-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

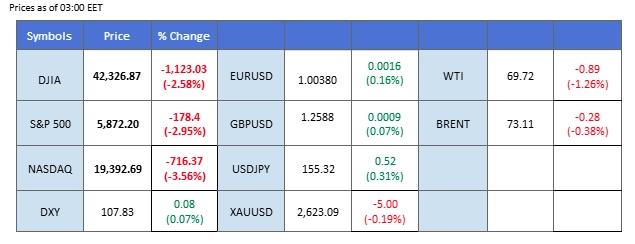

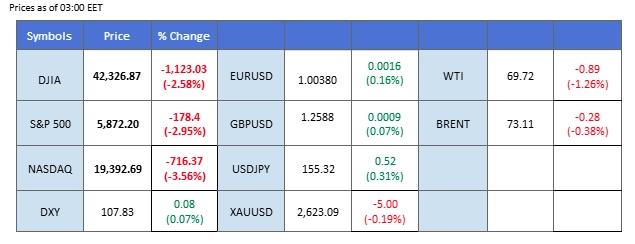

Market Summary

The FOMC interest rate decision yesterday triggered significant market volatility, with all eyes on the Federal Reserve’s hawkish stance. Jerome Powell’s remarks signaling fewer rate cuts in 2025 and the expectation that the Fed funds rate will remain near the 4% level to curb inflation drove the U.S. dollar higher. The dollar index (DXY) surged by more than 1%, reaching its highest level since November 2022, which put downward pressure on its peers.

In contrast, the New Zealand Dollar (NZD) was hammered by a disappointing GDP reading, which showed a -1.0% contraction, sending the NZD/USD pair to its lowest level since October 2022. Forex traders are now turning their focus to today’s Bank of England (BoE) interest rate decision, with expectations that the central bank will keep rates unchanged.

On Wall Street, U.S. equity markets took a hit from the hawkish remarks, with the Dow Jones leading the declines, closing more than 1,000 points lower. The perception of higher interest rates in the coming year is expected to keep selling pressure on riskier assets. Similarly, the crypto market saw a significant selloff, with both Bitcoin (BTC) and Ethereum (ETH) experiencing sharp declines. Bitcoin saw its largest single-day drop since September, following Powell’s comments, including his dismissal of the idea that the U.S. central bank would acquire Bitcoin as a national reserve, which further dampened market sentiment in the crypto space.

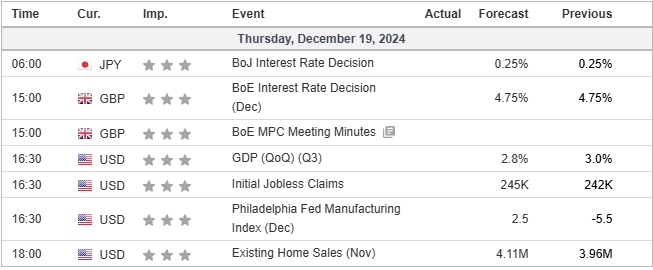

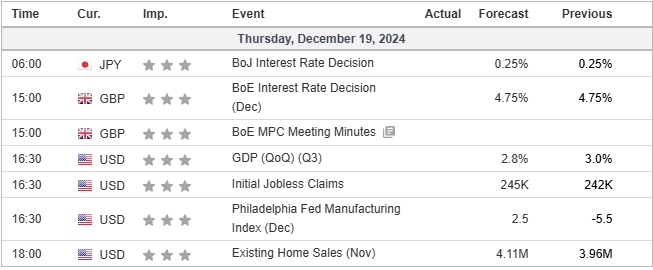

Current rate hike bets on 29th January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (93.6%) VS -25 bps (6.4%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The U.S. Dollar surged as Federal Reserve Chair Jerome Powell’s hawkish remarks following the FOMC interest rate decision reignited investor confidence in the greenback. Powell signalled the likelihood of fewer rate cuts next year to combat persistent inflation, reinforcing a robust monetary policy stance. Consequently, the Dollar Index spiked by over 1% in yesterday’s session, marking its strongest performance in weeks. With bullish momentum firmly in place, the index appears poised to test its next resistance level near the 108.60 mark.

The Dollar Index rose sharply after a week-long sideways pattern, suggesting a bullish signal for the dollar. The RSI has gotten into the overbought zone after 3 weeks while the MACD diverged above the zero line, suggesting that the bullish momentum is gaining.

Resistance level: 108.60, 109.50

Support level: 107.60, 106.75

Gold prices suffered a steep decline in yesterday’s session, driven by the strengthening U.S. dollar following the Fed’s hawkish outlook. The precious metal decisively broke below a critical fair-value gap, signaling a bearish trend. With no major independent catalysts, gold’s price movements remain closely tied to fluctuations in the Dollar Index. While a marginal recovery from yesterday’s plunge is plausible, strong selling pressure is anticipated near the $2,610 mark, limiting any substantial rebound and reinforcing the bearish outlook for the near term.

Gold slid by nearly 5% from its recent peak and has broken below its psychological support level at $2600, suggesting a bearish signal for the pair. The RSI has dropped into the oversold zone while the MACD edged lower after breaking below the zero line, suggesting that the bearish momentum is gaining.

Resistance level: 2612.50, 2656.00

Support level: 2556.00, 2485.65

The GBP/USD pair extended its decline, breaking below its previous low and signaling a bearish outlook for the currency pair. The Pound faced significant downward pressure, primarily driven by the strengthening U.S. dollar following the Federal Reserve’s hawkish statement, which bolstered market sentiment in favor of the greenback. However, attention now shifts to the Bank of England’s interest rate decision scheduled for today. Market consensus expects the BoE to maintain its current interest rate levels, a move that could provide some support and potentially help the Pound recover from its recent losses.

GBP/USD has recorded a new low, suggesting a bearish signal for the pair. The RSI is an inch away from dropping into the oversold zone, while the MACD failed to break above the zero line, suggesting the pair is trading with bearish momentum.

Resistance level: 1.2620, 1.2700

Support level:1.2505, 1.2410

The EUR/USD pair is on the verge of reaching its monthly low, having dropped by 1.35% in yesterday’s session as the U.S. dollar strengthened significantly. The dollar’s rally was further compounded by disappointing eurozone CPI data, which came in lower than market expectations, adding downward pressure on the euro. This combination of a stronger dollar and weaker-than-expected inflation figures from the eurozone has weighed heavily on the euro, leaving the EUR/USD pair vulnerable to further declines.

The EUR/USD is seemingly facing strong selling pressure at the near 1.0520 mark, suggesting a bearish bias for the pair. The RSI is flowing near to the 50 level while the MACD is hovering close to the zero line, suggesting a neutral signal for the pair.

Resistance level: 1.0444, 1.0608

Support level: 1.0324, 1.0238

The NZD/USD pair plunged to its lowest level since November 2022, marking its biggest single-day drop in months, signaling a bearish outlook for the pair. The release of New Zealand’s GDP data, which showed a contraction of -1.0%, significantly lower than market expectations, has weighed heavily on the Kiwi. The disappointing GDP figure adds to the bearish sentiment surrounding the New Zealand dollar, with further downside potential for the pair if the economic weakness persists.

The NZD/USD pair is currently trading in an extreme bearish momentum, suggesting a bearish bias for the pair. The RSI has gotten into the oversold zone while the MACD is diverging below the zero line, suggesting that the bearish momentum is gaining.

Resistance level: 0.5665, 0.5730

Support level: 0.5545, 0.5465

The USD/JPY pair surged to a new high, breaking above the 155.00 mark for the first time in four weeks, indicating a strong bullish bias. The initial boost came from the hawkish remarks by Jerome Powell following the FOMC interest rate decision yesterday, which reinforced expectations of a more aggressive Fed stance. Later in the session, the pair’s rally continued as the Bank of Japan (BoJ) announced, as expected, that it would maintain its interest rate level unchanged. This decision further pressured the Yen, fueling the upward momentum for the USD/JPY pair.

The pair edged higher after a minor technical correction incurred in the previous session, suggesting a bullish bias for the pair. The RSI is close to the overbought zone while the MACD is flowing at elevated levels, suggesting that the pair is trading with bullish momentum.

Resistance level: 157.00, 160.00

Support level: 153.75, 151.55

Oil prices experienced volatile swings of over 130 pips in yesterday’s session, driven by a mix of market forces. Prices initially climbed as traders digested a significant drawdown in U.S. crude stockpiles, signaling tighter supply conditions. However, gains were erased later in the session as the market reacted to the Federal Reserve’s hawkish tone, which raised concerns about dampened economic activity and potential pressure on oil demand in 2025.

Oil prices seesawed in the last session but remain trading within its downtrend trajectory, suggesting a bearish bias for the oil. The RSI continues to slide while the MACD is about to cross below the zero line, suggesting that a bearish momentum is forming.

Resistance level: 69.90, 72.30

Support level: 68.25, 67.00

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Market Summary

The FOMC interest rate decision yesterday triggered significant market volatility, with all eyes on the Federal Reserve’s hawkish stance. Jerome Powell’s remarks signaling fewer rate cuts in 2025 and the expectation that the Fed funds rate will remain near the 4% level to curb inflation drove the U.S. dollar higher. The dollar index (DXY) surged by more than 1%, reaching its highest level since November 2022, which put downward pressure on its peers.

In contrast, the New Zealand Dollar (NZD) was hammered by a disappointing GDP reading, which showed a -1.0% contraction, sending the NZD/USD pair to its lowest level since October 2022. Forex traders are now turning their focus to today’s Bank of England (BoE) interest rate decision, with expectations that the central bank will keep rates unchanged.

On Wall Street, U.S. equity markets took a hit from the hawkish remarks, with the Dow Jones leading the declines, closing more than 1,000 points lower. The perception of higher interest rates in the coming year is expected to keep selling pressure on riskier assets. Similarly, the crypto market saw a significant selloff, with both Bitcoin (BTC) and Ethereum (ETH) experiencing sharp declines. Bitcoin saw its largest single-day drop since September, following Powell’s comments, including his dismissal of the idea that the U.S. central bank would acquire Bitcoin as a national reserve, which further dampened market sentiment in the crypto space.

Current rate hike bets on 29th January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (93.6%) VS -25 bps (6.4%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The U.S. Dollar surged as Federal Reserve Chair Jerome Powell’s hawkish remarks following the FOMC interest rate decision reignited investor confidence in the greenback. Powell signalled the likelihood of fewer rate cuts next year to combat persistent inflation, reinforcing a robust monetary policy stance. Consequently, the Dollar Index spiked by over 1% in yesterday’s session, marking its strongest performance in weeks. With bullish momentum firmly in place, the index appears poised to test its next resistance level near the 108.60 mark.

The Dollar Index rose sharply after a week-long sideways pattern, suggesting a bullish signal for the dollar. The RSI has gotten into the overbought zone after 3 weeks while the MACD diverged above the zero line, suggesting that the bullish momentum is gaining.

Resistance level: 108.60, 109.50

Support level: 107.60, 106.75

Gold prices suffered a steep decline in yesterday’s session, driven by the strengthening U.S. dollar following the Fed’s hawkish outlook. The precious metal decisively broke below a critical fair-value gap, signaling a bearish trend. With no major independent catalysts, gold’s price movements remain closely tied to fluctuations in the Dollar Index. While a marginal recovery from yesterday’s plunge is plausible, strong selling pressure is anticipated near the $2,610 mark, limiting any substantial rebound and reinforcing the bearish outlook for the near term.

Gold slid by nearly 5% from its recent peak and has broken below its psychological support level at $2600, suggesting a bearish signal for the pair. The RSI has dropped into the oversold zone while the MACD edged lower after breaking below the zero line, suggesting that the bearish momentum is gaining.

Resistance level: 2612.50, 2656.00

Support level: 2556.00, 2485.65

The GBP/USD pair extended its decline, breaking below its previous low and signaling a bearish outlook for the currency pair. The Pound faced significant downward pressure, primarily driven by the strengthening U.S. dollar following the Federal Reserve’s hawkish statement, which bolstered market sentiment in favor of the greenback. However, attention now shifts to the Bank of England’s interest rate decision scheduled for today. Market consensus expects the BoE to maintain its current interest rate levels, a move that could provide some support and potentially help the Pound recover from its recent losses.

GBP/USD has recorded a new low, suggesting a bearish signal for the pair. The RSI is an inch away from dropping into the oversold zone, while the MACD failed to break above the zero line, suggesting the pair is trading with bearish momentum.

Resistance level: 1.2620, 1.2700

Support level:1.2505, 1.2410

The EUR/USD pair is on the verge of reaching its monthly low, having dropped by 1.35% in yesterday’s session as the U.S. dollar strengthened significantly. The dollar’s rally was further compounded by disappointing eurozone CPI data, which came in lower than market expectations, adding downward pressure on the euro. This combination of a stronger dollar and weaker-than-expected inflation figures from the eurozone has weighed heavily on the euro, leaving the EUR/USD pair vulnerable to further declines.

The EUR/USD is seemingly facing strong selling pressure at the near 1.0520 mark, suggesting a bearish bias for the pair. The RSI is flowing near to the 50 level while the MACD is hovering close to the zero line, suggesting a neutral signal for the pair.

Resistance level: 1.0444, 1.0608

Support level: 1.0324, 1.0238

The NZD/USD pair plunged to its lowest level since November 2022, marking its biggest single-day drop in months, signaling a bearish outlook for the pair. The release of New Zealand’s GDP data, which showed a contraction of -1.0%, significantly lower than market expectations, has weighed heavily on the Kiwi. The disappointing GDP figure adds to the bearish sentiment surrounding the New Zealand dollar, with further downside potential for the pair if the economic weakness persists.

The NZD/USD pair is currently trading in an extreme bearish momentum, suggesting a bearish bias for the pair. The RSI has gotten into the oversold zone while the MACD is diverging below the zero line, suggesting that the bearish momentum is gaining.

Resistance level: 0.5665, 0.5730

Support level: 0.5545, 0.5465

The USD/JPY pair surged to a new high, breaking above the 155.00 mark for the first time in four weeks, indicating a strong bullish bias. The initial boost came from the hawkish remarks by Jerome Powell following the FOMC interest rate decision yesterday, which reinforced expectations of a more aggressive Fed stance. Later in the session, the pair’s rally continued as the Bank of Japan (BoJ) announced, as expected, that it would maintain its interest rate level unchanged. This decision further pressured the Yen, fueling the upward momentum for the USD/JPY pair.

The pair edged higher after a minor technical correction incurred in the previous session, suggesting a bullish bias for the pair. The RSI is close to the overbought zone while the MACD is flowing at elevated levels, suggesting that the pair is trading with bullish momentum.

Resistance level: 157.00, 160.00

Support level: 153.75, 151.55

Oil prices experienced volatile swings of over 130 pips in yesterday’s session, driven by a mix of market forces. Prices initially climbed as traders digested a significant drawdown in U.S. crude stockpiles, signaling tighter supply conditions. However, gains were erased later in the session as the market reacted to the Federal Reserve’s hawkish tone, which raised concerns about dampened economic activity and potential pressure on oil demand in 2025.

Oil prices seesawed in the last session but remain trading within its downtrend trajectory, suggesting a bearish bias for the oil. The RSI continues to slide while the MACD is about to cross below the zero line, suggesting that a bearish momentum is forming.

Resistance level: 69.90, 72.30

Support level: 68.25, 67.00

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.