-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

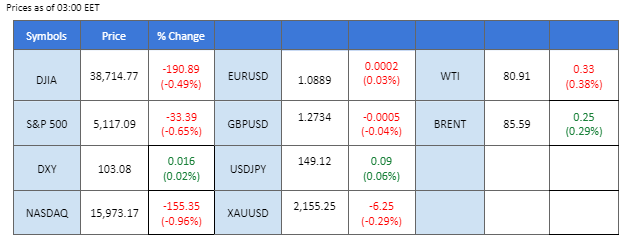

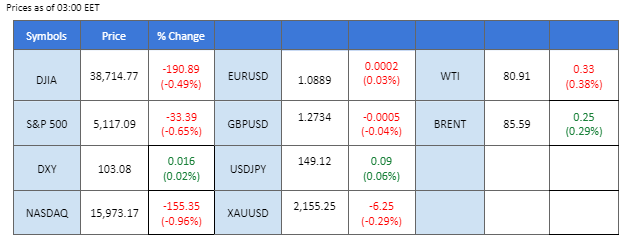

In the lead-up to pivotal interest rate decisions by the Bank of Japan (BoJ) and the Reserve Bank of Australia (RBA), global financial markets are exhibiting signs of stability. The U.S. Dollar Index (DXY) is maintaining its position above the 103.50 threshold, bolstered by last week’s Producer Price Index (PPI) figures that have steered market sentiment towards expectations of a more hawkish Federal Reserve policy stance in Q2 2024.

Amid this climate of anticipation, gold prices have seen a modest uptick, as investors position themselves strategically ahead of this week’s central bank decisions. This surge reflects the market’s hedge against potential currency volatility in the aftermath of the upcoming policy announcements.

Concurrently, crude oil prices are on an ascending trajectory, stimulated by a recent Ukrainian drone strike on Russian refineries which has resulted in a temporary disruption of oil production. This event has heightened concerns over supply constraints and geopolitical uncertainties, propelling oil prices upward.

In the cryptocurrency domain, Bitcoin (BTC) is encountering a period of stagnation, unable to breach the $70,000 psychological threshold. Despite this, significant buying activity by Bitcoin ‘whales’ have been reported, with large volumes of BTC being acquired at an average price of $56,000 predominantly through Spot ETFs. This buying pattern is perceived as establishing a robust support level for the cryptocurrency.

Current rate hike bets on 20th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

(MT4 System Time)

Source: MQL5

The Dollar index strengthened against major currencies in anticipation of the Federal Open Market Committee’s (FOMC) monetary policy decisions. Last week’s higher-than-expected US producer and consumer price indexes raised hopes for a hawkish stance from the Federal Reserve. All eyes are on the Fed meeting for clues on the central bank’s outlook for rate cuts.

The Dollar Index is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 70, suggesting the index might enter overbought territory.

Resistance level: 103.75, 104.50

Support level:103.05, 102.40

Gold prices declined as the US Dollar appreciated and US Treasury yields rose, dampening demand for non-yielding assets like gold. Better-than-expected economic data from the US signalled expectations of more hawkish policies from the Federal Reserve, further weighing on gold demand. Investors are closely monitoring monetary policy decisions for trading signals amid shifting market dynamics.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 41, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 2150.00, 2235.00

Support level: 2080.00, 2035.00

The GBP/USD pair faced pressure from the strengthening dollar following the release of higher-than-expected PPI figures last week. Expectations are for the pair to experience notable fluctuations this week, with several significant events on the calendar likely to influence its direction. The upcoming FOMC interest rate decision on Wednesday and the BoE interest rate decision on Thursday are both anticipated to be key drivers for the pair’s movement. Traders will closely monitor these events for insights into potential shifts in monetary policy and their implications for the GBP/USD exchange rate.

GBP/USD is trading in a bearish trajectory but is currently supported at the above 1.2710 level. The RSI has been flowing close to the oversold zone, while the MACD has broken below the zero line, suggesting the pair remains trading with bearish momentum.

Resistance level: 1.2780, 1.2880

Support level: 1.2710, 1.2630

The EUR/USD pair experienced a significant decline in the recent session and is currently hovering above the 1.0866 level. Market attention is focused on the Eurozone’s CPI reading, which is scheduled for later today. Projections suggest that the CPI reading may come in lower than the previous figure, signalling a potential easing in inflationary pressures. If the actual CPI reading falls below expectations, it could exert additional downward pressure on the pair.

EUR/USD has found support and consolidation after its significant plunge from the last session. The MACD has broken below the zero line, while the RSI hovers in the lower region, suggesting the pair’s bearish momentum remains intact.

Resistance level: 1.0960, 1.1040

Support level: 1.0870, 1.0775

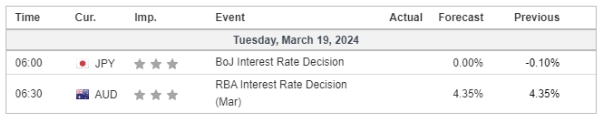

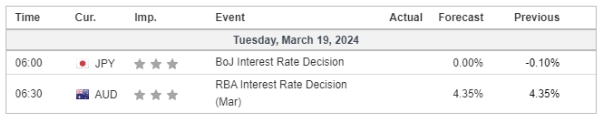

The Japanese yen experienced significant selling pressure as investors offloaded positions ahead of high volatility events. Despite the sell-off, bullish prospects remain for the Japanese yen, driven by speculation of potential monetary shifts from the Bank of Japan. Tuesday’s BOJ meeting is poised to be consequential, with officials deliberating on ending eight years of negative interest rates in a landmark shift away from its stimulus program.

USD/JPY is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 69, suggesting the pair might enter overbought territory.

Resistance level: 148.35, 150.80

Support level: 147.50, 146.20

The AUD/USD pair faced significant pressure from the robust U.S. dollar and witnessed a sharp decline in the previous session. However, the pair managed to find support ahead of the upcoming RBA interest rate decision scheduled for tomorrow (March 19th). With inflation in Australia remaining elevated, the market anticipates that the RBA will maintain its current interest rate level to mitigate inflationary pressures and prevent economic recession.

AUD/USD is consolidating at near 0.6560 levels, suggesting a potential trend reversal for the pair. The RSI was supported above the oversold zone while the MACD continued to move lower, suggesting the pair’s bearish momentum remains intact.

Resistance level: 0.6560, 0.6617

Support level: 0.6540, 0.6485

Oil prices saw a slight retreat primarily attributed to technical correction. However, the long-term outlook for the oil market remains positive as the International Energy Agency (IEA) and OPEC revised their 2024 oil demand forecasts upwards for the fourth time. Economic growth surpassing expectations is anticipated to bolster oil demand, underpinning the positive trend in the oil market.

Oil prices are trading flat while currently testing the support level. Nonetheless, MACD has illustrated diminishing bullish momentum, while RSI is at 61, suggesting the commodity might extend its losses after breakout since the RSI retreated sharply from overbought territory.

Resistance level: 82.45, 84.10

Support level: 80.20, 78.00

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

In the lead-up to pivotal interest rate decisions by the Bank of Japan (BoJ) and the Reserve Bank of Australia (RBA), global financial markets are exhibiting signs of stability. The U.S. Dollar Index (DXY) is maintaining its position above the 103.50 threshold, bolstered by last week’s Producer Price Index (PPI) figures that have steered market sentiment towards expectations of a more hawkish Federal Reserve policy stance in Q2 2024.

Amid this climate of anticipation, gold prices have seen a modest uptick, as investors position themselves strategically ahead of this week’s central bank decisions. This surge reflects the market’s hedge against potential currency volatility in the aftermath of the upcoming policy announcements.

Concurrently, crude oil prices are on an ascending trajectory, stimulated by a recent Ukrainian drone strike on Russian refineries which has resulted in a temporary disruption of oil production. This event has heightened concerns over supply constraints and geopolitical uncertainties, propelling oil prices upward.

In the cryptocurrency domain, Bitcoin (BTC) is encountering a period of stagnation, unable to breach the $70,000 psychological threshold. Despite this, significant buying activity by Bitcoin ‘whales’ have been reported, with large volumes of BTC being acquired at an average price of $56,000 predominantly through Spot ETFs. This buying pattern is perceived as establishing a robust support level for the cryptocurrency.

Current rate hike bets on 20th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

(MT4 System Time)

Source: MQL5

The Dollar index strengthened against major currencies in anticipation of the Federal Open Market Committee’s (FOMC) monetary policy decisions. Last week’s higher-than-expected US producer and consumer price indexes raised hopes for a hawkish stance from the Federal Reserve. All eyes are on the Fed meeting for clues on the central bank’s outlook for rate cuts.

The Dollar Index is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 70, suggesting the index might enter overbought territory.

Resistance level: 103.75, 104.50

Support level:103.05, 102.40

Gold prices declined as the US Dollar appreciated and US Treasury yields rose, dampening demand for non-yielding assets like gold. Better-than-expected economic data from the US signalled expectations of more hawkish policies from the Federal Reserve, further weighing on gold demand. Investors are closely monitoring monetary policy decisions for trading signals amid shifting market dynamics.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 41, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 2150.00, 2235.00

Support level: 2080.00, 2035.00

The GBP/USD pair faced pressure from the strengthening dollar following the release of higher-than-expected PPI figures last week. Expectations are for the pair to experience notable fluctuations this week, with several significant events on the calendar likely to influence its direction. The upcoming FOMC interest rate decision on Wednesday and the BoE interest rate decision on Thursday are both anticipated to be key drivers for the pair’s movement. Traders will closely monitor these events for insights into potential shifts in monetary policy and their implications for the GBP/USD exchange rate.

GBP/USD is trading in a bearish trajectory but is currently supported at the above 1.2710 level. The RSI has been flowing close to the oversold zone, while the MACD has broken below the zero line, suggesting the pair remains trading with bearish momentum.

Resistance level: 1.2780, 1.2880

Support level: 1.2710, 1.2630

The EUR/USD pair experienced a significant decline in the recent session and is currently hovering above the 1.0866 level. Market attention is focused on the Eurozone’s CPI reading, which is scheduled for later today. Projections suggest that the CPI reading may come in lower than the previous figure, signalling a potential easing in inflationary pressures. If the actual CPI reading falls below expectations, it could exert additional downward pressure on the pair.

EUR/USD has found support and consolidation after its significant plunge from the last session. The MACD has broken below the zero line, while the RSI hovers in the lower region, suggesting the pair’s bearish momentum remains intact.

Resistance level: 1.0960, 1.1040

Support level: 1.0870, 1.0775

The Japanese yen experienced significant selling pressure as investors offloaded positions ahead of high volatility events. Despite the sell-off, bullish prospects remain for the Japanese yen, driven by speculation of potential monetary shifts from the Bank of Japan. Tuesday’s BOJ meeting is poised to be consequential, with officials deliberating on ending eight years of negative interest rates in a landmark shift away from its stimulus program.

USD/JPY is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 69, suggesting the pair might enter overbought territory.

Resistance level: 148.35, 150.80

Support level: 147.50, 146.20

The AUD/USD pair faced significant pressure from the robust U.S. dollar and witnessed a sharp decline in the previous session. However, the pair managed to find support ahead of the upcoming RBA interest rate decision scheduled for tomorrow (March 19th). With inflation in Australia remaining elevated, the market anticipates that the RBA will maintain its current interest rate level to mitigate inflationary pressures and prevent economic recession.

AUD/USD is consolidating at near 0.6560 levels, suggesting a potential trend reversal for the pair. The RSI was supported above the oversold zone while the MACD continued to move lower, suggesting the pair’s bearish momentum remains intact.

Resistance level: 0.6560, 0.6617

Support level: 0.6540, 0.6485

Oil prices saw a slight retreat primarily attributed to technical correction. However, the long-term outlook for the oil market remains positive as the International Energy Agency (IEA) and OPEC revised their 2024 oil demand forecasts upwards for the fourth time. Economic growth surpassing expectations is anticipated to bolster oil demand, underpinning the positive trend in the oil market.

Oil prices are trading flat while currently testing the support level. Nonetheless, MACD has illustrated diminishing bullish momentum, while RSI is at 61, suggesting the commodity might extend its losses after breakout since the RSI retreated sharply from overbought territory.

Resistance level: 82.45, 84.10

Support level: 80.20, 78.00

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.