-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

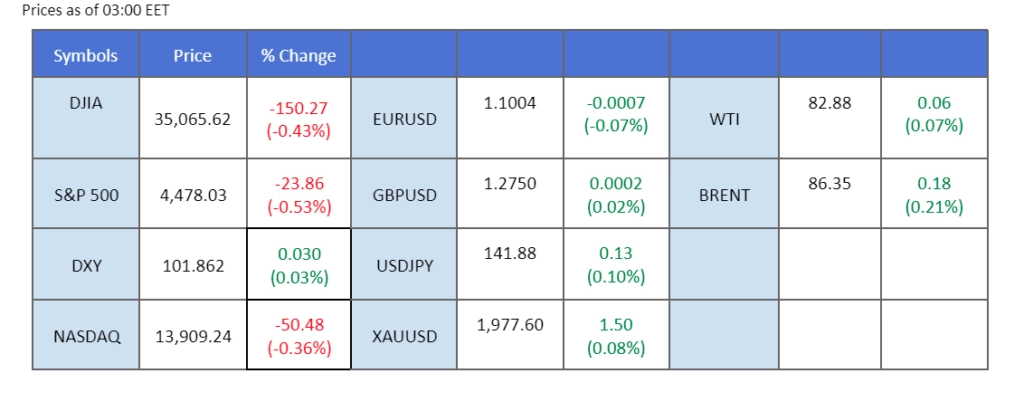

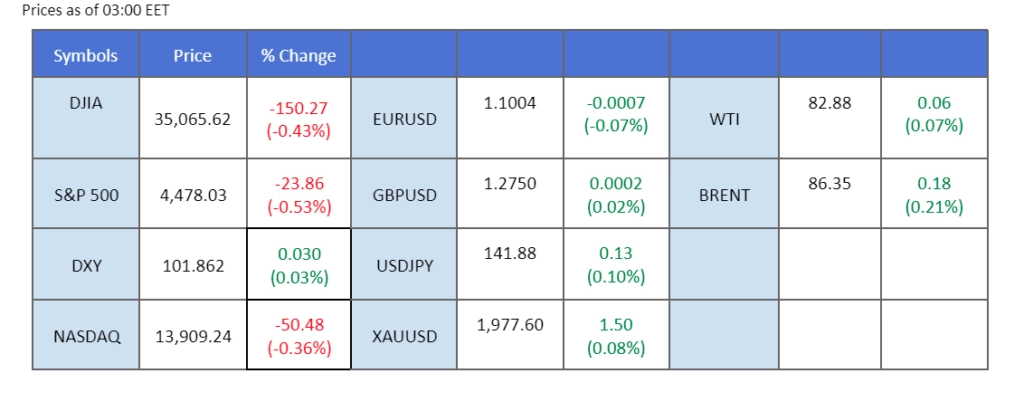

Last Friday, the United States experienced a blend of economic indicators. The unemployment rate in the country improved to 3.5%, but the Nonfarm Payroll saw a reduction to 187k, suggesting a moderate trend in the U.S. job market. This resulted in slightly easing the dollar, which found support around the $102 mark. Meanwhile, gold prices capitalized on the situation, recording a gain of nearly 0.5% on the same day. In another development, oil prices surged to their highest point since April, reaching $83. An unsettling event occurred as a Russian oil tanker was reportedly attacked by Ukraine in the Black Sea. This incident raised concerns about the vulnerability of Russia’s commodity exports and the potential tightening of the global oil supply. Simultaneously, investors are closely watching for the release of the Chinese Consumer Price Index (CPI) data, as it is expected to offer insights into the trajectory of oil prices in the near future.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (0.2%) VS 25 bps (99.8%)

The release of pessimistic Nonfarm Payroll data triggered significant selling pressures on the US Dollar. Investors’ initial reaction centred on hopes that the weak employment figures could prompt a more accommodative monetary policy. Nevertheless, the revelation of higher wages, reflected in the 4.4% annual wage inflation (measured by Average Hourly Earnings), added further uncertainties.

The dollar index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 44, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 102.60, 103.45

Support level: 102.00, 101.55

Gold prices surged in response to the downbeat Nonfarm Payroll data, strengthening its status as a safe-haven asset amidst market uncertainties. The disappointing job growth figures intensified investors’ search for stability, driving demand for the precious metal.

Gold prices are trading higher while currently near the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 51, suggesting the commodity might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 1950.00, 1980.00

Support level: 1930.00, 1910.00

The Australian dollar faced downward pressure as the Reserve Bank of Australia (RBA) paused its rate hikes, exposing it to downside risks and causing it to consistently trade lower against the strengthening U.S. dollar. However, a shift occurred last Friday when the Nonfarm Payroll results fell short of expectations, leading to a decline in the dollar’s value to $102. Despite experiencing a technical rebound, the Australian dollar remains constrained by a significant resistance level, approximately near 0.6600.

The indicators suggest a trend reversal for the pair with the RSI rebounded from the oversold zone while the MACD has crossed and is moving toward the zero line. A break above the strong resistance level at 0.6600 will be a bullish signal for the pair.

Resistance level: 0.6600, 0.6670

Support level: 0.6500, 0.6390

Throughout the initial days of August, the Canadian dollar has lost momentum, even in the face of escalating oil prices and the Federal Reserve’s implementation of a more tempered monetary policy. Despite a temporary uplift following the release of Nonfarm Payrolls figures last Friday, which turned out to be softer than anticipated, the Canadian dollar’s gains were short-lived. As a result, the U.S. dollar managed to garner an overall increase of more than 0.22% against its Canadian counterpart. A disruption in oil supply has arisen in the Black Sea, attributed to Ukraine’s actions against Russian oil vessels. This occurrence could potentially lead to a heightened oil price, which in turn might exert a positive influence on the Canadian dollar.

The Canadian dollar has formed a double top price pattern at near 1.3380 which has the implication of a downtrend. The RSI has also dropped out of the overbought zone while the MACD has crossed, supporting the view of a trend reversal.

Resistance level: 1.3440, 1.3530

Support level: 1.3330, 1.3250

The Pound Sterling continued to face downward pressures as fears surrounding UK employment and growth conditions persisted. Market participants adopted a cautious approach, particularly ahead of the first readings of the UK’s second-quarter Gross Domestic Product (GDP). The recent 25-basis-point rate hike by the Bank of England did little to alleviate concerns, as Governor Bailey emphasized the current softer inflation scenario.

GBP/USD is trading lower following the prior retracement from the resistance level. However, MACD has illustrated increasing bullish momentum, while RSI is at 50, suggesting the pair might be traded higher as technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 1.2815, 1.2990

Support level: 1.2655, 1.2500

Following the release of mixed economic data, Wall Street witnessed a broad decline, with the Nasdaq posting their largest weekly percentage declines since March. Investors’ profit-taking was evident after five months of gains, as uncertainties surrounding the Fed’s monetary policy and inflation trends weighed on market sentiment. The near-term trajectory for equities remains uncertain, with a focus on Thursday’s US inflation data, which may influence the Federal Reserve’s future interest rate decisions.

Nasdaq trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 41, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 15900.00, 16590.00

Support level: 15300.00, 14265.00

The Euro took advantage of the weakened dollar opportunity last Friday after disclosing various U.S. economic indicators, among them the Nonfarm Payroll (NFP). These economic figures came with mixed results, while the NFP fell more than anticipated, the unemployment rate, on the contrary, was lower compared to the preceding reading. Despite this mixed scenario, the dollar experienced a drop to $102, leading the Euro to appreciate by over 0.5% during the same Friday. Meanwhile, investors are anxiously anticipating the release of the German CPI data. This information is sought after to assess the robustness of the Eurozone economy and the Euro’s standing.

The Euro still trades below its downtrend resistance level despite a technical rebound last Friday. The RSI rebounded while the MACD attempted to cross above the zero line, suggesting a trend reversal signal.

Resistance level: 1.1030, 1.1088

Support level: 1.0950, 1.0840

Oil prices witnessed an extended rally, reaching their highest levels since mid-April. This surge was bolstered by commitments from top producers Saudi Arabia and Russia to keep supplies constrained for another month. With expectations of US interest rate hikes tapering off and a reduction in OPEC+ supplies, coupled with hopes of economic stimulus driving oil demand recovery in China, the market sentiment remained optimistic.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 66, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 83.20, 87.25

Support level: 79.90, 76.90

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Last Friday, the United States experienced a blend of economic indicators. The unemployment rate in the country improved to 3.5%, but the Nonfarm Payroll saw a reduction to 187k, suggesting a moderate trend in the U.S. job market. This resulted in slightly easing the dollar, which found support around the $102 mark. Meanwhile, gold prices capitalized on the situation, recording a gain of nearly 0.5% on the same day. In another development, oil prices surged to their highest point since April, reaching $83. An unsettling event occurred as a Russian oil tanker was reportedly attacked by Ukraine in the Black Sea. This incident raised concerns about the vulnerability of Russia’s commodity exports and the potential tightening of the global oil supply. Simultaneously, investors are closely watching for the release of the Chinese Consumer Price Index (CPI) data, as it is expected to offer insights into the trajectory of oil prices in the near future.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (0.2%) VS 25 bps (99.8%)

The release of pessimistic Nonfarm Payroll data triggered significant selling pressures on the US Dollar. Investors’ initial reaction centred on hopes that the weak employment figures could prompt a more accommodative monetary policy. Nevertheless, the revelation of higher wages, reflected in the 4.4% annual wage inflation (measured by Average Hourly Earnings), added further uncertainties.

The dollar index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 44, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 102.60, 103.45

Support level: 102.00, 101.55

Gold prices surged in response to the downbeat Nonfarm Payroll data, strengthening its status as a safe-haven asset amidst market uncertainties. The disappointing job growth figures intensified investors’ search for stability, driving demand for the precious metal.

Gold prices are trading higher while currently near the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 51, suggesting the commodity might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 1950.00, 1980.00

Support level: 1930.00, 1910.00

The Australian dollar faced downward pressure as the Reserve Bank of Australia (RBA) paused its rate hikes, exposing it to downside risks and causing it to consistently trade lower against the strengthening U.S. dollar. However, a shift occurred last Friday when the Nonfarm Payroll results fell short of expectations, leading to a decline in the dollar’s value to $102. Despite experiencing a technical rebound, the Australian dollar remains constrained by a significant resistance level, approximately near 0.6600.

The indicators suggest a trend reversal for the pair with the RSI rebounded from the oversold zone while the MACD has crossed and is moving toward the zero line. A break above the strong resistance level at 0.6600 will be a bullish signal for the pair.

Resistance level: 0.6600, 0.6670

Support level: 0.6500, 0.6390

Throughout the initial days of August, the Canadian dollar has lost momentum, even in the face of escalating oil prices and the Federal Reserve’s implementation of a more tempered monetary policy. Despite a temporary uplift following the release of Nonfarm Payrolls figures last Friday, which turned out to be softer than anticipated, the Canadian dollar’s gains were short-lived. As a result, the U.S. dollar managed to garner an overall increase of more than 0.22% against its Canadian counterpart. A disruption in oil supply has arisen in the Black Sea, attributed to Ukraine’s actions against Russian oil vessels. This occurrence could potentially lead to a heightened oil price, which in turn might exert a positive influence on the Canadian dollar.

The Canadian dollar has formed a double top price pattern at near 1.3380 which has the implication of a downtrend. The RSI has also dropped out of the overbought zone while the MACD has crossed, supporting the view of a trend reversal.

Resistance level: 1.3440, 1.3530

Support level: 1.3330, 1.3250

The Pound Sterling continued to face downward pressures as fears surrounding UK employment and growth conditions persisted. Market participants adopted a cautious approach, particularly ahead of the first readings of the UK’s second-quarter Gross Domestic Product (GDP). The recent 25-basis-point rate hike by the Bank of England did little to alleviate concerns, as Governor Bailey emphasized the current softer inflation scenario.

GBP/USD is trading lower following the prior retracement from the resistance level. However, MACD has illustrated increasing bullish momentum, while RSI is at 50, suggesting the pair might be traded higher as technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 1.2815, 1.2990

Support level: 1.2655, 1.2500

Following the release of mixed economic data, Wall Street witnessed a broad decline, with the Nasdaq posting their largest weekly percentage declines since March. Investors’ profit-taking was evident after five months of gains, as uncertainties surrounding the Fed’s monetary policy and inflation trends weighed on market sentiment. The near-term trajectory for equities remains uncertain, with a focus on Thursday’s US inflation data, which may influence the Federal Reserve’s future interest rate decisions.

Nasdaq trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 41, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 15900.00, 16590.00

Support level: 15300.00, 14265.00

The Euro took advantage of the weakened dollar opportunity last Friday after disclosing various U.S. economic indicators, among them the Nonfarm Payroll (NFP). These economic figures came with mixed results, while the NFP fell more than anticipated, the unemployment rate, on the contrary, was lower compared to the preceding reading. Despite this mixed scenario, the dollar experienced a drop to $102, leading the Euro to appreciate by over 0.5% during the same Friday. Meanwhile, investors are anxiously anticipating the release of the German CPI data. This information is sought after to assess the robustness of the Eurozone economy and the Euro’s standing.

The Euro still trades below its downtrend resistance level despite a technical rebound last Friday. The RSI rebounded while the MACD attempted to cross above the zero line, suggesting a trend reversal signal.

Resistance level: 1.1030, 1.1088

Support level: 1.0950, 1.0840

Oil prices witnessed an extended rally, reaching their highest levels since mid-April. This surge was bolstered by commitments from top producers Saudi Arabia and Russia to keep supplies constrained for another month. With expectations of US interest rate hikes tapering off and a reduction in OPEC+ supplies, coupled with hopes of economic stimulus driving oil demand recovery in China, the market sentiment remained optimistic.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 66, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 83.20, 87.25

Support level: 79.90, 76.90

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.