-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

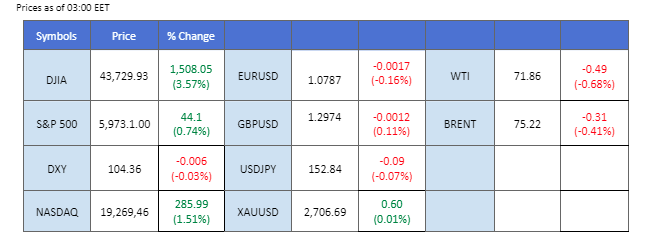

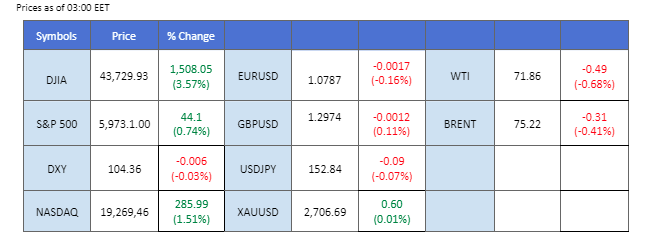

Market Summary

The market’s focus was on the Fed’s interest rate decision, which saw the U.S. central bank reduce rates by 25 basis points, in line with market expectations. This rate cut weighed on the dollar, causing the Dollar Index to decline to a critical level near 104.30. Similarly, the BoE also implemented its first rate cut in the post-pandemic era, signalling the end of the UK’s monetary tightening cycle. However, this widely anticipated move did not create significant turbulence for the Pound Sterling.

In reaction to the Fed’s easing stance, Wall Street, particularly the Nasdaq, was boosted, with most major tech stocks closing higher. In the commodities space, gold benefited from the softened dollar, rising by nearly 2% in the previous session. Oil prices, which have remained bullish since the beginning of the month, were further supported by the easing monetary policies from central banks, reaching monthly highs.

Current rate hike bets on 18th December Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (32.2%) VS -25 bps (67.8%)

(MT4 System Time)

N/A

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index took a hit following the Fed’s decision to implement a 25 bps rate cut yesterday, dropping to a critical level near the 104.30 mark. A break below this threshold could signal a potential shift in the index’s direction. Fundamentally, Fed Chair Jerome Powell’s dovish remarks indicated that the U.S. central bank remains committed to rate cuts aimed at sustaining economic growth and supporting a robust job market. This policy stance may contribute to a continued easing in dollar strength in the near term.

The Dollar Index retraced from its recent peak at close to the 105.50 mark; should the index fail to defend above the 104.30 mark, it may be seen as a bearish signal for the index. The RSI has declined to the 50 level while the MACD has a deadly cross at the top, suggesting a shift from the bullish momentum for the index.

Resistance level: 104.60, 105.17

Support level: 103.80, 103.05

Gold prices staged a technical rebound after experiencing a sharp decline in the previous session, supported by a softer dollar. The precious metal climbed to a critical resistance level around the $2,700 mark, where it is likely to encounter strong selling pressure. However, a sustained break above this level could signal a potential bullish reversal for gold, opening the door for further gains.

Gold prices rebounded from their support level near the 2660 mark. However, the bullish momentum is still lacking with the gold. The RSI remained below the 50 level while the MACD had crossed at the bottom, giving a neutral signal for the gold.

Resistance level: 2705.00, 2737.70

Support level: 2660.00, 2607.00

The GBP/USD pair remains below the key 1.3000 level, weighed down by the Bank of England’s recent monetary policy shift. The BoE’s 25-basis-point rate cut, while widely anticipated, had a limited immediate impact on the Pound. However, the central bank’s dovish pivot could gradually contribute to a softening in Pound Sterling’s strength in the near term as market sentiment adjusts to this policy stance.

GBP/USD did not reach its previous high from its technical rebound yesterday, suggesting a bearish bias for the pair. The RSI is hovering close to the 50 level while the MACD is flowing in between the zero line, giving the pair a neutral signal.

Resistance level: 1.3040. 1.3130

Support level: 1.2940, 1.2815

The EUR/USD pair experienced a technical rebound yesterday following the Fed’s rate cut, which weakened the dollar and provided support for the euro. Additionally, the euro gained momentum from a better-than-expected Retail Sales report. However, the rebound stalled at the 50% Fibonacci retracement level near the 1.0820 mark, indicating that the pair remains in a bearish trajectory as it struggles to sustain upward momentum.

The EUR/USD recorded a marginal gain yesterday, but the bearish momentum seems overwhelming and is weighing on the pair. The RSI remains below the 50 level while the MACD edges lower, suggesting the pair remain trading with excessive bearish momentum.

Resistance level: 1.0815, 1.0890

Support level: 1.0735, 1.0675

The AUD/USD pair formed a higher high in yesterday’s session, indicating a bullish bias for the pair. Following the BoE’s rate cut, the Reserve Bank of Australia (RBA) remains one of the few central banks maintaining a restrictive monetary policy, which has helped the Australian dollar trade strongly against its peers.

The AUD/USD edged higher yesterday and reached a new high in the recent sessions, suggesting a bullish bias for the pair. The RSI is close to the overbought zone, while the MACD edge is higher after breaking above the zero line, suggesting the bullish momentum is gaining.

Resistance level: 0.6730, 0.6785

Support level: 0.6610, 0.6550

The tech-heavy Nasdaq closed 1.50% higher in yesterday’s session, reaching a new all-time high, signalling a bullish bias for the index. The upbeat sentiment on Wall Street was fueled by the Fed’s dovish stance, as the central bank cut interest rates further, benefiting interest-rate-sensitive tech stocks.

Nasdaq reached an all-time high in the last session, suggesting a bullish bias for the index; the RSI is poised to break into the overbought zone while the MACD shows signs of rebounding from the zero line, suggesting the bullish momentum is gaining.

Resistance level: 21950.00, 23000.00

Support level: 20560.00, 19860.00

Oil prices continue to trade within an established uptrend channel, building on momentum since rebounding from recent lows earlier this month. A breakout above the next resistance level at $72.60 could signal further bullish potential for crude. The recent Fed rate cut, combined with the BoE’s first rate reduction, has provided additional support, as lower rates are anticipated to stimulate economic activity and potentially boost future oil demand.

The oil remains trading with an uptrend basis suggesting a bullish bias for the oil. The RSI is hovering above the 50 level while the MACD is flowing flat, suggesting the bullish momentum is easing.

Resistance level: 74.60, 77.00

Support level: 69.90, 68.45

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Market Summary

The market’s focus was on the Fed’s interest rate decision, which saw the U.S. central bank reduce rates by 25 basis points, in line with market expectations. This rate cut weighed on the dollar, causing the Dollar Index to decline to a critical level near 104.30. Similarly, the BoE also implemented its first rate cut in the post-pandemic era, signalling the end of the UK’s monetary tightening cycle. However, this widely anticipated move did not create significant turbulence for the Pound Sterling.

In reaction to the Fed’s easing stance, Wall Street, particularly the Nasdaq, was boosted, with most major tech stocks closing higher. In the commodities space, gold benefited from the softened dollar, rising by nearly 2% in the previous session. Oil prices, which have remained bullish since the beginning of the month, were further supported by the easing monetary policies from central banks, reaching monthly highs.

Current rate hike bets on 18th December Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (32.2%) VS -25 bps (67.8%)

(MT4 System Time)

N/A

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index took a hit following the Fed’s decision to implement a 25 bps rate cut yesterday, dropping to a critical level near the 104.30 mark. A break below this threshold could signal a potential shift in the index’s direction. Fundamentally, Fed Chair Jerome Powell’s dovish remarks indicated that the U.S. central bank remains committed to rate cuts aimed at sustaining economic growth and supporting a robust job market. This policy stance may contribute to a continued easing in dollar strength in the near term.

The Dollar Index retraced from its recent peak at close to the 105.50 mark; should the index fail to defend above the 104.30 mark, it may be seen as a bearish signal for the index. The RSI has declined to the 50 level while the MACD has a deadly cross at the top, suggesting a shift from the bullish momentum for the index.

Resistance level: 104.60, 105.17

Support level: 103.80, 103.05

Gold prices staged a technical rebound after experiencing a sharp decline in the previous session, supported by a softer dollar. The precious metal climbed to a critical resistance level around the $2,700 mark, where it is likely to encounter strong selling pressure. However, a sustained break above this level could signal a potential bullish reversal for gold, opening the door for further gains.

Gold prices rebounded from their support level near the 2660 mark. However, the bullish momentum is still lacking with the gold. The RSI remained below the 50 level while the MACD had crossed at the bottom, giving a neutral signal for the gold.

Resistance level: 2705.00, 2737.70

Support level: 2660.00, 2607.00

The GBP/USD pair remains below the key 1.3000 level, weighed down by the Bank of England’s recent monetary policy shift. The BoE’s 25-basis-point rate cut, while widely anticipated, had a limited immediate impact on the Pound. However, the central bank’s dovish pivot could gradually contribute to a softening in Pound Sterling’s strength in the near term as market sentiment adjusts to this policy stance.

GBP/USD did not reach its previous high from its technical rebound yesterday, suggesting a bearish bias for the pair. The RSI is hovering close to the 50 level while the MACD is flowing in between the zero line, giving the pair a neutral signal.

Resistance level: 1.3040. 1.3130

Support level: 1.2940, 1.2815

The EUR/USD pair experienced a technical rebound yesterday following the Fed’s rate cut, which weakened the dollar and provided support for the euro. Additionally, the euro gained momentum from a better-than-expected Retail Sales report. However, the rebound stalled at the 50% Fibonacci retracement level near the 1.0820 mark, indicating that the pair remains in a bearish trajectory as it struggles to sustain upward momentum.

The EUR/USD recorded a marginal gain yesterday, but the bearish momentum seems overwhelming and is weighing on the pair. The RSI remains below the 50 level while the MACD edges lower, suggesting the pair remain trading with excessive bearish momentum.

Resistance level: 1.0815, 1.0890

Support level: 1.0735, 1.0675

The AUD/USD pair formed a higher high in yesterday’s session, indicating a bullish bias for the pair. Following the BoE’s rate cut, the Reserve Bank of Australia (RBA) remains one of the few central banks maintaining a restrictive monetary policy, which has helped the Australian dollar trade strongly against its peers.

The AUD/USD edged higher yesterday and reached a new high in the recent sessions, suggesting a bullish bias for the pair. The RSI is close to the overbought zone, while the MACD edge is higher after breaking above the zero line, suggesting the bullish momentum is gaining.

Resistance level: 0.6730, 0.6785

Support level: 0.6610, 0.6550

The tech-heavy Nasdaq closed 1.50% higher in yesterday’s session, reaching a new all-time high, signalling a bullish bias for the index. The upbeat sentiment on Wall Street was fueled by the Fed’s dovish stance, as the central bank cut interest rates further, benefiting interest-rate-sensitive tech stocks.

Nasdaq reached an all-time high in the last session, suggesting a bullish bias for the index; the RSI is poised to break into the overbought zone while the MACD shows signs of rebounding from the zero line, suggesting the bullish momentum is gaining.

Resistance level: 21950.00, 23000.00

Support level: 20560.00, 19860.00

Oil prices continue to trade within an established uptrend channel, building on momentum since rebounding from recent lows earlier this month. A breakout above the next resistance level at $72.60 could signal further bullish potential for crude. The recent Fed rate cut, combined with the BoE’s first rate reduction, has provided additional support, as lower rates are anticipated to stimulate economic activity and potentially boost future oil demand.

The oil remains trading with an uptrend basis suggesting a bullish bias for the oil. The RSI is hovering above the 50 level while the MACD is flowing flat, suggesting the bullish momentum is easing.

Resistance level: 74.60, 77.00

Support level: 69.90, 68.45

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.