-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

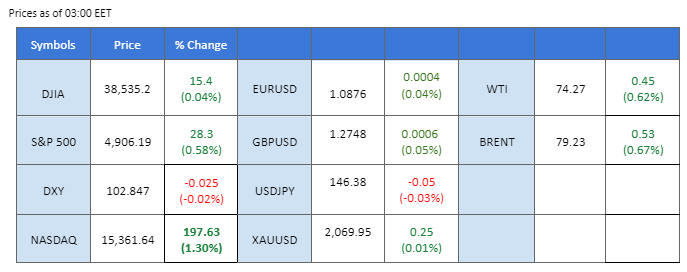

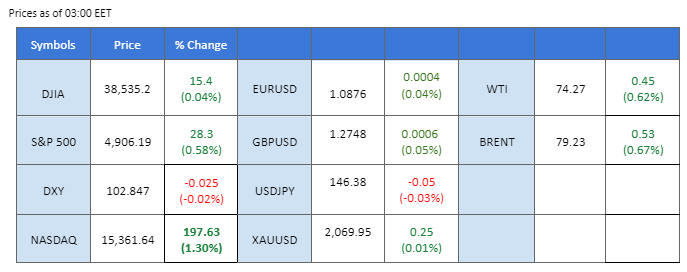

U.S. equity markets staged a rebound fueled by impressive earnings reports, and this positive sentiment spilled over to Asian markets, including Hong Kong and China, which all opened on a positive note. However, the dollar index has experienced a decline and is teetering on the edge of breaking below its crucial support level at $103, just ahead of the highly anticipated Nonfarm Payroll report scheduled for later today. Meanwhile, gold prices encountered strong traction, hovering near the $2060 level, while talks of a Gaza ceasefire are developing positively. Alongside with the gold, oil prices are heading to close the week with a loss of about 5%, reflecting an apparent easing of the Middle East conflict.

Current rate hike bets on 20th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (65%) VS -25 bps (35%)

(MT4 System Time)

Source: MQL5

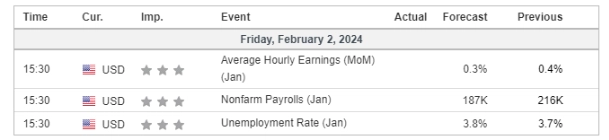

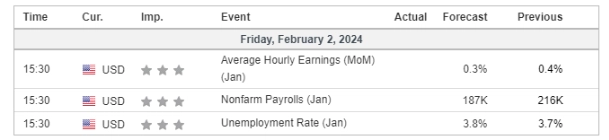

The Dollar Index experiences a decline driven by technical correction and profit-taking ahead of crucial US jobs data set to be released later today. Initial surges followed US Fed Chair Jerome Powell’s statement ruling out a March interest rate cut, citing a robust economic recovery. Traders are now recalibrating expectations, with a 39% probability of a March rate cut and a 94% chance of a reduction by May, according to the CME FedWatch Tool. As markets await the release of US Nonfarm Payrolls data, expectations hover around the addition of 180,000 jobs, slightly lower than the previous reading. Economists anticipate a marginal increase in the US Unemployment rate from 3.7% to 3.80%.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 40, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 103.85, 104.60

Support level: 103.05, 102.15

Following a hawkish Federal Reserve statement, US Treasury yields retreat, boosting gold’s appeal as investors shift focus to rising tensions in the Middle East. The US’s reprisal strikes against an Iranian-backed militia contribute to an atmosphere of geopolitical uncertainty, reinforcing gold’s safe-haven status.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 64, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 2055.00, 2080.00

Support level: 2035.00, 2020.00

The GBP/USD exhibited strength against yesterday’s lacklustre U.S. dollar and is currently trading above its resistance level at 1.2710. The Bank of England (BoE) has announced its interest rate decision, maintaining it at the current level. Most board members voted for this decision, with only one member suggesting a rate cut. This perceived hawkish stance in the interest rate decision is contributing to the strength of the British Pound.

GBPUSD rebounded strongly yesterday with a solid bullish candlestick, suggesting a potential trend reversal for the pair. The RSI has rebounded while the MACD has broken above the zero line, suggesting a bullish momentum may be forming.

Resistance level: 1.2785, 1.2815

Support level:1.2710, 1.2610

The EUR/USD pair experienced a notable surge from its lowest level in one month. The U.S. dollar weakened significantly ahead of the crucial Nonfarm Payroll report. Despite a hawkish statement made by the Federal Reserve after the interest rate decision, the market still perceives that there is a chance for a rate cut in March. The dynamic environment and uncertainty around future monetary policy decisions influence currency movements.

The EUR/USD rebounded strongly by more than 0.5%, suggesting a potential trend reversal for the pair. The RSI is moving upward while the MACD has broken above the zero line, suggesting a bullish momentum is building.

Resistance level: 1.0904, 1.0954

Support level: 1.0775, 1.0700

The US equity market continues its bullish momentum, reaching a fresh record closing high as investors digest the Federal Reserve’s hawkish stance. Attention now shifts to the impending US jobs report. Previous expectations prompted an increase in Treasury yields, initially dampening the appeal for equities, particularly in the tech sector. However, a rebound follows strong quarterly results from major tech corporations, including Amazon and Meta platform, beating Wall Street expectations.

Dow Jones extended its gains after it successfully breakout above the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 66, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 39280.00, 40000.00

Support level: 37815.00, 36600.00

The USD/JPY pair is trading sustainably below its liquidity zone, signalling a potential bearish trend for the pair. The central banks of both countries have a divergence in monetary policy, with the Bank of Japan (BoJ) considering a shift in monetary policy and the Federal Reserve anticipating a rate cut. This divergence may lead to a decline in the pair as market participants navigate the contrasting policy directions.

The pair has traded at below $147 and, suggesting a potential trend reversal for the pair. The RSI is hovering near the oversold zone while the MACD continue to move lower, suggesting a bearish momentum is forming.

Resistance level: 146.76, 148.67

Support level: 145.21, 143.67

Oil prices tumble as hopes emerge for a resolution in the Israel-Hamas conflict, with reports of a proposal for an extended pause in fighting by Hamas. Meanwhile, the OPEC+ meeting shows limited price impact as the group refrains from changes to production policies, leaving markets to react to geopolitical developments.

Oil prices are trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 37, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 75.20, 78.65

Support level: 72.05, 69.85

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

U.S. equity markets staged a rebound fueled by impressive earnings reports, and this positive sentiment spilled over to Asian markets, including Hong Kong and China, which all opened on a positive note. However, the dollar index has experienced a decline and is teetering on the edge of breaking below its crucial support level at $103, just ahead of the highly anticipated Nonfarm Payroll report scheduled for later today. Meanwhile, gold prices encountered strong traction, hovering near the $2060 level, while talks of a Gaza ceasefire are developing positively. Alongside with the gold, oil prices are heading to close the week with a loss of about 5%, reflecting an apparent easing of the Middle East conflict.

Current rate hike bets on 20th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (65%) VS -25 bps (35%)

(MT4 System Time)

Source: MQL5

The Dollar Index experiences a decline driven by technical correction and profit-taking ahead of crucial US jobs data set to be released later today. Initial surges followed US Fed Chair Jerome Powell’s statement ruling out a March interest rate cut, citing a robust economic recovery. Traders are now recalibrating expectations, with a 39% probability of a March rate cut and a 94% chance of a reduction by May, according to the CME FedWatch Tool. As markets await the release of US Nonfarm Payrolls data, expectations hover around the addition of 180,000 jobs, slightly lower than the previous reading. Economists anticipate a marginal increase in the US Unemployment rate from 3.7% to 3.80%.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 40, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 103.85, 104.60

Support level: 103.05, 102.15

Following a hawkish Federal Reserve statement, US Treasury yields retreat, boosting gold’s appeal as investors shift focus to rising tensions in the Middle East. The US’s reprisal strikes against an Iranian-backed militia contribute to an atmosphere of geopolitical uncertainty, reinforcing gold’s safe-haven status.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 64, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 2055.00, 2080.00

Support level: 2035.00, 2020.00

The GBP/USD exhibited strength against yesterday’s lacklustre U.S. dollar and is currently trading above its resistance level at 1.2710. The Bank of England (BoE) has announced its interest rate decision, maintaining it at the current level. Most board members voted for this decision, with only one member suggesting a rate cut. This perceived hawkish stance in the interest rate decision is contributing to the strength of the British Pound.

GBPUSD rebounded strongly yesterday with a solid bullish candlestick, suggesting a potential trend reversal for the pair. The RSI has rebounded while the MACD has broken above the zero line, suggesting a bullish momentum may be forming.

Resistance level: 1.2785, 1.2815

Support level:1.2710, 1.2610

The EUR/USD pair experienced a notable surge from its lowest level in one month. The U.S. dollar weakened significantly ahead of the crucial Nonfarm Payroll report. Despite a hawkish statement made by the Federal Reserve after the interest rate decision, the market still perceives that there is a chance for a rate cut in March. The dynamic environment and uncertainty around future monetary policy decisions influence currency movements.

The EUR/USD rebounded strongly by more than 0.5%, suggesting a potential trend reversal for the pair. The RSI is moving upward while the MACD has broken above the zero line, suggesting a bullish momentum is building.

Resistance level: 1.0904, 1.0954

Support level: 1.0775, 1.0700

The US equity market continues its bullish momentum, reaching a fresh record closing high as investors digest the Federal Reserve’s hawkish stance. Attention now shifts to the impending US jobs report. Previous expectations prompted an increase in Treasury yields, initially dampening the appeal for equities, particularly in the tech sector. However, a rebound follows strong quarterly results from major tech corporations, including Amazon and Meta platform, beating Wall Street expectations.

Dow Jones extended its gains after it successfully breakout above the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 66, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 39280.00, 40000.00

Support level: 37815.00, 36600.00

The USD/JPY pair is trading sustainably below its liquidity zone, signalling a potential bearish trend for the pair. The central banks of both countries have a divergence in monetary policy, with the Bank of Japan (BoJ) considering a shift in monetary policy and the Federal Reserve anticipating a rate cut. This divergence may lead to a decline in the pair as market participants navigate the contrasting policy directions.

The pair has traded at below $147 and, suggesting a potential trend reversal for the pair. The RSI is hovering near the oversold zone while the MACD continue to move lower, suggesting a bearish momentum is forming.

Resistance level: 146.76, 148.67

Support level: 145.21, 143.67

Oil prices tumble as hopes emerge for a resolution in the Israel-Hamas conflict, with reports of a proposal for an extended pause in fighting by Hamas. Meanwhile, the OPEC+ meeting shows limited price impact as the group refrains from changes to production policies, leaving markets to react to geopolitical developments.

Oil prices are trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 37, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 75.20, 78.65

Support level: 72.05, 69.85

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.