-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

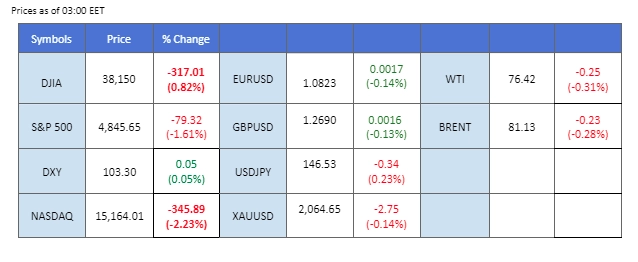

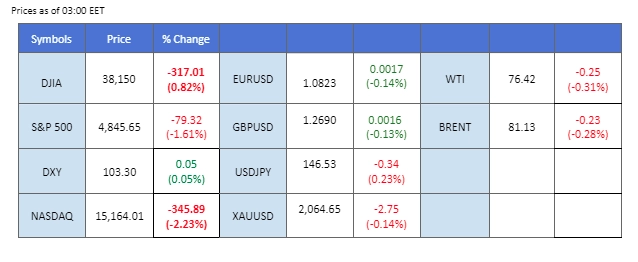

The Federal Reserve’s interest rate decision aligned with market expectations, maintaining the rate at its current level. However, the notable aspect of the event unfolded in the statements made after the decision. Jerome Powell, the Fed’s chair, emphasised that the central bank is not in a rush to shift its monetary policy and has ruled out near-term interest rate cuts, citing the need for more data to gain confidence before making such a bold move. The dollar steadied near the 103.50 level, but the equity market experienced a significant downturn in response to the Fed’s hawkish statement, with the Nasdaq declining by more than 300 points.

In the commodities sector, both gold and oil prices were impacted negatively by the Fed’s hawkish stance, with oil prices facing additional pressure from a gloomy demand outlook. In addition, all eyes will be on the Bank of England’s interest rate decision, scheduled to be announced today, and it is expected to have a direct impact on the Pound Sterling’s strength.

Current rate hike bets on 20th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (65%) VS -25 bps (35%)

(MT4 System Time)

Source: MQL5

The Dollar Index experienced seesaw movements yesterday, ultimately leaving the index almost unchanged after the market processed the statements made by the Fed’s chair following the interest rate decision. Jerome Powell hinted that the central bank has initiated considerations for a rate cut but ruled out the possibility of it happening in the near term. The dollar was subsequently encouraged by the hawkish narrative in Powell’s statement, leading to a stabilising effect on the Dollar Index.

The Dollar Index continues to trade on a sideways trajectory. The RSI continues to flow near to the 50 level while the MACD is on the brink of breaking below the zero line, suggesting a neutral-bearish bias signal for the index.

Resistance level: 103.90, 104.65

Support level: 103.15, 102.20

Gold prices experienced a sharp decline as the strength of the dollar was bolstered by the hawkish statement made by the Fed’s chair. The precious metal faced rejection at the robust resistance level around $2050, all while geopolitical tensions in the Middle East heightened. The combined impact of a strengthening dollar and the resistance at a key level contributed to the pronounced downturn in gold prices.

Gold prices failed to break through the strong resistance level at $2050 but remained trading at above its support level at $2035. The RSI remains at an elevated level while the MACD continues to move upward, suggesting the bullish momentum remains intact with gold prices.

Resistance level:2050.00, 2069.00

Support level: 2035.00, 2020.50

The GBP/USD pair continues to trade within a narrower range, awaiting the pivotal Bank of England (BoE) interest rate decision set to be released today. The dollar strengthened yesterday following a hawkish statement from the Fed’s chair, Jerome Powell, who ruled out the possibility of an early rate cut. This development has had an impact on the dynamics of the GBP/USD pair as market participants assess the implications of central bank statements on currency movements.

GBPUSD traded sideways with marginally lower. The RSI has been flowing in the lower region while the MACD has broken below the zero line, suggesting a bearish momentum is forming.

Resistance level: 1.2785, 1.2815

Support level: 1.2610, 1.2530

The EUR/USD pair declined to its recent low after facing rejection from a robust resistance level at 1.0866, forming an evening star candlestick pattern. The newly released German Consumer Price Index (CPI) reading, as well as Retail Sales, both fell short of expectations. This data weighed down on the euro’s strength and heightened market speculation of a potential rate cut from the European Central Bank (ECB).

The EUR/USD pair is struggling from a technical rebound and has declined to its recent low levels. The RSI remains at the lower region while the MACD continues to flow below the zero line, suggesting the bearish momentum remains intact with the pair.

Resistance level: 1.0866, 1.0954

Support level: 1.0775, 1.0700

The US equity market underwent a technical retracement from its bullish trajectory. The hawkish statement from the Fed indicated a commitment to maintaining a monetary tightening policy until the inflation rate in the U.S. is sustainably below 2%. The equity markets felt the impact of this hawkish stance, experiencing a downturn as the prospect of a prolonged high-interest-rate environment persisted.

Dow Jones experienced a technical retracement but remained in a bullish trajectory. The RSI has dropped out from the overbought zone while the MACD continues to move upward, suggesting the bullish momentum remains strong.

Resistance level: 39280.00, 40000.00

Support level: 37815.00, 36600.00

The USD/JPY pair has broken below a crucial liquidity zone and is currently trading below the $147 level. The recently released Bank of Japan (BoJ) meeting minutes, where board members discussed a potential shift from the current monetary policy, have been digested by the market. There is anticipation in the market that the BoJ might make a move before April, contributing to the downward pressure on the USD/JPY pair.

The pair has traded at below $147 and, suggesting a potential trend reversal for the pair. The RSI is on the brink of breaking into the oversold zone while the MACD flows closely to the zero line, suggesting a bearish momentum is forming.

Resistance level: 148.67, 151.76

Support level: 145.21, 143.67

Crude oil prices declined by more than 2.5% on the first day of February, following its first monthly gain since last September. The unexpected build-up in U.S. crude oil inventories, as indicated by the weekly data, exerted pressure on oil prices. Compounding the situation, the hawkish statement made by the Fed after the interest rate decision further impeded the bullish trend in oil prices. These factors collectively contributed to the decline observed in crude oil prices.

Oil prices continue to slide after trading to its highest level since December. The RSI declined sharply while the MACD is on the brink of breaking below the zero line, suggesting a bearish momentum is forming.

Resistance level: 78.65, 81.20

Support level: 72.00, 70.30

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

The Federal Reserve’s interest rate decision aligned with market expectations, maintaining the rate at its current level. However, the notable aspect of the event unfolded in the statements made after the decision. Jerome Powell, the Fed’s chair, emphasised that the central bank is not in a rush to shift its monetary policy and has ruled out near-term interest rate cuts, citing the need for more data to gain confidence before making such a bold move. The dollar steadied near the 103.50 level, but the equity market experienced a significant downturn in response to the Fed’s hawkish statement, with the Nasdaq declining by more than 300 points.

In the commodities sector, both gold and oil prices were impacted negatively by the Fed’s hawkish stance, with oil prices facing additional pressure from a gloomy demand outlook. In addition, all eyes will be on the Bank of England’s interest rate decision, scheduled to be announced today, and it is expected to have a direct impact on the Pound Sterling’s strength.

Current rate hike bets on 20th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (65%) VS -25 bps (35%)

(MT4 System Time)

Source: MQL5

The Dollar Index experienced seesaw movements yesterday, ultimately leaving the index almost unchanged after the market processed the statements made by the Fed’s chair following the interest rate decision. Jerome Powell hinted that the central bank has initiated considerations for a rate cut but ruled out the possibility of it happening in the near term. The dollar was subsequently encouraged by the hawkish narrative in Powell’s statement, leading to a stabilising effect on the Dollar Index.

The Dollar Index continues to trade on a sideways trajectory. The RSI continues to flow near to the 50 level while the MACD is on the brink of breaking below the zero line, suggesting a neutral-bearish bias signal for the index.

Resistance level: 103.90, 104.65

Support level: 103.15, 102.20

Gold prices experienced a sharp decline as the strength of the dollar was bolstered by the hawkish statement made by the Fed’s chair. The precious metal faced rejection at the robust resistance level around $2050, all while geopolitical tensions in the Middle East heightened. The combined impact of a strengthening dollar and the resistance at a key level contributed to the pronounced downturn in gold prices.

Gold prices failed to break through the strong resistance level at $2050 but remained trading at above its support level at $2035. The RSI remains at an elevated level while the MACD continues to move upward, suggesting the bullish momentum remains intact with gold prices.

Resistance level:2050.00, 2069.00

Support level: 2035.00, 2020.50

The GBP/USD pair continues to trade within a narrower range, awaiting the pivotal Bank of England (BoE) interest rate decision set to be released today. The dollar strengthened yesterday following a hawkish statement from the Fed’s chair, Jerome Powell, who ruled out the possibility of an early rate cut. This development has had an impact on the dynamics of the GBP/USD pair as market participants assess the implications of central bank statements on currency movements.

GBPUSD traded sideways with marginally lower. The RSI has been flowing in the lower region while the MACD has broken below the zero line, suggesting a bearish momentum is forming.

Resistance level: 1.2785, 1.2815

Support level: 1.2610, 1.2530

The EUR/USD pair declined to its recent low after facing rejection from a robust resistance level at 1.0866, forming an evening star candlestick pattern. The newly released German Consumer Price Index (CPI) reading, as well as Retail Sales, both fell short of expectations. This data weighed down on the euro’s strength and heightened market speculation of a potential rate cut from the European Central Bank (ECB).

The EUR/USD pair is struggling from a technical rebound and has declined to its recent low levels. The RSI remains at the lower region while the MACD continues to flow below the zero line, suggesting the bearish momentum remains intact with the pair.

Resistance level: 1.0866, 1.0954

Support level: 1.0775, 1.0700

The US equity market underwent a technical retracement from its bullish trajectory. The hawkish statement from the Fed indicated a commitment to maintaining a monetary tightening policy until the inflation rate in the U.S. is sustainably below 2%. The equity markets felt the impact of this hawkish stance, experiencing a downturn as the prospect of a prolonged high-interest-rate environment persisted.

Dow Jones experienced a technical retracement but remained in a bullish trajectory. The RSI has dropped out from the overbought zone while the MACD continues to move upward, suggesting the bullish momentum remains strong.

Resistance level: 39280.00, 40000.00

Support level: 37815.00, 36600.00

The USD/JPY pair has broken below a crucial liquidity zone and is currently trading below the $147 level. The recently released Bank of Japan (BoJ) meeting minutes, where board members discussed a potential shift from the current monetary policy, have been digested by the market. There is anticipation in the market that the BoJ might make a move before April, contributing to the downward pressure on the USD/JPY pair.

The pair has traded at below $147 and, suggesting a potential trend reversal for the pair. The RSI is on the brink of breaking into the oversold zone while the MACD flows closely to the zero line, suggesting a bearish momentum is forming.

Resistance level: 148.67, 151.76

Support level: 145.21, 143.67

Crude oil prices declined by more than 2.5% on the first day of February, following its first monthly gain since last September. The unexpected build-up in U.S. crude oil inventories, as indicated by the weekly data, exerted pressure on oil prices. Compounding the situation, the hawkish statement made by the Fed after the interest rate decision further impeded the bullish trend in oil prices. These factors collectively contributed to the decline observed in crude oil prices.

Oil prices continue to slide after trading to its highest level since December. The RSI declined sharply while the MACD is on the brink of breaking below the zero line, suggesting a bearish momentum is forming.

Resistance level: 78.65, 81.20

Support level: 72.00, 70.30

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.