-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

Market Summary

Risk assets staged a strong rebound this week, led by a more than 10% surge in the Nasdaq, after President Donald Trump announced a significant shift in U.S. trade policy. In a move that surprised markets, the U.S. will implement a 90-day pause on reciprocal tariffs for all countries except China, reducing the base tariff rate to 10% during the negotiation period. This unexpected policy pivot triggered a broad risk-on rally, lifting equities, cryptocurrencies, and crude oil as investor sentiment turned sharply more optimistic.

However, the relief did not extend to China. In a stark escalation of trade tensions, the U.S. raised tariffs on Chinese goods from 104% to 125% with immediate effect. This came in response to China’s announcement of an additional 50% tariff on U.S. imports, set to begin on April 10th. The tit-for-tat actions have intensified concerns of a prolonged and potentially more damaging trade conflict between the world’s two largest economies.

Market reactions were mixed, reflecting cautious optimism. While equities and other high-risk assets soared on the back of easing tariff pressure, gold also saw renewed inflows. Many portfolio managers, who had previously liquidated gold positions to meet margin calls during the recent downturn, are now reallocating as volatility shows signs of easing. The simultaneous strength in both risk and safe-haven assets suggests that while investors are regaining confidence, uncertainty around global trade dynamics continues to weigh on broader market sentiment.

Current rate hike bets on 7th May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (85%) VS -25 bps (15%)

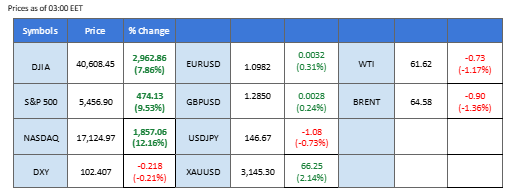

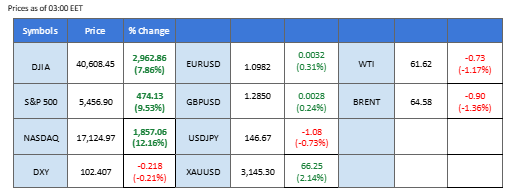

Market Overview

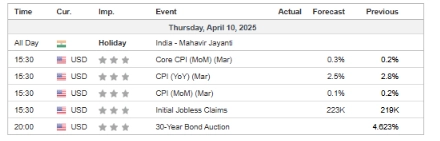

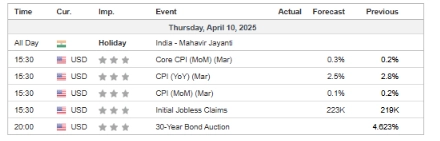

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

The Dollar Index remains range bound as conflicting U.S. tariff policies generate mixed signals for currency traders. After China retaliated with an 84% tariff, the U.S. pushed forward with a 125% tariff on Chinese goods, adding to investor uncertainty. Markets are now closely watching China’s next move, which will likely shape the next directional bias for the dollar.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 48, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 103.15, 103.80

Support level: 102.45, 102.00

Gold prices are regaining traction as safe-haven demand returns in the wake of stabilizing equity markets. Earlier selloffs triggered by margin calls are reversing, with portfolio managers reallocating into gold amid ongoing geopolitical tensions. Although President Trump delayed some tariff actions for selected countries, the U.S.-China relationship continues to deteriorate, keeping trade risks high and supporting gold’s long-term bullish outlook.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 72, suggesting the commodity might enter overbought territory.

Resistance level: 3130.00, 3170.00

Support level: 3090.00, 3045.00

Despite a modest rebound in global risk appetite, China-related equities remain under pressure amid escalating trade tensions. The U.S. has announced a new wave of aggressive tariffs, prompting China to impose a 50% tariff on U.S. imports effective April 10. In response, the U.S. escalated its stance by raising tariffs on Chinese goods from 104% to 125%, effective immediately. With China yet to respond to this latest move, market volatility remains elevated and investor sentiment cautious.

HK50 is trading lower following the prior retracement from the resistance level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 34, suggesting the index might enter oversold territory.

Resistance level: 21180.00, 22640.00

Support level: 18855.00, 17150.00

EUR/USD remains strong above 1.1000, nearing a two-month high at 1.1100, driven by USD weakness as escalating U.S.-China trade tensions. Trump’s new 125% tariffs on Chinese goods and Beijing’s 84% retaliatory duties on U.S. agriculture have raised fears of global trade fragmentation. The EU’s $23B tariffs on U.S. products have further boosted euro sentiment. Meanwhile, Fed rate cut expectations (75 bps in 2025) weigh on the dollar. However, euro gains may be capped as the ECB’s April cut is priced in and Eurozone growth forecasts drop, with Morgan Stanley predicting just 0.8% GDP in 2025.

EUR/USD is showing some consolidation after a sharp rally. The RSI is at 51, indicating neutral momentum with a slight tilt toward bullishness, while the MACD shows weakening bullish momentum as the histogram contracts and the MACD line hovers just above the signal line.

Resistance level: 1.1007, 1.1085

Support level: 1.0960, 1.9065

Oil prices surged over 4%, recovering from a four-year low after President Trump paused recent tariff implementations for most nations, while simultaneously raising China’s tariff rate to 125%. The initial 104% tariff in China took effect earlier, fueling concerns over global growth but also prompting speculative buying in oil markets.

Crude oil prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 37, suggesting the commodity might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 63.00, 66.65

Support level: 57.80, 53.85

Global equity markets staged a powerful comeback, led by the Nasdaq’s surge of over 10%, following President Trump’s announcement of a 90-day pause on reciprocal tariffs for all countries except China. During this negotiation window, most nations will benefit from a reduced base tariff of 10%, easing short-term trade tensions. However, tariffs on China were raised to a staggering 125%, keeping geopolitical risks elevated and fueling continued market volatility.

Nasdaq is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 55, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 19505.00, 20150.00

Support level: 18860.00, 18065.00

Bitcoin continues to find support, buoyed by improved global risk sentiment after the U.S. paused tariff implementations for several countries—except China—for 90 days. While optimism grows, uncertainty lingers, as traders await further developments in U.S.-China negotiations before making bold moves.

BTC/USD is recovering slightly after a sharp drop that tested support near $79,000. The broader trend remains bearish with multiple failed attempts to reclaim the $86,300 resistance zone. The RSI is at 46 while the MACD remains in bearish territory, with the MACD line below the signal and histogram bars still red—indicating ongoing downward pressure.

Resistance level: 86,306.00, 92,323.00

Support level: 79,000.00, 71,525.00

Global risk appetite improved following Trump’s delay of most of the countries tariffs implementations for 90 days, risk-on sentiment supported higher risk currencies such as Pound Sterling. Nonetheless, the BoE has flagged financial stability risks, and JPMorgan warns the UK may slide into a technical recession. On the policy front, Deutsche Bank sees a 50 bps BoE cut in May, while the Fed signals patience, pushing expected U.S. rate cuts to mid-year or later.

GBP/USD is consolidating around 1.2844, showing signs of a short-term bullish recovery after bouncing from the 1.2695 support level. The RSI sits at 49, indicating a neutral stance but showing upward movement from recent lows, while the MACD has just made a bullish crossover, supporting the case for continued gains.The overall structure favors range-bound trading, with potential for volatility around key macro data releases.

Resistance level: 1.2875, 1.2960

Support level: 1.2785, 1.2695

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Market Summary

Risk assets staged a strong rebound this week, led by a more than 10% surge in the Nasdaq, after President Donald Trump announced a significant shift in U.S. trade policy. In a move that surprised markets, the U.S. will implement a 90-day pause on reciprocal tariffs for all countries except China, reducing the base tariff rate to 10% during the negotiation period. This unexpected policy pivot triggered a broad risk-on rally, lifting equities, cryptocurrencies, and crude oil as investor sentiment turned sharply more optimistic.

However, the relief did not extend to China. In a stark escalation of trade tensions, the U.S. raised tariffs on Chinese goods from 104% to 125% with immediate effect. This came in response to China’s announcement of an additional 50% tariff on U.S. imports, set to begin on April 10th. The tit-for-tat actions have intensified concerns of a prolonged and potentially more damaging trade conflict between the world’s two largest economies.

Market reactions were mixed, reflecting cautious optimism. While equities and other high-risk assets soared on the back of easing tariff pressure, gold also saw renewed inflows. Many portfolio managers, who had previously liquidated gold positions to meet margin calls during the recent downturn, are now reallocating as volatility shows signs of easing. The simultaneous strength in both risk and safe-haven assets suggests that while investors are regaining confidence, uncertainty around global trade dynamics continues to weigh on broader market sentiment.

Current rate hike bets on 7th May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (85%) VS -25 bps (15%)

Market Overview

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

The Dollar Index remains range bound as conflicting U.S. tariff policies generate mixed signals for currency traders. After China retaliated with an 84% tariff, the U.S. pushed forward with a 125% tariff on Chinese goods, adding to investor uncertainty. Markets are now closely watching China’s next move, which will likely shape the next directional bias for the dollar.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 48, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 103.15, 103.80

Support level: 102.45, 102.00

Gold prices are regaining traction as safe-haven demand returns in the wake of stabilizing equity markets. Earlier selloffs triggered by margin calls are reversing, with portfolio managers reallocating into gold amid ongoing geopolitical tensions. Although President Trump delayed some tariff actions for selected countries, the U.S.-China relationship continues to deteriorate, keeping trade risks high and supporting gold’s long-term bullish outlook.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 72, suggesting the commodity might enter overbought territory.

Resistance level: 3130.00, 3170.00

Support level: 3090.00, 3045.00

Despite a modest rebound in global risk appetite, China-related equities remain under pressure amid escalating trade tensions. The U.S. has announced a new wave of aggressive tariffs, prompting China to impose a 50% tariff on U.S. imports effective April 10. In response, the U.S. escalated its stance by raising tariffs on Chinese goods from 104% to 125%, effective immediately. With China yet to respond to this latest move, market volatility remains elevated and investor sentiment cautious.

HK50 is trading lower following the prior retracement from the resistance level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 34, suggesting the index might enter oversold territory.

Resistance level: 21180.00, 22640.00

Support level: 18855.00, 17150.00

EUR/USD remains strong above 1.1000, nearing a two-month high at 1.1100, driven by USD weakness as escalating U.S.-China trade tensions. Trump’s new 125% tariffs on Chinese goods and Beijing’s 84% retaliatory duties on U.S. agriculture have raised fears of global trade fragmentation. The EU’s $23B tariffs on U.S. products have further boosted euro sentiment. Meanwhile, Fed rate cut expectations (75 bps in 2025) weigh on the dollar. However, euro gains may be capped as the ECB’s April cut is priced in and Eurozone growth forecasts drop, with Morgan Stanley predicting just 0.8% GDP in 2025.

EUR/USD is showing some consolidation after a sharp rally. The RSI is at 51, indicating neutral momentum with a slight tilt toward bullishness, while the MACD shows weakening bullish momentum as the histogram contracts and the MACD line hovers just above the signal line.

Resistance level: 1.1007, 1.1085

Support level: 1.0960, 1.9065

Oil prices surged over 4%, recovering from a four-year low after President Trump paused recent tariff implementations for most nations, while simultaneously raising China’s tariff rate to 125%. The initial 104% tariff in China took effect earlier, fueling concerns over global growth but also prompting speculative buying in oil markets.

Crude oil prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 37, suggesting the commodity might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 63.00, 66.65

Support level: 57.80, 53.85

Global equity markets staged a powerful comeback, led by the Nasdaq’s surge of over 10%, following President Trump’s announcement of a 90-day pause on reciprocal tariffs for all countries except China. During this negotiation window, most nations will benefit from a reduced base tariff of 10%, easing short-term trade tensions. However, tariffs on China were raised to a staggering 125%, keeping geopolitical risks elevated and fueling continued market volatility.

Nasdaq is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 55, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 19505.00, 20150.00

Support level: 18860.00, 18065.00

Bitcoin continues to find support, buoyed by improved global risk sentiment after the U.S. paused tariff implementations for several countries—except China—for 90 days. While optimism grows, uncertainty lingers, as traders await further developments in U.S.-China negotiations before making bold moves.

BTC/USD is recovering slightly after a sharp drop that tested support near $79,000. The broader trend remains bearish with multiple failed attempts to reclaim the $86,300 resistance zone. The RSI is at 46 while the MACD remains in bearish territory, with the MACD line below the signal and histogram bars still red—indicating ongoing downward pressure.

Resistance level: 86,306.00, 92,323.00

Support level: 79,000.00, 71,525.00

Global risk appetite improved following Trump’s delay of most of the countries tariffs implementations for 90 days, risk-on sentiment supported higher risk currencies such as Pound Sterling. Nonetheless, the BoE has flagged financial stability risks, and JPMorgan warns the UK may slide into a technical recession. On the policy front, Deutsche Bank sees a 50 bps BoE cut in May, while the Fed signals patience, pushing expected U.S. rate cuts to mid-year or later.

GBP/USD is consolidating around 1.2844, showing signs of a short-term bullish recovery after bouncing from the 1.2695 support level. The RSI sits at 49, indicating a neutral stance but showing upward movement from recent lows, while the MACD has just made a bullish crossover, supporting the case for continued gains.The overall structure favors range-bound trading, with potential for volatility around key macro data releases.

Resistance level: 1.2875, 1.2960

Support level: 1.2785, 1.2695

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.