-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

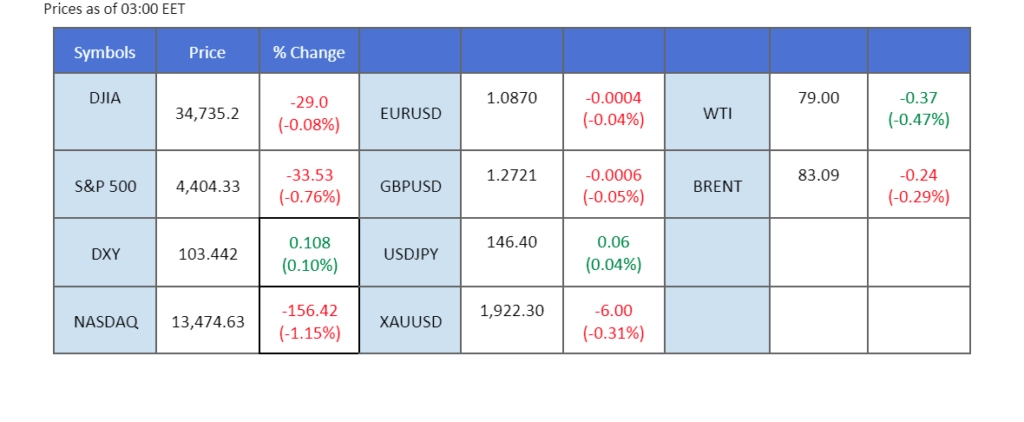

The Chinese stock markets, including the Hang Seng index, are grappling with downward pressure due to investor pessimism surrounding the Chinese economy. Adding to these concerns, the release of the Federal Open Market Committee (FOMC) meeting minutes from July has exacerbated the situation. The minutes revealed that the Fed is notably concerned about the potential for inflation to remain elevated, particularly considering recent economic data surpassing expectations. This has led to a robust strengthening of the U.S. dollar against a majority of other currencies following the release of the hawkish FOMC minutes. Concurrently, the price of gold has breached its significant psychological support level at $1900. Conversely, Australia has experienced an increase in its unemployment rate compared to the previous reading. This has adversely impacted the Australian dollar, causing it to drop to its lowest since last November.

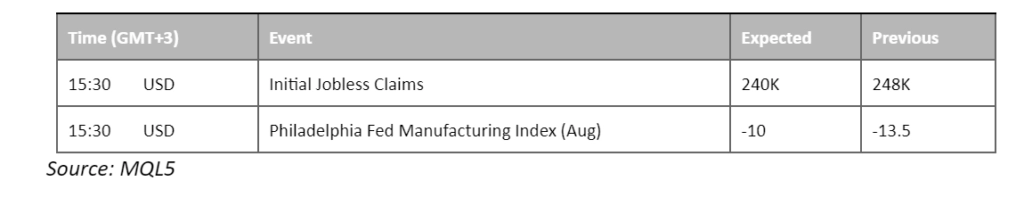

Current rate hike bets on 20th September Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (86%) VS 25 bps (14%)

The US Dollar gains strength as the Federal Reserve expresses concerns about rising inflation during its recent meeting. There’s a general agreement that unless things change, more interest rate hikes might be needed. They’ve already raised rates by a quarter percentage point, which was expected to be the last hike in this cycle. Nonetheless, the meeting notes hint at uncertainty about future policies. To decode a clearer path, savvy investors are prompted to meticulously monitor forthcoming economic metrics, unveiling potential permutations for the US Dollar.

The dollar index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 65, suggesting the index might enter overbought territory.

Resistance level: 103.45, 104.50

Support level: 102.65, 102.10

Gold prices take a hit as the US Dollar gets stronger. Bolstered by the Federal Reserve’s resolute vigilance against the spectre of soaring inflation, the Dollar stands fortified—its influence pivotal in gold’s stark decline.

Gold prices are trading lower following prior breakout below the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 30, suggesting the commodity might enter oversold territory.

Resistance level: 1900.00, 1930.00

Support level: 1880.00, 1855.00

The dollar index maintains its bullish momentum and is trading above $103, reaching its highest level since June. The recently disclosed July FOMC meeting minutes have shed light on the Federal Reserve’s continued concern regarding the potential lack of decline in inflation within the country. This revelation has spurred market speculation that the Fed might pursue further interest rate increases come September. Concurrently, market participants are eagerly anticipating the release of the Eurozone Consumer Price Index (CPI) scheduled for tomorrow. The hope is that this economic data could potentially inject some positivity into the weakened euro.

The Euro portrayed a bearish price movement after it broke below the descending triangle pattern. The RSI is approaching the oversold zone while the MACD continues to slide, suggesting a bearish bias for the pair.

Resistance level: 1.0924, 1.0990

Support level: 1.0848, 1.0760

Despite the dollar’s recent strength, the British Pound (Sterling) has demonstrated a sideways trading pattern marked by a substantial fluctuation range, spanning from 1.2780 to 1.2670. The UK’s CPI, which was unveiled yesterday, revealed a decline to 6.8%. While this figure aligned with market expectations, it remains notably distant from the country’s targeted inflation rate of 2%. This circumstance raises the anticipation that the Bank of England (BoE) may opt to continue raising interest rates throughout the year. Simultaneously, market attention is focused on the impending release of the UK’s retail sales data, scheduled for tomorrow. This release is anticipated to serve as a potential catalyst that could prompt the Cable to move beyond its current price consolidation range.

The Sterling is firm against the strengthened dollar. The RSI is gradually moving upward while the MACD has broken above the zero line suggesting the bearish momentum for the Cable is vanishing.

Resistance level: 1.2780, 1.2870

Support level: 1.2640, 1.2550

US equity markets experience a tentative dip mirroring the ascent of US Treasury yields. The Federal Reserve’s meeting minutes spark uncertainty in the global financial market. Earlier, market participants widely thought the Fed might slow down rate hikes, but now there’s confusion as some policymakers vowed to maintain its tightening monetary cycle to combat inflation. This mixed message is making investors unsure about what’s coming next.

The Dow is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 36, suggesting the index might extend its losses in the short-term since the RSI stays below the midline.

Resistance level: 35605.00, 36520.00

Support level: 34550.00, 33715.00

Despite New Zealand’s central bank’s clarification for rate hikes to tame inflation’s tempest, the New Zealand Dollar remained in bearish pressure. Aggravated by China’s property market tremors, the allure of the New Zealand Dollar wanes as a China-proxy. While the Reserve Bank of New Zealand maintains stability, an undertone of resolute commitment to steep rate hikes adds depth, with the Official Cash Rate standing firm at 5.5%, mirroring economist projections.

NZD/USD is trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 27, suggesting the pair might enter oversold territory.

Resistance level: 0.6020, 0.6240

Support level: 0.5880, 0.5735

Oil prices plunge following a breach of its upward trend line. Echoes of rate hike expectations reverberate from multiple central banks, including the Federal Reserve and New Zealand’s Reserve Bank. This intricate web of tightening monetary policies stokes concerns of global economic downturn, pulling at oil demand’s threads. Despite this, buoyant inventory data tempers the decline, with the Energy Information Administration revealing a substantial drop in US crude oil inventories, propelled by robust exports and refining activities.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 38, suggesting the commodity might extend its losses toward support level since the RSI stays below the midline.

Resistance level: 83.25, 87.25

Support level: 79.90, 76.90

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!