-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

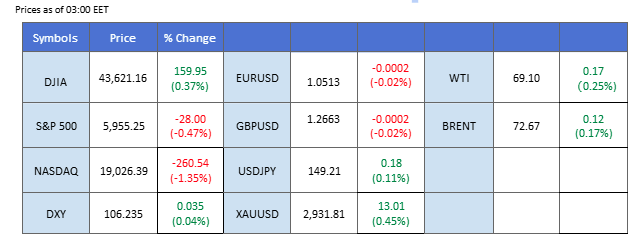

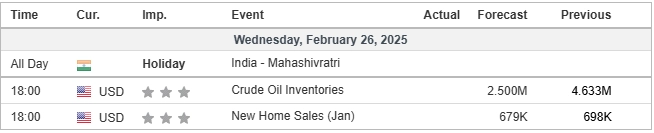

Market Summary

The U.S. dollar remains under pressure as long-term Treasury yields continue to slide, with the 10-year yield dipping below 4.3%, its lowest level of the year. This decline has weakened the greenback’s appeal, making it more vulnerable in the broader financial market. At the same time, uncertainty surrounding President Trump’s latest trade policies has further eroded confidence. Reports suggest that his administration is probing potential copper tariffs, opening the door for additional trade restrictions.

While the dollar struggles, the Japanese yen has emerged as the most favored safe-haven currency, driving USD/JPY below the 149.00 mark for the first time this year. The growing preference for the yen underscores mounting market anxieties, as investors seek stability amid rising uncertainties. Wall Street, meanwhile, has been left directionless, with equities struggling to find traction. The focus now turns to Nvidia’s highly anticipated earnings report, which could serve as a crucial barometer for the AI sector. A stronger-than-expected performance from Nvidia may provide a much-needed boost, particularly for the Nasdaq, which has struggled to gain momentum in recent sessions.

Over in Asia, the Hang Seng Index (HSI) continues to build on its bullish momentum, as optimism surrounding China’s stock market recovery strengthens. The rally has been fueled by growing confidence in the AI sector following DeepSeek’s debut, with investors betting on sustained technological advancements to drive further gains.

In contrast, the crypto market has suffered a brutal sell-off, with major digital assets facing heavy losses. Bitcoin plunged below the $90,000 mark, driven by renewed concerns over security in the digital asset space following the Bybit hack, which resulted in a staggering $1.5 billion loss. The broader risk-off sentiment, exacerbated by Trump’s increasingly combative stance on trade and rising geopolitical tensions, has further discouraged investors from taking on riskier assets.

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98%) VS -25 bps (2%)

Market Overview

(MT4 System Time)

Source: MQL5

Market Movements

The Dollar Index weakened as soft consumer confidence data raised concerns about U.S. economic stability, fueling expectations of Fed rate cuts despite ongoing inflation pressures. Recent economic reports, including disappointing retail, services, and housing data, have added to market uncertainty, increasing downside risks for the greenback.

The Dollar Index is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 39, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 106.55, 107.30

Support level: 105.65, 104.30

Gold prices experienced sharp swings, initially retreating as forced liquidations in crypto and equities led investors to cover margin calls. However, the metal rebounded as trade tariff uncertainties resurfaced, with Trump reaffirming his aggressive stance on global trade policies. Weak consumer confidence further reinforced gold’s safe-haven appeal, supporting a recovery in prices.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 42, suggesting the commodity might extend its gains after breakout since the RSI rebounded from the oversold territory.

Resistance level: 2920.00, 2940.00

Support level: 2895.00, 2880.00

The GBP/USD pair is encountering strong resistance near the 1.2665 level and is in search of a catalyst to break higher. The pair has been supported by the weakening U.S. dollar, as Treasury yields surged to new highs in the last session, putting downward pressure on the greenback. Meanwhile, the market continues to digest President Trump’s latest proposal for new metal tariffs, which could have significant implications for the dollar’s trajectory. Any further developments on this front may influence market sentiment and determine whether GBP/USD can push past its current resistance level.

GBP/USD remains trading in a higher-high price pattern but was kept below the 1.2665 mark. A break above this level suggests a solid bullish signal for the pair. The RSI remains close to the overbought zone, while the MACD is easing, suggesting that the bullish momentum is gradually easing.

Resistance level: 1.2780, 1.2865

Support level: 1.2575, 1.2502

The EUR/USD pair continues to trade within an ascending triangle pattern, with a series of lower highs keeping it capped below the 1.0520 mark. Market attention is now focused on the upcoming meeting between Ukrainian President Volodymyr Zelensky and U.S. President Donald Trump on Friday, as discussions are expected to ease recent tensions between Ukraine and the U.S. government. The ultimate goal of the talks is to push for a ceasefire with Russia, and any positive developments on this front could provide a boost to the euro. The pair may gain momentum and break to new highs in 2025 if the situation unfold favourably.

EUR/USD remains trading within its bullish trajectory and is poised to break above its 2025 high at 1.0520. The RSI stayed above the 50 level, while the MACD flowed flat above the zero line, suggesting that the pair’s bullish momentum remains intact.

Resistance level: 1.0596, 1.0650

Support level: 1.0450, 1.0385

Tech stocks remained under pressure, with the Nasdaq Composite sliding 1.3%, led by steep losses in Nvidia and Tesla. Nvidia continues to face AI-sector headwinds ahead of its earnings report, compounded by new U.S. chip restrictions on China, which could impact future growth. Meanwhile, Tesla plunged over 8% after reporting a 45% drop in European sales for January, stemming concerns over demand and profitability. The broader tech sector remains vulnerable as investors reassess growth prospects in a high-interest-rate environment.

Nasdaq is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 30, suggesting the index might enter oversold territory.

Resistance level: 21560.00, 22180.00

Support level: 21045.00, 20550.00

USD/JPY may extend its losses, weighed down by declining U.S. Treasury yields and weak consumer confidence. February’s Consumer Confidence Index plummeted to an eight-month low of 98.3, down from 104.1, signifying growing economic concerns. Inflation expectations also surged to 6% from 5.2%, raising speculation over potential Fed policy shifts. In Japan, producer prices rose to 3.1% YoY, driven by higher service costs. The Bank of Japan (BoJ) remains focused on services inflation as a key indicator of sustained wage growth. Governor Kazuo Ueda reaffirmed the BoJ’s data-driven approach, signaling a readiness to hike rates if wage growth continues.

USD/JPY is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 34, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 149.50, 151.35

Support level: 146.95, 143.80

Copper prices surged nearly 4% in the last session as the market reacted to the latest tariff threats from the Trump administration. President Trump has ordered an investigation into potential new tariffs on copper imports, a move widely seen as targeting China, which dominates the global copper market. If these tariffs are implemented, copper prices are expected to rise further due to the increased costs from higher levies and potential supply disruptions. The prospect of reduced availability in the market, coupled with geopolitical tensions, could sustain upward pressure on copper prices in the near term.

Copper prices found support at the near 4.478 mark and gained nearly 4% in the last session, suggesting a bullish bias for copper. If copper prices can maintain above 4.540, copper will remain trading within its bullish trajectory.

Resistance level: 4.684, 4.786

Support level: 4.570, 4.483

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

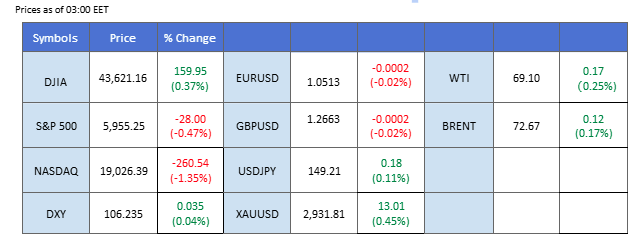

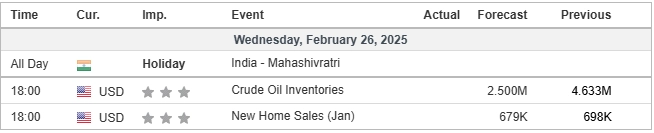

Market Summary

The U.S. dollar remains under pressure as long-term Treasury yields continue to slide, with the 10-year yield dipping below 4.3%, its lowest level of the year. This decline has weakened the greenback’s appeal, making it more vulnerable in the broader financial market. At the same time, uncertainty surrounding President Trump’s latest trade policies has further eroded confidence. Reports suggest that his administration is probing potential copper tariffs, opening the door for additional trade restrictions.

While the dollar struggles, the Japanese yen has emerged as the most favored safe-haven currency, driving USD/JPY below the 149.00 mark for the first time this year. The growing preference for the yen underscores mounting market anxieties, as investors seek stability amid rising uncertainties. Wall Street, meanwhile, has been left directionless, with equities struggling to find traction. The focus now turns to Nvidia’s highly anticipated earnings report, which could serve as a crucial barometer for the AI sector. A stronger-than-expected performance from Nvidia may provide a much-needed boost, particularly for the Nasdaq, which has struggled to gain momentum in recent sessions.

Over in Asia, the Hang Seng Index (HSI) continues to build on its bullish momentum, as optimism surrounding China’s stock market recovery strengthens. The rally has been fueled by growing confidence in the AI sector following DeepSeek’s debut, with investors betting on sustained technological advancements to drive further gains.

In contrast, the crypto market has suffered a brutal sell-off, with major digital assets facing heavy losses. Bitcoin plunged below the $90,000 mark, driven by renewed concerns over security in the digital asset space following the Bybit hack, which resulted in a staggering $1.5 billion loss. The broader risk-off sentiment, exacerbated by Trump’s increasingly combative stance on trade and rising geopolitical tensions, has further discouraged investors from taking on riskier assets.

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98%) VS -25 bps (2%)

Market Overview

(MT4 System Time)

Source: MQL5

Market Movements

The Dollar Index weakened as soft consumer confidence data raised concerns about U.S. economic stability, fueling expectations of Fed rate cuts despite ongoing inflation pressures. Recent economic reports, including disappointing retail, services, and housing data, have added to market uncertainty, increasing downside risks for the greenback.

The Dollar Index is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 39, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 106.55, 107.30

Support level: 105.65, 104.30

Gold prices experienced sharp swings, initially retreating as forced liquidations in crypto and equities led investors to cover margin calls. However, the metal rebounded as trade tariff uncertainties resurfaced, with Trump reaffirming his aggressive stance on global trade policies. Weak consumer confidence further reinforced gold’s safe-haven appeal, supporting a recovery in prices.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 42, suggesting the commodity might extend its gains after breakout since the RSI rebounded from the oversold territory.

Resistance level: 2920.00, 2940.00

Support level: 2895.00, 2880.00

The GBP/USD pair is encountering strong resistance near the 1.2665 level and is in search of a catalyst to break higher. The pair has been supported by the weakening U.S. dollar, as Treasury yields surged to new highs in the last session, putting downward pressure on the greenback. Meanwhile, the market continues to digest President Trump’s latest proposal for new metal tariffs, which could have significant implications for the dollar’s trajectory. Any further developments on this front may influence market sentiment and determine whether GBP/USD can push past its current resistance level.

GBP/USD remains trading in a higher-high price pattern but was kept below the 1.2665 mark. A break above this level suggests a solid bullish signal for the pair. The RSI remains close to the overbought zone, while the MACD is easing, suggesting that the bullish momentum is gradually easing.

Resistance level: 1.2780, 1.2865

Support level: 1.2575, 1.2502

The EUR/USD pair continues to trade within an ascending triangle pattern, with a series of lower highs keeping it capped below the 1.0520 mark. Market attention is now focused on the upcoming meeting between Ukrainian President Volodymyr Zelensky and U.S. President Donald Trump on Friday, as discussions are expected to ease recent tensions between Ukraine and the U.S. government. The ultimate goal of the talks is to push for a ceasefire with Russia, and any positive developments on this front could provide a boost to the euro. The pair may gain momentum and break to new highs in 2025 if the situation unfold favourably.

EUR/USD remains trading within its bullish trajectory and is poised to break above its 2025 high at 1.0520. The RSI stayed above the 50 level, while the MACD flowed flat above the zero line, suggesting that the pair’s bullish momentum remains intact.

Resistance level: 1.0596, 1.0650

Support level: 1.0450, 1.0385

Tech stocks remained under pressure, with the Nasdaq Composite sliding 1.3%, led by steep losses in Nvidia and Tesla. Nvidia continues to face AI-sector headwinds ahead of its earnings report, compounded by new U.S. chip restrictions on China, which could impact future growth. Meanwhile, Tesla plunged over 8% after reporting a 45% drop in European sales for January, stemming concerns over demand and profitability. The broader tech sector remains vulnerable as investors reassess growth prospects in a high-interest-rate environment.

Nasdaq is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 30, suggesting the index might enter oversold territory.

Resistance level: 21560.00, 22180.00

Support level: 21045.00, 20550.00

USD/JPY may extend its losses, weighed down by declining U.S. Treasury yields and weak consumer confidence. February’s Consumer Confidence Index plummeted to an eight-month low of 98.3, down from 104.1, signifying growing economic concerns. Inflation expectations also surged to 6% from 5.2%, raising speculation over potential Fed policy shifts. In Japan, producer prices rose to 3.1% YoY, driven by higher service costs. The Bank of Japan (BoJ) remains focused on services inflation as a key indicator of sustained wage growth. Governor Kazuo Ueda reaffirmed the BoJ’s data-driven approach, signaling a readiness to hike rates if wage growth continues.

USD/JPY is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 34, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 149.50, 151.35

Support level: 146.95, 143.80

Copper prices surged nearly 4% in the last session as the market reacted to the latest tariff threats from the Trump administration. President Trump has ordered an investigation into potential new tariffs on copper imports, a move widely seen as targeting China, which dominates the global copper market. If these tariffs are implemented, copper prices are expected to rise further due to the increased costs from higher levies and potential supply disruptions. The prospect of reduced availability in the market, coupled with geopolitical tensions, could sustain upward pressure on copper prices in the near term.

Copper prices found support at the near 4.478 mark and gained nearly 4% in the last session, suggesting a bullish bias for copper. If copper prices can maintain above 4.540, copper will remain trading within its bullish trajectory.

Resistance level: 4.684, 4.786

Support level: 4.570, 4.483

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.