-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

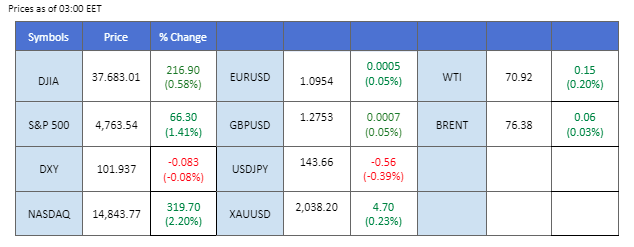

In anticipation of the upcoming U.S. CPI release on Thursday, the dollar retreated from its consolidation range. The reassurance from Fed officials that the targeted inflation rate of 2% may soon be achieved provided a dovish perspective in the market. U.S. equity markets rekindled their bullish momentum last night following a dovish stance from the Fed officials. This sentiment carried over to the Asian markets, leading to a higher opening today. Gold prices experienced a revival from their bearish trend, but oil prices continued to face strong downward pressure. Short contracts are gaining in the oil market due to a dampening outlook for oil demand. Additionally, Bitcoin traded at its recent high, reaching the $47,000 level, ahead of the SEC’s decision on the Spot BTC ETF.

Current rate hike bets on 31 January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

N/A

The US Dollar faced a pullback as Federal Reserve Bank of Atlanta President Raphael Bostic expressed a cautious stance on inflation, emphasising the need for continued monitoring. The mixed economic signals add uncertainty, prompting investors to focus on upcoming inflation data for clearer insights into the economic outlook.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 48, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 102.60, 103.45

Support level: 101.75, 101.30

Gold prices rebounded, driven by the depreciation of the US Dollar, making the dollar-denominated precious metal more attractive to global investors. Anticipation of potential interest rate cuts not only from the Federal Reserve but also major central banks like the ECB and BoE added to gold’s appeal as a non-yielding asset.

Gold prices are trading higher while currently near the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 53, suggesting the commodity might extend its gains after it successfully breakout above the resistance level since the RSI stays above the midline. .

Resistance level: 2035.00, 2050.00

Support level: 2030.00, 2020.00

The GBP/USD pair exhibited an upward movement, surpassing its nearby resistance level, signalling a potential bullish bias for the pair. The ascent occurred as several Fed officials conveyed relatively dovish statements, expressing confidence in the central bank’s efforts to mitigate inflation in the U.S. and anticipating the achievement of the targeted inflation rate. The dollar’s strength waned in response to the dovish stance emanating from the Fed, propelling the GBP/USD pair higher.

The GBP/USD pair gained and surpassed its near-resistance level, suggesting a bullish bias for the pair. The RSI continues to gain while the MACD moves upward after breaking above the zero line, suggesting the bullish momentum is gaining.

Resistance level: 1.2815, 1.2906

Support level: 1.2729, 1.2528

The EUR/USD pair displayed stability, trading sideways in proximity to its pivotal level around 1.0954. Despite the dollar softening in strength last night following dovish statements from several Fed officials, the Euro struggled to capitalise on the weaker dollar. Recent Eurozone CPI data indicated a mitigated inflationary risk in the region. Market participants are now anticipating the U.S. CPI report scheduled for release on the upcoming Tuesday to gauge potential movements in the pair.

The EUR/USD has been traded sideways, giving a neutral signal for the pair. The RSI has been moving upward while the MACD is on the brink of breaking above the zero line, suggesting the bullish momentum is forming.

Resistance level: 1.1041, 1.1138

Support level: 1.0866, 1.0775

The Japanese Yen showcased strength as the USD/JPY pair experienced a downward trend, reflecting a decrease in the dollar’s strength. This decline in the dollar’s vigour was primarily attributed to dovish statements made by Fed officials. Despite the Tokyo Core CPI reading meeting market expectations at 2.1%, a slight decline from the previous figure, it failed to provide substantial support for the Yen’s strength.

After its bullish run, the USD/JPY pair had a technical retracement since breaking above its long-term downtrend resistance level. The RSI has declined from the overbought zone while the MACD has crossed and moved toward the zero line from above, suggesting that bearish momentum is forming.

Resistance level: 145.35, 146.88

Support level: 141.64, 138.87

The US equity market saw gains in early 2024, propelled by a strong tech rally that boosted investor confidence. Despite a dip in US Treasury yields, Nasdaq outperformed, led by Nvidia Corp surge after announcing new artificial intelligence products. Boeing’s challenges, with its 737 Max 9 model temporarily grounded, posed a drag on overall market performance.

The Dow is trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 62, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 37850.00, 39275.00

Support level: 36735.00, 35950.00

Crude oil prices took a hit as Saudi Arabia decided to cut oil selling prices, aligning with a pessimistic demand outlook. Despite OPEC’s efforts, rising oil output in December, particularly from Angola, Iraq, and Nigeria, offset cuts by Saudi Arabia. Diplomatic talks led by US Secretary of State Antony Blinken aimed at resolving conflicts in the Middle East contributed to easing concerns of supply disruptions.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 43, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 72.70, 78.65

Support level: 67.40, 63.70

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!