-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

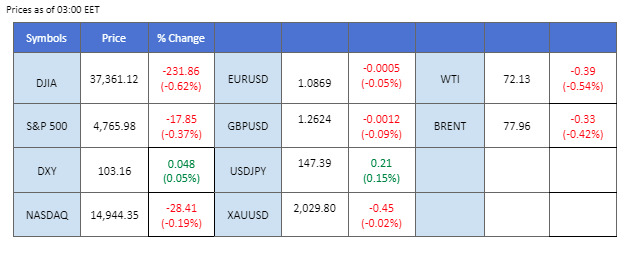

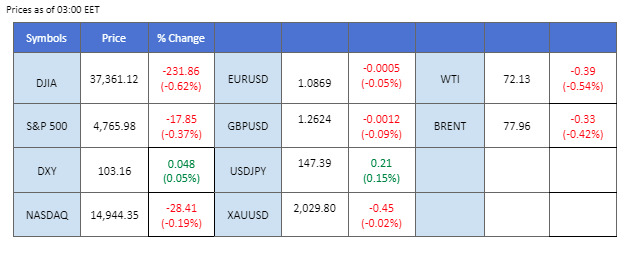

Despite a relatively dovish speech from Fed governor Christopher Waller, the U.S. dollar maintained its upward trajectory, putting pressure on both gold and equity markets. Wall Street faced selling pressure as early bets on Fed rate cuts diminished. Gold prices experienced their most significant daily decline of 1.28% in 2024, primarily attributed to the strengthened dollar. Meanwhile, oil prices edged lower, with market participants awaiting Chinese GDP data. The data fell slightly short of expectations, failing to provide the anticipated boost to oil prices. Traders are closely monitoring upcoming UK and Eurozone CPI readings, anticipating potential impacts on the Sterling and Euro.

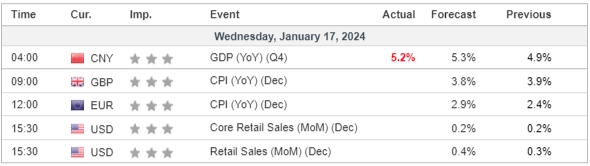

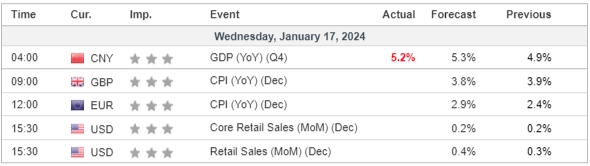

Current rate hike bets on 31 January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

(MT4 System Time)

Source: MQL5

The Dollar Index sees an extension of its upward trajectory, finding support in surging US Treasury yields as expectations for a March rate cut from the Federal Reserve diminish. Christopher Waller’s recent hawkish remarks, emphasizing the proximity to the Fed’s 2% inflation target, prompt market participants to recalibrate their outlook. As Waller cautions against hasty rate cuts in response to improved inflation figures, the US Dollar experiences renewed demand.

The Dollar Index is trading higher following the prior breakout above the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 75, suggesting the index might experience technical correction since the RSI had entered overbought territory.

Resistance level: 103.50, 104.40

Support level: 102.60, 101.90

Despite rising geopolitical tensions in the Middle East sparking a risk-off sentiment, gold prices face headwinds, primarily from the strengthening US Dollar. The hawkish statements from Fed’s Waller, coupled with an uptick in US Treasury yields, contribute to the dollar’s ascent, weighing down on the appeal of dollar-denominated gold. The complex interplay between geopolitical events and currency dynamics underscores the nuanced environment for gold investors.

Gold prices are trading lower following the prior breakout below the support level. MACD has illustrated increasing bearish momentum, while RSI is at 42, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 2035.00, 2055.00

Support level: 2015.00, 1985.00

The Pound Sterling is encountering challenges as the U.S. dollar maintains its momentum, driven by shifting market sentiment. Despite a dovish narrative in the Fed Governor’s recent speech, expectations for an early Fed rate cut continue diminishing, bolstering the dollar’s strength. Traders eagerly await the UK’s CPI reading later today, seeking insights into Sterling’s performance amid the evolving global market dynamics.

GBP/USD declined significantly as the dollar continued to strengthen. The pair is currently supported by its near support level at 1.2631; a break below suggests a strong bearish bias for the pair. The RSI is on the brink of breaking into the oversold zone while the MACD continues to diverge at below zero line, suggesting the bearish momentum is strong.

Resistance level: 1.2729, 1.2815

Support level: 1.2630, 1.2528

The EUR/USD pair faced downward pressure as the U.S. dollar extended its strength, prompted by remarks from Fed Governor Christopher Waller. Waller emphasised the need for caution regarding a rate cut, stating that while possible, it requires careful consideration. This tempered market expectations for an early rate cut in 2024, subsequently boosting the dollar.

The EUR/USD pair is currently supported at near the 1.0866 level while the bearish momentum remains strong. The RSI is on the brink of breaking into the oversold zone, while the MACD has broken below the zero line and started to diverge, suggesting the bearish momentum is strong.

Resistance level: 1.0954, 1.1041

Support level: 1.0866, 1.0775

The USD/JPY pair continues its upward trajectory as the U.S. dollar maintains its robust performance, propelled by positive economic indicators. The Japanese Yen faces challenges amid dovish market expectations for the Bank of Japan (BoJ). Upbeat U.S. economic data has led to reduced expectations of an early Fed rate cut, contrasting with Japan’s struggle to achieve inflation targets. This contributes to speculation that the BoJ may delay its monetary policy shift. Investors are eagerly awaiting the release of U.S. retail sales data later today, which is poised to influence the strength of the dollar.

USD/JPY traded to its one-month high level and has broken multiple resistance levels, suggesting the bullish momentum remains strong. The RSI has broken into the overbought zone while the MACD rebounded from above the zero line, suggesting the bullish momentum has picked up.

Resistance level: 148.77, 151.83

Support level: 145.35, 143.80

The US equity market edges lower following mixed earnings reports from banking giants Morgan Stanley and Goldman Sachs, placing pressure on the financial sector. Concurrently, rising US Treasury yields, driven by heightened expectations of a high-interest-rate environment, weigh on overall market sentiment. Boeing’s significant slump, triggered by the FAA’s indefinite extension of the grounding of its 737 Max 9 aeroplanes, adds to the challenges faced by the market.

The Dow is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 57, suggesting the index might extend its losses toward support level since the RSI retrated sharply from overbought territory.

Resistance level: 37850.00, 39275.00

Support level: 36735.00, 35950.00

Oil prices stabilize amidst a tug-of-war between a surging US Dollar and concerns over China’s economic outlook. Pessimistic signals from China, a major global oil importer, pose a threat to oil demand. Investors closely monitor economic data, including China’s GDP, for insights. Escalating tensions in the Middle East provide a counterbalance, limiting losses. The latest US military strike in Yemen adds to the geopolitical complexity influencing oil market dynamics.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 45, suggetting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 74.00, 78.65

Support level: 70.25, 67.40

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Despite a relatively dovish speech from Fed governor Christopher Waller, the U.S. dollar maintained its upward trajectory, putting pressure on both gold and equity markets. Wall Street faced selling pressure as early bets on Fed rate cuts diminished. Gold prices experienced their most significant daily decline of 1.28% in 2024, primarily attributed to the strengthened dollar. Meanwhile, oil prices edged lower, with market participants awaiting Chinese GDP data. The data fell slightly short of expectations, failing to provide the anticipated boost to oil prices. Traders are closely monitoring upcoming UK and Eurozone CPI readings, anticipating potential impacts on the Sterling and Euro.

Current rate hike bets on 31 January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

(MT4 System Time)

Source: MQL5

The Dollar Index sees an extension of its upward trajectory, finding support in surging US Treasury yields as expectations for a March rate cut from the Federal Reserve diminish. Christopher Waller’s recent hawkish remarks, emphasizing the proximity to the Fed’s 2% inflation target, prompt market participants to recalibrate their outlook. As Waller cautions against hasty rate cuts in response to improved inflation figures, the US Dollar experiences renewed demand.

The Dollar Index is trading higher following the prior breakout above the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 75, suggesting the index might experience technical correction since the RSI had entered overbought territory.

Resistance level: 103.50, 104.40

Support level: 102.60, 101.90

Despite rising geopolitical tensions in the Middle East sparking a risk-off sentiment, gold prices face headwinds, primarily from the strengthening US Dollar. The hawkish statements from Fed’s Waller, coupled with an uptick in US Treasury yields, contribute to the dollar’s ascent, weighing down on the appeal of dollar-denominated gold. The complex interplay between geopolitical events and currency dynamics underscores the nuanced environment for gold investors.

Gold prices are trading lower following the prior breakout below the support level. MACD has illustrated increasing bearish momentum, while RSI is at 42, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 2035.00, 2055.00

Support level: 2015.00, 1985.00

The Pound Sterling is encountering challenges as the U.S. dollar maintains its momentum, driven by shifting market sentiment. Despite a dovish narrative in the Fed Governor’s recent speech, expectations for an early Fed rate cut continue diminishing, bolstering the dollar’s strength. Traders eagerly await the UK’s CPI reading later today, seeking insights into Sterling’s performance amid the evolving global market dynamics.

GBP/USD declined significantly as the dollar continued to strengthen. The pair is currently supported by its near support level at 1.2631; a break below suggests a strong bearish bias for the pair. The RSI is on the brink of breaking into the oversold zone while the MACD continues to diverge at below zero line, suggesting the bearish momentum is strong.

Resistance level: 1.2729, 1.2815

Support level: 1.2630, 1.2528

The EUR/USD pair faced downward pressure as the U.S. dollar extended its strength, prompted by remarks from Fed Governor Christopher Waller. Waller emphasised the need for caution regarding a rate cut, stating that while possible, it requires careful consideration. This tempered market expectations for an early rate cut in 2024, subsequently boosting the dollar.

The EUR/USD pair is currently supported at near the 1.0866 level while the bearish momentum remains strong. The RSI is on the brink of breaking into the oversold zone, while the MACD has broken below the zero line and started to diverge, suggesting the bearish momentum is strong.

Resistance level: 1.0954, 1.1041

Support level: 1.0866, 1.0775

The USD/JPY pair continues its upward trajectory as the U.S. dollar maintains its robust performance, propelled by positive economic indicators. The Japanese Yen faces challenges amid dovish market expectations for the Bank of Japan (BoJ). Upbeat U.S. economic data has led to reduced expectations of an early Fed rate cut, contrasting with Japan’s struggle to achieve inflation targets. This contributes to speculation that the BoJ may delay its monetary policy shift. Investors are eagerly awaiting the release of U.S. retail sales data later today, which is poised to influence the strength of the dollar.

USD/JPY traded to its one-month high level and has broken multiple resistance levels, suggesting the bullish momentum remains strong. The RSI has broken into the overbought zone while the MACD rebounded from above the zero line, suggesting the bullish momentum has picked up.

Resistance level: 148.77, 151.83

Support level: 145.35, 143.80

The US equity market edges lower following mixed earnings reports from banking giants Morgan Stanley and Goldman Sachs, placing pressure on the financial sector. Concurrently, rising US Treasury yields, driven by heightened expectations of a high-interest-rate environment, weigh on overall market sentiment. Boeing’s significant slump, triggered by the FAA’s indefinite extension of the grounding of its 737 Max 9 aeroplanes, adds to the challenges faced by the market.

The Dow is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 57, suggesting the index might extend its losses toward support level since the RSI retrated sharply from overbought territory.

Resistance level: 37850.00, 39275.00

Support level: 36735.00, 35950.00

Oil prices stabilize amidst a tug-of-war between a surging US Dollar and concerns over China’s economic outlook. Pessimistic signals from China, a major global oil importer, pose a threat to oil demand. Investors closely monitor economic data, including China’s GDP, for insights. Escalating tensions in the Middle East provide a counterbalance, limiting losses. The latest US military strike in Yemen adds to the geopolitical complexity influencing oil market dynamics.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 45, suggetting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 74.00, 78.65

Support level: 70.25, 67.40

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.