-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

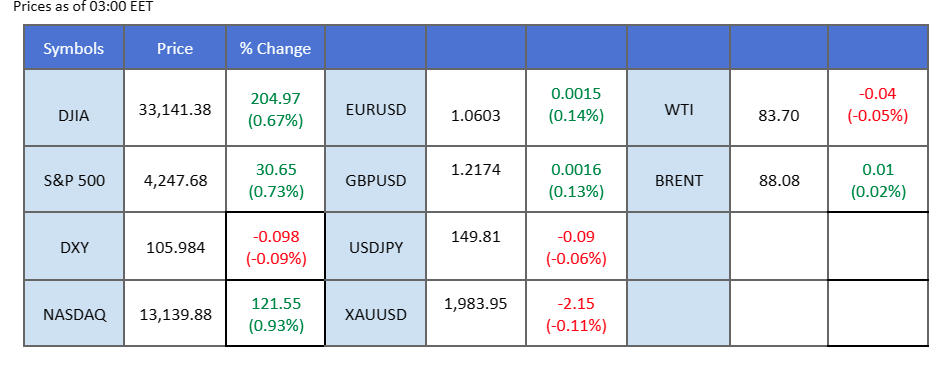

Amidst improving conditions in the Middle East conflict, international leaders and the United Nations advocate for Humanitarian Pauses to facilitate essential aid access for civilians. Gold prices remained stable, but oil prices faced a downturn due to disappointing European PMI readings. In contrast, favourable U.S. PMI data, coupled with better-than-expected Eurozone economic figures, led to the dollar rebounding above the $106 level. Additionally, the Australian dollar strengthened against the strong U.S. dollar following higher-than-expected CPI data from Australia, fueling market expectations of an upcoming rate hike by the Reserve Bank of Australia (RBA).

Current rate hike bets on 1st November Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (88.0%) VS 25 bps (12%)

The US Dollar strengthened as positive economic data emerged, fostering optimism for the US economy. Markit’s report showed the US Services Purchasing Managers Index (PMI) rising from 50.1 to 50.9, surpassing the market’s expectations of 49.8. Additionally, the S&P Global Composite PMI climbed to 51 from 50.2 in September, signifying continued expansion in the private sector in early October.

The Dollar Index is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 55, suggesting the index might extend its gains toward resistance level since the RSI stays above the midline.

Resistance level: 106.60, 107.15

Support level: 105.55, 104.80

Gold prices remained relatively stable, with the strengthening US Dollar slightly dampening gains. However, uncertainties persist, prompting investors to closely monitor forthcoming economic data, particularly the inflation data from the PCE report, for further insights. Simultaneously, geopolitical tensions in the Middle East remain a significant factor that could potentially drive movements in the safe-haven gold market.

Gold prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 69, suggesting the commodity might enter overbought territory.

Resistance level: 1980.00, 2015.00

Support level: 1940.00, 1910.00

The Euro faced significant downward pressure following a series of discouraging economic indicators. Reports from HCOB highlighted below-expectation manufacturing and services PMI data in the Eurozone, suggesting the region may be heading towards a potential recession. These developments are likely to limit the European Central Bank’s ability to extend its current tightening policy cycle..

EUR/USD is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 51, suggesting the pair might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 1.0675, 1.0795

Support level: 1.0580, 1.0450

The British Pound experienced volatility before sharply declining as the US Dollar strengthened significantly. Positive job data in the UK, with lower than expected unemployment rates, briefly supported the Pound. However, the Sterling weakened after disappointing UK PMI data was released. In contrast, strong economic indicators from the United States allowed the Dollar to recover its losses from Monday, further pressuring the Pound.

The Cable plunged by 0.7% but is still trading above its short-term support level at 1.2140. The momentum indicators suggest that the bullish momentum has waned, with the RSI dropping to near 50-level while the MACD is falling back to the zero line.

Resistance level: 1.2220, 1.2300

Support level: 1.2120, 1.2050

Amid robust corporate earnings and optimistic forecasts, the US equity market experienced an upward trajectory, igniting a broad rally. The third-quarter earnings season has bolstered market confidence in corporate performance, with a significant portion of S&P 500 companies expected to report positive results. LSEG’s data indicated that 118 of S&P 500 companies have reported so far, with 81% surpassing analyst expectation.

S&P 500 is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 41, suggesting the index might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 4315.00, 4444.00

Support level: 4200.00, 4060.00

The Australian Dollar exhibited strength against the resilient US Dollar, surpassing its long-term downtrend resistance level. This surge was spurred by higher-than-expected CPI data in Australia, fueling speculation that the Reserve Bank of Australia (RBA) might resume its monetary tightening cycle by raising interest rates in November due to its data-dependent approach. Additionally, China’s introduction of a new fiscal stimulus package, aimed at achieving its GDP target, had a positive effect on the Australian Dollar, often considered a proxy for the Chinese economy.

The AUD/USD pair has broken above the long-term downtrend resistance level, suggesting a trend reversal. The RSI is approaching the overbought zone while the MACD has broken above the zero line, suggesting the bullish momentum is forming.

Resistance level: 0.6390, 0.6510

Support level: 0.6290, 0.6200

The Hang Seng Index surged during the opening session, experiencing a remarkable 5% jump, buoyed by China’s government announcement of extensive measures to bolster its economy. These measures involve issuing additional sovereign debt and increasing the budget deficit ratio, with the objective of fortifying economic recovery and achieving the targeted GDP rate.

The Hang Seng index found support and rebounded above its psychological support level at nearly 17,000. The RSI spiked up sharply from the oversold zone and the MACD has crossed below the zero line, suggesting the bearish momentum has vanished.

Resistance level: 17670, 18350

Support level: 16980, 16300

Oil prices saw a retreat from recent highs as global attention shifted towards leaders’ negotiations aimed at de-escalating tensions between Israel and Hamas. Additionally, bearish sentiment in the oil market was influenced by lacklustre economic reports from the European and UK regions.

Oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 42, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 89.35, 94.00

Support level: 82.50, 78.15

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!