-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

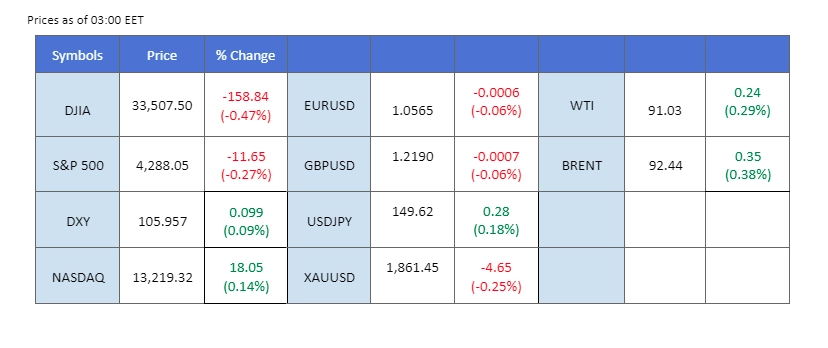

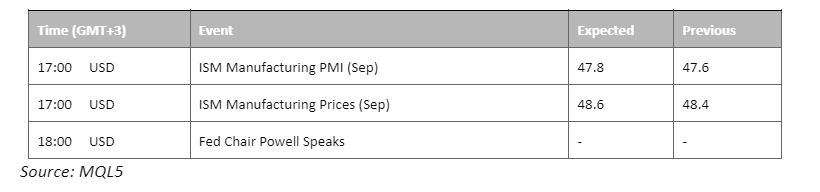

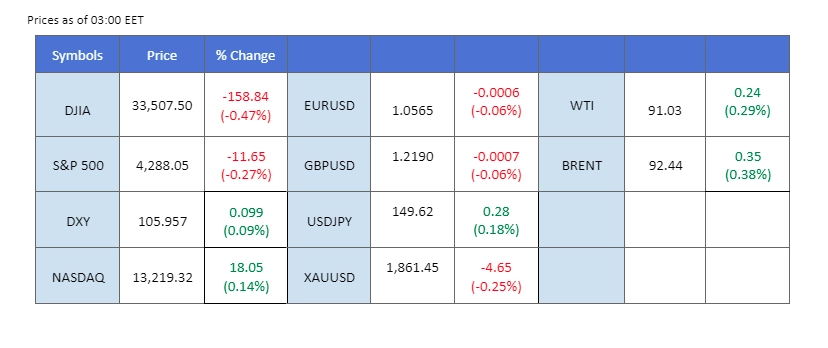

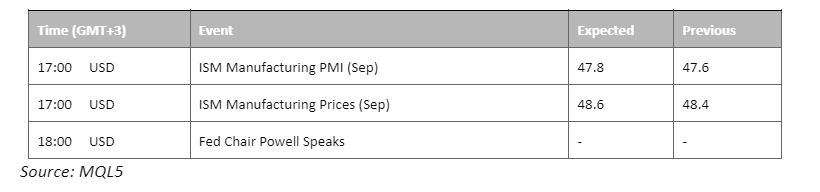

Global equity markets surged on the heels of reassuring news: the threat of a U.S. government shutdown was averted, instilling confidence across the board. Although tempered after breaching the $106 threshold, the dollar index held steady, while U.S. treasuries maintained robust levels. Oil prices, initially dampened by lower-than-expected China PMI readings, found support in the dissipation of U.S. government shutdown fears, boosting market risk appetite. Meanwhile, the Japanese Yen weakened further when the Bank of Japan’s September meeting minutes hinted at a gradual departure from negative interest rates within the country, potentially bolstering the Japanese Yen to trade strongly against its peers.

Current rate hike bets on 1st November Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (78.0%) VS 25 bps (22%)

Despite a lacklustre inflation report, the US Dollar continues its bullish streak, fuelled by rising Treasury yields and persistent rate hike expectations from the Federal Reserve, bolstering demand even in the face of economic challenge. The latest core personal consumption expenditures price index report for August unveiled a meager 0.10% uptick, marking its slowest pace since late 2020 and falling shy of market projections. As anticipation mounts for the forthcoming Nonfarm Payroll and unemployment figures, market watchers hold their breath.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 68, suggesting the index might enter overbought territory.

Resistance level: 106.95, 108.65

Support level: 105.25, 103.15

Gold prices see a sixth consecutive day of decline, driven by a sell-off in US bonds and escalating Treasury yields, putting pressure on USD-denominated gold as investors navigate shifting market dynamics.

Gold prices are trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 24, suggesting the commodity might enter oversold territory.

Resistance level: 1885.00, 1950.00

Support level: 1840.00, 1790.00

The euro regained ground against the sturdy dollar following the resolution of U.S. government shutdown concerns, which eased the dollar’s dominance. However, the euro’s ascent faced obstacles due to the lingering uncertainty surrounding the ECB’s future monetary policies. Economic stability in the region remains precarious despite the CPI reading being significantly below the favoured 2% targeted rate, casting a shadow on the euro’s strength.

Despite the EUR/USD pair has experienced a rebound since last Friday, the pair has yet to get out from its long-term bearish trend. The MACD momentum is eased before it breaks above the zero line while the RSI has also fallen back to near the 50-level, suggesting the bullish momentum has eased.

Resistance level: 1.0617, 1.0705

Support level: 1.0548, 1.04730

The Japanese Yen extended its decline against the resilient dollar, reaching its lowest point in 2023. This decline persisted even after the dissipation of U.S. government shutdown concerns and the subsequent softening of the safe-haven dollar. Notably, the Bank of Japan’s September meeting minutes revealed strategic moves toward phasing out negative interest rates, adding a layer of complexity to the currency market dynamics.

The USD/JPY pair continues to climb and has reached its highest level in 11 months, suggesting the bullish momentum is strong. The MACD remained above the zero line while the RSI continued to flow in the higher region, suggesting the bullish momentum is solid.

Resistance level: 150.75, 151.50

Support level: 149.30, 147.80

China’s manufacturing sector faces setbacks as the Caixin/S&P Global Manufacturing PMI slips to 50.6, below market expectations. This prompts retreats in Chinese proxy-currencies, including the NZD and AUD after the release of disappointing data.

AUD/USD is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 54, suggesting the pair might extend its losses toward support level since the RSI retreated sharply from overbought territory.

Resistance level: 0.6510, 0.6615

Support level: 0.6395, 0.6285

US equities experienced a swift rise following a last-minute agreement by legislators, averting a government shutdown. The Senate’s passing of a continuing resolution, signed into law by President Biden, provides a temporary lifeline, allowing lawmakers a 45-day window to finalise funding legislation.

The Dow is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 34, suggesting the index might enter oversold territory.

Resistance level: 34355.00, 34900.00

Support level: 33490.00, 32745.00

Oil prices dip amid macroeconomic concerns and profit-taking, despite OPEC+ production cuts. Worries about global economic prospects intensify due to below-par Chinese economic data, dampening demand for the commodity. Eyes remain on oil inventories and central banks’ rate hike announcements for market cues.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 60, suggesting the commodity might extend its losses toward support level since the RSI retreated sharply from overbought territory.

Resistance level: 94.40, 101.00

Support level: 87.80, 79.65

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Global equity markets surged on the heels of reassuring news: the threat of a U.S. government shutdown was averted, instilling confidence across the board. Although tempered after breaching the $106 threshold, the dollar index held steady, while U.S. treasuries maintained robust levels. Oil prices, initially dampened by lower-than-expected China PMI readings, found support in the dissipation of U.S. government shutdown fears, boosting market risk appetite. Meanwhile, the Japanese Yen weakened further when the Bank of Japan’s September meeting minutes hinted at a gradual departure from negative interest rates within the country, potentially bolstering the Japanese Yen to trade strongly against its peers.

Current rate hike bets on 1st November Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (78.0%) VS 25 bps (22%)

Despite a lacklustre inflation report, the US Dollar continues its bullish streak, fuelled by rising Treasury yields and persistent rate hike expectations from the Federal Reserve, bolstering demand even in the face of economic challenge. The latest core personal consumption expenditures price index report for August unveiled a meager 0.10% uptick, marking its slowest pace since late 2020 and falling shy of market projections. As anticipation mounts for the forthcoming Nonfarm Payroll and unemployment figures, market watchers hold their breath.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 68, suggesting the index might enter overbought territory.

Resistance level: 106.95, 108.65

Support level: 105.25, 103.15

Gold prices see a sixth consecutive day of decline, driven by a sell-off in US bonds and escalating Treasury yields, putting pressure on USD-denominated gold as investors navigate shifting market dynamics.

Gold prices are trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 24, suggesting the commodity might enter oversold territory.

Resistance level: 1885.00, 1950.00

Support level: 1840.00, 1790.00

The euro regained ground against the sturdy dollar following the resolution of U.S. government shutdown concerns, which eased the dollar’s dominance. However, the euro’s ascent faced obstacles due to the lingering uncertainty surrounding the ECB’s future monetary policies. Economic stability in the region remains precarious despite the CPI reading being significantly below the favoured 2% targeted rate, casting a shadow on the euro’s strength.

Despite the EUR/USD pair has experienced a rebound since last Friday, the pair has yet to get out from its long-term bearish trend. The MACD momentum is eased before it breaks above the zero line while the RSI has also fallen back to near the 50-level, suggesting the bullish momentum has eased.

Resistance level: 1.0617, 1.0705

Support level: 1.0548, 1.04730

The Japanese Yen extended its decline against the resilient dollar, reaching its lowest point in 2023. This decline persisted even after the dissipation of U.S. government shutdown concerns and the subsequent softening of the safe-haven dollar. Notably, the Bank of Japan’s September meeting minutes revealed strategic moves toward phasing out negative interest rates, adding a layer of complexity to the currency market dynamics.

The USD/JPY pair continues to climb and has reached its highest level in 11 months, suggesting the bullish momentum is strong. The MACD remained above the zero line while the RSI continued to flow in the higher region, suggesting the bullish momentum is solid.

Resistance level: 150.75, 151.50

Support level: 149.30, 147.80

China’s manufacturing sector faces setbacks as the Caixin/S&P Global Manufacturing PMI slips to 50.6, below market expectations. This prompts retreats in Chinese proxy-currencies, including the NZD and AUD after the release of disappointing data.

AUD/USD is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 54, suggesting the pair might extend its losses toward support level since the RSI retreated sharply from overbought territory.

Resistance level: 0.6510, 0.6615

Support level: 0.6395, 0.6285

US equities experienced a swift rise following a last-minute agreement by legislators, averting a government shutdown. The Senate’s passing of a continuing resolution, signed into law by President Biden, provides a temporary lifeline, allowing lawmakers a 45-day window to finalise funding legislation.

The Dow is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 34, suggesting the index might enter oversold territory.

Resistance level: 34355.00, 34900.00

Support level: 33490.00, 32745.00

Oil prices dip amid macroeconomic concerns and profit-taking, despite OPEC+ production cuts. Worries about global economic prospects intensify due to below-par Chinese economic data, dampening demand for the commodity. Eyes remain on oil inventories and central banks’ rate hike announcements for market cues.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 60, suggesting the commodity might extend its losses toward support level since the RSI retreated sharply from overbought territory.

Resistance level: 94.40, 101.00

Support level: 87.80, 79.65

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.