-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

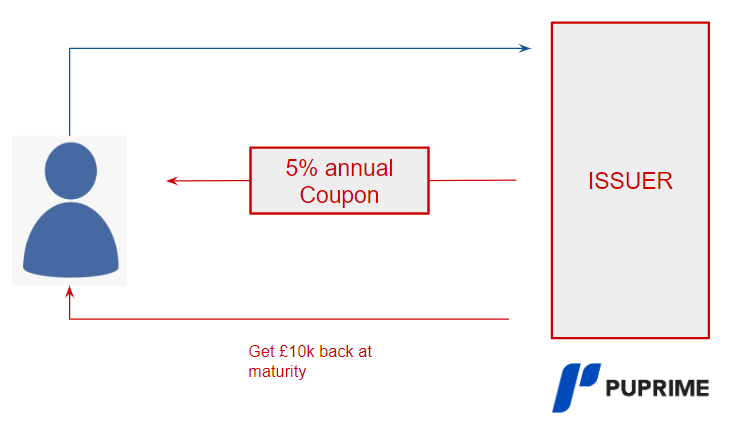

Bonds refer to a type of loan in which a bondholder lends money to a company or government. The borrower pays interest periodically until a specified date in the future when repaying the original loan amount.

The final amount that the bond issuer repays to the bondholder is called the ‘principal’ and the interest is a series of payments called the ‘coupon’.

The principal amount is also called the face value or par value of the bond. Coupons are paid at specified intervals (e.g. semi-annually, sometimes annually or monthly) and are a percentage of the principal balance. The coupon amount is usually fixed, but like index-linked bonds, it can fluctuate as the bonds adjust its payouts in response to index movements such as inflation.

Because bonds are generally tradable securities, they can be bought and sold on the secondary market like stocks, although there are significant differences between the two. Some bonds are listed on exchanges such as the London Stock Exchange (LSE), but they are primarily traded over-the-counter (OTC) through institutional broker-dealers.

Like stocks, prices of bonds are subject to market forces of supply and demand. This means that the investor can make a profit if the value of the asset rises, or make a loss if the bond sold falls in value.

There are many types of bonds. In practice, bonds are often defined by the identity of the issuer, such as a government, corporation, municipality, or agency. When it is necessary to raise capital to cover investments and ongoing expenses, issuers can find more favorable interest rates and terms in the bond market than those offered by other financing channels such as banks.

Four Common Types Of Bonds Include:

Government Bonds

Corporate Bonds

Local Bonds

Agency Bonds

Government bonds are issued and backed by the governing authorities of their issuing companies. These sometimes have unique names. In America, government bonds are called Treasuries, in England, they’re called Gilts, and in Germany they are called Bunds.

While all investments involve risk, government bonds from established and stable economies are considered some of the lowest-risk investments one can make.

US Treasury bills (or short-term Treasury bills) are bonds with a maturity of one year or less. US Treasuries (T notes) have maturities ranging from 2 to 10 years. Government bonds (T-Bonds) have a maturity of 30 years.

The majority of government-issued bonds in the US and UK are fixed rate, but some, like the Treasury Inflation Protected Securities (TIPS) in the US and Indexed Gilt Securities in the UK, offer variable coupon payments based on inflation rate.

Learn more about government bonds and how to trade them here.

Corporate bonds are issued by companies to secure investment funds. High-quality bonds are seen by established companies as conservative investments, but they still carry more risk and pay higher interest rates than government bonds.

When you buy corporate bonds, you become a creditor and enjoy greater loss protection than shareholders. This means that if the company goes into liquidation, the bondholders will be compensated before the shareholders. Corporate bonds are rated by rating agencies such as Standard & Poor’s, Moody’s and Fitch Ratings. Because lower ratings means that investors are undertaking more risk, the coupon payment for lower-rated bonds are usually higher.

Municipal bonds, or “munis,” are used by local government agencies (parliaments, municipalities, cities, counties, etc.) to fund local infrastructure projects.

Like government bonds, they are considered low-risk investments and have relatively low interest rates. In the United States, municipal bonds may be exempt from certain taxes at both the local and state levels.

A predominantly U.S. phenomenon, agency bonds are securities issued by government-sponsored enterprises (GSEs) or government agencies other than the Treasury Department. Federal agency bonds are backed by the US government, but GSE bonds are not. Notable GSE bonds include those of the National Mortgage Association (“Fannie Mae”) and Federal Home Loan Mortgage (“Freddie Mac”).

Bonds are debt instruments. The bondholder lends capital to the issuer, and the issuer repays the loan in the manner stated on the bond. Issuers often make periodic series of fixed-rate payments (coupons). The principal of the loan is finally repaid when the bond reaches maturity or maturity date. However, there are variations to this pattern, such as zero-coupon bonds and index-linked bonds.

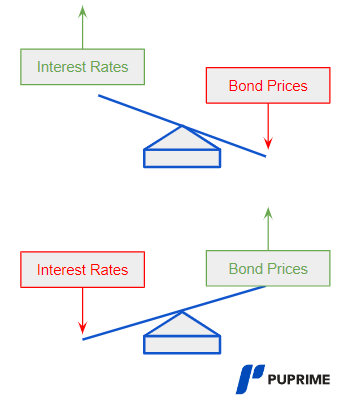

A bond must state both its maturity and duration. While they sound similar, they are different things. A bond’s maturity is the date to which the principal is paid back. Duration, however is a more complicated concept that is used to measure how sensitive to interest rates bonds can be. While there are different ways to measure duration (like the commonly used Macaulay duration), they are all used to measure how a bond’s price will be affected by interest rates. This is because bonds are susceptible to interest rate risks, and the longer the maturity of a bond, the more interest rate risk it takes on. Broadly, the value of bonds is inverse to interest rate change, and the longer the maturity, the more sensitive this relationship becomes.

Rating agencies such as Standard & Poor’s, Moody’s and Fitch assess the creditworthiness of bond issuers and provide market participants with valuable insight into bond credit risk. This is important for both issuers and potential buyers.

Buyers need to know whether the issuer is well positioned to make coupons and principal repayments consistently and in a timely manner. Issuers can also use ratings to rate bonds at levels that attract investors.

The lower the credit risk or higher the credit rating of the issuer, the lower the coupon rate can be set and thus the lower the borrowing cost. Conversely, the higher the credit risk of an issuer, the higher the yield needed to attract investors.

Using the Fitch Rating Scale as an example, the lowest risk long-term bonds are rated AAA, while sub-investment grade (or “junk bonds”) bonds start at BB+.

The face value of a bond is the amount of principal that the bondholder is willing to pay, excluding coupons. This is usually paid in a lump sum at maturity of the bond and remains constant for the life of the bond. However, this is not always the case. For example, certain index-linked bonds, such as Treasury Inflation-Protected Securities (TIPS), adjust their face value for inflation.

In theory, the issue price should be the par value for different bonds, except for zero-coupon bonds. This is because the full amount of the loan paid to the issuer when the bond is purchased equals the face value. However, after issuance, the price of a bond in the secondary market can fluctuate significantly due to various factors.

Zero-coupon bonds make no coupon payments, so the issue price is lower than the bond’s face value, and the difference between the issue price and the face value is calculated as the interest.

A bond’s coupon rate is the ratio of the bond’s coupon payment to its face value, expressed as a percentage. For example, if a bond has a face value of $1000 and pays a coupon of $50 per year, its coupon rate is 5% per year. Traditionally, coupon rates are calculated on an annual basis, so paying $25 twice in a year returns a coupon rate of 5%.

A bond’s coupon rate should be distinguished from its current yield and yield to maturity.

The current yield is the current market price of the bonds compounded with annual coupon payments.

The yield to maturity is a more abstract concept, representing the estimated annual return of a bond that is held until maturity, including reinvesting coupon payments at the same rate.

The coupon date is the date on which the bond issuer must pay the coupon. These are stated on the bond and can be paid out annually, semi-annually, quarterly or monthly. Bond prices can be quoted as ex-coupon or cum-coupon. These refer to bonds sold on the secondary market, where ex-coupon excludes the current coupon payment, while cum-coupon includes the current payment.

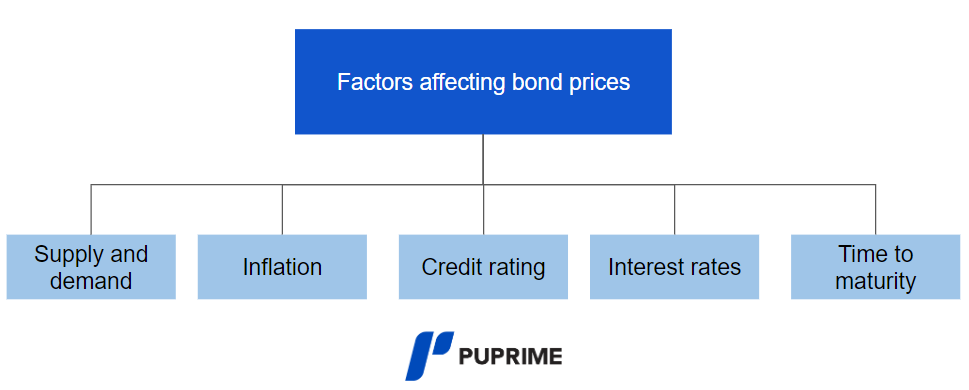

Like all tradable assets, bond prices are subject to supply and demand forces. The scope of the bond depends on the issuing organization and its funding requirements. Demand is determined by the attractiveness of bonds as an investment compared to alternative options. Interest rates play an important role in determining supply and demand. The relationship between interest rates and bond prices is discussed in more detail below.

High inflation is usually bad news for bondholders. This could be attributed to his two factors:

Fixed coupon payments on bonds lose value to investors when money loses purchasing power

Central banks often react to high inflation by raising interest rates. As prevailing rates rise against fixed coupon rates, the opportunity cost of holding bonds increases for investors. Therefore, interest rates and bond prices are inversely related.

Newly issued bonds are always valued using current interest rates. That is, they are usually traded at or near par. As a bond reaches maturity, its yield to maturity and coupon rate converges as interest risk decreases. Eventually, the bond returns to face value as the number of coupon payments reach zero.

Bonds are often considered a conservative investment vehicle, but they can still default. Higher risk bonds typically trade at lower prices than lower risk bonds with similar interest rates. As noted above, the primary method of assessing the default risk of bond issuers is by rating them from the three major rating agencies: Standard & Poor’s, Moody’s, and Fitch.

Interest rates have a significant impact on both the demand and supply of bonds. If the interest rate is lower than the bond’s coupon rate, demand for that bond increases as it is a better investment. On the other hand, if interest rates exceed bond coupons, demand will decrease.

Similarly, if interest rates are too high to make borrowing an affordable source of funding, bond issuers may limit its supply. As a rule of thumb, interest rates and bond prices are inversely related, and when one goes up, the other goes down. When deciding how to trade bonds, it’s important to understand how interest rates affect your overall strategy.

Because the Federal Reserve is the monetary authority of the world’s largest economy, policy decisions made by the Federal Reserve have global implications. For example, when the Fed cuts interest rates, the market for 10-year Treasury notes (T-notes) becomes very large, making T-notes issued at coupon rates higher than the prevailing rate attractive to investors.

Institutional investors, such as pension funds, mutual funds, ETFs, investment banks, and trusts, who hold large amounts of T-notes, see their assets grow in value as T-note and other bond prices rise.

Gilts are bonds issued by the UK treasury. They are denoted in pound sterling, and come in a variety of maturities.

These do not take coupon payments. Instead, interest on a bond is the difference between the bond’s price – usually issued at a discount – and its principal (or face value). For example, if an investor buys a bond for $950 and at a maturity of 2 years he receives $1000 at face value, this means that the accrued coupon is $50 over 2 years, which comes to a roughly 2.6% of annual interest.

These change coupon payments as the inflation rate fluctuates. In the US, these are Treasury Inflation Protection Securities (TIPS), which adjusts its coupon based on the US Consumer Price Index. In the UK, these are known as Index-Linked Gilts.

Credit risk is the risk that a bond issuer will fail to repay the full amount of the coupon or principal on time. In the worst case, the debtor may default completely. Rating agencies assess creditworthiness and classify issuers accordingly.

Interest rate risk is the potential for a bond’s value to decline due to rising interest rates. This is because high interest rates affect the opportunity cost of holding bonds.

Inflation risk refers to the possibility that a bond’s value will decline due to rising inflation. If inflation exceeds the bond’s coupon, the investment loses real money. Index-linked bonds can help mitigate this risk.

Liquidity risk is the possibility that there are not enough buyers in the market to quickly buy your bonds at current prices. If you want to sell quickly, you may need to lower your price.

Currency risk only arises when you purchase bonds that pay in a currency other than the reference currency. In that case, exchange rate fluctuations may reduce the value of your investment.

Call risk arises when the issuer of a callable or redeemable bond has the right, but not obligation, to redeem the par value of the bond before its official maturity date. Failure to pay remaining coupons may result in the loss of fixed income securities or a reduction in the investment’s yield to maturity. Issuers usually compensate for this by offering callable bonds with attractive interest rates.

Bonds are debt securities that are issued by companies, municipalities, and governments to raise capital. When you buy a bond, you are essentially lending money to the issuer, who promises to pay you back the face value of the bond plus interest at a specified rate and schedule. The interest rate on a bond is called the coupon rate, and the schedule of interest payments is called the coupon schedule. Bonds generally have a fixed maturity date, at which point the issuer will return the face value of the bond to the bondholder. The value of a bond can fluctuate based on interest rates and the creditworthiness of the issuer.

Bonds can be a good investment as they offer a fixed income and can provide diversification in a portfolio. However, the suitability of bonds as an investment will depend on an individual’s financial goals, risk tolerance, and overall investment portfolio.

It is difficult to identify the top 5 bonds as the best bond investments will vary depending on an individual’s financial goals, risk tolerance, and investment horizon. However, some bonds that are considered to be among the safest and most widely held by investors include:

1. Sovereign bonds of major economies like U.S. Treasuries

2. High-Grade Corporate Bonds

3. Municipal or agency bonds backed by the U.S. government

Bonds, while considered to be relatively safe investments, are not completely guaranteed. The safety and return of a bond investment depend on the creditworthiness and financial stability of the issuer, such as the U.S. government or a corporation.

When it comes to bonds, the riskiest type of bond is often considered to be high-yield or “junk” bonds. These bonds are issued by companies with lower credit ratings and offer higher interest rates to compensate for the additional risk. These bonds are considered riskier than other types of bonds like Treasury or municipal bonds, as they are issued by companies that are seen as having a higher likelihood of defaulting on their debt. Additionally, the prices of high-yield bonds are more sensitive to changes in interest rates and economic conditions.

When it comes to investing in bonds, the safest option is often considered to be U.S. Treasury bonds. These bonds are issued by the U.S. government and are considered to be among the most secure investments due to their backing by the full faith and credit of the U.S. government. Treasury bonds are available in a variety of maturities, from a few months to 30 years, making them suitable for investors with a range of investment horizons.

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!