-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

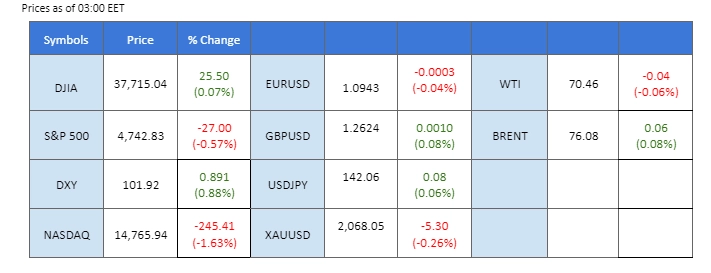

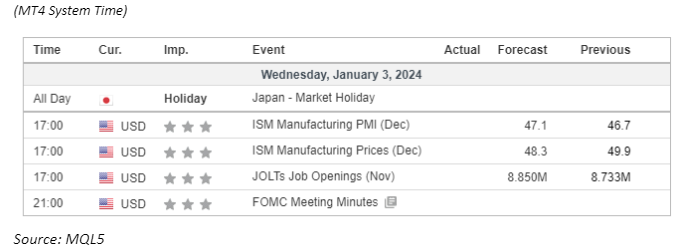

The global bond market experienced selling pressure as traders scaled back expectations of interest rate cuts from major central banks, including the Federal Reserve. The U.S. Treasury saw a drop, causing the treasury yield to rise by nearly 2% yesterday. This surge in yields bolstered the strength of the U.S. dollar, with the dollar index currently trading above the $102 trajectory. Simultaneously, U.S. equity markets dipped in tandem with the bond market after their bullish run since last November. Markets are currently taking a breather in anticipation of the upcoming earnings report season in January, awaiting fresh catalysts to challenge recent highs. Additionally, Bitcoin (BTC) traded above $45,000 for the first time since April 2022 as the SEC deadline on BTC ETF approval decision approaches.

Current rate hike bets on 31 January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (85.0%) VS -25 bps (15.0%)

The Dollar Index showed significant resilience against major currencies, staging a comeback as the 10-year Treasury note yield surpassed 4% in early 2024. The uptick suggests a tilt towards a more hawkish stance by global institutional investors, reflecting optimism about the US economic outlook. However, market experts caution that the rebound may be a technical correction, and the long-term trajectory of the US Dollar remains uncertain, prompting investors to closely monitor upcoming economic data, including Nonfarm Payrolls and Unemployment rate releases.

The Dollar Index is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 75, suggesting the index might enter overbought territory.

Resistance level: 102.60, 103.45

Support level: 101.75, 101.30

Gold prices experienced a notable decline amid a strengthening US Dollar, coupled with a technical rebound in US Treasury yields. The shift in interest rate expectations for 2024 from the Federal Reserve, indicated by rising treasury yields, diminished the appeal for gold. Despite short-term pressure on the precious metal, the overall outlook remains uncertain. Investors are advised to stay vigilant and monitor forthcoming economic data for clearer trading signals.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 45, suggesting the commodity might extend its losses after its successful breakout below the support level since the RSI stays below the midline.

Resistance level: 2090.00, 2120.00

Support level: 2055.00, 2020.00

The GBP/USD pair experienced a decline yesterday as the U.S. dollar strengthened. The dollar gained momentum from the escalating U.S. treasury yield as the bond market faced a significant shift in sentiment. The speculation of rate cuts from major central banks in 2024 diminished, resulting in a plunge in the global bond market. Traders are now eagerly awaiting the release of the FOMC meeting minutes later today to gain insights into the potential future moves of the Federal Reserve regarding monetary policy.

The GBP/USD dipped sharply and traded below its previous downtrend resistance level, suggesting a bearish bias. The RSI is approaching the oversold zone while the MACD has broken below the zero line, suggesting the bearish momentum is forming.

Resistance level: 1.2728, 1.2815

Support level: 1.2528, 1.2437

The EUR/USD pair is navigating a robust bearish momentum, particularly as the U.S. dollar strengthened yesterday. The dollar’s upswing aligned with the surge in U.S. treasury yields, driven by significant selling pressure on the U.S. treasury last night. The euro has shown weakness against its counterparts, and market participants eagerly await the euro’s Consumer Price Index (CPI) data scheduled for release this coming Friday to assess its strength.

The EUR/USD has broken below its uptrend channel and is currently trading with strong downward pressure. The MACD has broken below the zero line while the RSI is on the brink of breaking into the oversold zone, suggesting the bearish momentum is strong.

Resistance level: 1.1041, 1.1140

Support level: 1.0866, 1.0775

The Japanese Yen managed to hold its ground against a strengthening U.S. dollar yesterday, as the dollar found encouragement from the recovery of U.S. treasury yields and traded higher. Traders are currently in anticipation of the release of several crucial economic indicators, including U.S. Purchasing Managers’ Index (PMI) readings, JOLTs job opening data, and the FOMC meeting minutes. These data points will be instrumental in assessing the strength of the dollar and determining the potential price movement of the USD/JPY pair.

USD/JPY bearish momentum has eased but remains trading at below the long-term downtrend resistance level. The RSI has rebounded from the oversold zone while the MACD is on the brink of breaking above the zero line, suggesting the bullish momentum is forming.

Resistance level: 143.80, 145.35

Support level: 141.64, 138.87

The US equity market maintained a flat trajectory as investors awaited crucial economic data that could affirm expectations for Fed interest rate decisions in 2024. Despite a positive long-term trend in 2023, driven by Fed rate cut expectations in the first quarter of 2024, uncertainties surrounding the global economic outlook for 2024 introduce ambiguity. Investors are urged to shift focus to upcoming economic data to better assess potential movements in the US equity market.

The Dow is trading higher while currently testing the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 77, suggesting the index might enter overbought territory.

Resistance level: 37850.00, 39275.00

Support level: 36735.00, 35950.00

The oil market faces headwinds as pessimistic economic outlooks continue to weigh on demand. Further dampening sentiment, India’s crude oil imports from Russia plunged in December to their lowest level since January 2023, attributed to payment issues amid tightening US sanctions on Russia. Additionally, the strengthening US Dollar has contributed to higher dollar-denominated oil prices, impacting demand. The combination of these factors suggests a bearish trend in oil prices at the beginning of 2024.

Oil prices are trading lower following the prior breakout below the previous support level of 72.85. MACD has illustrated increasing bearish momentum, while RSI is at 34, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 72.85, 78.65

Support level: 68.00, 64.85

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!