-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

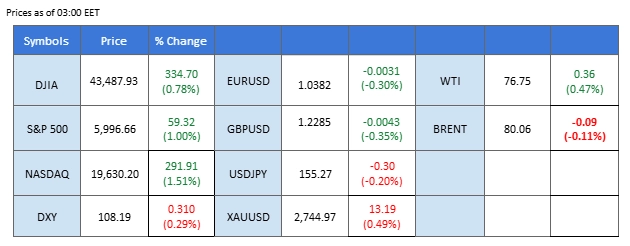

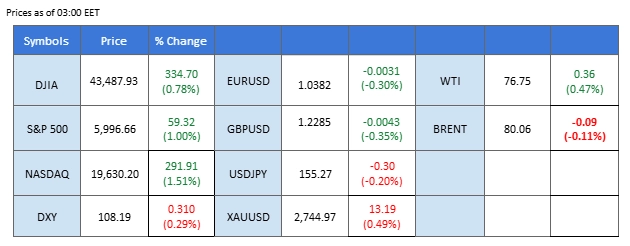

Market Summary

The U.S. dollar experienced heightened volatility as markets reopened following Monday’s U.S. public holiday. Initially, the Dollar Index declined by over 1% during the Sydney session, reflecting market sentiment that President Donald Trump might delay imposing tariffs. However, the narrative shifted dramatically when Trump took executive action to announce a 25% tariff on imports from Mexico and Canada, effective February 1. This aggressive stance bolstered the dollar, reversing earlier losses and driving the Dollar Index higher. Wall Street futures responded positively to Trump’s assertive policies, suggesting a potential rally when the New York session begins. Investors appear optimistic about the administration’s proactive measures, fueling risk appetite in equity markets.

In the forex market, attention now turns to key economic data releases. The UK’s job market report and Canada’s CPI reading are expected to influence the Pound Sterling and Canadian dollar, respectively, providing fresh direction for currency pairs tied to these economies.

In the commodities market, gold prices have climbed to near $2,720 as investors hedge against uncertainties surrounding Trump’s policies. The precious metal’s recent rally underscores its appeal as a safe haven amidst geopolitical and economic shifts. Conversely, oil prices face downside risks, with Trump’s pledge to boost U.S. oil output potentially exacerbating supply concerns in an already soft demand environment.

The cryptocurrency market saw Bitcoin retreat by over 6% after Trump’s inauguration, reflecting a “buy the rumor, sell the news” sentiment. Despite this correction, Bitcoin remains firmly above the $100,000 mark, supported by indications of Trump’s interest in the crypto market.

Current rate hike bets on 29th January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (97.9%) VS -25 bps (2.1%)

Market Overview

Economic Calendar

(MT4 System Time)

N/A

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The U.S. dollar extended its decline as Treasury yields dropped, with the 10-year yield falling nine basis points to 4.54% following Monday’s holiday. Potential easing sanctions implementation on China, had diminished inflation concerns and weighed on the dollar. This development has led investors to reassess expectations for Federal Reserve policy adjustments, with market participants now pricing in a higher probability of rate cuts later this year.

The Dollar Index is trading flat while currently testing the support level at 107.95. MACD has illustrated increasing bearish momentum, while RSI is at 32, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 109.00, 110.00

Support level: 107.95, 106.80

Gold prices surged to a new high, supported by a weaker dollar in recent sessions. Additionally, uncertainty surrounding President Trump’s policy decisions has increased demand for the safe-haven asset. However, gold traders should remain cautious, as a potential rebound in the dollar, driven by Trump’s executive actions, could limit gold’s upward momentum.

Gold prices have broken above their sideways trend, suggesting a bullish bias for gold. The RSI remains close to the overbought zone, while the MACD remains elevated, suggesting that gold remains trading with strong bullish momentum.

Resistance level: 2755.00, 2789.00

Support level: 2718.35, 2665.00

The GBP/USD pair broke above its downtrend resistance, signaling a potential bullish trend. The pair benefited from an initial decline in the dollar’s strength, driven by market expectations of a softer trade stance from Trump’s administration. However, the dollar is anticipated to recover following Trump’s announcement of high tariffs on Canada and Mexico, which could support the greenback. Meanwhile, traders will focus on the UK’s job data, which may influence the Pound Sterling’s strength and the pair’s further direction.

GBP/USD returned to its previous high level near the 1.2305 mark, suggesting a bullish bias for the pair. The RSI is moving upward while the MACD is breaking above the zero line, suggesting that the pair is trading with bullish momentum.

Resistance level: 1.2408, 1.2506

Support level: 1.2220, 1.2140

The USD/CAD pair is trading within an expanding triangle pattern near its recent highs, indicating a bullish outlook. The U.S. dollar remains strong, while the Canadian dollar weakens due to underwhelming economic data and dovish BoC policies. Additionally, Trump’s announcement of a 25% tariff on Canada is expected to pressure the Canadian dollar further, potentially driving the pair higher in the coming sessions.

The pair seesawed in the recent session but remains elevated, suggesting a bullish bias. The RSI is hovering near the 50 level, while the MACD is flowing close to the zero line, suggesting a neutral signal for the pair.

Resistance level: 1.4540, 1.4625

Support level: 1.4350, 1.4240

The USD/JPY pair is exhibiting a lower-high price pattern, signaling a bearish outlook. Traders are closely watching Friday’s BoJ interest rate decision and Japan’s CPI data to assess the Yen’s strength. Anticipation of a potential BoJ rate hike has already supported the Yen, contributing to the pair’s downward momentum.

The USD/JPY has been trading in a bearish trajectory and has reached a new low in recent sessions. The RSI remains below the 50 level, while the MACD continues to flow below the zero line, suggesting that the pair’s bearish momentum remains intact.

Resistance level: 156.00, 157.30

Support level: 154.25, 152.50

Global risk appetite improved significantly after Trump refrained from announcing immediate tariffs on major trading partners, including China. His more measured approach eased concerns over escalating trade tensions and signaled a potential shift away from aggressive protectionist policies. This supported U.S. equities, particularly the Dow Jones Industrial Average, which benefited from declining Treasury yields and increased investor optimism over a more stable economic outlook. If Trump maintains a balanced trade stance, equity markets may continue to rally.

Dow Jones is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 62, suggesting the index might extend tis gains since the RSI stays above the midline.

Resistance level: 43920.00, 45375.00

Support level: 42900.00, 41875.00

Bitcoin pulled back from record highs amid heightened market volatility surrounding Trump’s inauguration. The initial selloff was fueled by uncertainty as Trump’s speech did not address Bitcoin or cryptocurrencies directly. However, market sentiment later turned optimistic, with investors interpreting the absence of negative rhetoric as a potential sign of a more crypto-friendly regulatory stance under his administration. While short-term profit-taking weighed on BTC prices, expectations of looser regulations could support renewed bullish momentum in the coming weeks.

BTC/USD is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 42, suggesting the crypto might extend its losses since the RSI stays below the midline.

Resistance level: 102685.00, 106170.00

Support level: 99435.00, 97075.00

Oil prices edged lower as Trump pledged to declare a national energy emergency to boost domestic energy production, postponing immediate tariffs on China. His proposed policies include relaxing LNG export restrictions and accelerating approvals for U.S. energy projects, which could lead to an increase in long-term oil supply. However, demand-side factors remain supportive, with China’s Q4 GDP growing 5%—in line with Beijing’s target—and industrial production exceeding expectations. While oil faced short-term selling pressure, continued economic resilience in China and global demand growth could provide support moving forward.

Crude oil is trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 44, suggesting the commodity might experience technical correction since the RSI rebounded from oversold territory.

Resistance level: 77.50, 80.75

Support level: 75.20, 72.95

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Market Summary

The U.S. dollar experienced heightened volatility as markets reopened following Monday’s U.S. public holiday. Initially, the Dollar Index declined by over 1% during the Sydney session, reflecting market sentiment that President Donald Trump might delay imposing tariffs. However, the narrative shifted dramatically when Trump took executive action to announce a 25% tariff on imports from Mexico and Canada, effective February 1. This aggressive stance bolstered the dollar, reversing earlier losses and driving the Dollar Index higher. Wall Street futures responded positively to Trump’s assertive policies, suggesting a potential rally when the New York session begins. Investors appear optimistic about the administration’s proactive measures, fueling risk appetite in equity markets.

In the forex market, attention now turns to key economic data releases. The UK’s job market report and Canada’s CPI reading are expected to influence the Pound Sterling and Canadian dollar, respectively, providing fresh direction for currency pairs tied to these economies.

In the commodities market, gold prices have climbed to near $2,720 as investors hedge against uncertainties surrounding Trump’s policies. The precious metal’s recent rally underscores its appeal as a safe haven amidst geopolitical and economic shifts. Conversely, oil prices face downside risks, with Trump’s pledge to boost U.S. oil output potentially exacerbating supply concerns in an already soft demand environment.

The cryptocurrency market saw Bitcoin retreat by over 6% after Trump’s inauguration, reflecting a “buy the rumor, sell the news” sentiment. Despite this correction, Bitcoin remains firmly above the $100,000 mark, supported by indications of Trump’s interest in the crypto market.

Current rate hike bets on 29th January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (97.9%) VS -25 bps (2.1%)

Market Overview

Economic Calendar

(MT4 System Time)

N/A

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The U.S. dollar extended its decline as Treasury yields dropped, with the 10-year yield falling nine basis points to 4.54% following Monday’s holiday. Potential easing sanctions implementation on China, had diminished inflation concerns and weighed on the dollar. This development has led investors to reassess expectations for Federal Reserve policy adjustments, with market participants now pricing in a higher probability of rate cuts later this year.

The Dollar Index is trading flat while currently testing the support level at 107.95. MACD has illustrated increasing bearish momentum, while RSI is at 32, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 109.00, 110.00

Support level: 107.95, 106.80

Gold prices surged to a new high, supported by a weaker dollar in recent sessions. Additionally, uncertainty surrounding President Trump’s policy decisions has increased demand for the safe-haven asset. However, gold traders should remain cautious, as a potential rebound in the dollar, driven by Trump’s executive actions, could limit gold’s upward momentum.

Gold prices have broken above their sideways trend, suggesting a bullish bias for gold. The RSI remains close to the overbought zone, while the MACD remains elevated, suggesting that gold remains trading with strong bullish momentum.

Resistance level: 2755.00, 2789.00

Support level: 2718.35, 2665.00

The GBP/USD pair broke above its downtrend resistance, signaling a potential bullish trend. The pair benefited from an initial decline in the dollar’s strength, driven by market expectations of a softer trade stance from Trump’s administration. However, the dollar is anticipated to recover following Trump’s announcement of high tariffs on Canada and Mexico, which could support the greenback. Meanwhile, traders will focus on the UK’s job data, which may influence the Pound Sterling’s strength and the pair’s further direction.

GBP/USD returned to its previous high level near the 1.2305 mark, suggesting a bullish bias for the pair. The RSI is moving upward while the MACD is breaking above the zero line, suggesting that the pair is trading with bullish momentum.

Resistance level: 1.2408, 1.2506

Support level: 1.2220, 1.2140

The USD/CAD pair is trading within an expanding triangle pattern near its recent highs, indicating a bullish outlook. The U.S. dollar remains strong, while the Canadian dollar weakens due to underwhelming economic data and dovish BoC policies. Additionally, Trump’s announcement of a 25% tariff on Canada is expected to pressure the Canadian dollar further, potentially driving the pair higher in the coming sessions.

The pair seesawed in the recent session but remains elevated, suggesting a bullish bias. The RSI is hovering near the 50 level, while the MACD is flowing close to the zero line, suggesting a neutral signal for the pair.

Resistance level: 1.4540, 1.4625

Support level: 1.4350, 1.4240

The USD/JPY pair is exhibiting a lower-high price pattern, signaling a bearish outlook. Traders are closely watching Friday’s BoJ interest rate decision and Japan’s CPI data to assess the Yen’s strength. Anticipation of a potential BoJ rate hike has already supported the Yen, contributing to the pair’s downward momentum.

The USD/JPY has been trading in a bearish trajectory and has reached a new low in recent sessions. The RSI remains below the 50 level, while the MACD continues to flow below the zero line, suggesting that the pair’s bearish momentum remains intact.

Resistance level: 156.00, 157.30

Support level: 154.25, 152.50

Global risk appetite improved significantly after Trump refrained from announcing immediate tariffs on major trading partners, including China. His more measured approach eased concerns over escalating trade tensions and signaled a potential shift away from aggressive protectionist policies. This supported U.S. equities, particularly the Dow Jones Industrial Average, which benefited from declining Treasury yields and increased investor optimism over a more stable economic outlook. If Trump maintains a balanced trade stance, equity markets may continue to rally.

Dow Jones is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 62, suggesting the index might extend tis gains since the RSI stays above the midline.

Resistance level: 43920.00, 45375.00

Support level: 42900.00, 41875.00

Bitcoin pulled back from record highs amid heightened market volatility surrounding Trump’s inauguration. The initial selloff was fueled by uncertainty as Trump’s speech did not address Bitcoin or cryptocurrencies directly. However, market sentiment later turned optimistic, with investors interpreting the absence of negative rhetoric as a potential sign of a more crypto-friendly regulatory stance under his administration. While short-term profit-taking weighed on BTC prices, expectations of looser regulations could support renewed bullish momentum in the coming weeks.

BTC/USD is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 42, suggesting the crypto might extend its losses since the RSI stays below the midline.

Resistance level: 102685.00, 106170.00

Support level: 99435.00, 97075.00

Oil prices edged lower as Trump pledged to declare a national energy emergency to boost domestic energy production, postponing immediate tariffs on China. His proposed policies include relaxing LNG export restrictions and accelerating approvals for U.S. energy projects, which could lead to an increase in long-term oil supply. However, demand-side factors remain supportive, with China’s Q4 GDP growing 5%—in line with Beijing’s target—and industrial production exceeding expectations. While oil faced short-term selling pressure, continued economic resilience in China and global demand growth could provide support moving forward.

Crude oil is trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 44, suggesting the commodity might experience technical correction since the RSI rebounded from oversold territory.

Resistance level: 77.50, 80.75

Support level: 75.20, 72.95

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.