-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

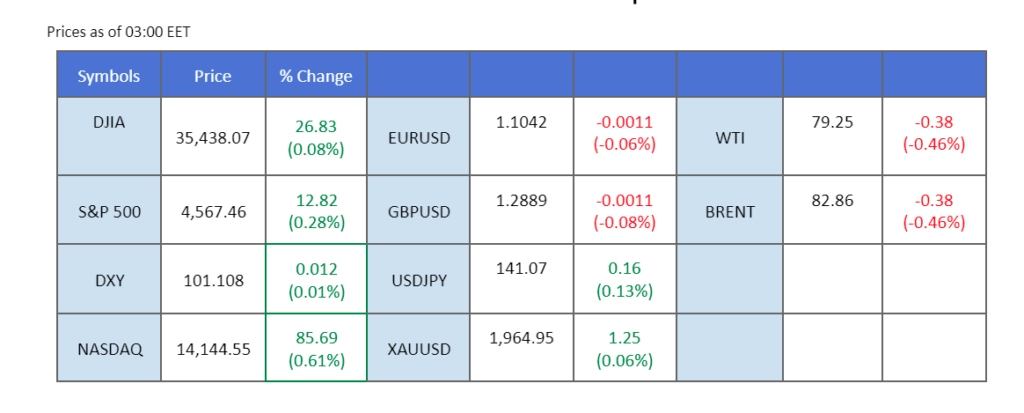

Investors’ unwavering attention is fixed on the Fed’s interest rate decision, eagerly awaiting its release later today. With market speculations rife, the consensus points towards a 25 basis points rate hike by the Fed. If the rate is indeed raised to the 5.25% to 5.5% range, it will mark the highest level in 22 years. Anticipation of the Fed’s pivotal move kept the financial landscape relatively subdued last night, with the dollar, gold, and equity markets displaying limited activity ahead of the rate announcement. A similar sentiment resonates across the Asian region, despite China’s ambitious large-scale economic stimulus package having recently sparked a modest uptick in the equity market. Asian markets traded cautiously, as investors opted to trim risks and await the U.S. central bank’s decisive move.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (0.2%) VS 25 bps (99.8%)

-1024x402.webp)

The US Dollar continues to trade flat with a positive trajectory as the Federal Open Market Committee (FOMC) is expected to raise rates by 25 basis points to the 5.25% to 5.50% range. Investors are closely watching for signals from Powell on the central bank’s determination to raise rates further in 2023, especially after inflation pressures eased last month.

The dollar index is higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 47, suggesting the index might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 101.50, 104.25

Support level: 98.70, 94.75

Investors seek safety in gold amidst market uncertainties ahead of the crucial FOMC meeting which is due later. With the possibility of no additional rate increases in the near term, caution is advised while awaiting further market catalysts before entering trades.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 50, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 1970.00, 1985.00

Support level: 1950.00, 1930.45

The Australian CPI data showed a mixed result, with YoY CPI meeting the market expectation at 5.4%, while QoQ CPI dropped to 0.8%, the lowest since May. With the RBA adopting a data-dependent approach for its interest rate decisions, market sentiment leans towards the RBA’s potential for a rate pause, considering the signs of inflation moderation in the country. Meanwhile, all eyes are currently fixed on the upcoming Federal Reserve interest rate decision, scheduled for release later today. The U.S. dollar has exhibited strength against the Australian dollar over the past two weeks, and should the Fed opt for a higher rate hike, it may exert further pressure on the Aussie dollar.

AUD/USD traded sluggishly for the past 2 weeks and is trading within its downtrend channel. The RSI has a slight rebound before entering the oversold zone while the MACD has crossed below the zero line suggesting that there might be a trend reversal.

Resistance level: 0.6815, 0.6882

Support level: 0.6749, 0.6694

The Pound Sterling shows signs of recovery against the U.S. dollar, rebounding after a 2% drop over the past two weeks. The dollar is trading slightly lower as investors await the Federal Reserve’s interest rate decision, which is set to be released later today. Meanwhile, market speculations suggest that the Bank of England (BoE) might revise down their terminal rate, previously targeted at 6%, in response to weaker-than-expected economic data. Such a move could have a negative impact on the strength of Sterling.

GBP/USD has rebounded and is trading out of the downtrend channel suggesting the bearish momentum has vanished. The RSI has rebounded from below to near 50-level while the MACD has crossed and is moving toward the zero line from below suggesting a bullish momentum is forming.

Resistance level: 1.2950, 1.3062

Support level: 1.2820, 1.2665

The tech-heavy Nasdaq index edged higher, led by increasing investor interest in artificial intelligence. Both Microsoft and Alphabet have launched a range of AI products following the success of OpenAI’s ChatGPT in late 2022. Investors anticipate these innovations to bolster the tech giants’ prospects. Microsoft reported better-than-expected fiscal fourth-quarter results, with earnings per share reaching $2.69 compared to the anticipated $2.55. Alphabet also outperformed Wall Street estimates, posting earnings per share of $1.44 on revenue, surpassing the market’s expected $1.34. Strong growth in cloud computing and advertising were major contributors to these stellar results.

Nasdaq is trading higher while currently near the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 60, suggesting the index might be traded lower as technical correction since the RSI retreated from overbought territory.

Resistance level: 15880.00, 16585.00

Support level: 14725.00, 13710.00

The Japanese yen rebounded, buoyed by a positive economic outlook. Japan’s economy is set to expand at a faster pace of 1.4% in 2023, according to the IMF’s latest projections, surpassing last year’s 1.0% rise. The IMF’s chief economist, Pierre-Oliver Gourinchas, suggests that Japan’s ultra-loose monetary policy can remain accommodative for now, but cautions the need to prepare for potential interest rate hikes in response to inflationary risks and robust wage negotiations. As investors closely monitor the Bank of Japan’s policy meeting on Friday, discussions will revolve around sustainable progress in hitting the inflation target.

USD/JPY is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 54, suggesting the pair might extend its losses toward support level since the RSI retraced sharply from overbought territory.

Resistance level: 142.10, 143.30

Support level: 140.35, 139.30

Oil prices continue to climb for a third consecutive session, buoyed by tighter supplies from OPEC and support from Chinese authorities to bolster their economy. OPEC+ cuts and a focus on boosting domestic demand in China are contributing to bullish sentiment. However, investors remain cautious ahead of major events, including the FOMC meeting, and are closely monitoring trading signals.

Oil prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 68, suggesting the commodity might enter overbought territory.

Resistance level: 79.90, 82.35

Support level: 77.30, 73.70

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

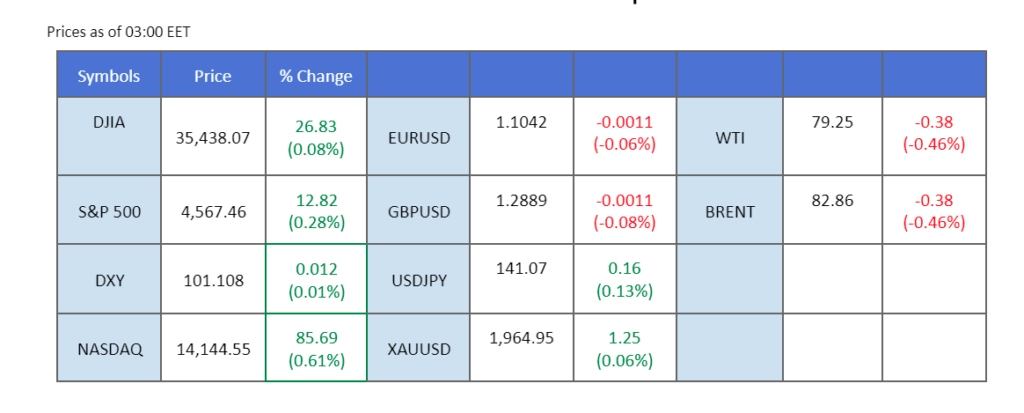

Investors’ unwavering attention is fixed on the Fed’s interest rate decision, eagerly awaiting its release later today. With market speculations rife, the consensus points towards a 25 basis points rate hike by the Fed. If the rate is indeed raised to the 5.25% to 5.5% range, it will mark the highest level in 22 years. Anticipation of the Fed’s pivotal move kept the financial landscape relatively subdued last night, with the dollar, gold, and equity markets displaying limited activity ahead of the rate announcement. A similar sentiment resonates across the Asian region, despite China’s ambitious large-scale economic stimulus package having recently sparked a modest uptick in the equity market. Asian markets traded cautiously, as investors opted to trim risks and await the U.S. central bank’s decisive move.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (0.2%) VS 25 bps (99.8%)

-1024x402.webp)

The US Dollar continues to trade flat with a positive trajectory as the Federal Open Market Committee (FOMC) is expected to raise rates by 25 basis points to the 5.25% to 5.50% range. Investors are closely watching for signals from Powell on the central bank’s determination to raise rates further in 2023, especially after inflation pressures eased last month.

The dollar index is higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 47, suggesting the index might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 101.50, 104.25

Support level: 98.70, 94.75

Investors seek safety in gold amidst market uncertainties ahead of the crucial FOMC meeting which is due later. With the possibility of no additional rate increases in the near term, caution is advised while awaiting further market catalysts before entering trades.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 50, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 1970.00, 1985.00

Support level: 1950.00, 1930.45

The Australian CPI data showed a mixed result, with YoY CPI meeting the market expectation at 5.4%, while QoQ CPI dropped to 0.8%, the lowest since May. With the RBA adopting a data-dependent approach for its interest rate decisions, market sentiment leans towards the RBA’s potential for a rate pause, considering the signs of inflation moderation in the country. Meanwhile, all eyes are currently fixed on the upcoming Federal Reserve interest rate decision, scheduled for release later today. The U.S. dollar has exhibited strength against the Australian dollar over the past two weeks, and should the Fed opt for a higher rate hike, it may exert further pressure on the Aussie dollar.

AUD/USD traded sluggishly for the past 2 weeks and is trading within its downtrend channel. The RSI has a slight rebound before entering the oversold zone while the MACD has crossed below the zero line suggesting that there might be a trend reversal.

Resistance level: 0.6815, 0.6882

Support level: 0.6749, 0.6694

The Pound Sterling shows signs of recovery against the U.S. dollar, rebounding after a 2% drop over the past two weeks. The dollar is trading slightly lower as investors await the Federal Reserve’s interest rate decision, which is set to be released later today. Meanwhile, market speculations suggest that the Bank of England (BoE) might revise down their terminal rate, previously targeted at 6%, in response to weaker-than-expected economic data. Such a move could have a negative impact on the strength of Sterling.

GBP/USD has rebounded and is trading out of the downtrend channel suggesting the bearish momentum has vanished. The RSI has rebounded from below to near 50-level while the MACD has crossed and is moving toward the zero line from below suggesting a bullish momentum is forming.

Resistance level: 1.2950, 1.3062

Support level: 1.2820, 1.2665

The tech-heavy Nasdaq index edged higher, led by increasing investor interest in artificial intelligence. Both Microsoft and Alphabet have launched a range of AI products following the success of OpenAI’s ChatGPT in late 2022. Investors anticipate these innovations to bolster the tech giants’ prospects. Microsoft reported better-than-expected fiscal fourth-quarter results, with earnings per share reaching $2.69 compared to the anticipated $2.55. Alphabet also outperformed Wall Street estimates, posting earnings per share of $1.44 on revenue, surpassing the market’s expected $1.34. Strong growth in cloud computing and advertising were major contributors to these stellar results.

Nasdaq is trading higher while currently near the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 60, suggesting the index might be traded lower as technical correction since the RSI retreated from overbought territory.

Resistance level: 15880.00, 16585.00

Support level: 14725.00, 13710.00

The Japanese yen rebounded, buoyed by a positive economic outlook. Japan’s economy is set to expand at a faster pace of 1.4% in 2023, according to the IMF’s latest projections, surpassing last year’s 1.0% rise. The IMF’s chief economist, Pierre-Oliver Gourinchas, suggests that Japan’s ultra-loose monetary policy can remain accommodative for now, but cautions the need to prepare for potential interest rate hikes in response to inflationary risks and robust wage negotiations. As investors closely monitor the Bank of Japan’s policy meeting on Friday, discussions will revolve around sustainable progress in hitting the inflation target.

USD/JPY is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 54, suggesting the pair might extend its losses toward support level since the RSI retraced sharply from overbought territory.

Resistance level: 142.10, 143.30

Support level: 140.35, 139.30

Oil prices continue to climb for a third consecutive session, buoyed by tighter supplies from OPEC and support from Chinese authorities to bolster their economy. OPEC+ cuts and a focus on boosting domestic demand in China are contributing to bullish sentiment. However, investors remain cautious ahead of major events, including the FOMC meeting, and are closely monitoring trading signals.

Oil prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 68, suggesting the commodity might enter overbought territory.

Resistance level: 79.90, 82.35

Support level: 77.30, 73.70

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.