-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

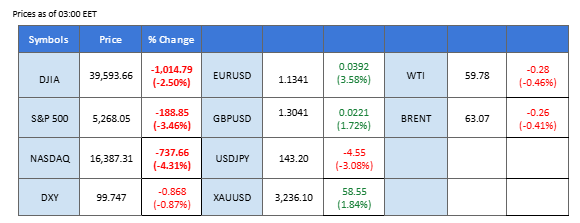

Market Summary

Markets remain under heavy pressure as U.S.-China trade tensions intensify, with both sides continuing to escalate tariff measures. China’s announcement of an 84% tariff on U.S. imports, coupled with reports that Washington is set to raise its tariffs to 125%, has rattled investor sentiment and triggered a broad risk-off move across global financial markets.

As a result, demand for safe-haven assets surged, with gold rallying to a fresh all-time high above the $3,200 mark. Meanwhile, safe-haven currencies like the Japanese Yen and Swiss Franc climbed to new highs, reflecting mounting concerns over the trajectory of global trade and economic growth.

Risk assets were sharply lower, led by equities—the Dow Jones Industrial Average plunged over 1,000 points, as investors fled risk amid rising geopolitical and economic uncertainty. The U.S. dollar also came under pressure, after the Trump administration announced a 90-day tariff pause for countries that have not retaliated against the U.S.—a move viewed by markets as inconsistent and damaging to investor confidence.

The Dollar Index slumped to its lowest level since July 2023, signaling broad skepticism toward the administration’s trade strategy and its potential impact on U.S. economic stability. With both Washington and Beijing showing little sign of softening their stances, the market is likely to remain on edge, with safe-haven demand expected to stay elevated in the near term.

Current rate hike bets on 7th May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (85%) VS -25 bps (15%)

Market Overview

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

The Dollar Index fell sharply, breaking below the 100 mark for the first time since July 2023, as mounting trade tensions and disappointing U.S. economic data pressured the greenback. Uncertainty over President Trump’s tariff escalation plans and their potential economic impact weighed on investor sentiment. The dollar’s selloff accelerated following a weaker-than-expected U.S. CPI report, which further eroded confidence in the economic outlook.

The Dollar Index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 30, suggesting the index might enter oversold territory.

Resistance level: 102.95, 106.80

Support level: 100.15, 95.85

Gold prices rebounded strongly, driven by the weaker dollar and rising concerns over global growth prospects. The combination of worsening inflation and heightened U.S.-China trade war fears fueled renewed safe-haven demand. Additionally, increasing speculation over potential Federal Reserve rate cuts boosted gold’s appeal as a hedge against both inflationary and geopolitical risks.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 72, suggesting the commodity might enter overbought territory.

Resistance level: 3225.00, 3295.00

Support level: 3170.00, 3130.00

The GBP/USD pair saw choppy price action in the recent session, largely driven by shifting sentiment around the U.S. dollar. The greenback initially rebounded on technical grounds and was briefly supported by rumors of a potential 90-day tariff pause from the Trump administration—moves that momentarily eased global trade fears. However, the dollar later reversed gains and sank to fresh lows following a softer-than-expected U.S. CPI reading, which reignited concerns over the health of the U.S. economy. Looking ahead, UK GDP data is expected to take centre stage today. A stronger-than-expected print could offer a lift to the Pound, potentially fueling further upside for the GBP/USD pair.

The GBP/USD pair has gained for the past four sessions from its recent low level, suggesting a bullish bias for the pair. The RSI is heading toward the overbought zone, while the MACD is about to cross above the zero line, suggesting that bullish momentum is forming.

Resistance level: 1.3085, 1.3180

Support level: 1.2945, 1.2875

The Australian dollar reversed its downward trajectory and posted gains in the recent session, buoyed by its close economic ties with China. As a proxy for Chinese economic sentiment, the Aussie dollar often mirrors shifts in market confidence toward China’s outlook. Recent developments saw Beijing taking a firm stance against U.S. trade tariffs, which was interpreted by the market as a sign of resilience and stability in the Chinese economy. This renewed optimism helped bolster demand for the Australian dollar, lifting it from recent lows.

The AUD/USD pair has broken above its fair-value gap incurred in the previous downtrend, suggesting a solid bullish trend reversal for the pair. The RSI is heading toward the overbought zone, while the MACD is about to get past the zero line, suggesting that bullish momentum may be forming.

Resistance level: 0.6271, 0.6368

Support level: 0.6207, 0.6130

Crude oil dropped over 3% after President Trump unveiled a steep 145% tariff on Chinese imports, reigniting concerns over global demand. The move overshadowed a 90-day tariff pause for other U.S. trade partners and rattled markets, particularly due to China’s role as the world’s largest crude importer. Despite a softer dollar, demand fears dominated, pushing prices lower. Goldman Sachs slashed its 2025 China GDP forecast to 4.0%, citing export weakness and supply chain disruptions.

Crude oil prices are showing signs of consolidation after plunging to multi-month lows, with WTI currently hovering just below the $60 mark. The pair has struggled to reclaim the $61.45 resistance level, suggesting that upside momentum remains limited. The RSI has edged higher but stays below the neutral 50 line, reflecting continued bearish bias. Meanwhile, the MACD is still in negative territory, though the histogram is narrowing and the MACD line is inching closer to the signal line—hinting at a possible slowdown in downside momentum.

Resistance level: 61.45, 66.65

Support level: 53.50, 48.45

The Japanese yen strengthened significantly, with USD/JPY dropping 2.3% to 144.35. The rally followed a hotter-than-expected Japanese producer inflation print for March, reinforcing market expectations of continued monetary tightening by the Bank of Japan. Governor Kazuo Ueda’s reaffirmation of policy normalization further underpinned yen strength, while rising U.S.-China tensions added safe-haven flows to the currency.

USD/JPY is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 33, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 144.15, 147.40

Support level: 140.65, 137.45

The Dow remained under pressure as markets priced in heightened macro uncertainty following a dramatic escalation in the U.S.-China trade tensions. The White House confirmed a sweeping 145% tariff on Chinese imports, triggering an 84% retaliatory move from Beijing targeting key U.S. sectors. Tech and consumer discretionary stocks led losses, with Apple and Nvidia sliding over 4%, while Nike plunged 8.3% amid global demand concerns. Looking ahead,any sign of tariff-related margin pressure could exacerbate bearish sentiment.

The Dow Jones retreated after testing the critical resistance level of 39,975.00. While equities remain fragile, the short-term recovery suggests dip-buying interest remains intact. However, RSI has climbed to 45, recovering from oversold territory, hinting at improving momentum. MACD has also started to converge, with a bullish crossover on the horizon, suggesting the index might experience technical correction.

Resistance level: 39,975.00, 41,792.00

Support level: 38,742.00, 37,705.00

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

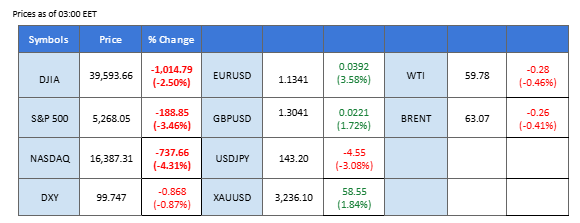

Market Summary

Markets remain under heavy pressure as U.S.-China trade tensions intensify, with both sides continuing to escalate tariff measures. China’s announcement of an 84% tariff on U.S. imports, coupled with reports that Washington is set to raise its tariffs to 125%, has rattled investor sentiment and triggered a broad risk-off move across global financial markets.

As a result, demand for safe-haven assets surged, with gold rallying to a fresh all-time high above the $3,200 mark. Meanwhile, safe-haven currencies like the Japanese Yen and Swiss Franc climbed to new highs, reflecting mounting concerns over the trajectory of global trade and economic growth.

Risk assets were sharply lower, led by equities—the Dow Jones Industrial Average plunged over 1,000 points, as investors fled risk amid rising geopolitical and economic uncertainty. The U.S. dollar also came under pressure, after the Trump administration announced a 90-day tariff pause for countries that have not retaliated against the U.S.—a move viewed by markets as inconsistent and damaging to investor confidence.

The Dollar Index slumped to its lowest level since July 2023, signaling broad skepticism toward the administration’s trade strategy and its potential impact on U.S. economic stability. With both Washington and Beijing showing little sign of softening their stances, the market is likely to remain on edge, with safe-haven demand expected to stay elevated in the near term.

Current rate hike bets on 7th May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (85%) VS -25 bps (15%)

Market Overview

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

The Dollar Index fell sharply, breaking below the 100 mark for the first time since July 2023, as mounting trade tensions and disappointing U.S. economic data pressured the greenback. Uncertainty over President Trump’s tariff escalation plans and their potential economic impact weighed on investor sentiment. The dollar’s selloff accelerated following a weaker-than-expected U.S. CPI report, which further eroded confidence in the economic outlook.

The Dollar Index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 30, suggesting the index might enter oversold territory.

Resistance level: 102.95, 106.80

Support level: 100.15, 95.85

Gold prices rebounded strongly, driven by the weaker dollar and rising concerns over global growth prospects. The combination of worsening inflation and heightened U.S.-China trade war fears fueled renewed safe-haven demand. Additionally, increasing speculation over potential Federal Reserve rate cuts boosted gold’s appeal as a hedge against both inflationary and geopolitical risks.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 72, suggesting the commodity might enter overbought territory.

Resistance level: 3225.00, 3295.00

Support level: 3170.00, 3130.00

The GBP/USD pair saw choppy price action in the recent session, largely driven by shifting sentiment around the U.S. dollar. The greenback initially rebounded on technical grounds and was briefly supported by rumors of a potential 90-day tariff pause from the Trump administration—moves that momentarily eased global trade fears. However, the dollar later reversed gains and sank to fresh lows following a softer-than-expected U.S. CPI reading, which reignited concerns over the health of the U.S. economy. Looking ahead, UK GDP data is expected to take centre stage today. A stronger-than-expected print could offer a lift to the Pound, potentially fueling further upside for the GBP/USD pair.

The GBP/USD pair has gained for the past four sessions from its recent low level, suggesting a bullish bias for the pair. The RSI is heading toward the overbought zone, while the MACD is about to cross above the zero line, suggesting that bullish momentum is forming.

Resistance level: 1.3085, 1.3180

Support level: 1.2945, 1.2875

The Australian dollar reversed its downward trajectory and posted gains in the recent session, buoyed by its close economic ties with China. As a proxy for Chinese economic sentiment, the Aussie dollar often mirrors shifts in market confidence toward China’s outlook. Recent developments saw Beijing taking a firm stance against U.S. trade tariffs, which was interpreted by the market as a sign of resilience and stability in the Chinese economy. This renewed optimism helped bolster demand for the Australian dollar, lifting it from recent lows.

The AUD/USD pair has broken above its fair-value gap incurred in the previous downtrend, suggesting a solid bullish trend reversal for the pair. The RSI is heading toward the overbought zone, while the MACD is about to get past the zero line, suggesting that bullish momentum may be forming.

Resistance level: 0.6271, 0.6368

Support level: 0.6207, 0.6130

Crude oil dropped over 3% after President Trump unveiled a steep 145% tariff on Chinese imports, reigniting concerns over global demand. The move overshadowed a 90-day tariff pause for other U.S. trade partners and rattled markets, particularly due to China’s role as the world’s largest crude importer. Despite a softer dollar, demand fears dominated, pushing prices lower. Goldman Sachs slashed its 2025 China GDP forecast to 4.0%, citing export weakness and supply chain disruptions.

Crude oil prices are showing signs of consolidation after plunging to multi-month lows, with WTI currently hovering just below the $60 mark. The pair has struggled to reclaim the $61.45 resistance level, suggesting that upside momentum remains limited. The RSI has edged higher but stays below the neutral 50 line, reflecting continued bearish bias. Meanwhile, the MACD is still in negative territory, though the histogram is narrowing and the MACD line is inching closer to the signal line—hinting at a possible slowdown in downside momentum.

Resistance level: 61.45, 66.65

Support level: 53.50, 48.45

The Japanese yen strengthened significantly, with USD/JPY dropping 2.3% to 144.35. The rally followed a hotter-than-expected Japanese producer inflation print for March, reinforcing market expectations of continued monetary tightening by the Bank of Japan. Governor Kazuo Ueda’s reaffirmation of policy normalization further underpinned yen strength, while rising U.S.-China tensions added safe-haven flows to the currency.

USD/JPY is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 33, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 144.15, 147.40

Support level: 140.65, 137.45

The Dow remained under pressure as markets priced in heightened macro uncertainty following a dramatic escalation in the U.S.-China trade tensions. The White House confirmed a sweeping 145% tariff on Chinese imports, triggering an 84% retaliatory move from Beijing targeting key U.S. sectors. Tech and consumer discretionary stocks led losses, with Apple and Nvidia sliding over 4%, while Nike plunged 8.3% amid global demand concerns. Looking ahead,any sign of tariff-related margin pressure could exacerbate bearish sentiment.

The Dow Jones retreated after testing the critical resistance level of 39,975.00. While equities remain fragile, the short-term recovery suggests dip-buying interest remains intact. However, RSI has climbed to 45, recovering from oversold territory, hinting at improving momentum. MACD has also started to converge, with a bullish crossover on the horizon, suggesting the index might experience technical correction.

Resistance level: 39,975.00, 41,792.00

Support level: 38,742.00, 37,705.00

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.