-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

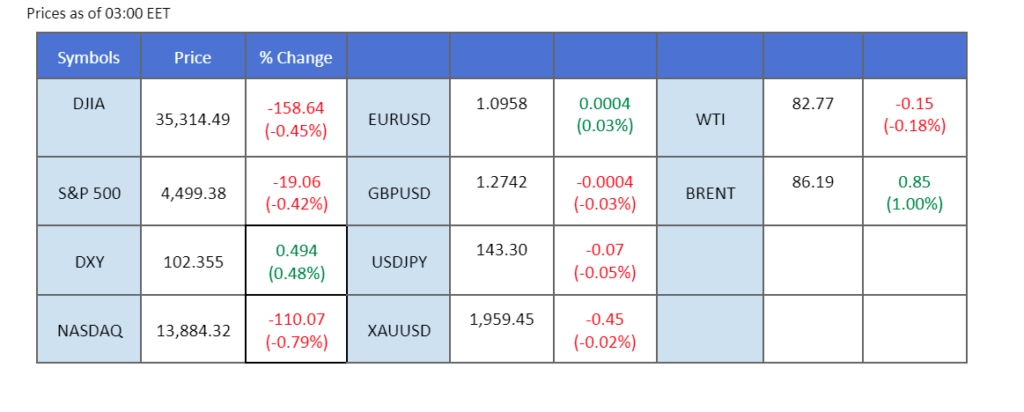

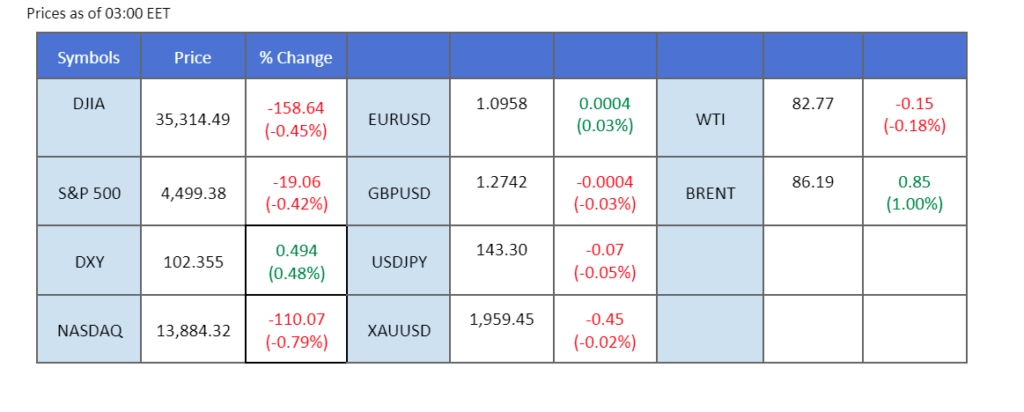

Moody’s decision to downgrade select U.S. banks, citing escalating financial risks, triggered selling pressure in the U.S. stock market last night. The situation worsened as China unveiled its Consumer Price Index (CPI) and Producer Price Index (PPI) readings, both of which recorded more significant declines than initially projected. This prompted a downward trajectory during the initial trading sessions in the Asian region. Conversely, amidst this backdrop of disappointing Chinese economic indicators, oil prices showcased resilience by finding a stronghold at the $82 mark. This notable support was facilitated by the ongoing efforts of the OPEC+ coalition, which introduced further cuts to oil supply, thus serving as a stabilising force for oil prices. In another development, market bets that the BoJ is losing its grip on long-term bond yield implies that the end of negative rates is near and might fuel the yen to appreciate.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (0.2%) VS 25 bps (99.8%)

The US Dollar maintained its positive stance as it awaited crucial inflation data scheduled for release later in the week. Economists predicted a slightly elevated Consumer Price Index (CPI) Year-over-Year reading of 3.30%, compared to the previous 3.0%. These developments were accompanied by assertive remarks from Federal Reserve members, such as Michelle Bowman and John C. Williams, underlining the need to sustain the tightening policy to combat inflation.

The dollar index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 61, suggesting the index might be traded lower as technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 102.60, 103.40

Support level: 102.05, 101.45

The gold market extended its bearish trajectory, breaching another significant support level. This decline was influenced by rising US Treasury yields and a strengthened US Dollar, both bolstered by hawkish statements from the Federal Reserve. Despite potential volatility ahead of the US inflation report, caution was advised while focusing on the nation’s economic outlook.

Gold prices are trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 32, suggesting the commodity might enter oversold territory.

Resistance level: 1945.00, 1970.00

Support level: 1930.00, 1910.00

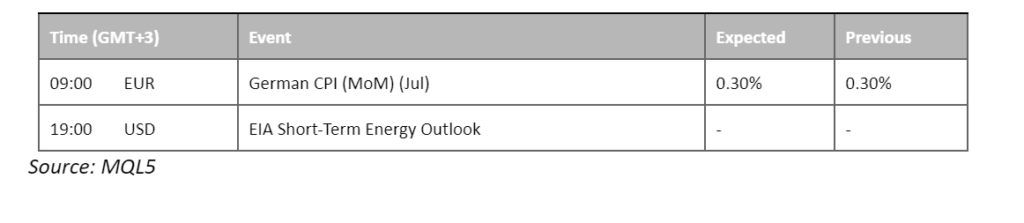

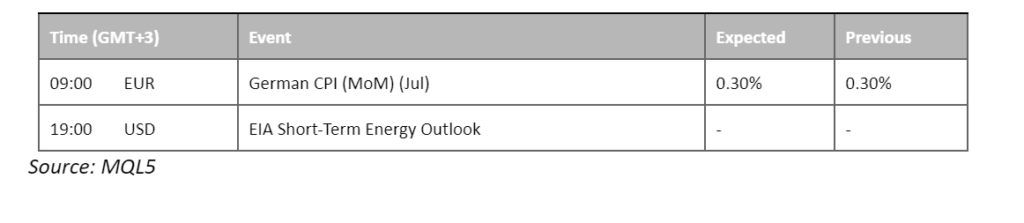

The Euro remained entrenched below its downtrend resistance threshold, witnessing a decline of approximately 0.5% before undergoing a subsequent technical rebound. The recently disclosed German Consumer Price Index (CPI) reading aligned with the market’s anticipations. The gradual deceleration evident in the German CPI figures spurred speculations within the markets that the European Central Bank (ECB) could potentially adopt a more accommodating stance in its forthcoming monetary policy decisions. Conversely, a contraction in the U.S. trade deficit attributed to reduced imports boosted the U.S. dollar’s strength.

Euro continues to trade under its downtrend resistance level with a crucial support level at around 1.0930. The RSI is hovering in the lower region while the MACD has plunged below the zero line suggesting the momentum with the pair is low.

Resistance level: 1.1090, 1.1150

Support level: 1.0930, 1.0850

The Pound Sterling extends its rally, as investors grapple with the repercussions of the hawkish monetary policy announced by the Bank of England (BoE) in the preceding week. The BoE, in its August policy meeting, elevated interest rates by 25 basis points to a 15-year pinnacle of 5.25%, up from the prior 5%. This resolute stance echoes the broader hawkish sentiment resonating across central banks.

GBP/USD is trading lower following the prior retracement from the resistance level. However, MACD has illustrated increasing bullish momentum, while RSI is at 50, suggesting the pair might be traded higher as technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 1.2815, 1.2990

Support level: 1.2655, 1.2500

The US equity market experienced a modest decline, driven by mounting apprehensions regarding the nation’s financial system and economic outlook. This shift in sentiment prompted investors to seek refuge in alternative safe-haven assets. Specifically, the banking sector faced headwinds as Moody’s Investors Service downgraded several small and midsize American lenders. This move, coupled with the potential downgrade of major institutions, triggered by deep valuation concerns, led to a dip in the bank sector.

The Dow is trading lower following the prior retracement from the resistance level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 50, suggesting the index might consolidate within a range since the RSI stays near the midline.

Resistance level: 35640.00, 36415.00

Support level: 34575.00, 33675.00

The Japanese Yen continued its slide, resulting in the currency pair once again surpassing the 143.00 threshold. A boost in the U.S. dollar’s momentum was propelled by trade data that exceeded expectations, with the trade balance narrowing to -$65.5 billion and a notable decrease in imports. This favourable data provided the impetus for the dollar to ascend against most of its counterparts. Concurrently, the market sentiment gained momentum due to the Bank of Japan’s (BoJ) adjustment to its Yield Curve Control (YCC) strategy the previous month. This adjustment has heightened speculation that the Japanese central bank might be nearing a conclusion to its negative interest rate policy.

The pair faced a strong resistance near the 143.00 level and has been suppressed at below 143.60 for the past month. The RSI is at above 50-level, and the MACD rebounded above the zero line suggesting a strong bullish momentum is intact with the pair.

Resistance level: 144.70, 145.75

Support level: 142.00, 141.20

The oil market initially experienced a decline following discouraging economic data from China. Concerns arising from lacklustre import and export figures cast shadows on the commodity’s outlook. However, despite the pessimism, certain market participants displayed confidence in a bullish long-term trend for oil. Recent decisions by OPEC+ to cut production further supported oil prices, with Saudi Arabia reiterating its commitment to extend voluntary output cuts into September.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 60, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 83.20, 86.10

Support level: 79.00, 74.45

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Moody’s decision to downgrade select U.S. banks, citing escalating financial risks, triggered selling pressure in the U.S. stock market last night. The situation worsened as China unveiled its Consumer Price Index (CPI) and Producer Price Index (PPI) readings, both of which recorded more significant declines than initially projected. This prompted a downward trajectory during the initial trading sessions in the Asian region. Conversely, amidst this backdrop of disappointing Chinese economic indicators, oil prices showcased resilience by finding a stronghold at the $82 mark. This notable support was facilitated by the ongoing efforts of the OPEC+ coalition, which introduced further cuts to oil supply, thus serving as a stabilising force for oil prices. In another development, market bets that the BoJ is losing its grip on long-term bond yield implies that the end of negative rates is near and might fuel the yen to appreciate.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (0.2%) VS 25 bps (99.8%)

The US Dollar maintained its positive stance as it awaited crucial inflation data scheduled for release later in the week. Economists predicted a slightly elevated Consumer Price Index (CPI) Year-over-Year reading of 3.30%, compared to the previous 3.0%. These developments were accompanied by assertive remarks from Federal Reserve members, such as Michelle Bowman and John C. Williams, underlining the need to sustain the tightening policy to combat inflation.

The dollar index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 61, suggesting the index might be traded lower as technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 102.60, 103.40

Support level: 102.05, 101.45

The gold market extended its bearish trajectory, breaching another significant support level. This decline was influenced by rising US Treasury yields and a strengthened US Dollar, both bolstered by hawkish statements from the Federal Reserve. Despite potential volatility ahead of the US inflation report, caution was advised while focusing on the nation’s economic outlook.

Gold prices are trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 32, suggesting the commodity might enter oversold territory.

Resistance level: 1945.00, 1970.00

Support level: 1930.00, 1910.00

The Euro remained entrenched below its downtrend resistance threshold, witnessing a decline of approximately 0.5% before undergoing a subsequent technical rebound. The recently disclosed German Consumer Price Index (CPI) reading aligned with the market’s anticipations. The gradual deceleration evident in the German CPI figures spurred speculations within the markets that the European Central Bank (ECB) could potentially adopt a more accommodating stance in its forthcoming monetary policy decisions. Conversely, a contraction in the U.S. trade deficit attributed to reduced imports boosted the U.S. dollar’s strength.

Euro continues to trade under its downtrend resistance level with a crucial support level at around 1.0930. The RSI is hovering in the lower region while the MACD has plunged below the zero line suggesting the momentum with the pair is low.

Resistance level: 1.1090, 1.1150

Support level: 1.0930, 1.0850

The Pound Sterling extends its rally, as investors grapple with the repercussions of the hawkish monetary policy announced by the Bank of England (BoE) in the preceding week. The BoE, in its August policy meeting, elevated interest rates by 25 basis points to a 15-year pinnacle of 5.25%, up from the prior 5%. This resolute stance echoes the broader hawkish sentiment resonating across central banks.

GBP/USD is trading lower following the prior retracement from the resistance level. However, MACD has illustrated increasing bullish momentum, while RSI is at 50, suggesting the pair might be traded higher as technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 1.2815, 1.2990

Support level: 1.2655, 1.2500

The US equity market experienced a modest decline, driven by mounting apprehensions regarding the nation’s financial system and economic outlook. This shift in sentiment prompted investors to seek refuge in alternative safe-haven assets. Specifically, the banking sector faced headwinds as Moody’s Investors Service downgraded several small and midsize American lenders. This move, coupled with the potential downgrade of major institutions, triggered by deep valuation concerns, led to a dip in the bank sector.

The Dow is trading lower following the prior retracement from the resistance level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 50, suggesting the index might consolidate within a range since the RSI stays near the midline.

Resistance level: 35640.00, 36415.00

Support level: 34575.00, 33675.00

The Japanese Yen continued its slide, resulting in the currency pair once again surpassing the 143.00 threshold. A boost in the U.S. dollar’s momentum was propelled by trade data that exceeded expectations, with the trade balance narrowing to -$65.5 billion and a notable decrease in imports. This favourable data provided the impetus for the dollar to ascend against most of its counterparts. Concurrently, the market sentiment gained momentum due to the Bank of Japan’s (BoJ) adjustment to its Yield Curve Control (YCC) strategy the previous month. This adjustment has heightened speculation that the Japanese central bank might be nearing a conclusion to its negative interest rate policy.

The pair faced a strong resistance near the 143.00 level and has been suppressed at below 143.60 for the past month. The RSI is at above 50-level, and the MACD rebounded above the zero line suggesting a strong bullish momentum is intact with the pair.

Resistance level: 144.70, 145.75

Support level: 142.00, 141.20

The oil market initially experienced a decline following discouraging economic data from China. Concerns arising from lacklustre import and export figures cast shadows on the commodity’s outlook. However, despite the pessimism, certain market participants displayed confidence in a bullish long-term trend for oil. Recent decisions by OPEC+ to cut production further supported oil prices, with Saudi Arabia reiterating its commitment to extend voluntary output cuts into September.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 60, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 83.20, 86.10

Support level: 79.00, 74.45

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.