-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

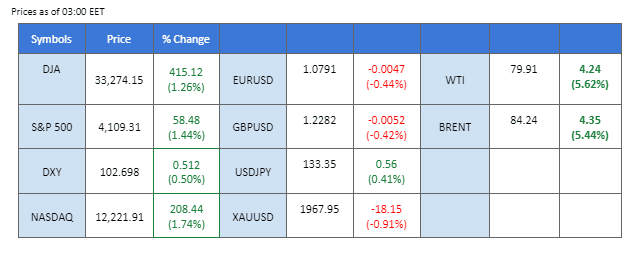

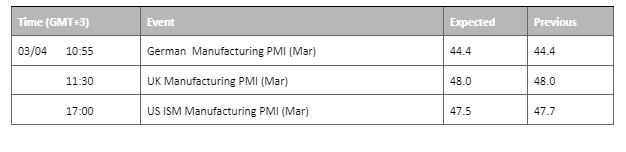

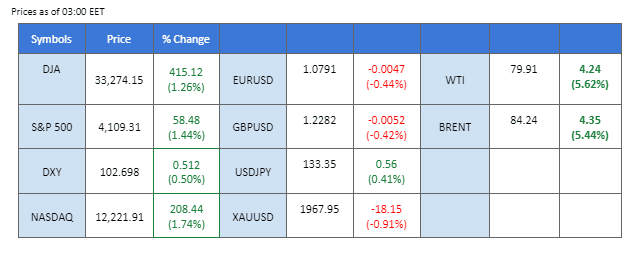

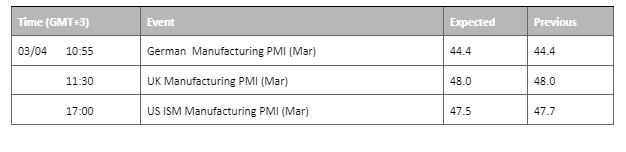

Oil prices surged by more than 8%, with WTI crude trading above $81 for the first time since January after an unexpected announcement from OPEC+ to cut crude supply to tighten the market. The oil allies announced cutting more than 1 million barrels of oil per day, with Saudi Arabia leading the cartel to cut 500,000 barrels daily. The dollar appreciated while treasury yields gained as higher oil prices aggravated inflation risks. On the other hand, equity markets continue to gain as the banking crisis evaporates and the U.S. PCE data came lower than the market expectation last Friday. In Australia, the Aussie dollar is moving in a narrow range while awaiting for the RBA’s interest rate decision which will be announced on Tuesday (4th April); the market is uncertain if the RBA will pause its rate hike program or continue in fighting inflation.

Current rate hike bets on 3rd May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (43.4%) VS 25 bps (56.6%)

The US Dollar Index, which measures against a basket of six major currencies, showed signs of recovery on Thursday as bargain buyers swooped in. However, the currency is still set to experience its fifth consecutive weekly loss after weak consumer spending data in the US eased concerns of aggressive interest rate hikes from the Federal Reserve. According to government data, the personal consumption expenditures price index rose by 0.3% in February, falling short of the market’s forecast of 0.4%.

The Dollar Index is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 61, suggesting the index might extend its gains after it successfully breakout since the RSI stays above the midline.

Resistance level: 102.90, 103.50

Support level: 101.95, 100.85

Gold prices experienced a slight retreat, undergoing a technical correction as it approached the crucial resistance level near $2,000. Despite this, the long-term trend for the gold market remains bullish as weak consumer spending data in the US has eased concerns over aggressive interest rate hikes by the Federal Reserve. The personal consumption expenditures price index increased by 0.3% in February, which was lower than the market’s expectations of 0.4%, supporting the notion that the Federal Reserve may not be in a rush to raise interest rates.

Gold prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum. However, RSI is at 33, suggesting the commodity might enter oversold territory.

Resistance level: 1980.00, 2000.00

Support level: 1935.00, 1910.55

The euro continued to trade lower against the dollar for the second continuous session since last Friday. The eurozone CPI reading came lower than the market expectation at 6.9%, overshadowing the lower U.S. core PCE price index. The dollar further strengthened after OPEC announced further crude oil cuts next month as markets perceive the U.S. may experience higher inflation with higher oil prices. The market initially predicted that the Fed might consider pausing its monetary tightening policy after the financial system instability occurred early this year; however, a surprise move from the oil cartel has increased the chance that the Fed may continue to raise rates to tame inflation.

The indicators depict a vanish in bullish momentum for the pair. The RSI is moving toward the oversold zone, while the MACD line has crossed against the Signal line on the above and moving toward the zero line.

Resistance level: 1.0867, 1.0917

Support level: 1.0698, 1.0613

The USD/JPY currency pair is currently facing downward pressure, as it struggles to recover from a negative manufacturing report. The closely watched Tankan Large Manufacturers Index, which measures business confidence among major Japanese manufacturers, plummeted from the previous reading of 7 to a disappointing 1. This outcome failed to meet market expectations of 3 and is casting a shadow of doubt on Japan’s economic prospects.

USDJPY is trading higher following the prior breakout above the previous resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 58, suggesting the pair might be traded lower in short-term as technical correction since the RSi retraced sharply from the overbought territory.

Resistance level: 134.80, 137.20

Support level: 132.75, 130.50

The Pound Sterling eased against the dollar by 0.87% to $1.2286 on Friday as a murky economic outlook overshadowed data that showed U.K.’s economy is likely to avoid a recession in the last quarter of 2022. Despite weak trading on Friday, the pound remains on track for its biggest monthly gain in four months of 3% and a 2.4% quarterly gain. Along with the improvement in the economic outlook, the pound is drawing benefits from the market’s conviction that the BoE will need to continue raising rates. Furthermore, Friday’s UK GDP data increased by 0.1% in the last quarter after a preliminary estimate of no growth. While U.K.’s inflation data showed unexpectedly rose to 10.4%, over 5 times the Bank of England’s target rate of 2%, the highest among the G7 nations. Even so, the pound is still erasing its February 2.4% drop.

The pound has fallen to its support level of $1.2298 as of writing. The overall movement might remain neutral-bullish momentum. MACD has illustrated neutral-bullish momentum ahead. RSI is at 40, indicating a neutral-bearish momentum. Investors can focus on U.K.’s manufacturing PMI data which will be released later today.

Resistance level: 1.2298, 1.2425

Support level: 1.2190, 1.2120

The Dow Jones Index rose 1.26% to 33,274 points on Friday as signs of cooling inflation bolstered hopes the Federal Reserve might soon end its aggressive interest rate hikes. On Friday, data showed that U.S. consumer spending rose moderately in February while inflation cooled. Therefore, a slight tick lower in inflation help in boosting up the equity markets, and Dow Jones rose 0.4% in the quarter. Moreover, the U.S. central bank would likely stop its rate hikes and maintain that level for some time, as they want to lower the high inflation rate back to the 2% target.

On Friday, the Dow broke its resistance level of 32874 points and closed at 33282 points. MACD has illustrated an increasing bullish momentum. RSI is at 68, trading near its overbought zone, indicating a strong bullish momentum ahead.

Resistance level: 34308, 35639

Support level: 32545, 30945

Oil prices surged by over $5 a barrel during early Asian trading hours on Monday following a surprise announcement by OPEC+ to cut production further, in a bid to support market stability. The Organization of the Petroleum Exporting Countries, along with allies such as Russia, announced cuts of around 1.16 million barrels per day on Sunday, calling it a “precautionary measure” aimed at stabilising the market. These cuts, which are set to begin in May, are in addition to those already agreed upon in October, which called for output cuts of 2 million barrels per day from November until the end of the year.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 86, suggesting the commodity might enter oversold territory.

Resistance level: 80.75, 85.45

Support level: 77.25, 73.80

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Oil prices surged by more than 8%, with WTI crude trading above $81 for the first time since January after an unexpected announcement from OPEC+ to cut crude supply to tighten the market. The oil allies announced cutting more than 1 million barrels of oil per day, with Saudi Arabia leading the cartel to cut 500,000 barrels daily. The dollar appreciated while treasury yields gained as higher oil prices aggravated inflation risks. On the other hand, equity markets continue to gain as the banking crisis evaporates and the U.S. PCE data came lower than the market expectation last Friday. In Australia, the Aussie dollar is moving in a narrow range while awaiting for the RBA’s interest rate decision which will be announced on Tuesday (4th April); the market is uncertain if the RBA will pause its rate hike program or continue in fighting inflation.

Current rate hike bets on 3rd May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (43.4%) VS 25 bps (56.6%)

The US Dollar Index, which measures against a basket of six major currencies, showed signs of recovery on Thursday as bargain buyers swooped in. However, the currency is still set to experience its fifth consecutive weekly loss after weak consumer spending data in the US eased concerns of aggressive interest rate hikes from the Federal Reserve. According to government data, the personal consumption expenditures price index rose by 0.3% in February, falling short of the market’s forecast of 0.4%.

The Dollar Index is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 61, suggesting the index might extend its gains after it successfully breakout since the RSI stays above the midline.

Resistance level: 102.90, 103.50

Support level: 101.95, 100.85

Gold prices experienced a slight retreat, undergoing a technical correction as it approached the crucial resistance level near $2,000. Despite this, the long-term trend for the gold market remains bullish as weak consumer spending data in the US has eased concerns over aggressive interest rate hikes by the Federal Reserve. The personal consumption expenditures price index increased by 0.3% in February, which was lower than the market’s expectations of 0.4%, supporting the notion that the Federal Reserve may not be in a rush to raise interest rates.

Gold prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum. However, RSI is at 33, suggesting the commodity might enter oversold territory.

Resistance level: 1980.00, 2000.00

Support level: 1935.00, 1910.55

The euro continued to trade lower against the dollar for the second continuous session since last Friday. The eurozone CPI reading came lower than the market expectation at 6.9%, overshadowing the lower U.S. core PCE price index. The dollar further strengthened after OPEC announced further crude oil cuts next month as markets perceive the U.S. may experience higher inflation with higher oil prices. The market initially predicted that the Fed might consider pausing its monetary tightening policy after the financial system instability occurred early this year; however, a surprise move from the oil cartel has increased the chance that the Fed may continue to raise rates to tame inflation.

The indicators depict a vanish in bullish momentum for the pair. The RSI is moving toward the oversold zone, while the MACD line has crossed against the Signal line on the above and moving toward the zero line.

Resistance level: 1.0867, 1.0917

Support level: 1.0698, 1.0613

The USD/JPY currency pair is currently facing downward pressure, as it struggles to recover from a negative manufacturing report. The closely watched Tankan Large Manufacturers Index, which measures business confidence among major Japanese manufacturers, plummeted from the previous reading of 7 to a disappointing 1. This outcome failed to meet market expectations of 3 and is casting a shadow of doubt on Japan’s economic prospects.

USDJPY is trading higher following the prior breakout above the previous resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 58, suggesting the pair might be traded lower in short-term as technical correction since the RSi retraced sharply from the overbought territory.

Resistance level: 134.80, 137.20

Support level: 132.75, 130.50

The Pound Sterling eased against the dollar by 0.87% to $1.2286 on Friday as a murky economic outlook overshadowed data that showed U.K.’s economy is likely to avoid a recession in the last quarter of 2022. Despite weak trading on Friday, the pound remains on track for its biggest monthly gain in four months of 3% and a 2.4% quarterly gain. Along with the improvement in the economic outlook, the pound is drawing benefits from the market’s conviction that the BoE will need to continue raising rates. Furthermore, Friday’s UK GDP data increased by 0.1% in the last quarter after a preliminary estimate of no growth. While U.K.’s inflation data showed unexpectedly rose to 10.4%, over 5 times the Bank of England’s target rate of 2%, the highest among the G7 nations. Even so, the pound is still erasing its February 2.4% drop.

The pound has fallen to its support level of $1.2298 as of writing. The overall movement might remain neutral-bullish momentum. MACD has illustrated neutral-bullish momentum ahead. RSI is at 40, indicating a neutral-bearish momentum. Investors can focus on U.K.’s manufacturing PMI data which will be released later today.

Resistance level: 1.2298, 1.2425

Support level: 1.2190, 1.2120

The Dow Jones Index rose 1.26% to 33,274 points on Friday as signs of cooling inflation bolstered hopes the Federal Reserve might soon end its aggressive interest rate hikes. On Friday, data showed that U.S. consumer spending rose moderately in February while inflation cooled. Therefore, a slight tick lower in inflation help in boosting up the equity markets, and Dow Jones rose 0.4% in the quarter. Moreover, the U.S. central bank would likely stop its rate hikes and maintain that level for some time, as they want to lower the high inflation rate back to the 2% target.

On Friday, the Dow broke its resistance level of 32874 points and closed at 33282 points. MACD has illustrated an increasing bullish momentum. RSI is at 68, trading near its overbought zone, indicating a strong bullish momentum ahead.

Resistance level: 34308, 35639

Support level: 32545, 30945

Oil prices surged by over $5 a barrel during early Asian trading hours on Monday following a surprise announcement by OPEC+ to cut production further, in a bid to support market stability. The Organization of the Petroleum Exporting Countries, along with allies such as Russia, announced cuts of around 1.16 million barrels per day on Sunday, calling it a “precautionary measure” aimed at stabilising the market. These cuts, which are set to begin in May, are in addition to those already agreed upon in October, which called for output cuts of 2 million barrels per day from November until the end of the year.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 86, suggesting the commodity might enter oversold territory.

Resistance level: 80.75, 85.45

Support level: 77.25, 73.80

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.