-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

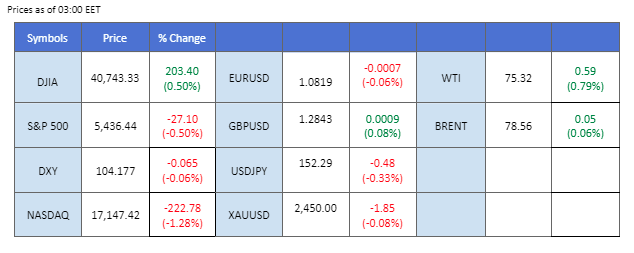

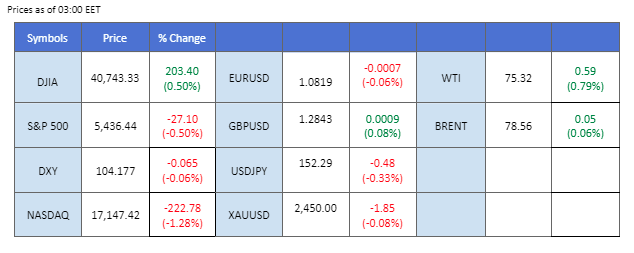

The Japanese Yen strengthened ahead of the BoJ’s interest rate decision, with part of the market anticipating a monetary tightening policy from the Japanese central bank due to sustainable inflation and wage growth in the country. If the BoJ raises rates by 10 bps, as expected, the Yen could strengthen further.

On the other hand, the eurozone GDP released yesterday was lacklustre, hammering the euro to its lowest levels in the near term. The Aussie dollar also slid lower after the CPI reading met market expectations. Market participants are currently keeping a close eye on today’s Fed interest rate decision for more clues on the possibility of a September rate cut from the U.S. central bank.

On Wall Street, the AI frenzy continued to weigh on the U.S. equity market, with mega-cap tech stocks plunging and leading the Nasdaq to close more than 200 points lower, hitting its lowest level since June.

In the commodity markets, gold took advantage of the softening dollar and traded above the $2400 threshold, while oil prices remained lacklustre, trading near the $75 mark.

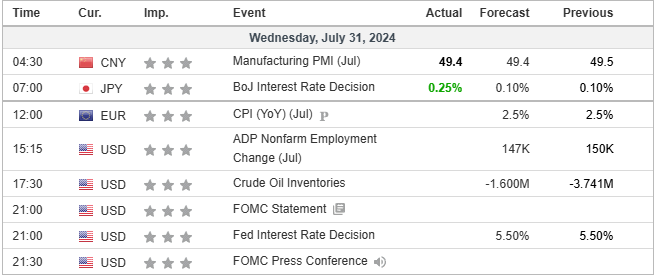

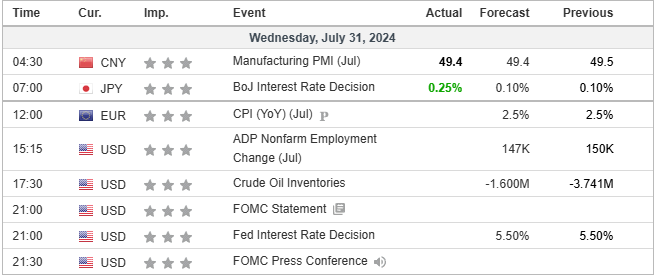

Current rate hike bets on 31st July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95.9%) VS -25 bps (4.1%)

(MT4 System Time)

Source: MQL5

The Dollar Index remained flat as market participants await a series of crucial US economic data releases before making decisive moves. Initially, the dollar strengthened following better-than-expected US CB Consumer Confidence and JOLTs Job Openings reports. However, it later retreated as investors took profits and adopted a wait-and-see approach. The dollar is likely to continue consolidating within a range until more significant data are released later this week.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 48, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 104.80, 105.50

Support level: 104.25, 103.75

Gold prices rebounded sharply due to rising market volatility ahead of multiple central bank decisions and critical US economic data. Investors shifted their portfolios toward safe-haven assets like gold. Recent statements from several Federal Reserve members have leaned towards a more dovish stance, further supporting bullish sentiment in the non-yielding gold market. Investors are advised to monitor upcoming US monetary policy decisions and economic data for further trading signals.

Gold prices are trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 62, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 2420.00, 2450.00

Support level: 2390.00, 2355.00

The GBP/USD pair is currently trading within its downtrend channel, though it recorded a marginal gain in the last session. This gain was supported by the softening of the U.S. dollar ahead of the Fed’s interest rate decision, with expectations of a dovish statement from the U.S. central bank. Meanwhile, the BoE is expected to announce its first rate cut on Thursday, an anticipation that is weighing on the Sterling’s strength.

GBP/USD continues trading within its downtrend channel, suggesting a bearish bias for the pair. The RSI remains hovering in the lower region, while the MACD flows flat below the zero line, suggesting the pair remains trading with bearish momentum.

Resistance level: 1.2940, 1.2995

Support level: 1.2785, 1.2660

The EUR/USD pair has plunged below its near-support level at 1.0820 following the release of the eurozone GDP reading, which met market expectations. The GDP data, alongside the PMI readings released last week, suggest that the economic performance in the region is contracting, thereby harming the euro’s strength. However, the pair found some support from the easing of dollar strength, as the market anticipated a dovish comment from the U.S. central bank when the interest rate decision was unveiled.

The euro remains trading in a downtrend trajectory and a lack of catalyst suggests a bearish bias for the pair. The RSI is at the lower region while the MACD edge lower suggests the pair remain trading with bearish momentum.

Resistance level: 1.0853, 1.0895

Support level: 1.0770, 1.0732

The AUD/USD pair was unable to perform a technical rebound after consolidating for the past few sessions, following a significant plummet earlier. The pair was weighed down by the soft CPI reading released in the Sydney session, which cast a shadow over the RBA’s monetary policy decision due in early August. This resulted in a plunge of the pair and a weakening of the Aussie dollar’s strength.

The AUD/USD pair’s edge lower from its price consolidation range suggests a bearish signal. The RSI remains closely in the oversold zone, while the MACD had a bearish cross below the zero line, suggesting the pair’s bearish momentum remains strong.

Resistance level: 0.6545, 0.6610

Support level: 0.6420, 0.6365

The Japanese yen surged following the Bank of Japan’s (BoJ) decision to increase its short-term interest rates to 0.25%. Additionally, the BoJ announced plans to gradually reduce its bond purchases under its quantitative easing program. At the end of its two-day policy meeting, the central bank stated that the decision to raise the policy rate was unanimous. The amount of bonds purchased per month will decrease to 3 trillion yen ($19.65 billion), half the current rough target, by early 2026.

USD/JPY is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 32, suggesting the pair might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 154.35, 155.75

Support level: 152.25, 150.80

The tech-heavy stock index was hit by the AI frenzy, triggering a selling spree for some mega-cap tech stocks. Nvidia dropped by 7%, Tesla by 4%, while the small-cap index, Russell 2000, recorded marginal gains. This reflects that Wall Street capital remains in rotation from mega-cap counters to interest rate-sensitive small-cap stocks.

The index was kept below the 19,200 mark, and its edge lower suggests a bearish signal. The RSI is dropping into the oversold zone, while the MACD continues to edge lower from below the zero line, suggesting that bearish momentum is gaining.

Resistance level: 19120.00, 19500.00

Support level: 18570.00, 18000.00

Oil prices extended their losses, reaching a seven-week low amid concerns about weakening demand from China and expectations that OPEC+ will maintain its plan to increase supplies. According to a Reuters poll, manufacturing activity in China, the world’s largest crude importer, likely contracted for the third month in July. Despite Chinese leaders’ pledges to support the economy, investors expect limited measures from the Third Plenum policy meeting. On Thursday, OPEC+ ministers will meet to review the market and discuss plans to unwind some output cuts starting in October. While no changes are currently expected, investors should monitor this meeting for further trading signals.

Oil prices are trading lower while currently near the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 37, suggesting the commodity might enter oversold territory.

Resistance level: 76.15, 78.65

Support level: 74.35, 72.50

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

The Japanese Yen strengthened ahead of the BoJ’s interest rate decision, with part of the market anticipating a monetary tightening policy from the Japanese central bank due to sustainable inflation and wage growth in the country. If the BoJ raises rates by 10 bps, as expected, the Yen could strengthen further.

On the other hand, the eurozone GDP released yesterday was lacklustre, hammering the euro to its lowest levels in the near term. The Aussie dollar also slid lower after the CPI reading met market expectations. Market participants are currently keeping a close eye on today’s Fed interest rate decision for more clues on the possibility of a September rate cut from the U.S. central bank.

On Wall Street, the AI frenzy continued to weigh on the U.S. equity market, with mega-cap tech stocks plunging and leading the Nasdaq to close more than 200 points lower, hitting its lowest level since June.

In the commodity markets, gold took advantage of the softening dollar and traded above the $2400 threshold, while oil prices remained lacklustre, trading near the $75 mark.

Current rate hike bets on 31st July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95.9%) VS -25 bps (4.1%)

(MT4 System Time)

Source: MQL5

The Dollar Index remained flat as market participants await a series of crucial US economic data releases before making decisive moves. Initially, the dollar strengthened following better-than-expected US CB Consumer Confidence and JOLTs Job Openings reports. However, it later retreated as investors took profits and adopted a wait-and-see approach. The dollar is likely to continue consolidating within a range until more significant data are released later this week.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 48, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 104.80, 105.50

Support level: 104.25, 103.75

Gold prices rebounded sharply due to rising market volatility ahead of multiple central bank decisions and critical US economic data. Investors shifted their portfolios toward safe-haven assets like gold. Recent statements from several Federal Reserve members have leaned towards a more dovish stance, further supporting bullish sentiment in the non-yielding gold market. Investors are advised to monitor upcoming US monetary policy decisions and economic data for further trading signals.

Gold prices are trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 62, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 2420.00, 2450.00

Support level: 2390.00, 2355.00

The GBP/USD pair is currently trading within its downtrend channel, though it recorded a marginal gain in the last session. This gain was supported by the softening of the U.S. dollar ahead of the Fed’s interest rate decision, with expectations of a dovish statement from the U.S. central bank. Meanwhile, the BoE is expected to announce its first rate cut on Thursday, an anticipation that is weighing on the Sterling’s strength.

GBP/USD continues trading within its downtrend channel, suggesting a bearish bias for the pair. The RSI remains hovering in the lower region, while the MACD flows flat below the zero line, suggesting the pair remains trading with bearish momentum.

Resistance level: 1.2940, 1.2995

Support level: 1.2785, 1.2660

The EUR/USD pair has plunged below its near-support level at 1.0820 following the release of the eurozone GDP reading, which met market expectations. The GDP data, alongside the PMI readings released last week, suggest that the economic performance in the region is contracting, thereby harming the euro’s strength. However, the pair found some support from the easing of dollar strength, as the market anticipated a dovish comment from the U.S. central bank when the interest rate decision was unveiled.

The euro remains trading in a downtrend trajectory and a lack of catalyst suggests a bearish bias for the pair. The RSI is at the lower region while the MACD edge lower suggests the pair remain trading with bearish momentum.

Resistance level: 1.0853, 1.0895

Support level: 1.0770, 1.0732

The AUD/USD pair was unable to perform a technical rebound after consolidating for the past few sessions, following a significant plummet earlier. The pair was weighed down by the soft CPI reading released in the Sydney session, which cast a shadow over the RBA’s monetary policy decision due in early August. This resulted in a plunge of the pair and a weakening of the Aussie dollar’s strength.

The AUD/USD pair’s edge lower from its price consolidation range suggests a bearish signal. The RSI remains closely in the oversold zone, while the MACD had a bearish cross below the zero line, suggesting the pair’s bearish momentum remains strong.

Resistance level: 0.6545, 0.6610

Support level: 0.6420, 0.6365

The Japanese yen surged following the Bank of Japan’s (BoJ) decision to increase its short-term interest rates to 0.25%. Additionally, the BoJ announced plans to gradually reduce its bond purchases under its quantitative easing program. At the end of its two-day policy meeting, the central bank stated that the decision to raise the policy rate was unanimous. The amount of bonds purchased per month will decrease to 3 trillion yen ($19.65 billion), half the current rough target, by early 2026.

USD/JPY is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 32, suggesting the pair might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 154.35, 155.75

Support level: 152.25, 150.80

The tech-heavy stock index was hit by the AI frenzy, triggering a selling spree for some mega-cap tech stocks. Nvidia dropped by 7%, Tesla by 4%, while the small-cap index, Russell 2000, recorded marginal gains. This reflects that Wall Street capital remains in rotation from mega-cap counters to interest rate-sensitive small-cap stocks.

The index was kept below the 19,200 mark, and its edge lower suggests a bearish signal. The RSI is dropping into the oversold zone, while the MACD continues to edge lower from below the zero line, suggesting that bearish momentum is gaining.

Resistance level: 19120.00, 19500.00

Support level: 18570.00, 18000.00

Oil prices extended their losses, reaching a seven-week low amid concerns about weakening demand from China and expectations that OPEC+ will maintain its plan to increase supplies. According to a Reuters poll, manufacturing activity in China, the world’s largest crude importer, likely contracted for the third month in July. Despite Chinese leaders’ pledges to support the economy, investors expect limited measures from the Third Plenum policy meeting. On Thursday, OPEC+ ministers will meet to review the market and discuss plans to unwind some output cuts starting in October. While no changes are currently expected, investors should monitor this meeting for further trading signals.

Oil prices are trading lower while currently near the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 37, suggesting the commodity might enter oversold territory.

Resistance level: 76.15, 78.65

Support level: 74.35, 72.50

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.