-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

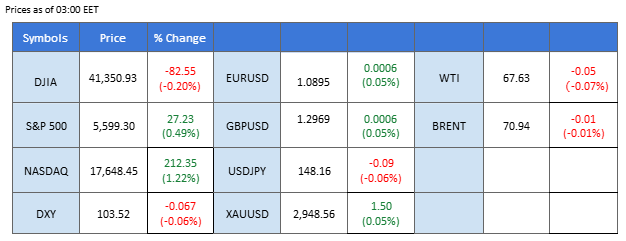

Market Summary

The highly anticipated U.S. CPI data released yesterday came in weaker than expected, reinforcing expectations that the Federal Reserve could adopt a more dovish stance. The softer inflation print provided buoyancy to the equity market, with Wall Street snapping its losing streak—the S&P 500 and Nasdaq both closed higher.

In contrast, the dollar index remains under pressure, weighed down by dovish Fed expectations and uncertainty over Trump’s trade policies. After threatening Canada with a 50% tariff, the U.S. President turned his focus to the European Union, raising the risk of escalating trade tensions.

Meanwhile, the Bank of Canada (BoC) cut interest rates by 25bps to 2.75%, a widely expected move that had limited impact on the Canadian dollar as markets had already priced it in.

In the commodity market, gold surged past its immediate resistance at $2,920, signaling a bullish breakout as traders sought safety amid global uncertainty and a weaker dollar. Oil prices also advanced, benefiting from the softer CPI print and expectations that a dovish Fed could fine-tune the global oil demand outlook.

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

Market Overview

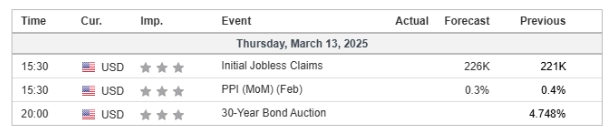

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

The Dollar Index (DXY) extended its decline as weaker-than-expected US inflation data reinforced expectations that the Federal Reserve may maintain a dovish stance for an extended period. The Consumer Price Index (CPI) fell to 2.9% in February from 3% in January, missing market forecasts, while Core CPI eased to 3.2% from 3.3%, further supporting the case for a more accommodative monetary policy. Additionally, Donald Trump’s recession warnings and escalating tariff concerns weighed on the dollar, heightening uncertainty about the US economic outlook.

The Dollar Index is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 27, suggesting the index might enter oversold territory.

Resistance level: 105.45, 106.50

Support level: 103.40, 101.70

With soft inflation data and a deteriorating growth outlook, US Treasury yields continued to decline, reinforcing market expectations of potential rate cuts. As a result, gold prices rebounded, benefiting from increased demand for safe-haven assets amid economic and trade-related uncertainties. Adding to market jitters, Trump’s expanded tariffs on steel and aluminum took effect, further straining global trade relations and dampening risk appetite.

Gold prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 70, suggesting the commodity might enter overbought territory.

Resistance level: 2940.00, 2955.00

Support level: 2920.00, 2900.00

The euro breached key support levels as concerns over a US-EU trade conflict intensified. President Trump hinted at retaliatory measures against the EU’s response to his 25% steel and aluminum tariffs, stoking fears of a broader trade dispute. “Of course I’m going to respond,” Trump stated, claiming the EU was designed to take advantage of the US. While specific countermeasures remain unclear, investors remain cautious, closely monitoring trade developments for further direction.

EUR/USD is trading lower while currently testing the support level. However, due to lack of market catalysts from MACD and RSI near the midline, we could be expecting the pair to consolidate in a zone between the resistance level of 1.0925 and support level of 1.0880.

Resistance level: 1.0925, 1.0970

Support level: 1.0880, 1.0825

The USD/JPY pair has broken above its short-term resistance level at 148.20, signaling a potential structural shift if the pair manages to find support above this level. A successful hold could reinforce a bullish bias, though the broader market landscape remains uncertain. Despite the breakout, the U.S. dollar continues to struggle following softer-than-expected CPI data, which has strengthened market bets on a dovish Fed outlook. Additionally, Trump’s escalating trade policies have introduced further uncertainty, limiting the greenback’s upside momentum. Meanwhile, the Japanese yen is expected to gain traction as traders position ahead of the Bank of Japan’s upcoming interest rate decision.

The pair has broken from the resistance level and reached its previous high, suggesting a potential bullish trend reversal. The RSI shows signs of rebounding, while the MACD is approaching the zero line from below, suggesting that the bearish momentum has vanished.

Resistance level: 149.48, 151.35

Support level: 146.95, 143.80

The GBP/USD pair surged to a new high in the last session after U.S. CPI data came in lower than expected, reinforcing market expectations that the Federal Reserve may adopt a more dovish stance. The softer inflation print has further dampened the dollar’s momentum, keeping the greenback under pressure. Beyond the monetary policy outlook, market confidence in the U.S. dollar remains fragile due to heightened uncertainty over Trump’s aggressive trade policies. The administration’s escalating tariff threats against key trading partners, including Canada and the European Union, has fueled investor caution, further weighing on the greenback.

The pair continued to edge higher, suggesting a bullish bias. The RSI remained hovering close to the overbought zone, while the MACD flowed flat in the recent session, suggesting that the pair remains trading with bullish momentum but is gradually easing.

Resistance level:1.3050, 1.3155

Support level: 1.2865, 1.2785

The Canadian dollar remained largely unchanged following the Bank of Canada’s 25-bps rate cut in the last session. The move was widely anticipated, resulting in limited market reaction for the Loonie. However, the Loonie faces downside risks as Trump’s renewed tariff threats against Canada could weigh on sentiment. If trade tensions escalate, the USD/CAD pair may find support and push higher, as market uncertainty could drive investors toward the safe-haven U.S. dollar, despite its recent weakness.

USD/CAD is now trading within its asymmetric triangle price pattern. A break from either side of the pattern should indicate a direction for the pair. The RSI is gradually easing while the MACD struggles to sustain above the zero line, suggesting that bullish momentum is vanishing.

Resistance level: 1.4450, 1.4550

Support level: 1.4265, 1.4150

The Nasdaq staged a technical rebound in the last session after tumbling 3,000 points over the past three weeks, buoyed by a softer U.S. CPI print that reinforced market expectations of a more dovish Fed policy ahead. The prospect of lower rate hikes or potential easing has supported the broader equity market. However, risk sentiment remains fragile, as Trump’s escalating tariff threats against major trade partners have injected uncertainty into global markets. While the tech-heavy index found short-term support, concerns over trade tensions could limit further upside momentum.

The Nasdaq has dipped to the lowest level since last September, suggesting a bearish bias for the pair. The RSI is flirting with the oversold zone while the MACD continues to edge lower, suggesting that the bearish momentum is gaining.

Resistance level: 19935.00, 20310.00

Support level: 19395.00, 18730.00

Crude oil prices surged as US inventory data fell short of expectations. According to the Energy Information Administration (EIA), US crude stockpiles rose by just 1.4 million barrels, significantly below the 2-million-barrel forecast, alleviating supply concerns. A weaker US dollar also provided additional support for dollar-denominated oil prices.

Crude oil prices are trading higher while currently testing the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 64, suggesting the commodity might experience technical correction since the RSI retreated from overbought territory.

Resistance level: 67.80, 68.45

Support level: 66.70, 65.60

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!