-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

Market Summary

The market’s focus remained on the FOMC meeting minutes, seeking clues on the Federal Reserve’s monetary policy outlook. As expected, the Fed maintained a cautious stance, balancing a resilient U.S. economy with uncertainties surrounding the Trump administration’s potential inflationary policies. Initially, the dollar strengthened post-release, but confidence in the greenback later waned, leading to a pullback.

In contrast, the Japanese yen surged, supported by a record high in JGB yields, reinforcing expectations of a BoJ rate hike. Meanwhile, the Australian dollar found support after better-than-expected employment data, aligning with the RBA’s stance to keep policy restrictive to combat inflation.

Geopolitical tensions resurfaced after reports suggested Trump distanced himself from Ukraine’s President Zelensky, leaving Ukraine’s future military aid uncertain amid the ongoing war. This complicated the Ukraine-Russia peace talks, fueling safe-haven demand and lifting gold prices to near $2,940.

In the crypto market, Bitcoin (BTC) and Ethereum (ETH) rebounded, breaking key resistance levels. The bullish breakout signals a potential trend reversal, as the market shakes off previous bearish momentum.

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98%) VS -25 bps (2%)

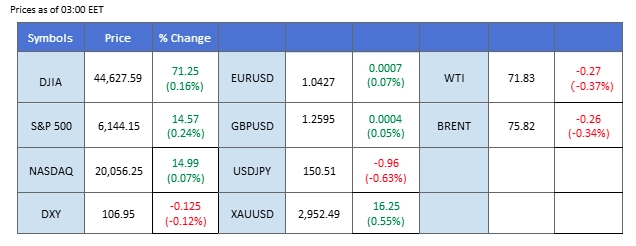

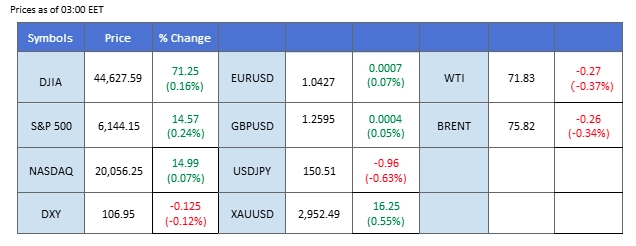

Market Overview

(MT4 System Time)

Source: MQL5

Market Movements

The dollar edged higher after the Fed’s January meeting minutes reinforced a hawkish stance, citing persistent inflation and economic uncertainty. Policymakers signaled that rate cuts are unlikely soon, stressing the need for stronger evidence of easing inflation. This dampened risk appetite as markets adjusted to prolonged tight monetary conditions.

The Dollar Index is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 50, suggesting the index might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 107.45, 108.40

Support level: 106.55, 105.65

Gold prices rebounded as safe-haven demand rose amid stalled Russia-Ukraine ceasefire talks. Tensions escalated after Trump warned Zelenskiy to negotiate swiftly or risk losing control of Ukraine. Meanwhile, U.S. and Russian officials met in Saudi Arabia—without Ukraine—fueling fears of a deal being struck without Kyiv’s involvement. Putin welcomed the meeting’s outcome, adding uncertainty to the geopolitical landscape.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 55, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 2940.00, 2960.00

Support level: 2915.00, 2880.00

The Pound Sterling managed to withstand the strengthening U.S. dollar in the last session, with the GBP/USD pair experiencing only a minor technical correction. The dollar initially gained after the FOMC meeting minutes revealed a hawkish stance, reinforcing the Fed’s cautious approach amid persistent inflation risks. However, upside momentum in the greenback was capped, as resistance levels limited further gains. Meanwhile, the Pound remained supported by an upbeat UK CPI reading, which exceeded market expectations and fueled speculation that the BoE might maintain restrictive monetary policy for longer.

GBP/USD remained sideways despite experiencing a slight correction yesterday, suggesting a bullish bias for the pair. The RSI is forming a lower-high pattern, while the MACD edged lower after the deadly cross, suggesting that the bullish momentum is easing.

Resistance level: 1.2730, 1.2850

Support level: 1.2485, 1.2375

The EUR/USD pair came under heavy selling pressure in the last session as the dollar surged following the release of the FOMC meeting minutes, which reinforced the Fed’s restrictive stance on monetary policy. The hawkish tone from the Fed bolstered expectations that interest rates may stay elevated for longer, driving demand for the greenback and pushing the pair to a weekly low. However, the dollar’s upside remained capped due to uncertainties surrounding Trump’s administration policies, which limited further gains. This allowed EUR/USD to find support above its uptrend support level.

The EUR/USD pair continues to face downside pressure but has found support at above the uptrend support level, suggesting a potential trend reversal. The RSI slides while the MACD is about to break below the zero line, suggesting that the bearish momentum is vanishing.

Resistance level: 1.0450, 1.0515

Support level: 1.0388, 1.0330

The AUD/USD pair tested a key resistance level near 0.6375 but failed to break higher, leading to a technical retracement in the last session. Despite the strengthened U.S. dollar, the Aussie held firm, finding support above its uptrend support level. In today’s session, Australia’s job data surprised to the upside, beating market expectations and reinforcing the RBA’s stance on maintaining restrictive monetary policy. This positive employment report is expected to provide further support to the Aussie, with a break above 0.6375 signalling a strong bullish continuation for the pair.

The pair remains trading within its uptrend trajectory, continuing to form a higher-high price pattern. However, the RSI is flirting with the 50 level while the MACD is edging lower, suggesting the bullish momentum is easing.

Resistance level: 0.6375, 0.6455

Support level: 0.6320, 0.6300

The yen strengthened as Japan’s economic data fueled expectations of a more hawkish BoJ. Q4 GDP grew 0.7%, exceeding forecasts, while Tokyo’s core inflation hit 2.5% for the third straight month. Rising wages and improving consumer sentiment add pressure on the BoJ to tighten policy, keeping the yen supported.

USD/JPY is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 29, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 151.35, 152.75

Support level: 149.15, 147.50

Crude prices retraced due to a technical correction following a sharp rebound driven by supply concerns. OPEC+ may delay planned production increases, while a Ukrainian drone strike disrupted Kazakhstan’s oil exports. Meanwhile, the G7 is considering stricter price caps on Russian crude, adding uncertainty to global energy markets. Any breakthrough in peace talks could shift the outlook for sanctioned Russian oil supplies.

Crude oil prices are trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 44, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 71.95, 72.55

Support level: 70.95, 70.25

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Market Summary

The market’s focus remained on the FOMC meeting minutes, seeking clues on the Federal Reserve’s monetary policy outlook. As expected, the Fed maintained a cautious stance, balancing a resilient U.S. economy with uncertainties surrounding the Trump administration’s potential inflationary policies. Initially, the dollar strengthened post-release, but confidence in the greenback later waned, leading to a pullback.

In contrast, the Japanese yen surged, supported by a record high in JGB yields, reinforcing expectations of a BoJ rate hike. Meanwhile, the Australian dollar found support after better-than-expected employment data, aligning with the RBA’s stance to keep policy restrictive to combat inflation.

Geopolitical tensions resurfaced after reports suggested Trump distanced himself from Ukraine’s President Zelensky, leaving Ukraine’s future military aid uncertain amid the ongoing war. This complicated the Ukraine-Russia peace talks, fueling safe-haven demand and lifting gold prices to near $2,940.

In the crypto market, Bitcoin (BTC) and Ethereum (ETH) rebounded, breaking key resistance levels. The bullish breakout signals a potential trend reversal, as the market shakes off previous bearish momentum.

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98%) VS -25 bps (2%)

Market Overview

(MT4 System Time)

Source: MQL5

Market Movements

The dollar edged higher after the Fed’s January meeting minutes reinforced a hawkish stance, citing persistent inflation and economic uncertainty. Policymakers signaled that rate cuts are unlikely soon, stressing the need for stronger evidence of easing inflation. This dampened risk appetite as markets adjusted to prolonged tight monetary conditions.

The Dollar Index is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 50, suggesting the index might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 107.45, 108.40

Support level: 106.55, 105.65

Gold prices rebounded as safe-haven demand rose amid stalled Russia-Ukraine ceasefire talks. Tensions escalated after Trump warned Zelenskiy to negotiate swiftly or risk losing control of Ukraine. Meanwhile, U.S. and Russian officials met in Saudi Arabia—without Ukraine—fueling fears of a deal being struck without Kyiv’s involvement. Putin welcomed the meeting’s outcome, adding uncertainty to the geopolitical landscape.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 55, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 2940.00, 2960.00

Support level: 2915.00, 2880.00

The Pound Sterling managed to withstand the strengthening U.S. dollar in the last session, with the GBP/USD pair experiencing only a minor technical correction. The dollar initially gained after the FOMC meeting minutes revealed a hawkish stance, reinforcing the Fed’s cautious approach amid persistent inflation risks. However, upside momentum in the greenback was capped, as resistance levels limited further gains. Meanwhile, the Pound remained supported by an upbeat UK CPI reading, which exceeded market expectations and fueled speculation that the BoE might maintain restrictive monetary policy for longer.

GBP/USD remained sideways despite experiencing a slight correction yesterday, suggesting a bullish bias for the pair. The RSI is forming a lower-high pattern, while the MACD edged lower after the deadly cross, suggesting that the bullish momentum is easing.

Resistance level: 1.2730, 1.2850

Support level: 1.2485, 1.2375

The EUR/USD pair came under heavy selling pressure in the last session as the dollar surged following the release of the FOMC meeting minutes, which reinforced the Fed’s restrictive stance on monetary policy. The hawkish tone from the Fed bolstered expectations that interest rates may stay elevated for longer, driving demand for the greenback and pushing the pair to a weekly low. However, the dollar’s upside remained capped due to uncertainties surrounding Trump’s administration policies, which limited further gains. This allowed EUR/USD to find support above its uptrend support level.

The EUR/USD pair continues to face downside pressure but has found support at above the uptrend support level, suggesting a potential trend reversal. The RSI slides while the MACD is about to break below the zero line, suggesting that the bearish momentum is vanishing.

Resistance level: 1.0450, 1.0515

Support level: 1.0388, 1.0330

The AUD/USD pair tested a key resistance level near 0.6375 but failed to break higher, leading to a technical retracement in the last session. Despite the strengthened U.S. dollar, the Aussie held firm, finding support above its uptrend support level. In today’s session, Australia’s job data surprised to the upside, beating market expectations and reinforcing the RBA’s stance on maintaining restrictive monetary policy. This positive employment report is expected to provide further support to the Aussie, with a break above 0.6375 signalling a strong bullish continuation for the pair.

The pair remains trading within its uptrend trajectory, continuing to form a higher-high price pattern. However, the RSI is flirting with the 50 level while the MACD is edging lower, suggesting the bullish momentum is easing.

Resistance level: 0.6375, 0.6455

Support level: 0.6320, 0.6300

The yen strengthened as Japan’s economic data fueled expectations of a more hawkish BoJ. Q4 GDP grew 0.7%, exceeding forecasts, while Tokyo’s core inflation hit 2.5% for the third straight month. Rising wages and improving consumer sentiment add pressure on the BoJ to tighten policy, keeping the yen supported.

USD/JPY is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 29, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 151.35, 152.75

Support level: 149.15, 147.50

Crude prices retraced due to a technical correction following a sharp rebound driven by supply concerns. OPEC+ may delay planned production increases, while a Ukrainian drone strike disrupted Kazakhstan’s oil exports. Meanwhile, the G7 is considering stricter price caps on Russian crude, adding uncertainty to global energy markets. Any breakthrough in peace talks could shift the outlook for sanctioned Russian oil supplies.

Crude oil prices are trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 44, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 71.95, 72.55

Support level: 70.95, 70.25

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.