-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

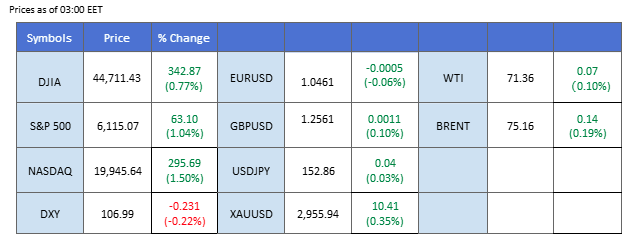

Market Summary

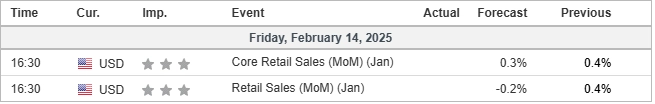

The U.S. dollar extended its decline, slipping to a three-week low despite Wednesday’s hotter-than-expected CPI reading and stronger-than-anticipated Initial Jobless Claims data. Typically, such figures would bolster the greenback, but investor confidence remains shaky as concerns over the U.S. economy mount. The nation’s rising debt levels and the Trump administration’s aggressive trade stance—particularly its latest tariff threats against BRICS member states—are fueling uncertainty.

The market’s risk aversion has driven a shift toward safe-haven assets, with gold surging over 4.5% in February. Meanwhile, the Japanese yen has gained traction as an alternative haven, sending USD/JPY down more than 1% in the last session. If the yen continues to strengthen, the pair could remain under pressure. Investors will closely watch the U.S. Retail Sales report, which could influence the dollar’s trajectory.

In the crypto space, BTC and ETH are showing signs of stabilizing, with selling pressure easing. If risk appetite in the market improves, both cryptocurrencies could stage a bullish reversal in the near term.

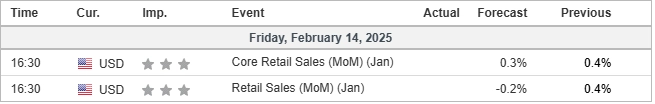

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98%) VS -25 bps (2%)

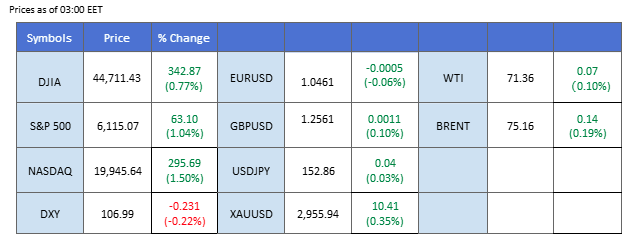

Market Overview

(MT4 System Time)

Source: MQL5

Market Movements

The Dollar Index fell significantly as Trump’s aggressive tariff plans against major economies raised concerns over the US economic outlook. The US President ordered his administration to explore reciprocal tariffs on trading partners, heightening fears of an escalating global trade war. Adding to market anxiety, Trump issued a warning to BRICS nations, stating they could face 100% tariffs if they attempt to establish their own currency. The BRICS bloc—Brazil, Russia, India, China, and expanding members—has been pushing for de-dollarization, posing long-term risks to global dollar demand.

The Dollar Index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 31, suggesting the dollar might enter oversold territory.

Resistance level: 107.95, 108.90

Support level: 107.05, 106.45

Gold extended its gains, fueled by rising trade uncertainties and weaker dollar momentum. Trump’s tariff escalation dampened risk appetite, boosting safe-haven demand for gold. Additionally, the depreciation of the dollar provided further support for dollar-denominated gold.

Gold prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 64, suggesting the commodity might experience technical correction since the RSI retreated from overbought territory.

Resistance level: 2935.00, 2950.00

Support level: 2915.00, 2880.00

The British pound surged after the UK posted better-than-expected GDP growth. According to the Office for National Statistics, UK GDP jumped to 1.4%, exceeding market expectations of 1.1% and up from the previous 1.0% reading. The strong economic performance reinforced confidence in the pound, pushing GBP/USD higher.

GBP/USD is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 65, suggesting the pair might extend its gains since the RSI stays above the midline.

Resistance level: 1.2615, 1.2725

Support level: 1.2515, 1.2390

The EUR/USD pair is riding strong bullish momentum, reaching its highest level in three weeks. Despite the ECB’s 25 bps rate cut this month, the move was widely anticipated and had already been priced in by the market. Instead, the euro found support from last week’s hotter-than-expected CPI reading, which helped ease concerns about further aggressive rate cuts from the central bank. Euro traders will closely watch the Eurozone GDP reading and job data, which could further shape sentiment on the euro’s strength.

EUR/USD has formed a long-term higher-high price pattern, suggesting a bullish bias for the pair. If the pair is able to break above its immediate resistance level at 1.0460, it may be a solid bullish signal. The RSI and the MACD have been moving upward, suggesting that the pair’s bullish momentum has been gaining.

Resistance level: 1.0595, 1.0688

Support level: 1.0353, 1.0260

USD/JPY declined as the dollar weakened sharply amid concerns over US economic stability and escalating trade tensions. Trump’s tariff threats against BRICS nations fueled de-dollarization fears, further dampening dollar demand. Meanwhile, the Japanese yen remained strong, supported by stable inflation and the Bank of Japan’s hawkish monetary policy stance.

USD/JPY is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 47, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 154.35, 155.35

Support level: 152.50, 151.30

The Hang Seng Index erased the 700-point gain from the previous session but swiftly shrugged off the technical correction, resuming its strong bullish rally in today’s session. The index is riding an extremely strong upward momentum, fueled by renewed interest in Chinese tech stocks, particularly after DeepSeek’s debut in mid-January. Adding to the optimism, the Chinese government’s firm stance against U.S. tariff threats has reassured investors, further bolstering market confidence.

The HSI has gained more than 5% this week to its highest level since last October, suggesting a bullish bias for the index. The RSI remains in the overbought zone, while the MACD continues to edge higher, suggesting that the bullish momentum has been gaining.

Resistance level: 22700.00, 23550.00

Support level: 21850.00, 21200.00

Oil prices rebounded after recent sharp losses, supported by bargain buying and technical correction. Earlier, crude oil prices had dropped significantly due to high inventory levels and potential ceasefire talks between Russia and Ukraine, which could minimize supply disruptions and pressure prices further.

Crude oil prices are trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 45, suggesting the commodity might extend its gains since the RSI rebounded from oversold territory.

Resistance level: 72.55, 75.05

Support level: 70.35, 68.45

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Market Summary

The U.S. dollar extended its decline, slipping to a three-week low despite Wednesday’s hotter-than-expected CPI reading and stronger-than-anticipated Initial Jobless Claims data. Typically, such figures would bolster the greenback, but investor confidence remains shaky as concerns over the U.S. economy mount. The nation’s rising debt levels and the Trump administration’s aggressive trade stance—particularly its latest tariff threats against BRICS member states—are fueling uncertainty.

The market’s risk aversion has driven a shift toward safe-haven assets, with gold surging over 4.5% in February. Meanwhile, the Japanese yen has gained traction as an alternative haven, sending USD/JPY down more than 1% in the last session. If the yen continues to strengthen, the pair could remain under pressure. Investors will closely watch the U.S. Retail Sales report, which could influence the dollar’s trajectory.

In the crypto space, BTC and ETH are showing signs of stabilizing, with selling pressure easing. If risk appetite in the market improves, both cryptocurrencies could stage a bullish reversal in the near term.

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98%) VS -25 bps (2%)

Market Overview

(MT4 System Time)

Source: MQL5

Market Movements

The Dollar Index fell significantly as Trump’s aggressive tariff plans against major economies raised concerns over the US economic outlook. The US President ordered his administration to explore reciprocal tariffs on trading partners, heightening fears of an escalating global trade war. Adding to market anxiety, Trump issued a warning to BRICS nations, stating they could face 100% tariffs if they attempt to establish their own currency. The BRICS bloc—Brazil, Russia, India, China, and expanding members—has been pushing for de-dollarization, posing long-term risks to global dollar demand.

The Dollar Index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 31, suggesting the dollar might enter oversold territory.

Resistance level: 107.95, 108.90

Support level: 107.05, 106.45

Gold extended its gains, fueled by rising trade uncertainties and weaker dollar momentum. Trump’s tariff escalation dampened risk appetite, boosting safe-haven demand for gold. Additionally, the depreciation of the dollar provided further support for dollar-denominated gold.

Gold prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 64, suggesting the commodity might experience technical correction since the RSI retreated from overbought territory.

Resistance level: 2935.00, 2950.00

Support level: 2915.00, 2880.00

The British pound surged after the UK posted better-than-expected GDP growth. According to the Office for National Statistics, UK GDP jumped to 1.4%, exceeding market expectations of 1.1% and up from the previous 1.0% reading. The strong economic performance reinforced confidence in the pound, pushing GBP/USD higher.

GBP/USD is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 65, suggesting the pair might extend its gains since the RSI stays above the midline.

Resistance level: 1.2615, 1.2725

Support level: 1.2515, 1.2390

The EUR/USD pair is riding strong bullish momentum, reaching its highest level in three weeks. Despite the ECB’s 25 bps rate cut this month, the move was widely anticipated and had already been priced in by the market. Instead, the euro found support from last week’s hotter-than-expected CPI reading, which helped ease concerns about further aggressive rate cuts from the central bank. Euro traders will closely watch the Eurozone GDP reading and job data, which could further shape sentiment on the euro’s strength.

EUR/USD has formed a long-term higher-high price pattern, suggesting a bullish bias for the pair. If the pair is able to break above its immediate resistance level at 1.0460, it may be a solid bullish signal. The RSI and the MACD have been moving upward, suggesting that the pair’s bullish momentum has been gaining.

Resistance level: 1.0595, 1.0688

Support level: 1.0353, 1.0260

USD/JPY declined as the dollar weakened sharply amid concerns over US economic stability and escalating trade tensions. Trump’s tariff threats against BRICS nations fueled de-dollarization fears, further dampening dollar demand. Meanwhile, the Japanese yen remained strong, supported by stable inflation and the Bank of Japan’s hawkish monetary policy stance.

USD/JPY is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 47, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 154.35, 155.35

Support level: 152.50, 151.30

The Hang Seng Index erased the 700-point gain from the previous session but swiftly shrugged off the technical correction, resuming its strong bullish rally in today’s session. The index is riding an extremely strong upward momentum, fueled by renewed interest in Chinese tech stocks, particularly after DeepSeek’s debut in mid-January. Adding to the optimism, the Chinese government’s firm stance against U.S. tariff threats has reassured investors, further bolstering market confidence.

The HSI has gained more than 5% this week to its highest level since last October, suggesting a bullish bias for the index. The RSI remains in the overbought zone, while the MACD continues to edge higher, suggesting that the bullish momentum has been gaining.

Resistance level: 22700.00, 23550.00

Support level: 21850.00, 21200.00

Oil prices rebounded after recent sharp losses, supported by bargain buying and technical correction. Earlier, crude oil prices had dropped significantly due to high inventory levels and potential ceasefire talks between Russia and Ukraine, which could minimize supply disruptions and pressure prices further.

Crude oil prices are trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 45, suggesting the commodity might extend its gains since the RSI rebounded from oversold territory.

Resistance level: 72.55, 75.05

Support level: 70.35, 68.45

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.