-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

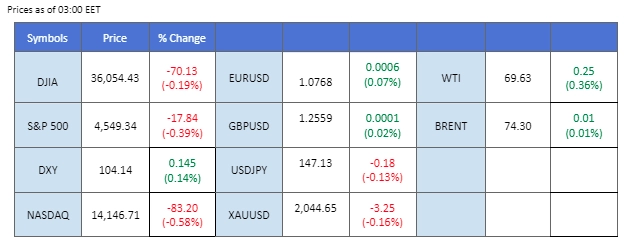

In yesterday’s highly anticipated release of the ADP Non-Farm Unemployment Change data, the dollar failed to gather momentum as the figure came short. Persistent downward pressure on the dollar’s strength ensued as U.S. long-term Treasury yields continued their decline. In the commodities arena, gold maintained its position above the $2020 level, awaiting a catalyst. Meanwhile, oil prices experienced a plunge, triggered by Moody’s credit rating downgrade for China, indicating ongoing challenges in the largest oil-importing nation’s economic recovery. This development coincided with a significant drop in Chinese equity market indexes, with the Hang Seng Index plummeting and the China A50 Index approaching its lowest level since 2019.

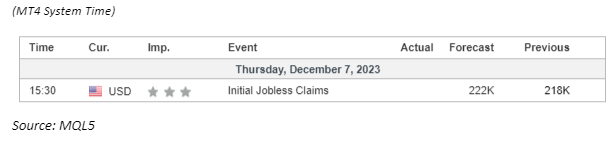

Current rate hike bets on 13rd December Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95.0%) VS 25 bps (5%)

The US Dollar maintains its upward momentum yet faces uncertainty amid lacklustre economic data. The disappointing November Private Payrolls’ growth, reported at 103,000, down from the previous month and below market expectations, adds to concerns. Investors are closely monitoring forthcoming economic data, particularly the crucial jobs report, to decipher signals and gain clarity on the dollar’s direction.

The Dollar Index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 68, suggesting the index might experience technical correction since the RSI had entered overbought territory.

Resistance level: 104.25, 104.80

Support level: 103.60, 103.10

A risk-off sentiment prevails in global markets as subdued US economic indicators, including ADP employment and JOLTs Job Openings, lead to a modest increase in gold prices. With investors seeking safe-haven assets, the movement in gold remains measured, awaiting cues from the upcoming US jobs report that could significantly impact market sentiment.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 46, suggesting the commodity might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 2030.00, 2050.00

Support level: 2010.00, 1980.00

The British Pound witnessed a reversal in its recent bullish trend, even as the U.S. dollar displayed relative stability in the recent session. The U.S. ADP Non-Farm Employment Change, falling short of expectations, failed to provide the impetus needed for the dollar to gain traction. Attention now turns to Friday’s Non-Farm Payrolls report, which is expected to offer insights into the Fed’s potential monetary policy decisions and their subsequent impact on the dollar’s strength.

The Cable continued to plunge since the start of the week and has a trend reversal price pattern, suggesting a bearish bias for the Cable. The RSI is on the brink of getting into the oversold zone while the MACD has broken below the zero line, suggesting the Cable is trading in a bearish momentum.

Resistance level: 1.2631 1.2729

Support level: 1.2528, 1.2437

The EUR/USD pair is on a persistent downward trend, marking a decline of over 2% since last Wednesday. The Euro is grappling with sustained downward pressure, exacerbated by recent underwhelming German factory orders data, which is indicative of challenges within the Eurozone economy. Market sentiment is now rife with speculation that the European Central Bank (ECB) may adopt a dovish stance in monetary policy next year to bolster its economy, which currently faces a sombre outlook.

The EUR/USD continues to trade in a downtrend trajectory and is heading to its crucial psychological support level at 1.0700 level. The MACD continues to move downward while the RSI has broken into the oversold zone, suggesting the bearish momentum is strong.

Resistance level: 1.0866, 1.0954

Support level: 1.0700, 1.0630

The US equity market experiences a slight downturn attributed to technical correction and diminishing hopes for Federal Reserve interest rate cuts. Declining energy stocks contribute to the market correction, with a 4% drop in oil prices intensifying concerns about the outlook for the energy industry. Investors stay vigilant, with the jobs report and ongoing economic releases serving as critical indicators shaping investment strategies in the evolving market landscape.

The Dow is trading flat while currently testing the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 71, suggesting the index might enter overbought territory.

Resistance level: 36490.00, 36955.00

Support level: 35930.00, 35465.00

The USD/JPY pair has shown a slight relief from its bearish trajectory, yet it remains positioned below its downtrend resistance level. Despite the U.S. ADP Nonfarm Employment Change falling short of acting as a catalyst for a dollar surge, the USD/JPY pair capitalised on the opportunity to register a lower trade yesterday. Market attention is now keenly focused on upcoming events, particularly Japan’s GDP release and the U.S. Nonfarm Payrolls (NFP) report, both scheduled for this coming Friday. Investors are closely monitoring these economic indicators to assess potential movements in the pair’s pricing.

The USD/JPY has eased in bearish momentum but remains at below the downtrend resistance level. The MACD is moving toward the zero line from below, while the RSI has been flowing flat at the lower region, suggesting the bearish momentum is diminishing.

Resistance level: 147.40, 148.30

Support level: 146.23, 144.78

The Swiss Franc has exhibited notable strength, marking an impressive gain of over 3% against the U.S. dollar since November. However, the downward momentum of the USD/CHF pair experienced a pause with the recent strengthening of the dollar, resulting in gains at the onset of the week. The pair teeters on the edge of breaking above the ascending triangle price pattern. The forthcoming Nonfarm Payrolls (NFP) data scheduled for Friday looms as a pivotal factor that will likely determine the direction of the pair, adding a significant element of anticipation for market participants.

There is a potential trend reversal for the USD/CHF pair as it is on the brink of breaking above its ascending triangle price pattern. The RSI has been gaining lately while the MACD is breaking above the zero line, suggesting the bullish momentum is gaining.

Resistance level: 0.8765, 0.8837

Support level: 0.8719, 0.8653

The oil market grapples with the spectre of diminished demand as Moody’s downgrades China’s credit outlook, citing increased economic risks stemming from a property market downturn and a dearth of government stimulus. As the world’s largest oil importer, China’s pessimistic economic prospects have broader implications for global oil consumption. Concerns about weakening fuel demand intensify as US gasoline inventories experience a larger-than-expected surge. The US Energy Information Administration reveals a substantial increase from 1.764 million to 5.421 million, surpassing market projections of 1.027 million.

Oil prices are trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum. However, RSI is at 25, suggesting the commodity might enter oversold territory.

Resistance level: 72.15, 74.85

Support level: 67.45, 64.85

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!