-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

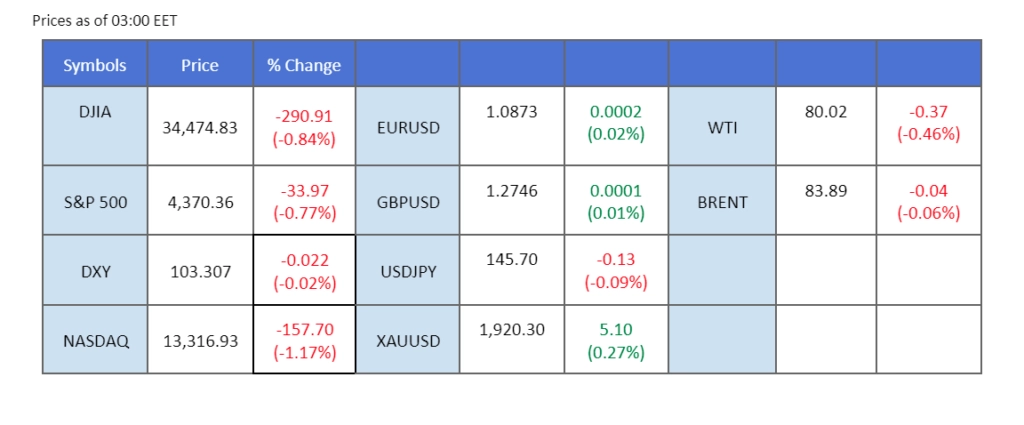

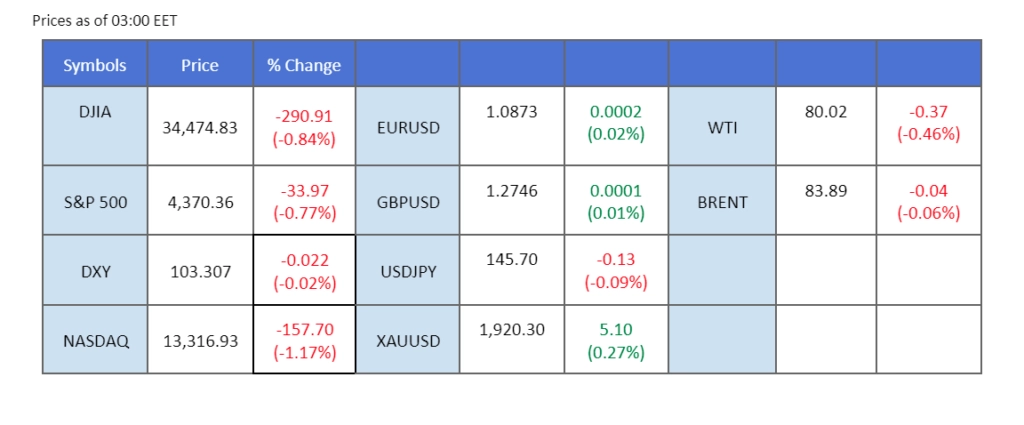

Asian stock markets are on track for a weekly decline, partly influenced by China’s economic challenges and the prevailing global high-interest rate environment. A notable increase in the global government bond yield, reaching a level not seen in 15 years, has sparked concerns among investors about a potential worldwide economic downturn. Meanwhile, the US dollar remains strong, and there’s a slight uptick in gold prices, reflecting a shift in investor sentiment towards safer assets. In a separate development, Japan’s core Consumer Price Index (CPI) has eased to 3.1% from its previous reading of 3.3%. This moderation in inflation has provided the Bank of Japan (BoJ) with reasons to maintain its current monetary policy stance. Conversely, the euro has gained strength following positive news about the Eurozone trade balance, which has improved from a deficit of -0.3 billion to a surplus of 23 billion.

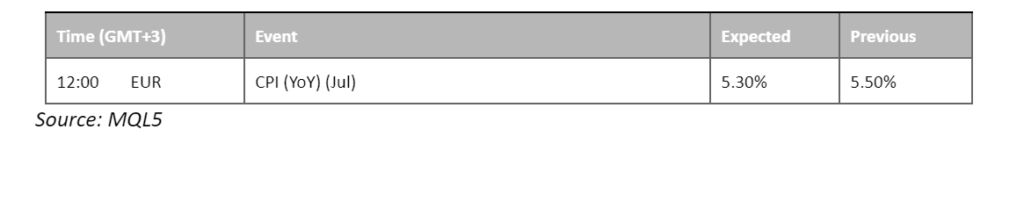

Current rate hike bets on 20th September Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (86%) VS 25 bps (14%)

The US Dollar remained perched close to a two-month high, absorbing the resonating impact of a hawkish Federal Reserve proclamation. The recently unveiled minutes from the Federal Reserve’s meeting unveiled a penchant for more rate hikes, coinciding with robust economic indicators that underscored the resilience of the US economy. US Initial Jobless Claims registered a slight descent, gracefully receding from 250K to 239K, a feat that outshone market expectations of 240K. In parallel, the Philadelphia Fed Manufacturing Index for August increased from a previous reading of -13.5 to 12.0, outpacing market projections of -10.0.

The dollar index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 58, suggesting the index might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 103.60, 104.20

Support level: 102.75, 102.15

The gold market slid deeper into its bearish trajectory, succumbing to the formidable influence of a resurging US Dollar, fortified by a confluence of constructive economic indicators and a firmly embedded hawkish sentiment echoing from the Federal Reserve.

Gold prices are trading lower following prior breakout below the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 30, suggesting the commodity might enter oversold territory.

Resistance level: 1900.00, 1930.00

Support level: 1880.00, 1855.00

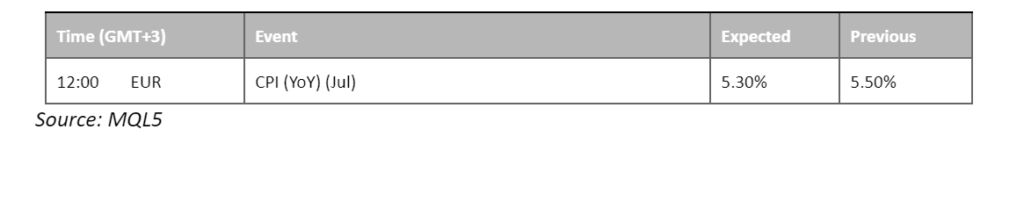

The euro has experienced its fifth consecutive decline, particularly in the wake of a stronger dollar fueled by the hawkish tone of the FOMC meeting minutes. Nonetheless, the Eurozone trade balance figures have displayed a noteworthy enhancement, shifting from a prior reading of -0.3 billion to a substantial increase of 23 billion. This improvement has acted as a supportive factor for the euro, helping it to maintain its position above the 1.0860 mark. Despite the rise in yields on US Treasuries, which typically puts pressure on the euro due to a strengthening dollar, there’s potential for the euro to find support. The forthcoming release of Eurozone Consumer Price Index (CPI) data, scheduled for today, could catalyse the euro to regain some strength in its trading.

The Euro has eased from its bearish momentum and stayed flat near the 1.0860 level. The RSI has rebounded before it breaks into the oversold zone while the MACD flows flat, suggesting that the bearish momentum is diminishing.

Resistance level: 1.0924, 1.0990

Support level: 1.0848, 1.0760

Amidst the recent upsurge in the dollar’s strength due to the hawkish sentiments conveyed in the FOMC meeting minutes, the British pound (sterling) has shown remarkable resilience. Despite the dollar’s recent vigour, the sterling has managed to stage a rebound and is actively seeking to surpass its price consolidation range. At the same time, investors in Cable are eagerly anticipating the release of UK retail sales data for July. This data holds the potential to serve as a barometer for the strength of the sterling, and there is optimism that it might offer the necessary impetus for the sterling to appreciate further in its trading.

The Sterling is resilient against the strong dollar and is attempting to break above its price consolidation range. The RSI is gradually moving upward while the MACD has broken above the zero line suggesting the bullish momentum is forming for the Cable.

Resistance level: 1.2780, 1.2870

Support level: 1.2640, 1.2550

US equities slide as investors fretted over potential prolonged rate hikes, prompting a fresh wave of divestment across US stocks and bonds. Following revealing Fed minutes hinting at a stricter stance, optimism waned on rate pause decisions. Global government bond yields surged to a 15-year high, driven by robust economic indicators. Lingering China economic concerns intensified asset sell-offs, including from the US equity market.

The Dow is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 29, suggesting the index might enter oversold territory.

Resistance level: 35605.00, 36520.00

Support level: 34415.00, 33715.00

The Japanese yen has shown a lack of vigour against the US dollar, breaking above the 146 mark earlier. Nevertheless, as global government bond yields have surged to their highest point in 15 years, concerns about an impending economic recession have gripped the market. In response, investors have turned their attention to the Japanese yen as a safe-haven currency, providing support for the yen’s strengthening. Despite this bullish factor, recent data revealed that Japan’s core Consumer Price Index (CPI) has displayed signs of easing. This development has reinforced the notion that the Bank of Japan (BoJ) might maintain its current ultra-loose monetary policy stance.

The USD/JPY pair shows signs of a trend reversal as it has dropped out of the uptrend channel. The RSI has also dropped out of the overbought zone while the MACD has crossed above the zero line suggesting a trend reversal.

Resistance level: 146.40, 147.20

Support level: 144.90, 144.00

Oil experiences a slight recovery due to technical factors, but the outlook remains bearish. Anticipated rate hikes and uncertainties about China’s economy continue to exert downward pressure. Investors await OPEC+ production cuts and broader economic trends for oil’s trajectory.

Oil prices are trading flat while currently near the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 41, suggesting the commodity might experience technical correction and trade higher since the RSI rebounded sharply from oversold territory.

Resistance level: 83.25, 87.25

Support level: 79.00, 76.90

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Asian stock markets are on track for a weekly decline, partly influenced by China’s economic challenges and the prevailing global high-interest rate environment. A notable increase in the global government bond yield, reaching a level not seen in 15 years, has sparked concerns among investors about a potential worldwide economic downturn. Meanwhile, the US dollar remains strong, and there’s a slight uptick in gold prices, reflecting a shift in investor sentiment towards safer assets. In a separate development, Japan’s core Consumer Price Index (CPI) has eased to 3.1% from its previous reading of 3.3%. This moderation in inflation has provided the Bank of Japan (BoJ) with reasons to maintain its current monetary policy stance. Conversely, the euro has gained strength following positive news about the Eurozone trade balance, which has improved from a deficit of -0.3 billion to a surplus of 23 billion.

Current rate hike bets on 20th September Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (86%) VS 25 bps (14%)

The US Dollar remained perched close to a two-month high, absorbing the resonating impact of a hawkish Federal Reserve proclamation. The recently unveiled minutes from the Federal Reserve’s meeting unveiled a penchant for more rate hikes, coinciding with robust economic indicators that underscored the resilience of the US economy. US Initial Jobless Claims registered a slight descent, gracefully receding from 250K to 239K, a feat that outshone market expectations of 240K. In parallel, the Philadelphia Fed Manufacturing Index for August increased from a previous reading of -13.5 to 12.0, outpacing market projections of -10.0.

The dollar index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 58, suggesting the index might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 103.60, 104.20

Support level: 102.75, 102.15

The gold market slid deeper into its bearish trajectory, succumbing to the formidable influence of a resurging US Dollar, fortified by a confluence of constructive economic indicators and a firmly embedded hawkish sentiment echoing from the Federal Reserve.

Gold prices are trading lower following prior breakout below the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 30, suggesting the commodity might enter oversold territory.

Resistance level: 1900.00, 1930.00

Support level: 1880.00, 1855.00

The euro has experienced its fifth consecutive decline, particularly in the wake of a stronger dollar fueled by the hawkish tone of the FOMC meeting minutes. Nonetheless, the Eurozone trade balance figures have displayed a noteworthy enhancement, shifting from a prior reading of -0.3 billion to a substantial increase of 23 billion. This improvement has acted as a supportive factor for the euro, helping it to maintain its position above the 1.0860 mark. Despite the rise in yields on US Treasuries, which typically puts pressure on the euro due to a strengthening dollar, there’s potential for the euro to find support. The forthcoming release of Eurozone Consumer Price Index (CPI) data, scheduled for today, could catalyse the euro to regain some strength in its trading.

The Euro has eased from its bearish momentum and stayed flat near the 1.0860 level. The RSI has rebounded before it breaks into the oversold zone while the MACD flows flat, suggesting that the bearish momentum is diminishing.

Resistance level: 1.0924, 1.0990

Support level: 1.0848, 1.0760

Amidst the recent upsurge in the dollar’s strength due to the hawkish sentiments conveyed in the FOMC meeting minutes, the British pound (sterling) has shown remarkable resilience. Despite the dollar’s recent vigour, the sterling has managed to stage a rebound and is actively seeking to surpass its price consolidation range. At the same time, investors in Cable are eagerly anticipating the release of UK retail sales data for July. This data holds the potential to serve as a barometer for the strength of the sterling, and there is optimism that it might offer the necessary impetus for the sterling to appreciate further in its trading.

The Sterling is resilient against the strong dollar and is attempting to break above its price consolidation range. The RSI is gradually moving upward while the MACD has broken above the zero line suggesting the bullish momentum is forming for the Cable.

Resistance level: 1.2780, 1.2870

Support level: 1.2640, 1.2550

US equities slide as investors fretted over potential prolonged rate hikes, prompting a fresh wave of divestment across US stocks and bonds. Following revealing Fed minutes hinting at a stricter stance, optimism waned on rate pause decisions. Global government bond yields surged to a 15-year high, driven by robust economic indicators. Lingering China economic concerns intensified asset sell-offs, including from the US equity market.

The Dow is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 29, suggesting the index might enter oversold territory.

Resistance level: 35605.00, 36520.00

Support level: 34415.00, 33715.00

The Japanese yen has shown a lack of vigour against the US dollar, breaking above the 146 mark earlier. Nevertheless, as global government bond yields have surged to their highest point in 15 years, concerns about an impending economic recession have gripped the market. In response, investors have turned their attention to the Japanese yen as a safe-haven currency, providing support for the yen’s strengthening. Despite this bullish factor, recent data revealed that Japan’s core Consumer Price Index (CPI) has displayed signs of easing. This development has reinforced the notion that the Bank of Japan (BoJ) might maintain its current ultra-loose monetary policy stance.

The USD/JPY pair shows signs of a trend reversal as it has dropped out of the uptrend channel. The RSI has also dropped out of the overbought zone while the MACD has crossed above the zero line suggesting a trend reversal.

Resistance level: 146.40, 147.20

Support level: 144.90, 144.00

Oil experiences a slight recovery due to technical factors, but the outlook remains bearish. Anticipated rate hikes and uncertainties about China’s economy continue to exert downward pressure. Investors await OPEC+ production cuts and broader economic trends for oil’s trajectory.

Oil prices are trading flat while currently near the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 41, suggesting the commodity might experience technical correction and trade higher since the RSI rebounded sharply from oversold territory.

Resistance level: 83.25, 87.25

Support level: 79.00, 76.90

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.