming Retail Sales data, with market expectations tilted toward a softer reading. A downside surprise in the data could reinforce the pair’s upward trajectory.

The pair has broken above the price consolidation range and found support above the range, suggesting a bullish bias for the pair. The RSI is climbing while the MACD is breaking above the zero line, suggesting that bullish momentum is forming.

Resistance level: 1.3970, 1.4065

Support level: 1.3752, 1.3650

Global equity markets edged higher during early Asian trading hours, following gains in the US indices—Dow Jones, S&P 500, and Nasdaq—which extended their rally. The upside was driven by expectations of Fed rate cuts and strong quarterly earnings, notably from Alphabet, which surged around 5% in after-hours trading after posting better-than-expected results. Despite lingering US-China trade tensions, risk appetite was supported as Fed Governor Christopher Waller said he would support rate cuts if tariffs began to weigh on jobs and economic growth.

Nasdaq is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 60, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 19485.00, 20125.00

Support level: 18050.00, 18060.00

The Japanese yen weakened slightly after the Bank of Japan raised concerns about global economic uncertainties. The BoJ’s cautious stance cast doubt on any near-term rate hikes, though officials stressed that future decisions would depend on more data. While yen demand rose briefly on risk aversion, a softening dollar capped gains in USD/JPY, keeping the pair in a narrow range.

USD/JPY is trading higher while currently near the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 59, suggesting the pair might experience technical correction since the RSI retreated from the resistance level.

Resistance level: 143.95, 147.15

Support level: 140.45, 137.45

Crude oil rebounded slightly from support, helped by a weaker dollar, but remained in consolidation mode. Bearish sentiment persists due to ongoing concerns around rising OPEC+ supply. Rumors of a possible output increase continue to weigh on prices. Meanwhile, diplomatic developments in Iran suggest potential easing of sanctions, which could bring more Iranian oil into global supply, further pressuring prices.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 51, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 64.45, 66.65

Support level: 62.00, 59.65

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!