-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

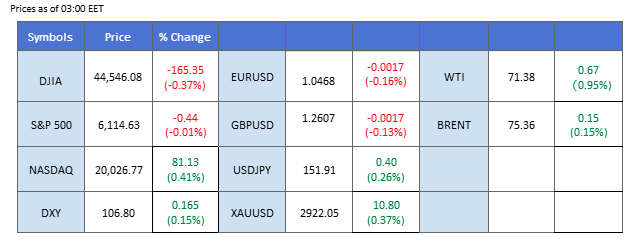

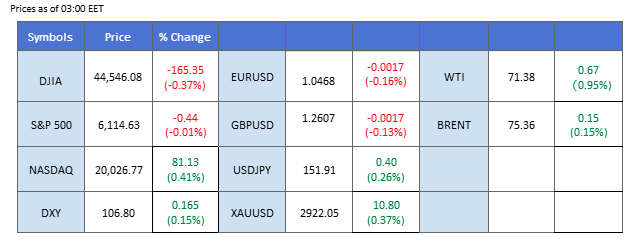

Market Summary

With U.S. markets closed for a public holiday, Chinese equities dominated global market attention. Investor confidence surged after President Xi met with top tech leaders, signaling a more accommodative stance toward the sector. The Hang Seng Index is nearing a five-month high, while the Hang Seng Tech Index has jumped over 25% this year, reaching its highest level since 2023—a sign of renewed optimism toward China’s tech industry.

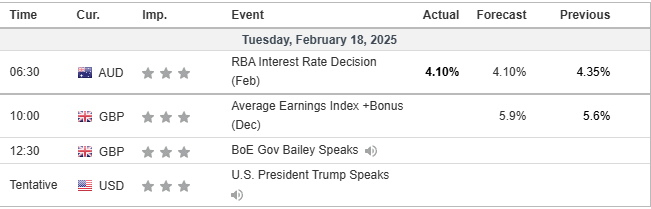

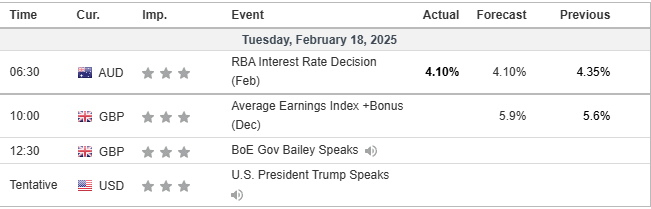

In FX markets, the U.S. dollar remained subdued due to the market holiday but may see a modest recovery when trading resumes. However, its longer-term downtrend remains intact as it lacks a clear catalyst. Meanwhile, the market is focused on today’s RBA interest rate decision, with expectations of the first rate cut in years, which could weigh on the Australian dollar. The Pound Sterling has climbed to its strongest level this year, with today’s UK jobs data likely to dictate its next move.

In commodities, gold prices remained muted amid the U.S. holiday, while traders monitored peace talks between U.S. and Russian delegates on the Ukraine-Russia conflict. Meanwhile, oil prices edged higher, supported by speculation that OPEC+ may extend supply cuts to counter persistently weak prices.

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98%) VS -25 bps (2%)

Market Overview

(MT4 System Time)

Source: MQL5

Market Movements

The Dollar Index remained stable as investors await further clarity on the impact of Trump’s tariff policies. Federal Reserve Governor Christopher Waller noted that recent economic data supports the Fed’s decision to keep interest rates unchanged, with inflation showing no immediate cause for concern. The Fed will continue monitoring CPI reports for future policy decisions. Geopolitical uncertainties, including the ongoing Russia-Ukraine conflict, have kept market sentiment cautious, and the dollar remained flat.

The Dollar Index is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 26, suggesting the index might enter oversold territory.

Resistance level: 107.45, 108.40

Support level: 106.55, 105.65

Gold prices mirrored the dollar’s uncertainty, as mixed market factors maintain a wait-and-see approach. Bullish drivers include potential de-dollarization by BRICS and uncertainty around Trump’s tariffs, which could reduce the dollar’s appeal and support gold. However, positive developments in the Russia-Ukraine ceasefire negotiations may shift sentiment toward riskier assets, triggering a selloff in gold. Investors should monitor these developments closely for potential direction.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 59, suggesting the commodity might extend its gains since the RSI stays above the midline.,

Resistance level: 2915.00, 2935.00

Support level: 2880.00, 2855.00

The GBP/USD pair remains near its recent highs, lacking a clear directional push as traders await fresh catalysts. With U.S. markets closed for a public holiday, the dollar stayed subdued, allowing the Pound Sterling to hold firm. However, all eyes are now on the UK job data, which could be a pivotal factor in shaping the pair’s next move. Market expectations point to a higher unemployment rate, which may weigh on the Pound if confirmed. A stronger-than-expected labor market report, however, could provide further support for Sterling’s bullish momentum.

GBP/USD has reached its recent peak and has been consolidating. It may face a technical correction in the near term. The RSI remains elevated, while the MACD is about to cross on the above, suggesting that the bullish momentum might be easing.

Resistance level: 1.2730, 1.2850

Support level: 1.2485, 1.2375

The USD/JPY pair has established a double-bottom pattern at its critical support level of 151.35, signaling the potential for a technical rebound. The Japanese yen has strengthened in recent sessions, bolstered by upbeat economic indicators that have reinforced market speculation of a March BoJ rate hike. Meanwhile, the U.S. dollar faces renewed headwinds amid uncertainty surrounding the Trump administration’s tariff threats and concerns over the ballooning U.S. national debt, both of which have weighed on investor confidence in the greenback.

The USD/JPY pair has eased bearish momentum as it approaches its critical support level at near 151.35. A break below such a level would be a solid bearish signal for the pair. The RSI remains in the lower region, while the MACD has broken below the zero line, suggesting that bearish momentum may be forming.

Resistance level: 152.65, 153.80

Support level: 151.35, 149.60

The Hang Seng Tech Index surged over 18% in February, breaking above its downtrend resistance level and signalling a shift into strong bullish momentum. This rally has been fueled by renewed investor confidence, particularly after Jack Ma’s return and the high-profile summit between Chinese tech giants and President Xi Jinping, which signalled a more supportive stance from Beijing toward the sector. The policy shift has reinvigorated optimism in Chinese tech stocks, driving robust capital inflows into the sector.

The index has been gaining and has reached its highest level since 2023, suggesting a bullish bias. The RSI remains flowing in the overbought zone, while the MACD continues to edge higher, suggesting that the bullish momentum remains strong with the pair.

Resistance level: 6155.00, 6722.00

Support level: 5160.00, 4700.00

AUD/USD has climbed to a two-month high, but momentum appears to be stalling as the pair consolidates and shows signs of a potential retracement. Traders are bracing for today’s RBA interest rate decision, with the market widely expecting a 25 basis point rate cut—a shift in monetary policy that could weigh on the Aussie dollar’s strength. A dovish tone from the RBA could reinforce downside pressure on the pair, especially if the central bank signals further easing ahead. However, if policymakers take a more cautious approach, the Aussie may find support, keeping the pair in its current range.

The has been trading within its uptrend trajectory and has gained to a two-month high, suggesting a bullish bias for the pair. The RSI remains above the 50 level while the MACD is hovering at the elevated level, suggesting that the pair remains trading with bullish momentum.

Resistance level: 0.6420, 0.6500

Support level: 0.6275, 0.6205

Oil prices stabilized after recent gains, with OPEC+ delegates considering a delay in planned output increases due to weak demand and rising non-member supply. The delay could mark the fourth since 2022. Additionally, Ukrainian drone attacks have disrupted exports through Kazakhstan’s main pipeline. Despite this, Russian Deputy Prime Minister Alexander Novak stated that OPEC+ is unlikely to delay the April 2025 supply hike.

Crude oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 51, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 73.30, 75.25

Support level: 70.40, 67.80

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Market Summary

With U.S. markets closed for a public holiday, Chinese equities dominated global market attention. Investor confidence surged after President Xi met with top tech leaders, signaling a more accommodative stance toward the sector. The Hang Seng Index is nearing a five-month high, while the Hang Seng Tech Index has jumped over 25% this year, reaching its highest level since 2023—a sign of renewed optimism toward China’s tech industry.

In FX markets, the U.S. dollar remained subdued due to the market holiday but may see a modest recovery when trading resumes. However, its longer-term downtrend remains intact as it lacks a clear catalyst. Meanwhile, the market is focused on today’s RBA interest rate decision, with expectations of the first rate cut in years, which could weigh on the Australian dollar. The Pound Sterling has climbed to its strongest level this year, with today’s UK jobs data likely to dictate its next move.

In commodities, gold prices remained muted amid the U.S. holiday, while traders monitored peace talks between U.S. and Russian delegates on the Ukraine-Russia conflict. Meanwhile, oil prices edged higher, supported by speculation that OPEC+ may extend supply cuts to counter persistently weak prices.

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98%) VS -25 bps (2%)

Market Overview

(MT4 System Time)

Source: MQL5

Market Movements

The Dollar Index remained stable as investors await further clarity on the impact of Trump’s tariff policies. Federal Reserve Governor Christopher Waller noted that recent economic data supports the Fed’s decision to keep interest rates unchanged, with inflation showing no immediate cause for concern. The Fed will continue monitoring CPI reports for future policy decisions. Geopolitical uncertainties, including the ongoing Russia-Ukraine conflict, have kept market sentiment cautious, and the dollar remained flat.

The Dollar Index is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 26, suggesting the index might enter oversold territory.

Resistance level: 107.45, 108.40

Support level: 106.55, 105.65

Gold prices mirrored the dollar’s uncertainty, as mixed market factors maintain a wait-and-see approach. Bullish drivers include potential de-dollarization by BRICS and uncertainty around Trump’s tariffs, which could reduce the dollar’s appeal and support gold. However, positive developments in the Russia-Ukraine ceasefire negotiations may shift sentiment toward riskier assets, triggering a selloff in gold. Investors should monitor these developments closely for potential direction.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 59, suggesting the commodity might extend its gains since the RSI stays above the midline.,

Resistance level: 2915.00, 2935.00

Support level: 2880.00, 2855.00

The GBP/USD pair remains near its recent highs, lacking a clear directional push as traders await fresh catalysts. With U.S. markets closed for a public holiday, the dollar stayed subdued, allowing the Pound Sterling to hold firm. However, all eyes are now on the UK job data, which could be a pivotal factor in shaping the pair’s next move. Market expectations point to a higher unemployment rate, which may weigh on the Pound if confirmed. A stronger-than-expected labor market report, however, could provide further support for Sterling’s bullish momentum.

GBP/USD has reached its recent peak and has been consolidating. It may face a technical correction in the near term. The RSI remains elevated, while the MACD is about to cross on the above, suggesting that the bullish momentum might be easing.

Resistance level: 1.2730, 1.2850

Support level: 1.2485, 1.2375

The USD/JPY pair has established a double-bottom pattern at its critical support level of 151.35, signaling the potential for a technical rebound. The Japanese yen has strengthened in recent sessions, bolstered by upbeat economic indicators that have reinforced market speculation of a March BoJ rate hike. Meanwhile, the U.S. dollar faces renewed headwinds amid uncertainty surrounding the Trump administration’s tariff threats and concerns over the ballooning U.S. national debt, both of which have weighed on investor confidence in the greenback.

The USD/JPY pair has eased bearish momentum as it approaches its critical support level at near 151.35. A break below such a level would be a solid bearish signal for the pair. The RSI remains in the lower region, while the MACD has broken below the zero line, suggesting that bearish momentum may be forming.

Resistance level: 152.65, 153.80

Support level: 151.35, 149.60

The Hang Seng Tech Index surged over 18% in February, breaking above its downtrend resistance level and signalling a shift into strong bullish momentum. This rally has been fueled by renewed investor confidence, particularly after Jack Ma’s return and the high-profile summit between Chinese tech giants and President Xi Jinping, which signalled a more supportive stance from Beijing toward the sector. The policy shift has reinvigorated optimism in Chinese tech stocks, driving robust capital inflows into the sector.

The index has been gaining and has reached its highest level since 2023, suggesting a bullish bias. The RSI remains flowing in the overbought zone, while the MACD continues to edge higher, suggesting that the bullish momentum remains strong with the pair.

Resistance level: 6155.00, 6722.00

Support level: 5160.00, 4700.00

AUD/USD has climbed to a two-month high, but momentum appears to be stalling as the pair consolidates and shows signs of a potential retracement. Traders are bracing for today’s RBA interest rate decision, with the market widely expecting a 25 basis point rate cut—a shift in monetary policy that could weigh on the Aussie dollar’s strength. A dovish tone from the RBA could reinforce downside pressure on the pair, especially if the central bank signals further easing ahead. However, if policymakers take a more cautious approach, the Aussie may find support, keeping the pair in its current range.

The has been trading within its uptrend trajectory and has gained to a two-month high, suggesting a bullish bias for the pair. The RSI remains above the 50 level while the MACD is hovering at the elevated level, suggesting that the pair remains trading with bullish momentum.

Resistance level: 0.6420, 0.6500

Support level: 0.6275, 0.6205

Oil prices stabilized after recent gains, with OPEC+ delegates considering a delay in planned output increases due to weak demand and rising non-member supply. The delay could mark the fourth since 2022. Additionally, Ukrainian drone attacks have disrupted exports through Kazakhstan’s main pipeline. Despite this, Russian Deputy Prime Minister Alexander Novak stated that OPEC+ is unlikely to delay the April 2025 supply hike.

Crude oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 51, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 73.30, 75.25

Support level: 70.40, 67.80

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.