-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

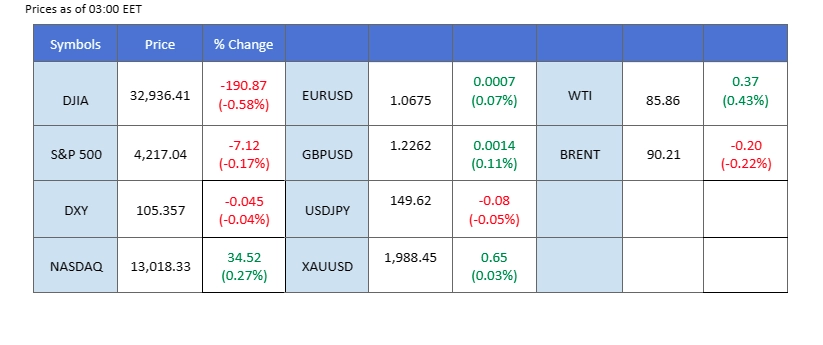

Hamas militants freed 2 hostages while Israel delayed a ground attack and provided relief from the heightened tension in the Middle East region. Meanwhile, China’s surprising affirmation of Israel’s right to self-defence injected optimism into global dynamics. This unexpected stance had a ripple effect, prompting a slight easing in gold prices and a decline in oil prices as tensions in the Middle East region moderated. Simultaneously, the US dollar faced headwinds, experiencing a decline of over 0.5% in response to a significant milestone—the US long-term bond yield touching the 5% mark for the first time since 2007. Analysts suggest that this surge in bond yields tightened financial conditions in the US, potentially influencing the Federal Reserve’s approach to future interest rate hikes. In the cryptocurrency sphere, Bitcoin (BTC) experienced a notable surge, climbing over 10% to reach its highest level since May. This bullish momentum was fueled by mounting optimism surrounding the potential approval of a Bitcoin ETF by the US SEC.

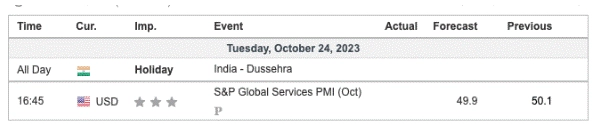

Current rate hike bets on 1st November Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (88.0%) VS 25 bps (12%)

The Dollar Index, which tracks major currencies, continued its downward trajectory as US Treasury yields saw a sharp decline from earlier highs of 5%. The market remains cautious, awaiting crucial US economic data later this week for clearer trading signals.

The Dollar Index is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 27, suggesting the index might enter oversold territory.

Resistance level: 106.60, 107.15

Support level: 105.55, 104.80

Despite a slight retreat due to technical corrections, the gold market remained relatively steady, with investors closely monitoring upcoming US economic data. Geopolitical tensions in the Middle East and declining US Treasury yields continue to support the appeal of gold, with attention fixed on the critical resistance level of $1880.

Gold prices are trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 68, suggesting the commodity might enter overbought territory.

Resistance level: 1980.00, 2013.00

Support level: 1940.00, 1910.00

Leveraging the weakened dollar, the Euro saw a technical rebound in recent sessions. Euro traders are now poised, awaiting the European Central Bank’s upcoming interest rate decision set for this Thursday. Market sentiments are uncertain, given the juxtaposition of a persistently stable inflation rate in the economic bloc and the escalating tensions in the Middle East, potentially dissuading the ECB from pursuing an interest rate hike. Investors remain on alert, anticipating the ECB’s nuanced approach amidst these complex dynamics.

EUR/USD has rebounded strongly with strong bullish momentum. The RSI has broken into the overbought zone while the MACD has been moving upward, suggesting a sustainable bullish momentum for the pair.

Resistance level: 1.0700, 1.0750

Support level: 1.0630, 1.056

The British Pound surged significantly last night, benefitting from the softened U.S. dollar. The U.S. long-term yield reached its peak, a level unseen since 2007, indicating a tightened financial atmosphere in the U.S. Market speculation is rife that the Fed might refrain from further interest rate hikes due to the elevated borrowing costs in the country. Meanwhile, Sterling traders closely monitor the U.K.’s unemployment rate and PMI readings, seeking insights into the Pound’s strength amid these global financial fluctuations.

The Cable has exhibited a strong bullish trend after its rebounded sharply from its price consolidation range yesterday. The RSI is on the brink of breaking into the overbought zone while the MACD continues moving upward after breaking above the zero line.

Resistance level: 1.2290, 1.2350

Support level: 1.2220, 1.2120

US equity markets traded flat amid a mix of market sentiment. The recent drop in US Treasury yields and growing market volatilities ahead of significant earnings reports and economic data releases have clouded the market’s outlook. Investors are advised to monitor these developments for further insights into the market trends.

The Dow is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 32, suggesting the index might enter oversold territory.

Resistance level: 33370.00, 33895.00

Support level: 32840.00, 32015.00

The Aussie dollar has experienced a short-term technical rebound due to the softening dollar’s strength. The Aussie dollar has recently leaned heavily on the U.S. dollar’s strength as a lack of catalyst for the Aussie dollar. However, Australia’s CPI is scheduled to be announced later and is expected to provide some volatility for the pair. A break above its long-term downtrend resistance level will be a bullish signal for the pair.

The AUD/USD pair seems to have eased from its bearish momentum but its long term resistance level still suppresses it. The RSI has been moving sideways and the MACD is breaking above the zero line, suggesting the bearish momentum has vanished.

Resistance level: 0.6390, 0.6510

Support level: 0.6290, 0.6200

Oil prices took a tumble as prospects for de-escalating tensions in Middle Eastern countries grew stronger. Global leaders, including US President Joe Biden and others from France and the Netherlands, have been actively working towards finding a diplomatic resolution. Despite the geopolitical situation, some oil traders view the conflict as a political event with limited direct impact on crude trade.

Oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 41, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 89.35, 94.00

Support level: 85.65, 82.50

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!