-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

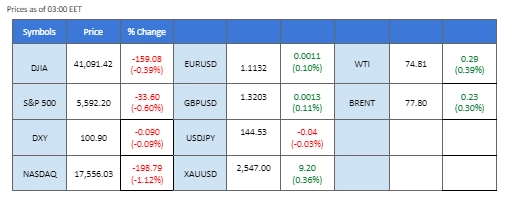

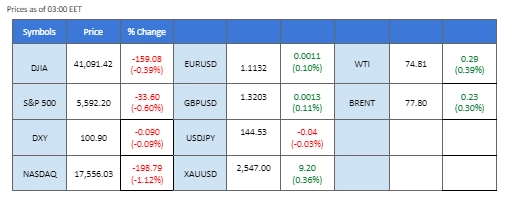

Market Summary

Nvidia’s highly anticipated earnings report was released yesterday, but despite the numbers beating market consensus, the performance lacked a “wow” factor for investors. As a result, the market seemed to have already priced in the earnings, leading to a decline in all three major indexes on Wall Street. Despite yesterday’s technical correction, Nvidia’s strong earnings suggest that the tech industry remains robust, with ongoing demand for Nvidia’s chips potentially driving future gains in the indexes.

In the forex market, ahead of today’s U.S. GDP release, the Atlanta Fed Chief indicated that the U.S. central bank might need more data to confirm a potential rate cut next month. This relatively hawkish comment provided some support for the dollar, though it remains below the $101 mark.

In the commodity market, both gold and oil traded steadily with minimal price changes as traders await today’s GDP data and tomorrow’s U.S. PCE report, both of which could significantly impact the prices of these commodities.

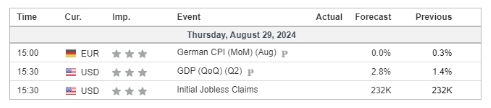

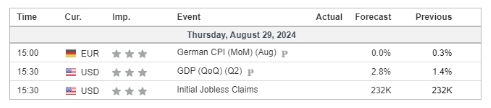

Current rate hike bets on 18th September Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (32.5%) VS -25 bps (67.5%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index, which tracks the greenback against a basket of six major currencies, rebounded slightly after recent declines pushed it to its lowest level in over a year. A strong support level helped to limit the losses, but the overall trend for the dollar remains uncertain. Investors are awaiting crucial US economic data before making any significant moves. Key reports due later this week include a preliminary estimate for US gross domestic product (GDP) in the second quarter and the core personal consumption expenditures (PCE) index, the Federal Reserve’s preferred inflation gauge. If these numbers come in weaker than expected, the dollar could face renewed pressure.

The Dollar Index is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 34, suggesting the index might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 102.35, 103.35

Support level: 100.55, 99.70

Gold prices remained flat as market participants awaited several key US economic reports before taking new positions. Gold initially dipped yesterday due to the dollar’s rebound driven by technical correction, but it quickly recovered after testing a strong support level. Investors are shifting their portfolios towards safe-haven assets like gold as they wait for more clarity from upcoming economic data. With expectations that US inflation may be stabilizing and ongoing geopolitical tensions in the Middle East, the appeal for gold remains strong.

Gold prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 54, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 2525.00, 2540.00

Support level: 2515.00, 2480.00

The GBP/USD pair eased in yesterday’s session after reaching its recent high of 1.2360. Comments from the Atlanta Fed Chief indicated that more data is required to confirm a potential rate cut next month, which conveyed a hawkish stance to the market. This bolstered the dollar’s strength, causing a pullback in the pair. Traders should keep an eye on today’s U.S. GDP data, as it could have a direct impact on the pair’s price movement.

GBP/USD seems to be easing from its bullish strength. The RSI dropped out of the overbought zone, and the MACD had a deadly cross above. Should the pair fail to defend the above gap at 1.3270, it will be a bearish signal for the pair.

Resistance level: 1.3280, 1.3350

Support level: 1.3140, 1.3065

The EUR/USD pair has formed a lower-high price pattern following a weeks-long uptrend, suggesting a potential trend reversal. Hawkish statements from Fed officials have strengthened the dollar, pushing the pair down to its critical support level near 1.1120. All eyes will be on tomorrow’s inflation data, which is crucial for both currencies and is expected to increase the pair’s volatility upon its release.

The pair seems to be easing from its bullish momentum after the MACD formed a bearish divergence in the earlier session. Should the pair break through the critical support level at 1.1105, this may also serve as a solid bearish signal for the pair.

Resistance level: 1.1170, 1.1230

Support level: 1.1105, 1.1045

The NZD/USD has been on an uptrend after rebounding from the fair value gap, indicating strong bullish momentum for the pair. Despite a stronger dollar fueled by hawkish comments from a Fed official yesterday, the Kiwi has managed to hold its ground and trade at its highest level in 2024.

The pair continues to trade within the uptrend channel and has rebounded from the fair value gap, suggesting a bullish signal for the pair. The RSI has been hovering close to the overbought zone, while the MACD remains at the elevated level, suggesting the bullish momentum remains intact with the pair.

Resistance level: 0.6300, 0.6365

Support level: 0.6235, 0.6160

The USD/JPY remains within its downtrend channel, despite a recent period of low volatility. Both regions’ inflation data are due tomorrow, which is expected to increase volatility for the pair, with Tokyo CPI set to be released during the Tokyo session and U.S. PCE during the New York session. If Japan’s inflation gauge surpasses market expectations, it could strengthen the Japanese Yen, potentially continuing the pair’s downtrend.

The pair has been trading in a downtrend trajectory, and the momentum indicators suggest that it remains trading with bearish momentum. The RSI has been flowing below the 50 level, while the MACD has been hovering below the zero line.

Resistance level: 146.00, 149.20

Support level: 143.45, 141.40

The US equity market saw a downturn, led by a sharp decline in Nvidia Corporation’s stock, which fell over 5% in after-hours trading despite the company reporting better-than-expected Q2 results and announcing a $50 billion stock buyback program. While Nvidia’s quarterly performance exceeded Wall Street’s expectations, concerns linger about whether the recent surge in the stock price aligns with earnings growth. The initial drop in Nvidia’s stock may be a short-term reaction, and investors are likely to monitor its performance closely to gauge market sentiment in the long term.

Nasdaq is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 49, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 20015.00, 20705.00

Support level: 19035.00, 17865.00

Crude oil prices continued to decline following a smaller-than-expected drop in US crude oil inventories. The Energy Information Administration (EIA) reported that US crude inventories fell by 0.846 million barrels, far less than the market’s expectation of a 2.7-million-barrel decline. However, losses were tempered by concerns over potential supply disruptions from Libya, an OPEC member. Several oil fields in Libya have halted production amid a conflict for control of the country’s central bank, with some estimates suggesting output disruptions of between 900,000 and 1 million barrels per day (bpd) for several weeks.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 45, suggesting the commodity might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 77.45, 80.90

Support level: 71.80, 67.50

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Market Summary

Nvidia’s highly anticipated earnings report was released yesterday, but despite the numbers beating market consensus, the performance lacked a “wow” factor for investors. As a result, the market seemed to have already priced in the earnings, leading to a decline in all three major indexes on Wall Street. Despite yesterday’s technical correction, Nvidia’s strong earnings suggest that the tech industry remains robust, with ongoing demand for Nvidia’s chips potentially driving future gains in the indexes.

In the forex market, ahead of today’s U.S. GDP release, the Atlanta Fed Chief indicated that the U.S. central bank might need more data to confirm a potential rate cut next month. This relatively hawkish comment provided some support for the dollar, though it remains below the $101 mark.

In the commodity market, both gold and oil traded steadily with minimal price changes as traders await today’s GDP data and tomorrow’s U.S. PCE report, both of which could significantly impact the prices of these commodities.

Current rate hike bets on 18th September Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (32.5%) VS -25 bps (67.5%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index, which tracks the greenback against a basket of six major currencies, rebounded slightly after recent declines pushed it to its lowest level in over a year. A strong support level helped to limit the losses, but the overall trend for the dollar remains uncertain. Investors are awaiting crucial US economic data before making any significant moves. Key reports due later this week include a preliminary estimate for US gross domestic product (GDP) in the second quarter and the core personal consumption expenditures (PCE) index, the Federal Reserve’s preferred inflation gauge. If these numbers come in weaker than expected, the dollar could face renewed pressure.

The Dollar Index is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 34, suggesting the index might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 102.35, 103.35

Support level: 100.55, 99.70

Gold prices remained flat as market participants awaited several key US economic reports before taking new positions. Gold initially dipped yesterday due to the dollar’s rebound driven by technical correction, but it quickly recovered after testing a strong support level. Investors are shifting their portfolios towards safe-haven assets like gold as they wait for more clarity from upcoming economic data. With expectations that US inflation may be stabilizing and ongoing geopolitical tensions in the Middle East, the appeal for gold remains strong.

Gold prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 54, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 2525.00, 2540.00

Support level: 2515.00, 2480.00

The GBP/USD pair eased in yesterday’s session after reaching its recent high of 1.2360. Comments from the Atlanta Fed Chief indicated that more data is required to confirm a potential rate cut next month, which conveyed a hawkish stance to the market. This bolstered the dollar’s strength, causing a pullback in the pair. Traders should keep an eye on today’s U.S. GDP data, as it could have a direct impact on the pair’s price movement.

GBP/USD seems to be easing from its bullish strength. The RSI dropped out of the overbought zone, and the MACD had a deadly cross above. Should the pair fail to defend the above gap at 1.3270, it will be a bearish signal for the pair.

Resistance level: 1.3280, 1.3350

Support level: 1.3140, 1.3065

The EUR/USD pair has formed a lower-high price pattern following a weeks-long uptrend, suggesting a potential trend reversal. Hawkish statements from Fed officials have strengthened the dollar, pushing the pair down to its critical support level near 1.1120. All eyes will be on tomorrow’s inflation data, which is crucial for both currencies and is expected to increase the pair’s volatility upon its release.

The pair seems to be easing from its bullish momentum after the MACD formed a bearish divergence in the earlier session. Should the pair break through the critical support level at 1.1105, this may also serve as a solid bearish signal for the pair.

Resistance level: 1.1170, 1.1230

Support level: 1.1105, 1.1045

The NZD/USD has been on an uptrend after rebounding from the fair value gap, indicating strong bullish momentum for the pair. Despite a stronger dollar fueled by hawkish comments from a Fed official yesterday, the Kiwi has managed to hold its ground and trade at its highest level in 2024.

The pair continues to trade within the uptrend channel and has rebounded from the fair value gap, suggesting a bullish signal for the pair. The RSI has been hovering close to the overbought zone, while the MACD remains at the elevated level, suggesting the bullish momentum remains intact with the pair.

Resistance level: 0.6300, 0.6365

Support level: 0.6235, 0.6160

The USD/JPY remains within its downtrend channel, despite a recent period of low volatility. Both regions’ inflation data are due tomorrow, which is expected to increase volatility for the pair, with Tokyo CPI set to be released during the Tokyo session and U.S. PCE during the New York session. If Japan’s inflation gauge surpasses market expectations, it could strengthen the Japanese Yen, potentially continuing the pair’s downtrend.

The pair has been trading in a downtrend trajectory, and the momentum indicators suggest that it remains trading with bearish momentum. The RSI has been flowing below the 50 level, while the MACD has been hovering below the zero line.

Resistance level: 146.00, 149.20

Support level: 143.45, 141.40

The US equity market saw a downturn, led by a sharp decline in Nvidia Corporation’s stock, which fell over 5% in after-hours trading despite the company reporting better-than-expected Q2 results and announcing a $50 billion stock buyback program. While Nvidia’s quarterly performance exceeded Wall Street’s expectations, concerns linger about whether the recent surge in the stock price aligns with earnings growth. The initial drop in Nvidia’s stock may be a short-term reaction, and investors are likely to monitor its performance closely to gauge market sentiment in the long term.

Nasdaq is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 49, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 20015.00, 20705.00

Support level: 19035.00, 17865.00

Crude oil prices continued to decline following a smaller-than-expected drop in US crude oil inventories. The Energy Information Administration (EIA) reported that US crude inventories fell by 0.846 million barrels, far less than the market’s expectation of a 2.7-million-barrel decline. However, losses were tempered by concerns over potential supply disruptions from Libya, an OPEC member. Several oil fields in Libya have halted production amid a conflict for control of the country’s central bank, with some estimates suggesting output disruptions of between 900,000 and 1 million barrels per day (bpd) for several weeks.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 45, suggesting the commodity might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 77.45, 80.90

Support level: 71.80, 67.50

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.