-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

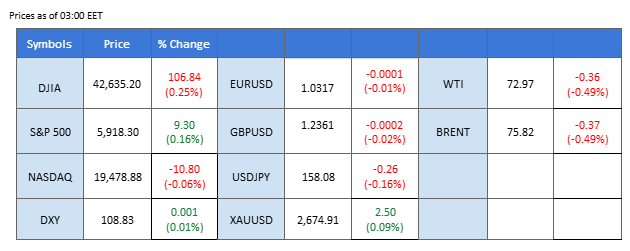

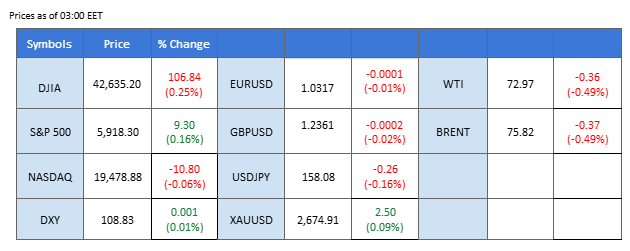

Market Summary

Yesterday’s market focus was dominated by U.S. economic indicators and the release of the Fed meeting minutes. The dollar experienced mixed movements, pressured by a weaker-than-expected U.S. ADP Nonfarm Employment Change but supported by better-than-expected Initial Jobless Claims data. The Fed minutes revealed a cautious stance, as members acknowledged the economy’s resilience and the potential inflationary pressures from Trump administration policies, suggesting a careful monetary policy approach in 2025.

Gold prices, closely tied to the dollar’s strength, remained near the $2,665 resistance level. A weakening dollar could drive gold prices higher. Meanwhile, oil prices fell 1.5%, weighed down by the Fed’s hawkish outlook and disappointing Chinese CPI and PPI readings, which raised concerns about oil demand in 2025. The cryptocurrency market also continued its decline, with BTC and ETH extending their losses following a sharp drop in previous sessions.

Current rate hike bets on 29th January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (90.4%) VS -25 bps (9.6%)

(MT4 System Time)

N/A

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index continued its upward momentum, supported by rising US Treasury yields. The US 10-year yield hit 4.73%, its highest level since April 25, as investors anticipate that Trump’s policies, including deregulation and tax cuts, will spur economic growth and inflation. Additionally, the better-than-expected US Initial Jobless Claims report helped maintain optimism around the dollar, with the Department of Labor reporting claims of 201K, outperforming the expected 214K. However, ADP Nonfarm Employment Change came in below expectations at 122K vs. 139K. Investors will be closely watching the US Nonfarm Payrolls and Unemployment rate for further clues on the dollar’s direction.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 59, suggesting the index might extend its losses since the RSI retreated from resistance level.

Resistance level: 109.40, 110.60

Support level: 107.90, 106.80

Gold prices gained for a second consecutive day, bolstered by uncertainties around potential tariffs. President-elect Donald Trump is reportedly considering declaring a national economic emergency to justify a large-scale tariff scheme, which could increase market uncertainties and drive demand for gold as a haven. The main catalyst for gold in the coming days remains the US jobs data.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 59, suggesting the gold might extend its gains since the RSI stays above the midline.

Resistance level: 2660.00, 2720.00

Support level: 2605.00, 2545.00

The GBP/USD pair has experienced significant volatility this week, initially gaining nearly 0.8% early on, only to see those gains erased in yesterday’s session, bringing the pair to its recent lows. Despite the decline, the UK 10-year bond yield has surged to its highest level since August 2008, potentially supporting the British pound. This could trigger a technical rebound for the pair, offering some relief amidst the prevailing bearish sentiment.

The pair has recorded a new low, which suggests that it is trading in a bearish bias. The RSI is close to the oversold zone, while the MACD is edging lower, suggesting that the pair is trading with bearish momentum.

Resistance level: 1.2410, 1.2505

Support level: 1.2310, 1.2220

The EUR/USD pair continues to trade within a bearish trend, but the formation of a higher-low price pattern indicates the potential for a trend reversal. The euro found support from upbeat PMI data across key Eurozone countries, including Germany and France, as well as strong overall Eurozone PMI readings. However, the pair remains under pressure due to the hawkish tone reflected in the recent Fed meeting minutes, which could weigh on the euro and sustain the pair’s downside risk.

The pair is trading in a higher-low price pattern, which suggests a potential trend reversal. The RSI has declined to near the 50 level, while the MACD is also edging lower, suggesting that the pair is trading with bearish momentum, which contradicts the price pattern.

Resistance level: 1.0330, 1.0458

Support level: 1.0230, 1.0112

The USD/CHF pair is testing its resistance level at 0.9123 but shows signs of easing bullish momentum, as indicated by a declining MACD. With the Swiss Franc lacking significant catalysts and the SNB maintaining one of the lowest interest rates among major central banks, the pair remains highly sensitive to U.S. dollar strength. Given the hawkish stance of the Fed, a decisive break above the 0.9123 resistance level could signal a strong bullish continuation for the pair.

The USD/CHF has traded to its resistance level after a technical retracement, suggesting a bullish bias for the pair. The RSI remains above 50, but the MACD is at a lower level, suggesting that the pair is awaiting sufficient bullish momentum to break above the resistance level.

Resistance level: 0.9173, 0.9233

Support level: 0.9058, 0.9000

The US equity market edged lower, with tech stocks recovering from session lows after US Treasury yields stabilized. The minutes from the Federal Reserve’s December meeting showed policymakers favored a slower pace of rate cuts due to concerns over stalled disinflation. Despite a drop in major tech stocks like Apple Inc (AAPL), Alphabet Inc Class C (GOOG), and Meta Platforms Inc (META), losses were trimmed as Treasury yields steadied, with NVIDIA Corporation (NVDA) hovering near the flatline.

Nasdaq is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 45, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 21480.00, 22085.00

Support level: 20705.00, 20090.00

Bitcoin faced a sharp rejection at the 61.8% Fibonacci retracement level near $102,000, recording a significant drop in the previous session. This indicates strong downside pressure, compounded by the hawkish tone of the Fed meeting minutes, which dampened risk appetite across markets. However, reports of BTC whales accumulating over 30,000 BTC in December could offer support, potentially stabilizing prices near the $90,000 mark.

BTC continued to edge lower after a plummet in the previous session, suggesting a bearish bias for BTC. The RSI has slid to the oversold zone, while the MACD has broken below the zero line and is diverging, suggesting that the bearish momentum is gaining.

Resistance level: 98700.00, 102,000.00

Support level: 91400.00, 87,600.00

Oil prices dropped more than 1% as a stronger dollar and a large build in US fuel inventories weighed on the market. The Energy Information Administration (EIA) reported a crude oil inventory draw of 0.959M barrels, missing the expected 1.800M draw. These reversed earlier gains supported by tightening supplies from Russia and other OPEC members.m a weaker U.S. dollar and forecasts of increased energy demand driven by an impending winter storm

Oil prices are trading lower while currently near the support level. MACD has illustrated increasing bearish momentum, while RSI is at 44, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 75.05, 77.25

Support level: 72.55, 71.10

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Market Summary

Yesterday’s market focus was dominated by U.S. economic indicators and the release of the Fed meeting minutes. The dollar experienced mixed movements, pressured by a weaker-than-expected U.S. ADP Nonfarm Employment Change but supported by better-than-expected Initial Jobless Claims data. The Fed minutes revealed a cautious stance, as members acknowledged the economy’s resilience and the potential inflationary pressures from Trump administration policies, suggesting a careful monetary policy approach in 2025.

Gold prices, closely tied to the dollar’s strength, remained near the $2,665 resistance level. A weakening dollar could drive gold prices higher. Meanwhile, oil prices fell 1.5%, weighed down by the Fed’s hawkish outlook and disappointing Chinese CPI and PPI readings, which raised concerns about oil demand in 2025. The cryptocurrency market also continued its decline, with BTC and ETH extending their losses following a sharp drop in previous sessions.

Current rate hike bets on 29th January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (90.4%) VS -25 bps (9.6%)

(MT4 System Time)

N/A

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index continued its upward momentum, supported by rising US Treasury yields. The US 10-year yield hit 4.73%, its highest level since April 25, as investors anticipate that Trump’s policies, including deregulation and tax cuts, will spur economic growth and inflation. Additionally, the better-than-expected US Initial Jobless Claims report helped maintain optimism around the dollar, with the Department of Labor reporting claims of 201K, outperforming the expected 214K. However, ADP Nonfarm Employment Change came in below expectations at 122K vs. 139K. Investors will be closely watching the US Nonfarm Payrolls and Unemployment rate for further clues on the dollar’s direction.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 59, suggesting the index might extend its losses since the RSI retreated from resistance level.

Resistance level: 109.40, 110.60

Support level: 107.90, 106.80

Gold prices gained for a second consecutive day, bolstered by uncertainties around potential tariffs. President-elect Donald Trump is reportedly considering declaring a national economic emergency to justify a large-scale tariff scheme, which could increase market uncertainties and drive demand for gold as a haven. The main catalyst for gold in the coming days remains the US jobs data.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 59, suggesting the gold might extend its gains since the RSI stays above the midline.

Resistance level: 2660.00, 2720.00

Support level: 2605.00, 2545.00

The GBP/USD pair has experienced significant volatility this week, initially gaining nearly 0.8% early on, only to see those gains erased in yesterday’s session, bringing the pair to its recent lows. Despite the decline, the UK 10-year bond yield has surged to its highest level since August 2008, potentially supporting the British pound. This could trigger a technical rebound for the pair, offering some relief amidst the prevailing bearish sentiment.

The pair has recorded a new low, which suggests that it is trading in a bearish bias. The RSI is close to the oversold zone, while the MACD is edging lower, suggesting that the pair is trading with bearish momentum.

Resistance level: 1.2410, 1.2505

Support level: 1.2310, 1.2220

The EUR/USD pair continues to trade within a bearish trend, but the formation of a higher-low price pattern indicates the potential for a trend reversal. The euro found support from upbeat PMI data across key Eurozone countries, including Germany and France, as well as strong overall Eurozone PMI readings. However, the pair remains under pressure due to the hawkish tone reflected in the recent Fed meeting minutes, which could weigh on the euro and sustain the pair’s downside risk.

The pair is trading in a higher-low price pattern, which suggests a potential trend reversal. The RSI has declined to near the 50 level, while the MACD is also edging lower, suggesting that the pair is trading with bearish momentum, which contradicts the price pattern.

Resistance level: 1.0330, 1.0458

Support level: 1.0230, 1.0112

The USD/CHF pair is testing its resistance level at 0.9123 but shows signs of easing bullish momentum, as indicated by a declining MACD. With the Swiss Franc lacking significant catalysts and the SNB maintaining one of the lowest interest rates among major central banks, the pair remains highly sensitive to U.S. dollar strength. Given the hawkish stance of the Fed, a decisive break above the 0.9123 resistance level could signal a strong bullish continuation for the pair.

The USD/CHF has traded to its resistance level after a technical retracement, suggesting a bullish bias for the pair. The RSI remains above 50, but the MACD is at a lower level, suggesting that the pair is awaiting sufficient bullish momentum to break above the resistance level.

Resistance level: 0.9173, 0.9233

Support level: 0.9058, 0.9000

The US equity market edged lower, with tech stocks recovering from session lows after US Treasury yields stabilized. The minutes from the Federal Reserve’s December meeting showed policymakers favored a slower pace of rate cuts due to concerns over stalled disinflation. Despite a drop in major tech stocks like Apple Inc (AAPL), Alphabet Inc Class C (GOOG), and Meta Platforms Inc (META), losses were trimmed as Treasury yields steadied, with NVIDIA Corporation (NVDA) hovering near the flatline.

Nasdaq is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 45, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 21480.00, 22085.00

Support level: 20705.00, 20090.00

Bitcoin faced a sharp rejection at the 61.8% Fibonacci retracement level near $102,000, recording a significant drop in the previous session. This indicates strong downside pressure, compounded by the hawkish tone of the Fed meeting minutes, which dampened risk appetite across markets. However, reports of BTC whales accumulating over 30,000 BTC in December could offer support, potentially stabilizing prices near the $90,000 mark.

BTC continued to edge lower after a plummet in the previous session, suggesting a bearish bias for BTC. The RSI has slid to the oversold zone, while the MACD has broken below the zero line and is diverging, suggesting that the bearish momentum is gaining.

Resistance level: 98700.00, 102,000.00

Support level: 91400.00, 87,600.00

Oil prices dropped more than 1% as a stronger dollar and a large build in US fuel inventories weighed on the market. The Energy Information Administration (EIA) reported a crude oil inventory draw of 0.959M barrels, missing the expected 1.800M draw. These reversed earlier gains supported by tightening supplies from Russia and other OPEC members.m a weaker U.S. dollar and forecasts of increased energy demand driven by an impending winter storm

Oil prices are trading lower while currently near the support level. MACD has illustrated increasing bearish momentum, while RSI is at 44, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 75.05, 77.25

Support level: 72.55, 71.10

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.