-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

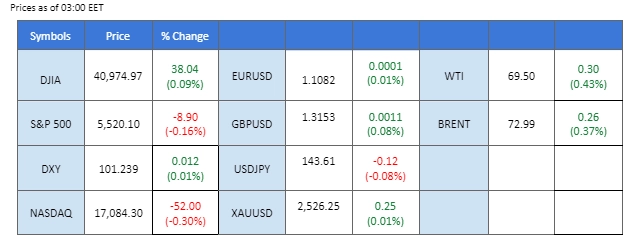

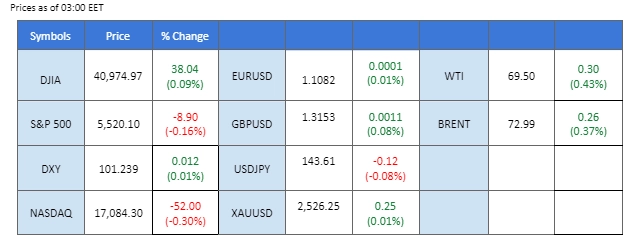

Market Summary

The U.S. dollar lost strength after reaching a two-week high in the Dollar Index (DXY). The release of the Fed’s Beige Book indicated a decline in economic activity, a softening labour market, and moderating wage growth, which fueled speculation of a potential Fed rate cut. This dampened the dollar’s momentum, as traders now await Friday’s NFP report, which could be pivotal for the Fed’s interest rate decision on September 18.

Meanwhile, the Bank of Canada (BoC) delivered a 25 bps rate cut as expected, with the Canadian dollar remaining stable since the move was already priced in. The Japanese yen emerged as one of the strongest currencies, bolstered by expectations of further rate hikes from the Bank of Japan, pushing the yen to its strongest level against the dollar in a month.

In the commodities market, gold prices benefited from the weaker dollar, rising toward the $2,500 mark, while oil prices remained subdued due to weak demand prospects.

Current rate hike bets on 18th September Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (32.5%) VS -25 bps (67.5%)

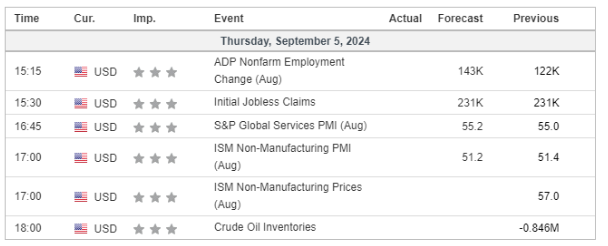

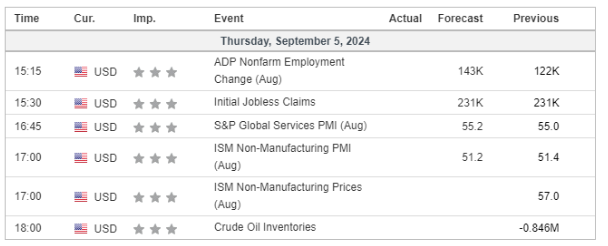

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index retreated after testing resistance levels, with market focus shifting to the upcoming US Nonfarm Payrolls and Unemployment report. Recent disappointing JOLTS Job Openings data dialed down optimism about US economic progress. The report showed job openings fell to 7.673M, below expectations of 8.090M. This has increased the probability of a 50-basis points rate cut to 48%, up from last week’s 36%, diminishing the dollar’s appeal.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 35, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 101.70, 102.35

Support level: 100.55, 99.70

With expectations of aggressive rate cuts from the Federal Reserve growing stronger, gold prices rebounded after hitting a strong support level. However, the overall trend for gold remains uncertain as traders await more clarity from the upcoming US jobs reports, including Nonfarm Payrolls and Unemployment rate.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 49, suggesting the commodity might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 2505.00, 2525.00

Support level: 2480.00, 2450.00

The GBP/USD pair has rebounded to its previous liquidity zone, with the Pound Sterling gaining strength while the U.S. dollar softened in the last session. The UK PMI readings exceeded market expectations, indicating a stronger-than-anticipated economic performance, which provided support for the pound. Meanwhile, the U.S. dollar faced pressure following the release of the Fed’s Beige Book, which highlighted signs of economic stagnation in the U.S. This shift in sentiment has weighed on the dollar, contributing to the pair’s recent recovery.

GBP/USD has eased from its bearish trend as the pair has returned to the liquidity zone. The RSI has climbed to above 50, while the MACD has a golden cross below the zero line, indicating that the bearish momentum is diminishing.

Resistance level: 1.3220, 1.3280

Support level: 1.3065, 1.2980

The Euro gained against the U.S. dollar in the last session, breaking above its short-term resistance level, signalling a potential trend reversal. Despite disappointing PMI readings, the stronger-than-expected eurozone PPI data suggests persistent inflationary pressures, which could lead the(ECB to maintain its current interest rates for an extended period, supporting the Euro’s strength. Traders are now focused on today’s U.S. economic indicators, particularly the ADP Nonfarm Employment Change and Initial Jobless Claims, which are expected to influence the direction of the EUR/USD pair in the near term.

EUR/USD has formed a double bottom and broken above its short-term resistance level, suggesting a potential trend reversal for the pair. The RSI has gained to above the 50 level, while the MACD crosses at the bottom and is approaching the zero line, suggesting that bullish momentum may be gaining.

Resistance level: 1.1106, 1.1170

Support level: 1.1040, 1.0985

The US equity market slipped as global risk appetite remained weak, prompting investors to avoid high-risk assets. The expectation of an aggressive 50 basis points rate cut from the Fed widened the yield gap between Japan and the US, boosting the Japanese yen. This raised concerns over carry trade risks, though analysts expect a less severe impact on stock markets compared to past instances like the Nikkei slump. Investors remain cautious amidst these risks.

Nasdaq is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 36, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 20015.00, 20705.00

Support level: 18890.00, 17865.00

The USD/CAD pair, after rebounding to the fair value gap, dropped by more than 50 pips in the last session, continuing its long-term downtrend. The Bank of Canada’s (BoC) expected 25 bps rate cut had a limited impact on the Canadian dollar, as it was already priced in by the market. Conversely, the U.S. dollar was weighed down by the Fed’s Beige Book, which indicated signs of economic contraction in the U.S., further contributing to the pair’s decline.

The pair rebounded to the fair-value gap and is now retracing and may continue to trade with its long-term bearish trend. The MACD had a deadly cross on top, while the RSI also declined from near the overbought zone. If the pair declines to below the 1.3480 level, this may be a solid bearish signal for the pair.

Resistance level: 1.3600, 1.3685

Support level: 1.3435, 1.3355

The USD/JPY pair has declined to its lowest level in a month as the Japanese yen strengthened while the U.S. dollar softened in the last session. The yen’s strength was bolstered by expectations of continued monetary tightening from the Bank of Japan (BoJ). In contrast, the U.S. dollar was pressured by market speculation of an outsized rate cut by the Federal Reserve, driven by worse-than-expected economic performance. This divergence between the monetary policies of the BoJ and the Fed may contribute to further downside pressure on the USD/JPY pair.

The USD/JPY pair was rejected at the strong liquidity zone at near 147.00 and has declined by more than 3% in the last two sessions, suggesting a bearish bias for the pair. The RSI is about to drop into the oversold zone, while the MACD has a deadly cross and is on the brink of breaking below the zero line, suggesting a bearish momentum is forming.

Resistance level: 146.00, 149.20

Support level: 141.40, 138.90

Oil prices continued to decline, driven by expectations of an OPEC+ output increase next month and easing geopolitical tensions in Libya. Concerns over weak demand growth, exacerbated by soft US Manufacturing data and bearish job reports, also weighed on oil. However, losses were limited by a bullish API report showing a sharp decline in US crude inventories by 7.4M, well above expectations of a 0.900M drop.

Oil prices are trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 24, suggesting the commodity might enter oversold territory.

Resistance level: 71.80, 74.30

Support level: 68.25, 65.80

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Market Summary

The U.S. dollar lost strength after reaching a two-week high in the Dollar Index (DXY). The release of the Fed’s Beige Book indicated a decline in economic activity, a softening labour market, and moderating wage growth, which fueled speculation of a potential Fed rate cut. This dampened the dollar’s momentum, as traders now await Friday’s NFP report, which could be pivotal for the Fed’s interest rate decision on September 18.

Meanwhile, the Bank of Canada (BoC) delivered a 25 bps rate cut as expected, with the Canadian dollar remaining stable since the move was already priced in. The Japanese yen emerged as one of the strongest currencies, bolstered by expectations of further rate hikes from the Bank of Japan, pushing the yen to its strongest level against the dollar in a month.

In the commodities market, gold prices benefited from the weaker dollar, rising toward the $2,500 mark, while oil prices remained subdued due to weak demand prospects.

Current rate hike bets on 18th September Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (32.5%) VS -25 bps (67.5%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index retreated after testing resistance levels, with market focus shifting to the upcoming US Nonfarm Payrolls and Unemployment report. Recent disappointing JOLTS Job Openings data dialed down optimism about US economic progress. The report showed job openings fell to 7.673M, below expectations of 8.090M. This has increased the probability of a 50-basis points rate cut to 48%, up from last week’s 36%, diminishing the dollar’s appeal.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 35, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 101.70, 102.35

Support level: 100.55, 99.70

With expectations of aggressive rate cuts from the Federal Reserve growing stronger, gold prices rebounded after hitting a strong support level. However, the overall trend for gold remains uncertain as traders await more clarity from the upcoming US jobs reports, including Nonfarm Payrolls and Unemployment rate.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 49, suggesting the commodity might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 2505.00, 2525.00

Support level: 2480.00, 2450.00

The GBP/USD pair has rebounded to its previous liquidity zone, with the Pound Sterling gaining strength while the U.S. dollar softened in the last session. The UK PMI readings exceeded market expectations, indicating a stronger-than-anticipated economic performance, which provided support for the pound. Meanwhile, the U.S. dollar faced pressure following the release of the Fed’s Beige Book, which highlighted signs of economic stagnation in the U.S. This shift in sentiment has weighed on the dollar, contributing to the pair’s recent recovery.

GBP/USD has eased from its bearish trend as the pair has returned to the liquidity zone. The RSI has climbed to above 50, while the MACD has a golden cross below the zero line, indicating that the bearish momentum is diminishing.

Resistance level: 1.3220, 1.3280

Support level: 1.3065, 1.2980

The Euro gained against the U.S. dollar in the last session, breaking above its short-term resistance level, signalling a potential trend reversal. Despite disappointing PMI readings, the stronger-than-expected eurozone PPI data suggests persistent inflationary pressures, which could lead the(ECB to maintain its current interest rates for an extended period, supporting the Euro’s strength. Traders are now focused on today’s U.S. economic indicators, particularly the ADP Nonfarm Employment Change and Initial Jobless Claims, which are expected to influence the direction of the EUR/USD pair in the near term.

EUR/USD has formed a double bottom and broken above its short-term resistance level, suggesting a potential trend reversal for the pair. The RSI has gained to above the 50 level, while the MACD crosses at the bottom and is approaching the zero line, suggesting that bullish momentum may be gaining.

Resistance level: 1.1106, 1.1170

Support level: 1.1040, 1.0985

The US equity market slipped as global risk appetite remained weak, prompting investors to avoid high-risk assets. The expectation of an aggressive 50 basis points rate cut from the Fed widened the yield gap between Japan and the US, boosting the Japanese yen. This raised concerns over carry trade risks, though analysts expect a less severe impact on stock markets compared to past instances like the Nikkei slump. Investors remain cautious amidst these risks.

Nasdaq is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 36, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 20015.00, 20705.00

Support level: 18890.00, 17865.00

The USD/CAD pair, after rebounding to the fair value gap, dropped by more than 50 pips in the last session, continuing its long-term downtrend. The Bank of Canada’s (BoC) expected 25 bps rate cut had a limited impact on the Canadian dollar, as it was already priced in by the market. Conversely, the U.S. dollar was weighed down by the Fed’s Beige Book, which indicated signs of economic contraction in the U.S., further contributing to the pair’s decline.

The pair rebounded to the fair-value gap and is now retracing and may continue to trade with its long-term bearish trend. The MACD had a deadly cross on top, while the RSI also declined from near the overbought zone. If the pair declines to below the 1.3480 level, this may be a solid bearish signal for the pair.

Resistance level: 1.3600, 1.3685

Support level: 1.3435, 1.3355

The USD/JPY pair has declined to its lowest level in a month as the Japanese yen strengthened while the U.S. dollar softened in the last session. The yen’s strength was bolstered by expectations of continued monetary tightening from the Bank of Japan (BoJ). In contrast, the U.S. dollar was pressured by market speculation of an outsized rate cut by the Federal Reserve, driven by worse-than-expected economic performance. This divergence between the monetary policies of the BoJ and the Fed may contribute to further downside pressure on the USD/JPY pair.

The USD/JPY pair was rejected at the strong liquidity zone at near 147.00 and has declined by more than 3% in the last two sessions, suggesting a bearish bias for the pair. The RSI is about to drop into the oversold zone, while the MACD has a deadly cross and is on the brink of breaking below the zero line, suggesting a bearish momentum is forming.

Resistance level: 146.00, 149.20

Support level: 141.40, 138.90

Oil prices continued to decline, driven by expectations of an OPEC+ output increase next month and easing geopolitical tensions in Libya. Concerns over weak demand growth, exacerbated by soft US Manufacturing data and bearish job reports, also weighed on oil. However, losses were limited by a bullish API report showing a sharp decline in US crude inventories by 7.4M, well above expectations of a 0.900M drop.

Oil prices are trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 24, suggesting the commodity might enter oversold territory.

Resistance level: 71.80, 74.30

Support level: 68.25, 65.80

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.