-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

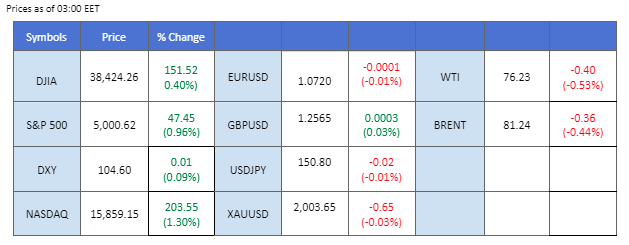

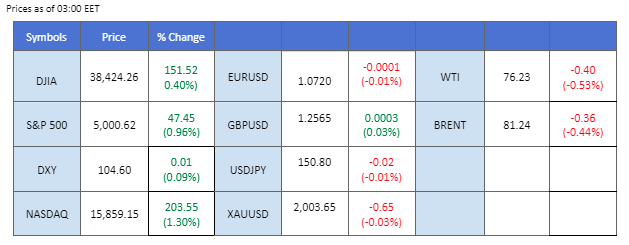

The Dollar Index (DXY) experienced a moderation in its bullish momentum due to prevailing profit-taking sentiment in the market.

The Dollar Index (DXY), initially bolstered by a positive Consumer Price Index (CPI) reading, experienced a moderation in its bullish momentum due to prevailing profit-taking sentiment in the market. Nevertheless, the steadfastly hawkish stance maintained by Federal Reserve officials implies the potential for the dollar to sustain its robust bullish trajectory, contributing to the diminishing expectations of a rate cut in May. Market participants are closely monitoring upcoming economic indicators, with today’s U.S. Retail Sales figures and tomorrow’s Producer Price Index (PPI) reading serve as pivotal events to discern the future trajectory of the Dollar Index.

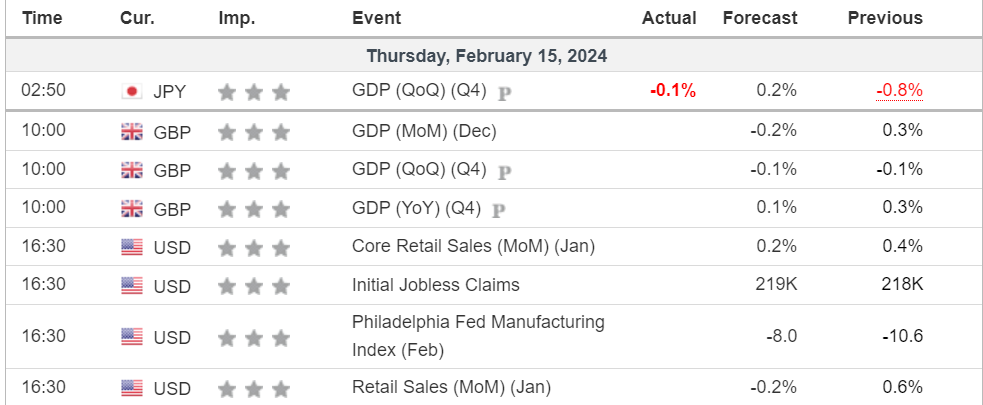

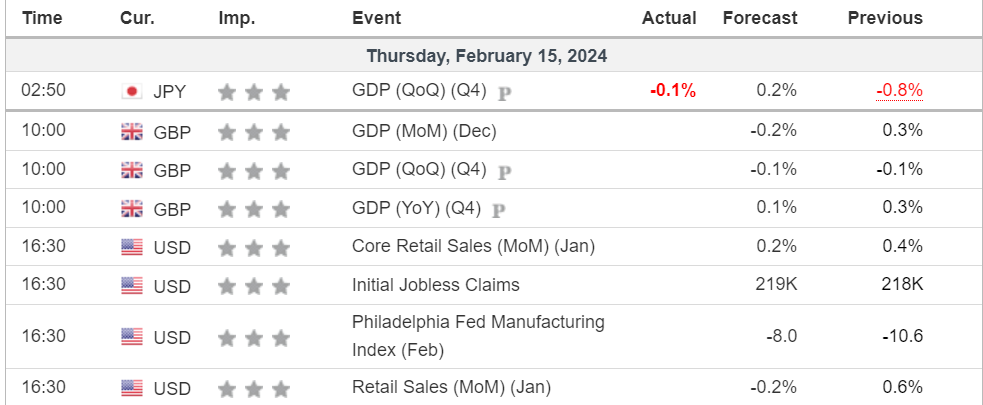

In a separate development, Japan’s recently released Gross Domestic Product (GDP) figures exceeded the previous reading at -0.1%, providing support for the softening Japanese Yen. There is also market speculation for a Japanese authority intervention after the USD/JPY pair approached the critical 150 mark.

Conversely, oil prices faced further downturns following the impact of a strengthened U.S. dollar. The U.S. crude stockpile data revealed a significant increase, surpassing market consensus and rising above 12 million barrels, exacerbating the pressures on oil prices.

Current rate hike bets on 20th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (89.5%) VS -25 bps (10.5%)

(MT4 System Time)

Source: MQL5

The Dollar Index has experienced a moderation in its bullish momentum, despite the impetus from the robust Consumer Price Index (CPI) unveiled on Tuesday. The market witnessed a trigger of profit-taking sentiment just before reaching the significant threshold of $105. Market participants are awaiting the Retail Sales data scheduled for later today, as well as the Producer Price Index (PPI) data set to be released tomorrow, as potential sources for driving renewed momentum in the strong dollar narrative.

The Dollar Index has eased from its bullish trend from the previous session but remains in an uptrend trajectory. The RSI has dropped out of the overbought zone while the MACD is on the brink of crossing at the above, suggesting the bullish momentum is easing slightly.

Resistance level: 105.70, 107.05

Support level: 104.60, 103.80

Gold prices found support around the $1993 level after breaking below the critical psychological threshold of $2000. The market experienced a shift in risk sentiment, driven by heightened geopolitical uncertainty in the Middle East. The Israeli Prime Minister’s decision to halt ceasefire talks with Hamas contributed to a positive outlook for gold prices.

Gold prices eased by more than 1.3% in the previous session, but the bearish momentum eased after the gold prices approached their crucial support level at the $2000 mark. The RSI remains hovering in the oversold zone, while the MACD moving lower suggests the bearish momentum remains strong.

Resistance level: 2020.00, 2050.00

Support level: 1968.00, 1933.00

The GBP/USD currency pair is presently navigating within a broad price consolidation range, finding support around the 1.2530 levels. The pair’s movement is currently influenced by several economic factors, including upcoming key data releases. Among these, the UK’s Gross Domestic Product (GDP) data and the U.S. Retail Sales figures, both scheduled for today, are anticipated to exert a direct impact on the pair.

GBPUSD remains trading in a bearish momentum but is currently supported at 1.2530 levels. The RSI hovering in the lower zone while the MACD failed to break above the zero line suggests the pair remain trading with bearish momentum.

Resistance level: 1.2635, 1.2710

Support level:1.2530, 1.2435

The EUR/USD pair is persistently characterised by a bearish trend, having descended to its lowest levels since last November. The Eurozone’s Gross Domestic Product (GDP) was released yesterday meeting market expectations at 0.1%, adding that the easing of the U.S. dollar allowed the pair to register a minor technical rebound in the preceding session.

EUR/USD is trading with strong bearish momentum despite recording a minor technical rebound yesterday. The RSI remains in the lower zone while the MACD remains flowing below the zero line, suggesting the pair is trading with strong bearish momentum.

Resistance level: 1.0775, 1.0865

Support level: 1.0700, 1.0630

The Australian dollar experienced a technical rebound, primarily attributed to the easing of the U.S. dollar’s bullish momentum. However, the Australian job data presented a contrasting picture, revealing a downbeat scenario. The unemployment rate in Australia climbed above 4%, marking the first instance since March 2022. This development has exerted pressure on the Australian dollar, raising concerns that the Reserve Bank of Australia (RBA) might contemplate a rate cut as a preventative measure to mitigate the risk of an economic recession.

The pair continue to trade in a bearish trajectory despite having a technical rebound in the last session. The RSI remains flowing in the lower region while the MACD hovering below the zero line suggests the pair remain trading with bearish momentum.

Resistance level: 0.6535, 0.6617

Support level: 0.6410, 0.6300

The USD/JPY pair has surpassed a significant threshold, breaking above the crucial level of 150. This upward movement is attributed to the ongoing strength of the U.S. dollar, coupled with lacklustre economic data from Japan, which has impeded the strength of the Yen. The breach of the critical 150 mark has triggered market speculation about potential intervention by Japanese authorities to bolster the Yen. Such intervention could lead to a reversal in the pair, causing a decline as authorities attempt to influence the currency’s value.

The pair has eased from its bullish momentum after breaking above its crucial level at 150. The RSI dropped out from the overbought zone but remained at a higher level, while the MACD formed a higher high, suggesting the bullish momentum remains strong.

Resistance level: 151.85, 154.90

Support level: 149.50, 147.60

Oil prices encountered formidable resistance at the $78 mark, and the bearish momentum intensified with the emergence of a new negative factor. The impact of the strengthened dollar, which had already exerted pressure on oil prices in the previous session, was further exacerbated by a substantial increase in U.S. stockpiles. The latest data reveals a significant rise to more than 12 million barrels, marking a stark contrast to the previous reading of 5.5 million barrels. This unexpected surge in stockpiles has added to the downward pressure on oil prices.

Oil prices retraced their bullish momentum and faced strong resistance at the 78.65 level. The RSI eased sharply from near the overbought zone while the MACD has also eased from the above, suggesting the bullish momentum has declined.

Resistance level: 78.65, 81.20

Support level:75.20, 71.35

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

The Dollar Index (DXY) experienced a moderation in its bullish momentum due to prevailing profit-taking sentiment in the market.

The Dollar Index (DXY), initially bolstered by a positive Consumer Price Index (CPI) reading, experienced a moderation in its bullish momentum due to prevailing profit-taking sentiment in the market. Nevertheless, the steadfastly hawkish stance maintained by Federal Reserve officials implies the potential for the dollar to sustain its robust bullish trajectory, contributing to the diminishing expectations of a rate cut in May. Market participants are closely monitoring upcoming economic indicators, with today’s U.S. Retail Sales figures and tomorrow’s Producer Price Index (PPI) reading serve as pivotal events to discern the future trajectory of the Dollar Index.

In a separate development, Japan’s recently released Gross Domestic Product (GDP) figures exceeded the previous reading at -0.1%, providing support for the softening Japanese Yen. There is also market speculation for a Japanese authority intervention after the USD/JPY pair approached the critical 150 mark.

Conversely, oil prices faced further downturns following the impact of a strengthened U.S. dollar. The U.S. crude stockpile data revealed a significant increase, surpassing market consensus and rising above 12 million barrels, exacerbating the pressures on oil prices.

Current rate hike bets on 20th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (89.5%) VS -25 bps (10.5%)

(MT4 System Time)

Source: MQL5

The Dollar Index has experienced a moderation in its bullish momentum, despite the impetus from the robust Consumer Price Index (CPI) unveiled on Tuesday. The market witnessed a trigger of profit-taking sentiment just before reaching the significant threshold of $105. Market participants are awaiting the Retail Sales data scheduled for later today, as well as the Producer Price Index (PPI) data set to be released tomorrow, as potential sources for driving renewed momentum in the strong dollar narrative.

The Dollar Index has eased from its bullish trend from the previous session but remains in an uptrend trajectory. The RSI has dropped out of the overbought zone while the MACD is on the brink of crossing at the above, suggesting the bullish momentum is easing slightly.

Resistance level: 105.70, 107.05

Support level: 104.60, 103.80

Gold prices found support around the $1993 level after breaking below the critical psychological threshold of $2000. The market experienced a shift in risk sentiment, driven by heightened geopolitical uncertainty in the Middle East. The Israeli Prime Minister’s decision to halt ceasefire talks with Hamas contributed to a positive outlook for gold prices.

Gold prices eased by more than 1.3% in the previous session, but the bearish momentum eased after the gold prices approached their crucial support level at the $2000 mark. The RSI remains hovering in the oversold zone, while the MACD moving lower suggests the bearish momentum remains strong.

Resistance level: 2020.00, 2050.00

Support level: 1968.00, 1933.00

The GBP/USD currency pair is presently navigating within a broad price consolidation range, finding support around the 1.2530 levels. The pair’s movement is currently influenced by several economic factors, including upcoming key data releases. Among these, the UK’s Gross Domestic Product (GDP) data and the U.S. Retail Sales figures, both scheduled for today, are anticipated to exert a direct impact on the pair.

GBPUSD remains trading in a bearish momentum but is currently supported at 1.2530 levels. The RSI hovering in the lower zone while the MACD failed to break above the zero line suggests the pair remain trading with bearish momentum.

Resistance level: 1.2635, 1.2710

Support level:1.2530, 1.2435

The EUR/USD pair is persistently characterised by a bearish trend, having descended to its lowest levels since last November. The Eurozone’s Gross Domestic Product (GDP) was released yesterday meeting market expectations at 0.1%, adding that the easing of the U.S. dollar allowed the pair to register a minor technical rebound in the preceding session.

EUR/USD is trading with strong bearish momentum despite recording a minor technical rebound yesterday. The RSI remains in the lower zone while the MACD remains flowing below the zero line, suggesting the pair is trading with strong bearish momentum.

Resistance level: 1.0775, 1.0865

Support level: 1.0700, 1.0630

The Australian dollar experienced a technical rebound, primarily attributed to the easing of the U.S. dollar’s bullish momentum. However, the Australian job data presented a contrasting picture, revealing a downbeat scenario. The unemployment rate in Australia climbed above 4%, marking the first instance since March 2022. This development has exerted pressure on the Australian dollar, raising concerns that the Reserve Bank of Australia (RBA) might contemplate a rate cut as a preventative measure to mitigate the risk of an economic recession.

The pair continue to trade in a bearish trajectory despite having a technical rebound in the last session. The RSI remains flowing in the lower region while the MACD hovering below the zero line suggests the pair remain trading with bearish momentum.

Resistance level: 0.6535, 0.6617

Support level: 0.6410, 0.6300

The USD/JPY pair has surpassed a significant threshold, breaking above the crucial level of 150. This upward movement is attributed to the ongoing strength of the U.S. dollar, coupled with lacklustre economic data from Japan, which has impeded the strength of the Yen. The breach of the critical 150 mark has triggered market speculation about potential intervention by Japanese authorities to bolster the Yen. Such intervention could lead to a reversal in the pair, causing a decline as authorities attempt to influence the currency’s value.

The pair has eased from its bullish momentum after breaking above its crucial level at 150. The RSI dropped out from the overbought zone but remained at a higher level, while the MACD formed a higher high, suggesting the bullish momentum remains strong.

Resistance level: 151.85, 154.90

Support level: 149.50, 147.60

Oil prices encountered formidable resistance at the $78 mark, and the bearish momentum intensified with the emergence of a new negative factor. The impact of the strengthened dollar, which had already exerted pressure on oil prices in the previous session, was further exacerbated by a substantial increase in U.S. stockpiles. The latest data reveals a significant rise to more than 12 million barrels, marking a stark contrast to the previous reading of 5.5 million barrels. This unexpected surge in stockpiles has added to the downward pressure on oil prices.

Oil prices retraced their bullish momentum and faced strong resistance at the 78.65 level. The RSI eased sharply from near the overbought zone while the MACD has also eased from the above, suggesting the bullish momentum has declined.

Resistance level: 78.65, 81.20

Support level:75.20, 71.35

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.