-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

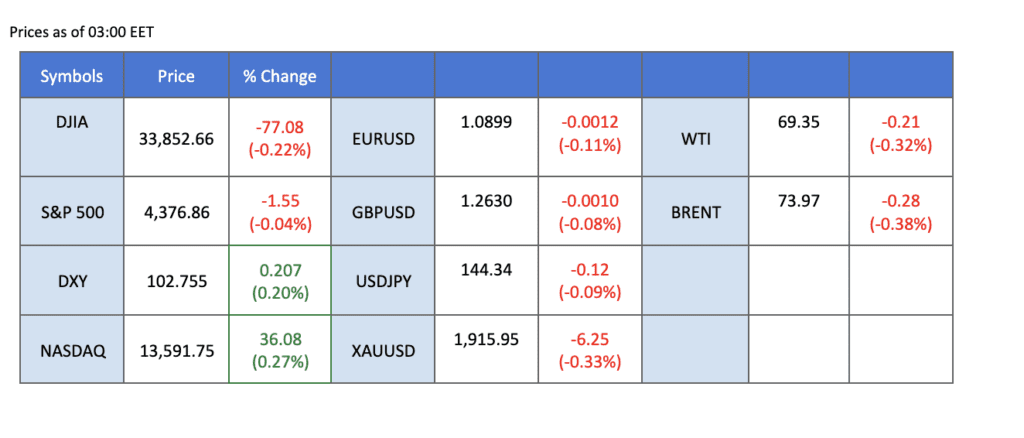

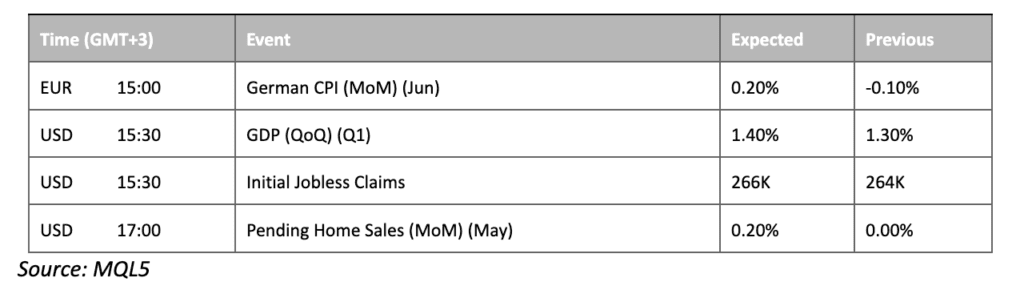

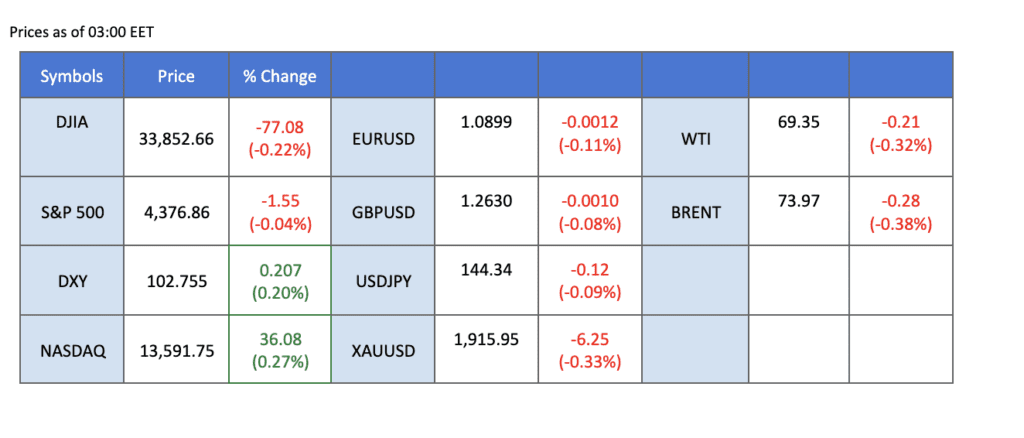

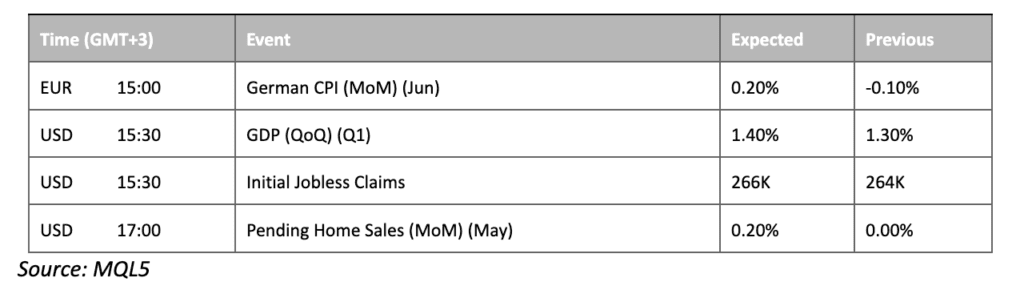

The global financial landscape is being marked by shifting monetary policies and concerns over inflationary pressures. Federal Reserve Chairman Jerome Powell’s hawkish tone has injected confidence in the US dollar, as market expectations for a rate hike in July have surged. Meanwhile, European Central Bank President Christine Lagarde has highlighted ongoing inflation concerns in EU countries, emphasizing the need for continued vigilance. Against this backdrop, US equity markets tread cautiously, grappling with the implications of potential rate hikes and balancing them against signs of a resurgent economy. Oil prices rebounded as US crude stockpiles saw a larger-than-expected draw, offsetting worries of slower economic growth due to potential interest rate hikes. Market participants eagerly await upcoming data releases, including US Initial Jobless Claims and the PCE index, to further assess trading signals and potential market movements.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (18%) VS 25 bps (82%)

The US Dollar surged after the Federal Reserve Chairman, Jerome Powell, signalled a more hawkish stance on monetary policy during a recent press conference. The central bank’s readiness to consider additional rate hikes at the upcoming July policy meeting has injected a renewed sense of confidence in the US dollar. Powell emphasised that future policy actions will be closely tied to the performance of the economy, signalling that the decision to hold rates steady in June was merely a temporary measure.

The dollar index is trading higher while currently testing the resistance level at 103.15. MACD has illustrated increasing bullish momentum, while RSI is at 59, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 103.15, 103.80

Support level: 102.50, 103.90

Market sentiment shifted significantly following Federal Reserve Chairman Jerome Powell’s hawkish comments, as market participants now assign an 80% probability to an interest rate increase of 25 basis points in July. With US inflation persistently surpassing the central bank’s 2% target, investors have braced themselves for further tightening measures. The anticipated rise in US interest rates presents a challenging landscape for safe-haven commodities, which is dragging down the appeal for the gold market.

Gold prices are trading lower while currently testing the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 42, suggesting the commodity might be traded higher as technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 1930.00, 1950.00

Support level: 1910.00, 1895.00

Euro slipped slightly amid technical correction, however in longer-term still remained bullish following the ECB unleashing their hawkish statements. Previously, European Central Bank President Christine Lagarde highlighted persistent inflationary pressures in EU countries. Despite a slight dip to 6.1% in May from the previous month’s 7%, headline inflation remains well above the ECB’s target of 2%. Lagarde emphasised that it is too early to declare victory over rising consumer prices, indicating a continued need for vigilance.

The EUR/USD is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 44, suggesting the pair might extend its losses after breakout since the RSI stays below the midline

Resistance level: 1.1027, 1.1088

Support level: 1.0892, 1.0848

The Australian Dollar continues to experience a bearish momentum as it faces pressure from both domestic and international factors. Following the release of Australian inflation data, which revealed a deceleration in the Monthly Consumer Price Index annual rate from 6.8% in April to 5.6% in May, below market expectations, market sentiment towards the Australian economy has turned more pessimistic.

The Aussie dollar is trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 36, suggesting the pair might enter oversold territory.

Resistance level: 0.6625, 0.6675

Support level: 0.6555, 0.6460

The Bank of Japan’s commitment to maintaining a low-interest rate environment has further widened the policy divergence between the central bank and its counterparts such as the Federal Reserve, the European Central Bank (ECB), and the Bank of England. While these central banks are signalling rate hikes to address inflationary pressures recently, the Bank of Japan’s stance reflects a more pessimistic outlook for the Japanese Yen.

USD/JPY is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 73, suggesting the pair might enter overbought territory.

Resistance level: 144.50, 148.70

Support level: 140.75, 137.35

Despite the Bank of England’s commitment to maintaining its rate hike path in line with other major central banks, the GBP/USD pair continues to experience a bearish trend. Investors have shifted their focus toward the Federal Reserve following the release of several positive economic data points from the United States. However, the trend remains uncertain as crucial data, including US Initial Jobless Claims and the Personal Consumption Expenditures (PCE) index, are yet to be released. Market participants should closely monitor these upcoming data releases for potential trading signals.

GBP/USD is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 32, suggesting the pair might enter oversold territory.

Resistance level: 1.2700, 1.2775

Support level: 1.2635, 1.2540

US equity markets have been treading cautiously, as investors grapple with the implications of potential rate hikes and the underlying economic momentum. With the Federal Reserve’s intentions now clearer, market participants face the challenging task of weighing the impact of tighter monetary policy against signs of a resurgent economy.

The Dow is trading flat while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 49, suggesting the index might continue to consolidate within a range since the RSI near the midline.

Resistance level: 34255.00, 34895.00

Support level: 33700.00, 33260.00

Oil prices surged notably, fueled by an unexpected decline in US crude stockpiles for the second consecutive week, surpassing market projections. Impressively, the US Energy Information Administration (EIA) reported an astonishing decline of -9.603 million barrels in US Crude Oil Inventories, greatly surpassing the market’s more conservative forecast of -1.757 million barrels

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 52, suggesting the commodity might extend its gains toward resistance level since the RSI stays above the midline.

Resistance level: 72.60, 74.90

Support level: 67.65, 64.50

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

The global financial landscape is being marked by shifting monetary policies and concerns over inflationary pressures. Federal Reserve Chairman Jerome Powell’s hawkish tone has injected confidence in the US dollar, as market expectations for a rate hike in July have surged. Meanwhile, European Central Bank President Christine Lagarde has highlighted ongoing inflation concerns in EU countries, emphasizing the need for continued vigilance. Against this backdrop, US equity markets tread cautiously, grappling with the implications of potential rate hikes and balancing them against signs of a resurgent economy. Oil prices rebounded as US crude stockpiles saw a larger-than-expected draw, offsetting worries of slower economic growth due to potential interest rate hikes. Market participants eagerly await upcoming data releases, including US Initial Jobless Claims and the PCE index, to further assess trading signals and potential market movements.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (18%) VS 25 bps (82%)

The US Dollar surged after the Federal Reserve Chairman, Jerome Powell, signalled a more hawkish stance on monetary policy during a recent press conference. The central bank’s readiness to consider additional rate hikes at the upcoming July policy meeting has injected a renewed sense of confidence in the US dollar. Powell emphasised that future policy actions will be closely tied to the performance of the economy, signalling that the decision to hold rates steady in June was merely a temporary measure.

The dollar index is trading higher while currently testing the resistance level at 103.15. MACD has illustrated increasing bullish momentum, while RSI is at 59, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 103.15, 103.80

Support level: 102.50, 103.90

Market sentiment shifted significantly following Federal Reserve Chairman Jerome Powell’s hawkish comments, as market participants now assign an 80% probability to an interest rate increase of 25 basis points in July. With US inflation persistently surpassing the central bank’s 2% target, investors have braced themselves for further tightening measures. The anticipated rise in US interest rates presents a challenging landscape for safe-haven commodities, which is dragging down the appeal for the gold market.

Gold prices are trading lower while currently testing the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 42, suggesting the commodity might be traded higher as technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 1930.00, 1950.00

Support level: 1910.00, 1895.00

Euro slipped slightly amid technical correction, however in longer-term still remained bullish following the ECB unleashing their hawkish statements. Previously, European Central Bank President Christine Lagarde highlighted persistent inflationary pressures in EU countries. Despite a slight dip to 6.1% in May from the previous month’s 7%, headline inflation remains well above the ECB’s target of 2%. Lagarde emphasised that it is too early to declare victory over rising consumer prices, indicating a continued need for vigilance.

The EUR/USD is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 44, suggesting the pair might extend its losses after breakout since the RSI stays below the midline

Resistance level: 1.1027, 1.1088

Support level: 1.0892, 1.0848

The Australian Dollar continues to experience a bearish momentum as it faces pressure from both domestic and international factors. Following the release of Australian inflation data, which revealed a deceleration in the Monthly Consumer Price Index annual rate from 6.8% in April to 5.6% in May, below market expectations, market sentiment towards the Australian economy has turned more pessimistic.

The Aussie dollar is trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 36, suggesting the pair might enter oversold territory.

Resistance level: 0.6625, 0.6675

Support level: 0.6555, 0.6460

The Bank of Japan’s commitment to maintaining a low-interest rate environment has further widened the policy divergence between the central bank and its counterparts such as the Federal Reserve, the European Central Bank (ECB), and the Bank of England. While these central banks are signalling rate hikes to address inflationary pressures recently, the Bank of Japan’s stance reflects a more pessimistic outlook for the Japanese Yen.

USD/JPY is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 73, suggesting the pair might enter overbought territory.

Resistance level: 144.50, 148.70

Support level: 140.75, 137.35

Despite the Bank of England’s commitment to maintaining its rate hike path in line with other major central banks, the GBP/USD pair continues to experience a bearish trend. Investors have shifted their focus toward the Federal Reserve following the release of several positive economic data points from the United States. However, the trend remains uncertain as crucial data, including US Initial Jobless Claims and the Personal Consumption Expenditures (PCE) index, are yet to be released. Market participants should closely monitor these upcoming data releases for potential trading signals.

GBP/USD is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 32, suggesting the pair might enter oversold territory.

Resistance level: 1.2700, 1.2775

Support level: 1.2635, 1.2540

US equity markets have been treading cautiously, as investors grapple with the implications of potential rate hikes and the underlying economic momentum. With the Federal Reserve’s intentions now clearer, market participants face the challenging task of weighing the impact of tighter monetary policy against signs of a resurgent economy.

The Dow is trading flat while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 49, suggesting the index might continue to consolidate within a range since the RSI near the midline.

Resistance level: 34255.00, 34895.00

Support level: 33700.00, 33260.00

Oil prices surged notably, fueled by an unexpected decline in US crude stockpiles for the second consecutive week, surpassing market projections. Impressively, the US Energy Information Administration (EIA) reported an astonishing decline of -9.603 million barrels in US Crude Oil Inventories, greatly surpassing the market’s more conservative forecast of -1.757 million barrels

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 52, suggesting the commodity might extend its gains toward resistance level since the RSI stays above the midline.

Resistance level: 72.60, 74.90

Support level: 67.65, 64.50

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.