-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

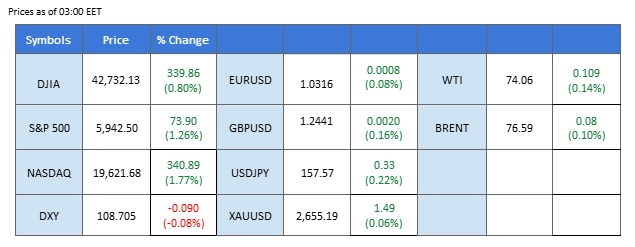

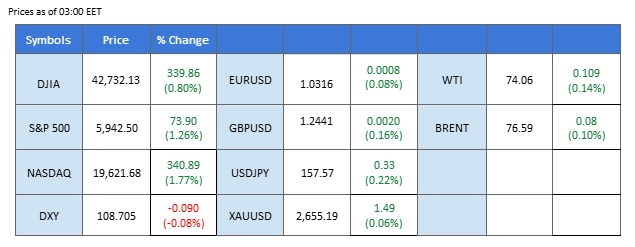

Market Summary

Wall Street surged in the last session, buoyed by a strong performance in tech stocks, with the Nasdaq Composite climbing 1.70%. However, investor focus this week shifts to key U.S. economic data, including the Nonfarm Payrolls (NFP) report scheduled for Friday, which could provide insights into the Fed’s monetary policy outlook.

The U.S. dollar remains elevated, hovering near its recent highs, applying downward pressure on gold prices. The precious metal slid 0.8% in the last session, as expectations of a hawkish Fed stance strengthened the dollar and undermined safe-haven demand.

In the oil market, prices extended gains, driven by short-term demand expectations amid cold weather and optimism over Chinese stimulus measures, which are expected to boost economic activity and oil consumption.

In cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH) rebounded as risk appetite improved. Notably, Metaplanet, a Japanese firm specializing in Bitcoin, announced plans to acquire 10,000 BTC by 2025, fueling optimism and supporting BTC prices in recent sessions.

Current rate hike bets on 29th January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (90.4%) VS -25 bps (9.6%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index (DXY), edged lower due to technical correction, but long-term prospects remained bullish. This rally was supported by stronger-than-expected U.S. economic data, signaling resilience in the economy. The ISM Manufacturing PMI for December rose to 49.3, marking its highest reading since March 2024 and exceeding the forecast of 48.2. Additionally, ISM Manufacturing Prices surged to 52.5, well above expectations of 51.5, reflecting robust activity in input costs. The data underscores optimism around U.S. economic recovery, bolstering the dollar’s strength.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 58, suggesting the index might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 109.50, 110.60

Support level: 108.60, 107.60

Gold prices retreated from a key resistance level, pressured by a stronger U.S. dollar and the robust U.S. economic outlook. Investors are anticipating the Federal Reserve’s December meeting minutes, to be released on Wednesday, which may provide further clarity on the Fed’s rate policy after delivering its third consecutive 25-basis-point rate cut in December. Traders should closely monitor this release for potential market signals that could influence gold’s trajectory.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 54, suggesting the gold might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 2665.00, 2685.00

Support level: 2635.00, 2615.00

The GBP/USD pair staged a technical rebound in the last session, supported by an easing dollar and gains on Wall Street as market sentiment improved on Friday. Despite this rebound, the dollar’s broader outlook remains bullish, underpinned by hawkish signals from Fed officials, who reiterated their commitment to lowering inflation to 2% and hinted at a slower pace of rate cuts in 2025. Today’s focus will be on the UK and U.S. PMI readings, which are expected to introduce volatility in the pairing. Technically, if the pair fails to break above the Fibonacci retracement level of 61.8% at 1.2470, it is expected to remain within its bearish trajectory, reflecting the dollar’s strength and ongoing economic uncertainties in the UK.

The pair slid drastically and performed a technical rebound in the last session, but it remains trading within its bearish trajectory. The RSI rebounded while the MACD is about to cross at the bottom, suggesting that the bearish momentum is easing.

Resistance level: 1.2505, 1.2620

Support level: 1.2405, 1.2310

The EUR/USD pair staged a rebound during last Friday’s New York session after touching a fresh low earlier in the week. However, the pair remains under pressure due to the divergent monetary policies between the Fed and the ECB. The ECB is widely expected to cut rates by more than 100 bps in 2025, reflecting a dovish outlook aimed at stimulating economic growth in the Eurozone. In contrast, the Fed’s hawkish stance, with slower and fewer rate cuts, continues to support the dollar’s strength, potentially hindering the euro’s recovery and maintaining a bearish bias for the pair.

The pair performed a technical rebound in the last session and is currently reaching its next resistance level at 1.0335. A break above this level would be seen as a potential trend-reversal signal for the pair. The RSI has rebounded while the MACD has crossed at the bottom, suggesting that the bearish momentum is easing.

Resistance level: 1.0330, 1.450

Support level: 1.0230, 1.0112

U.S. stock index futures were steady after Wall Street closed sharply higher last week, led by a rebound in technology stocks. The “Santa Rally” helped drive year-end gains, with NVIDIA Corporation rising 4.5% and Tesla Inc. surging over 8% on Friday. Investors are now turning their attention to crucial jobs data due next week, which could further influence market direction.

Nasdaq is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 49, suggesting the index might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 21820.00, 22590.00

Support level: 21115.00, 20395.00

The USD/JPY pair has established a double-bottom pattern near the 156.00 mark, signaling potential bullish momentum as it approaches the 158.00 resistance level. A break above 158.00 could serve as a bullish confirmation, paving the way for further upside movement. Despite the Japanese Yen’s recent weakness, Japan’s economic indicators have outperformed expectations, with the Services PMI rising to 50.9—a figure that suggests expansion in the services sector. This positive data has revived speculation about a January rate hike by the Bank of Japan (BoJ), which could boost Yen’s strength and limit USD/JPY’s upside in the near term.

The pair is testing its resistance level at near 158.00; a break above such a level would be a solid bullish signal for the pair. The RSI is heading toward the overbought zone while the MACD remains sideways, close to the zero line, suggesting that bullish momentum may be forming.

Resistance level: 158.00, 159.15

Support level: 156.00, 154.11

Bitcoin extended its seven-session winning streak after finding solid support near the $92,000 mark, signaling a potential bullish reversal from its recent bearish trend. The cryptocurrency’s rally has been underpinned by an improved risk-on sentiment in global markets, driven largely by the resurgence of the “Trump-trade” narrative. Further boosting Bitcoin’s momentum, Japanese firm Metaplanet announced its ambitious plan to acquire 10,000 BTC by 2025, adding to the growing demand and positive outlook for the asset. The news has reinforced investor confidence, as institutional adoption continues to strengthen Bitcoin’s position in the broader financial market.

BTC is attempting to break above its next resistance level, suggesting a bullish bias. The RSI is poised to break into the overbought zone, while the MACD is hovering flat above the zero line, suggesting that BTC is trading with bullish momentum.

Resistance level: 101,990.00, 105,415.00

Support level: 94650.00, 91425.00

Oil prices ended last week higher, supported by increased demand expectations due to cold weather in Europe and the U.S., as well as economic stimulus flagged by China. A decline in U.S. crude inventories also underpinned prices. However, oil’s gains may face pressure from the stronger dollar, which continues to strengthen on expectations that the U.S. economy will outperform its global peers and maintain relatively higher interest rates.

Oil prices are trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 61, suggesting the commodity might experience technical correction since the RSI retreated from overbought territory.

Resistance level: 74.65, 75.95

Support level: 73.55, 72.75

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Market Summary

Wall Street surged in the last session, buoyed by a strong performance in tech stocks, with the Nasdaq Composite climbing 1.70%. However, investor focus this week shifts to key U.S. economic data, including the Nonfarm Payrolls (NFP) report scheduled for Friday, which could provide insights into the Fed’s monetary policy outlook.

The U.S. dollar remains elevated, hovering near its recent highs, applying downward pressure on gold prices. The precious metal slid 0.8% in the last session, as expectations of a hawkish Fed stance strengthened the dollar and undermined safe-haven demand.

In the oil market, prices extended gains, driven by short-term demand expectations amid cold weather and optimism over Chinese stimulus measures, which are expected to boost economic activity and oil consumption.

In cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH) rebounded as risk appetite improved. Notably, Metaplanet, a Japanese firm specializing in Bitcoin, announced plans to acquire 10,000 BTC by 2025, fueling optimism and supporting BTC prices in recent sessions.

Current rate hike bets on 29th January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (90.4%) VS -25 bps (9.6%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index (DXY), edged lower due to technical correction, but long-term prospects remained bullish. This rally was supported by stronger-than-expected U.S. economic data, signaling resilience in the economy. The ISM Manufacturing PMI for December rose to 49.3, marking its highest reading since March 2024 and exceeding the forecast of 48.2. Additionally, ISM Manufacturing Prices surged to 52.5, well above expectations of 51.5, reflecting robust activity in input costs. The data underscores optimism around U.S. economic recovery, bolstering the dollar’s strength.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 58, suggesting the index might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 109.50, 110.60

Support level: 108.60, 107.60

Gold prices retreated from a key resistance level, pressured by a stronger U.S. dollar and the robust U.S. economic outlook. Investors are anticipating the Federal Reserve’s December meeting minutes, to be released on Wednesday, which may provide further clarity on the Fed’s rate policy after delivering its third consecutive 25-basis-point rate cut in December. Traders should closely monitor this release for potential market signals that could influence gold’s trajectory.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 54, suggesting the gold might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 2665.00, 2685.00

Support level: 2635.00, 2615.00

The GBP/USD pair staged a technical rebound in the last session, supported by an easing dollar and gains on Wall Street as market sentiment improved on Friday. Despite this rebound, the dollar’s broader outlook remains bullish, underpinned by hawkish signals from Fed officials, who reiterated their commitment to lowering inflation to 2% and hinted at a slower pace of rate cuts in 2025. Today’s focus will be on the UK and U.S. PMI readings, which are expected to introduce volatility in the pairing. Technically, if the pair fails to break above the Fibonacci retracement level of 61.8% at 1.2470, it is expected to remain within its bearish trajectory, reflecting the dollar’s strength and ongoing economic uncertainties in the UK.

The pair slid drastically and performed a technical rebound in the last session, but it remains trading within its bearish trajectory. The RSI rebounded while the MACD is about to cross at the bottom, suggesting that the bearish momentum is easing.

Resistance level: 1.2505, 1.2620

Support level: 1.2405, 1.2310

The EUR/USD pair staged a rebound during last Friday’s New York session after touching a fresh low earlier in the week. However, the pair remains under pressure due to the divergent monetary policies between the Fed and the ECB. The ECB is widely expected to cut rates by more than 100 bps in 2025, reflecting a dovish outlook aimed at stimulating economic growth in the Eurozone. In contrast, the Fed’s hawkish stance, with slower and fewer rate cuts, continues to support the dollar’s strength, potentially hindering the euro’s recovery and maintaining a bearish bias for the pair.

The pair performed a technical rebound in the last session and is currently reaching its next resistance level at 1.0335. A break above this level would be seen as a potential trend-reversal signal for the pair. The RSI has rebounded while the MACD has crossed at the bottom, suggesting that the bearish momentum is easing.

Resistance level: 1.0330, 1.450

Support level: 1.0230, 1.0112

U.S. stock index futures were steady after Wall Street closed sharply higher last week, led by a rebound in technology stocks. The “Santa Rally” helped drive year-end gains, with NVIDIA Corporation rising 4.5% and Tesla Inc. surging over 8% on Friday. Investors are now turning their attention to crucial jobs data due next week, which could further influence market direction.

Nasdaq is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 49, suggesting the index might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 21820.00, 22590.00

Support level: 21115.00, 20395.00

The USD/JPY pair has established a double-bottom pattern near the 156.00 mark, signaling potential bullish momentum as it approaches the 158.00 resistance level. A break above 158.00 could serve as a bullish confirmation, paving the way for further upside movement. Despite the Japanese Yen’s recent weakness, Japan’s economic indicators have outperformed expectations, with the Services PMI rising to 50.9—a figure that suggests expansion in the services sector. This positive data has revived speculation about a January rate hike by the Bank of Japan (BoJ), which could boost Yen’s strength and limit USD/JPY’s upside in the near term.

The pair is testing its resistance level at near 158.00; a break above such a level would be a solid bullish signal for the pair. The RSI is heading toward the overbought zone while the MACD remains sideways, close to the zero line, suggesting that bullish momentum may be forming.

Resistance level: 158.00, 159.15

Support level: 156.00, 154.11

Bitcoin extended its seven-session winning streak after finding solid support near the $92,000 mark, signaling a potential bullish reversal from its recent bearish trend. The cryptocurrency’s rally has been underpinned by an improved risk-on sentiment in global markets, driven largely by the resurgence of the “Trump-trade” narrative. Further boosting Bitcoin’s momentum, Japanese firm Metaplanet announced its ambitious plan to acquire 10,000 BTC by 2025, adding to the growing demand and positive outlook for the asset. The news has reinforced investor confidence, as institutional adoption continues to strengthen Bitcoin’s position in the broader financial market.

BTC is attempting to break above its next resistance level, suggesting a bullish bias. The RSI is poised to break into the overbought zone, while the MACD is hovering flat above the zero line, suggesting that BTC is trading with bullish momentum.

Resistance level: 101,990.00, 105,415.00

Support level: 94650.00, 91425.00

Oil prices ended last week higher, supported by increased demand expectations due to cold weather in Europe and the U.S., as well as economic stimulus flagged by China. A decline in U.S. crude inventories also underpinned prices. However, oil’s gains may face pressure from the stronger dollar, which continues to strengthen on expectations that the U.S. economy will outperform its global peers and maintain relatively higher interest rates.

Oil prices are trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 61, suggesting the commodity might experience technical correction since the RSI retreated from overbought territory.

Resistance level: 74.65, 75.95

Support level: 73.55, 72.75

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.