-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

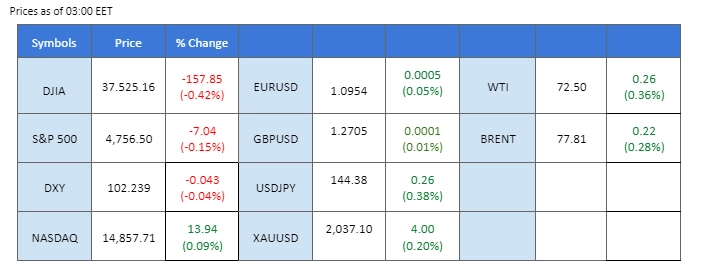

In yesterday’s market, the U.S. Dollar displayed subtle strength, with investors redirecting their attention toward the impending release of critical U.S. inflation data (CPI). As anticipation grows, the prevailing sentiment of a possible early Fed rate cut recedes, bolstering the dollar’s resilience and introducing an element of caution into risk-on assets. Simultaneously, oil prices found relief, recording positive gains following the release of the U.S. API crude oil stockpile data. A notable drawdown in stockpiles provided a welcome boost to oil prices amid a landscape of ongoing global uncertainties. Complicating matters, a security breach compromised the SEC’s official social media account overnight. A misleading thread falsely proclaiming the approval of a BTC ETF circulated, triggering significant volatility in Bitcoin prices.

Current rate hike bets on 31 January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

The Dollar Index remains ensconced near its resistance threshold, as market participants await pivotal inflation data later this week. Thursday’s release of December’s consumer price inflation report emerges as this week’s pivotal data point, with economists projecting a 0.2% monthly increase and a 3.2% annual uptick in headline inflation.

The Dollar Index is trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 57, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 102.60, 103.45

Support level: 101.75, 101.30

Gold prices witnessed a marginal decline, largely attributed to the strengthening U.S. Dollar and ascending Treasury yields. Amidst a dearth of market catalysts, technical corrections and speculative forces predominantly dictated the gold market’s trajectory. Investors are advised to closely monitor the forthcoming U.S. inflation report for potential trading cues, as an adverse inflation reading could bolster rate cut expectations and enhance gold’s allure.

Gold prices are trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 48, suggesting the commodity might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 2035.00, 2050.00

Support level: 2030.00, 2020.00

The GBP/USD pair retraced from recent highs as the U.S. Dollar gained momentum in anticipation of today’s crucial Consumer Price Index (CPI) release. Traders keenly await the CPI data for insights into potential shifts in the Fed’s monetary policy and lead to the dollar’s resilience. Concurrently, attention is on the forthcoming release of the UK’s Gross Domestic Product (GDP) data, which is expected to provide vital insights into the current state of the British economy and its impact on the Sterling.

The GBP/USD pair retrace but remain in a long-term upward trajectory. The RSI hovering near the 50-level while the MACD flowing near to the zero line gives a neutral signal for the pair.

Resistance level: 1.2728, 1.2815

Support level: 1.2631, 1.2528

The EUR/USD pair maintained a stable yet slightly lower trajectory as the U.S. Dollar exhibited marginal strength in anticipation of the pivotal Consumer Price Index (CPI) release later today. Market participants closely monitor the U.S. inflation data for potential impact on the greenback and broader market sentiment. In contrast, the euro struggled to find support as recent economic indicators revealed a less-than-rosy picture. German industrial production figures fell short of expectations, and the eurozone unemployment rate remained at elevated levels, contributing to the euro’s subdued performance.

The EUR/USD traded slightly lower yesterday but has formed a higher-low price pattern, suggesting a bullish bias for the pair. The RSI remains below the 50 level while the MACD flow close to the zero line, giving the pair a neutral signal.

Resistance level: 1.1041, 1.1138

Support level: 1.0866, 1.0775

The Japanese Yen experienced a loss in momentum against the recently strengthened U.S. Dollar. The Tokyo Core Consumer Price Index (CPI) data, coupled with the latest subdued wage growth figures, has fueled speculation that the Bank of Japan (BoJ) may maintain its ultra-loose monetary policy at the moment. This perception has contributed to a softer Yen in the currency markets. Simultaneously, the diminished expectations of an imminent Federal Reserve rate cut have provided additional support for the U.S. Dollar. As market sentiment tilts in favour of the greenback, the USD/JPY pair is witnessing an upward movement.

The USD/JPY pair rebounded near the 143.80 support level, suggesting the pair traded in its uptrend trajectory. The RSI maintained near the overbought zone while the MACD flowing above the zero line suggests the bullish momentum is maintained.

Resistance level: 145.35, 146.88

Support level: 143.82, 141.64

Elevated U.S. Treasury yields exerted downward pressure on U.S. equity indices, as the majority of the 11 major S&P sectors retreated. The energy sector bore the brunt of the decline, plummeting 1.63%, while the technology sector emerged as a lone gainer, albeit marginally, with a 0.25% uptick. CME FedWatch Tool data indicates diminished market expectations for a rate cut, currently standing at 65.7% for a 25 basis point reduction—down from 79% a week prior, primarily influenced by an encouraging jobs report.

The Dow is trading higher while currently testing the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 55, suggesting the index might experience technical correction since the RSI retreated sharply from the overbought territory.

Resistance level: 37850.00, 39275.00

Support level: 36735.00, 35950.00

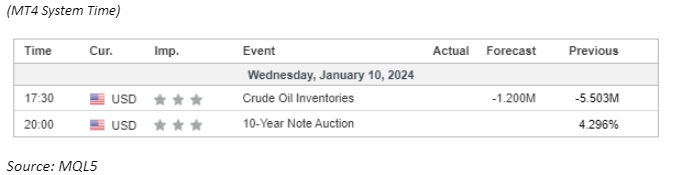

Crude oil prices rebounded, buoyed by escalating Middle East tensions and supply disruptions stemming from the closure of Libya’s 300,000 bpd Sharara oilfield—a frequent locus of political unrest. Additionally, the American Petroleum Institute’s (API) weekly crude inventory data revealed a significant drawdown of 5.215 million barrels, eclipsing market projections of a 1.200 million barrel decline, further bolstering oil prices amidst a complex geopolitical landscape.

Oil prices are trading flat while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 47, suggesting the commodity might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 72.70, 78.65

Support level: 67.40, 63.70

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!