-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

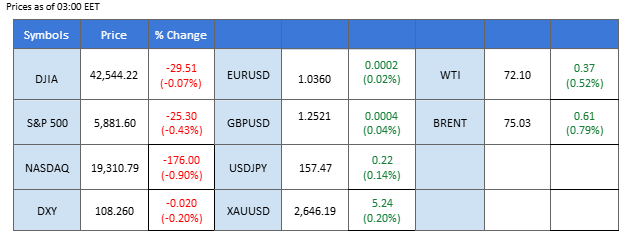

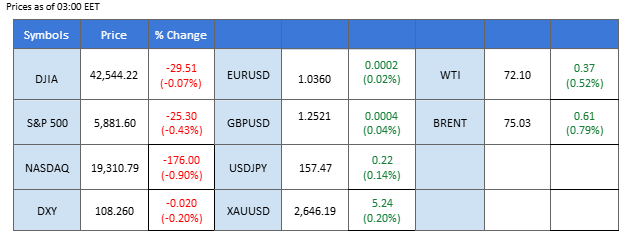

Market Summary

The U.S. dollar delivered a strong performance in 2024, with the dollar index gaining approximately 7%, and it started 2025 on a positive note, hovering near its recent highs. The dollar remains supported by the Fed’s cautious approach to monetary policy, with hawkish expectations weighing on equities. Wall Street is anticipated to face strong downside pressure as the year begins. In Asia, Hong Kong’s Hang Seng Index plunged over 200 points after resuming trading post-New Year holiday, reflecting investor concerns over potential tariff risks.

In commodities, gold surged more than 27% in 2024 and remains steady above the $2630 mark, buoyed by global geopolitical tensions driving safe-haven demand. Meanwhile, oil prices climbed, with WTI touching $72.00 for the first time since last November. U.S. crude stockpiles continue to decline, while disruptions in Russian gas supplies to Europe via Ukraine after the transit deal expired added to supply concerns.

In forex markets, traders are advised to monitor the UK PMI reading and U.S. job data, which could directly influence the Pound Sterling and U.S. dollar performance.

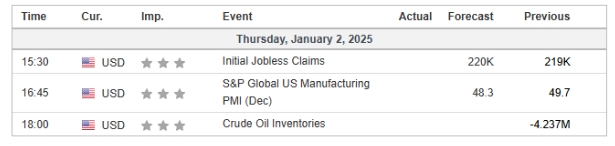

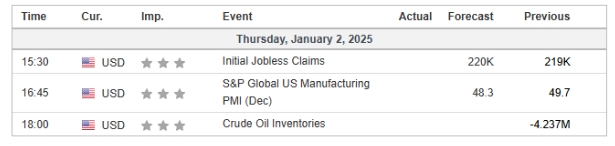

Current rate hike bets on 29th January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (90.4%) VS -25 bps (9.6%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index extended its annual gains as traders reassessed the Federal Reserve’s potential pace of monetary easing in 2025. Recent comments by Fed Chair Jerome Powell suggested caution in reducing borrowing costs due to persistent inflation concerns. Higher interest rates and rising Treasury yields continue to bolster the dollar’s strength. Investors are now focused on upcoming economic data, including jobless claims and manufacturing reports, for further insights into the Fed’s policy trajectory.

The Dollar Index is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 67, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 108.60, 109.50

Support level: 107.60, 106.75

Gold prices climbed amid heightened market uncertainties following a suspected terrorist attack in the U.S. During New Year’s celebrations in New Orleans, a deliberate act of violence resulted in multiple casualties and injuries, sparking risk-off sentiment. Additionally, the explosion of a Tesla Cybertruck outside a Trump-owned hotel in Las Vegas further fueled fears. The heightened geopolitical risks and safe-haven demand supported gold’s upward momentum in early Asian trading.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 71, suggesting the commodity might enter overbought territory.

Resistance level: 2635.00, 2656.00

Support level: 2612.00, 2588.00

The GBP/USD pair continues to face significant downside pressure, hovering just above the 1.2505 support level. A decisive break below this threshold could signal further bearish momentum for the pair. The Pound remains under pressure amid weaker UK economic data and growing expectations of a dovish pivot from the Bank of England, while the U.S. dollar is buoyed by hawkish Federal Reserve expectations. Traders are closely watching today’s UK PMI release, which is projected to soften compared to the prior reading, potentially adding further weight on the Pound Sterling.

The pair is currently testing its support level at 1.2505. A break below this level will be seen as a bearish signal for the pair. The RSI remains below the 50 level, while the MACD failed to break above the zero line, suggesting that the pair remains trading with bearish momentum.

Resistance level: 1.2620, 1.2700

Support level: 1.2505, 1.2408

The EUR/USD pair has dropped to recent lows near the 1.0340 mark, signalling a bearish outlook. The euro continues to face pressure amid expectations that the ECB will maintain a dovish monetary policy stance throughout 2025. Meanwhile, the dollar remains firm, supported by solid U.S. economic data as it enters the new year. A sustained break below the 1.0340 level could reinforce further downside momentum for the pair.

The pair is trading with a lower-high price pattern and is testing its support level, suggesting a bearish bias. The RSI is approaching the oversold zone, while the MACD failed to break above the zero line, suggesting that the pair remains trading with bearish momentum.

Resistance level: 1.0440, 1.0515

Support level: 1.0323, 1.0238

The Australian dollar has fallen to its lowest level since November 2022, reflecting persistent bearish momentum. The combination of a lackluster Australian dollar and a strong U.S. dollar has driven the pair’s continued decline. Adding to the weakness, Australia’s Manufacturing PMI released yesterday missed expectations, further pressuring the currency. However, signs of slowing bearish momentum suggest the possibility of a near-term trend reversal for the pair.

The pair has been trading in a lower-low price pattern, but the momentum indicators suggest decreasing bearish momentum, which indicates a potential trend reversal for the pair. If the RSI is able to break above the 50 level and the MACD is able to break above the zero line, it may be seen as a trend reversal signal for the pair.

Resistance level: 0.6276, 0.6345

Support level: 0.6130, 0.6035

The USD/JPY pair remained capped below the 158.00 mark and retreated following a period of price consolidation. Despite a brief technical rebound, the pair has yet to surpass its previous high, indicating it continues to trade within a bearish trajectory. The Japanese yen has regained footing from its recent lacklustre performance, supported by growing expectations of a Bank of Japan rate hike in January, which has bolstered optimism and strengthened the yen.

The pair is currently hovering in a wide range at its recent high levels. The pair has formed a double bottom at the 156.00 mark. Should the pair break below such a level, it may be seen as a bearish signal for the pair. The RSI has been seesawing lately, while the MACD is sliding toward the zero line, suggesting that the bullish momentum is vanishing.

Resistance level: 158.60, 159.80

Support level: 156.00, 154.70

Bitcoin’s outlook for 2025 remains optimistic, with analysts forecasting prices between $80,000 and $250,000. Drivers include favorable U.S. regulatory developments under the pro-crypto Trump administration, institutional adoption through ETFs, and the halving event reducing bitcoin’s supply. While risks such as geopolitical tensions and delayed Fed rate cuts persist, analysts predict strong price growth and broader adoption as mainstream and institutional interest continues to expand.

BTC/USD is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 55, suggesting the crypto might extend its gains since the RSI stays above the midline.

Resistance level: 98970.00, 103000.00

Support level: 93255.00, 87740.00

Oil prices broke through key resistance levels, buoyed by optimism over China’s fiscal stimulus plans. The Chinese government’s approval of 3 trillion yuan in special treasury bonds for 2025 aims to revive economic growth and boost domestic demand. As the world’s largest oil importer, China’s fiscal expansion is expected to significantly increase global oil demand, further supporting price gains.

Oil prices are trading higher while currently near the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 70, suggesting the commodity might enter overbought territory.

Resistance level: 72.35, 74.40

Support level: 71.45, 70.50

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Market Summary

The U.S. dollar delivered a strong performance in 2024, with the dollar index gaining approximately 7%, and it started 2025 on a positive note, hovering near its recent highs. The dollar remains supported by the Fed’s cautious approach to monetary policy, with hawkish expectations weighing on equities. Wall Street is anticipated to face strong downside pressure as the year begins. In Asia, Hong Kong’s Hang Seng Index plunged over 200 points after resuming trading post-New Year holiday, reflecting investor concerns over potential tariff risks.

In commodities, gold surged more than 27% in 2024 and remains steady above the $2630 mark, buoyed by global geopolitical tensions driving safe-haven demand. Meanwhile, oil prices climbed, with WTI touching $72.00 for the first time since last November. U.S. crude stockpiles continue to decline, while disruptions in Russian gas supplies to Europe via Ukraine after the transit deal expired added to supply concerns.

In forex markets, traders are advised to monitor the UK PMI reading and U.S. job data, which could directly influence the Pound Sterling and U.S. dollar performance.

Current rate hike bets on 29th January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (90.4%) VS -25 bps (9.6%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index extended its annual gains as traders reassessed the Federal Reserve’s potential pace of monetary easing in 2025. Recent comments by Fed Chair Jerome Powell suggested caution in reducing borrowing costs due to persistent inflation concerns. Higher interest rates and rising Treasury yields continue to bolster the dollar’s strength. Investors are now focused on upcoming economic data, including jobless claims and manufacturing reports, for further insights into the Fed’s policy trajectory.

The Dollar Index is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 67, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 108.60, 109.50

Support level: 107.60, 106.75

Gold prices climbed amid heightened market uncertainties following a suspected terrorist attack in the U.S. During New Year’s celebrations in New Orleans, a deliberate act of violence resulted in multiple casualties and injuries, sparking risk-off sentiment. Additionally, the explosion of a Tesla Cybertruck outside a Trump-owned hotel in Las Vegas further fueled fears. The heightened geopolitical risks and safe-haven demand supported gold’s upward momentum in early Asian trading.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 71, suggesting the commodity might enter overbought territory.

Resistance level: 2635.00, 2656.00

Support level: 2612.00, 2588.00

The GBP/USD pair continues to face significant downside pressure, hovering just above the 1.2505 support level. A decisive break below this threshold could signal further bearish momentum for the pair. The Pound remains under pressure amid weaker UK economic data and growing expectations of a dovish pivot from the Bank of England, while the U.S. dollar is buoyed by hawkish Federal Reserve expectations. Traders are closely watching today’s UK PMI release, which is projected to soften compared to the prior reading, potentially adding further weight on the Pound Sterling.

The pair is currently testing its support level at 1.2505. A break below this level will be seen as a bearish signal for the pair. The RSI remains below the 50 level, while the MACD failed to break above the zero line, suggesting that the pair remains trading with bearish momentum.

Resistance level: 1.2620, 1.2700

Support level: 1.2505, 1.2408

The EUR/USD pair has dropped to recent lows near the 1.0340 mark, signalling a bearish outlook. The euro continues to face pressure amid expectations that the ECB will maintain a dovish monetary policy stance throughout 2025. Meanwhile, the dollar remains firm, supported by solid U.S. economic data as it enters the new year. A sustained break below the 1.0340 level could reinforce further downside momentum for the pair.

The pair is trading with a lower-high price pattern and is testing its support level, suggesting a bearish bias. The RSI is approaching the oversold zone, while the MACD failed to break above the zero line, suggesting that the pair remains trading with bearish momentum.

Resistance level: 1.0440, 1.0515

Support level: 1.0323, 1.0238

The Australian dollar has fallen to its lowest level since November 2022, reflecting persistent bearish momentum. The combination of a lackluster Australian dollar and a strong U.S. dollar has driven the pair’s continued decline. Adding to the weakness, Australia’s Manufacturing PMI released yesterday missed expectations, further pressuring the currency. However, signs of slowing bearish momentum suggest the possibility of a near-term trend reversal for the pair.

The pair has been trading in a lower-low price pattern, but the momentum indicators suggest decreasing bearish momentum, which indicates a potential trend reversal for the pair. If the RSI is able to break above the 50 level and the MACD is able to break above the zero line, it may be seen as a trend reversal signal for the pair.

Resistance level: 0.6276, 0.6345

Support level: 0.6130, 0.6035

The USD/JPY pair remained capped below the 158.00 mark and retreated following a period of price consolidation. Despite a brief technical rebound, the pair has yet to surpass its previous high, indicating it continues to trade within a bearish trajectory. The Japanese yen has regained footing from its recent lacklustre performance, supported by growing expectations of a Bank of Japan rate hike in January, which has bolstered optimism and strengthened the yen.

The pair is currently hovering in a wide range at its recent high levels. The pair has formed a double bottom at the 156.00 mark. Should the pair break below such a level, it may be seen as a bearish signal for the pair. The RSI has been seesawing lately, while the MACD is sliding toward the zero line, suggesting that the bullish momentum is vanishing.

Resistance level: 158.60, 159.80

Support level: 156.00, 154.70

Bitcoin’s outlook for 2025 remains optimistic, with analysts forecasting prices between $80,000 and $250,000. Drivers include favorable U.S. regulatory developments under the pro-crypto Trump administration, institutional adoption through ETFs, and the halving event reducing bitcoin’s supply. While risks such as geopolitical tensions and delayed Fed rate cuts persist, analysts predict strong price growth and broader adoption as mainstream and institutional interest continues to expand.

BTC/USD is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 55, suggesting the crypto might extend its gains since the RSI stays above the midline.

Resistance level: 98970.00, 103000.00

Support level: 93255.00, 87740.00

Oil prices broke through key resistance levels, buoyed by optimism over China’s fiscal stimulus plans. The Chinese government’s approval of 3 trillion yuan in special treasury bonds for 2025 aims to revive economic growth and boost domestic demand. As the world’s largest oil importer, China’s fiscal expansion is expected to significantly increase global oil demand, further supporting price gains.

Oil prices are trading higher while currently near the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 70, suggesting the commodity might enter overbought territory.

Resistance level: 72.35, 74.40

Support level: 71.45, 70.50

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.