-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

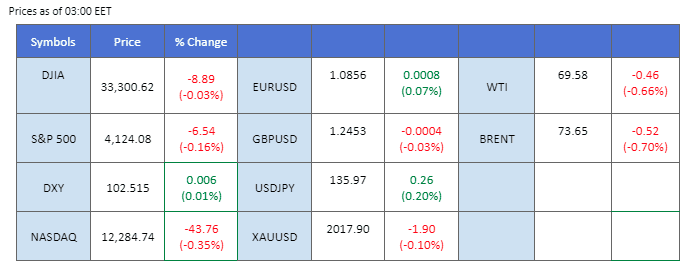

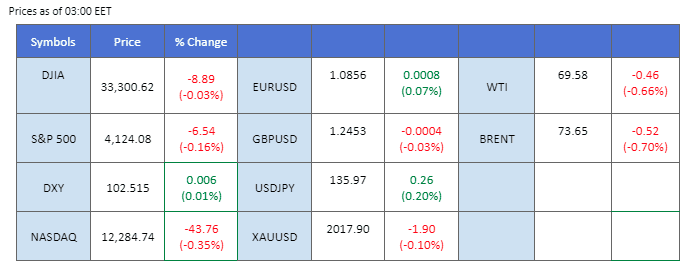

Equity markets were stagnant while the dollar has strengthened, driven by hawkish comments from various Fed officials stressing high inflation in the U.S. On the other hand, President Joe Biden and the country’s congressional leaders are going to meet on Tuesday as the national debt ceiling bill has yet to reach a consensus. The U.S. Treasury Secretary has voiced the urgency that the country will run out of money as soon as 1st of June. Elsewhere, oil is trading below $70 as concerns over the U.S. economy and China’s slower-than-expected recovery persist. Notwithstanding that, China kept its lending facility rate at 2.75%, in line with the market consensus while injecting more liquidity to the market; this may potentially boost oil demand in the long-run. Meanwhile, the Thai baht rose, fueled by the country’s election as it is reported that the pro-democracy parties are making a comeback since the coup a decade ago.

Current rate hike bets on 14th June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (92.8%) VS 25 bps (7.2%)

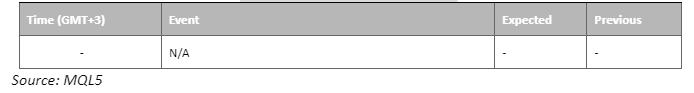

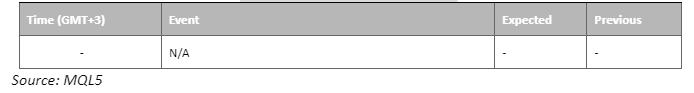

Hawkish comments from Federal Reserve officials have added further bullish momentum to the US Dollar. Chicago Fed President Austan Goolsbee stated during an interview that inflation is still too high, but the Fed can continue to tighten its monetary policy without pushing the economy into a recession. The yields on the two-year Treasuries, considered a bellwether of policy sentiment, experienced an ascent to 3.99% on Friday, while the benchmark 10-year yields rose to 3.46%. Consequently, the US Dollar has registered its most substantial weekly gain since February, further bolstering its position in the market.

The Dollar Index is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 77, suggesting the index might enter overbought territory.

Resistance level: 103.05, 103.90

Support level: 102.40, 101.75

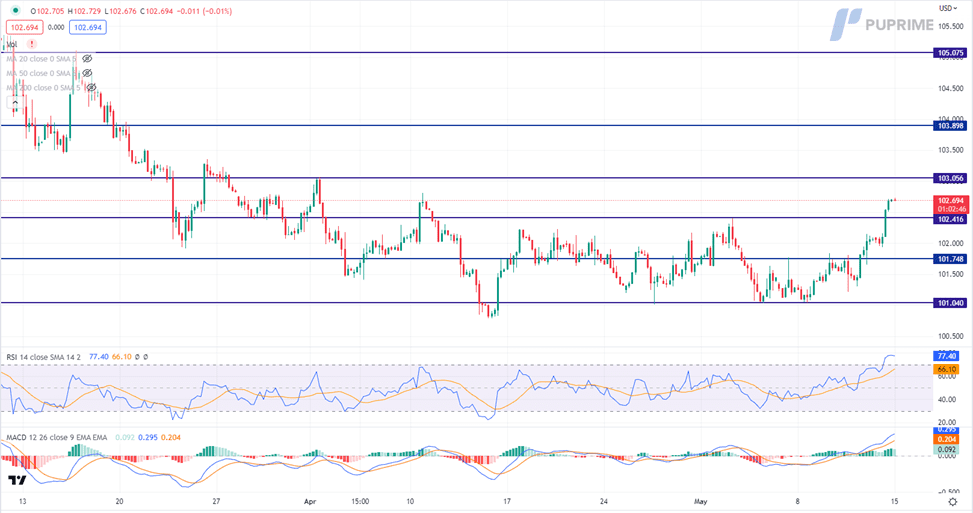

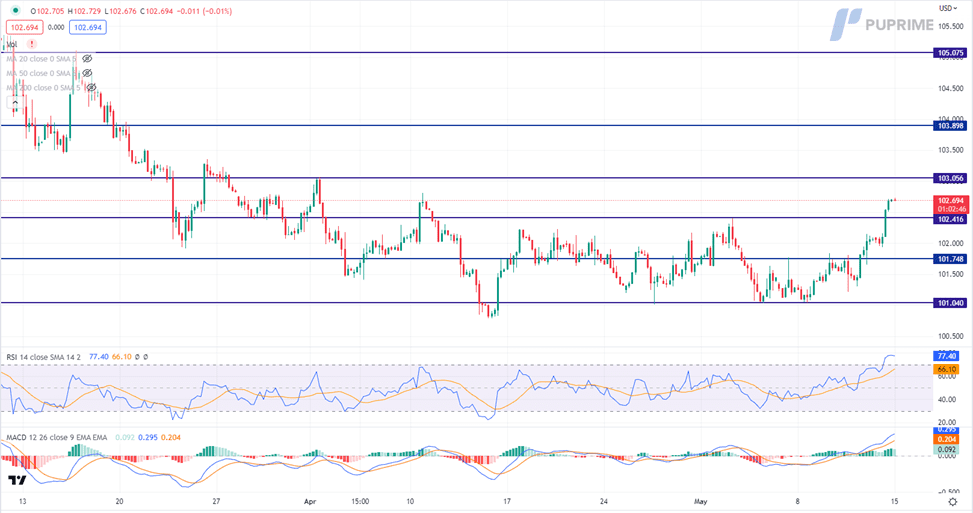

Gold prices faced a retreat as the US Dollar strengthened, propelled by hawkish remarks from Federal Reserve officials. Chicago Fed President Austan Goolsbee’s assertion during an interview that inflation remains elevated but manageable without jeopardising the economy bolstered the bullish momentum of the US Dollar. As a result, gold prices encountered headwinds, with investors shifting their focus towards the strengthening US Dollar as a safe-haven asset in the current market landscape.

Gold prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 42, suggesting the commodity might extend its losses toward support level.

Resistance level: 2045.00, 2080.00

Support level: 1980.00, 1940.00

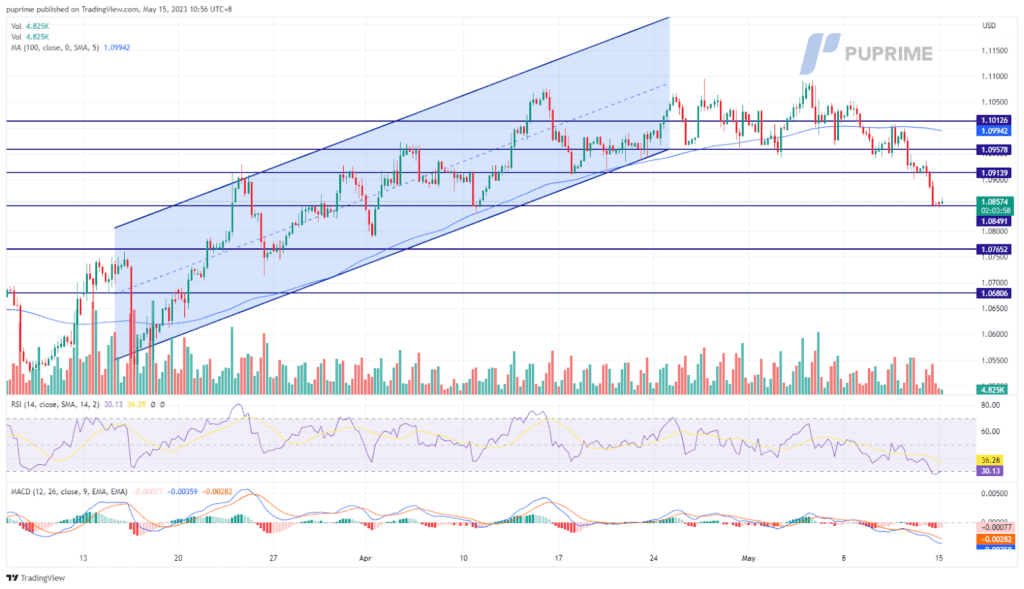

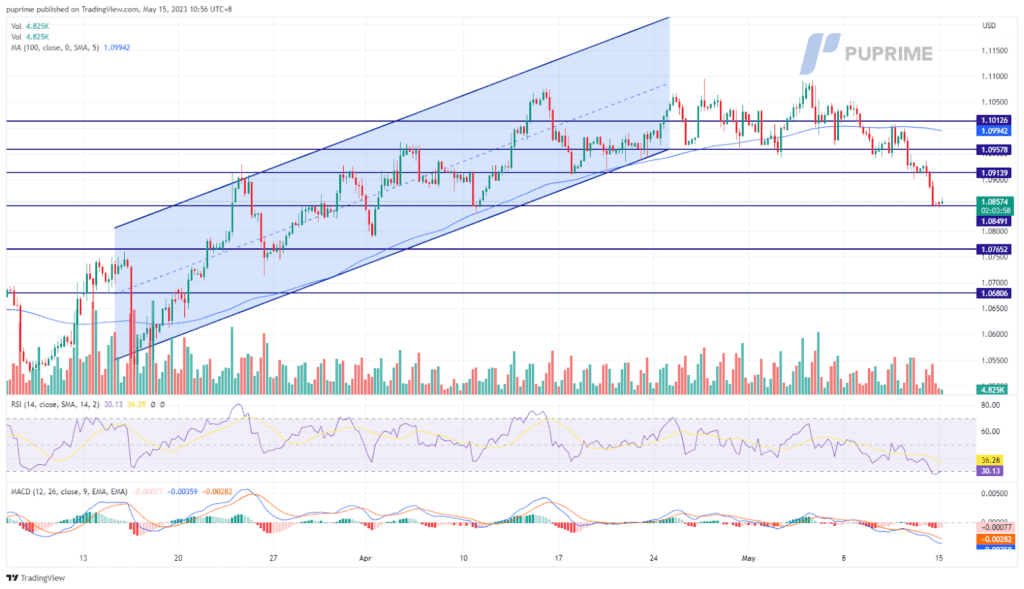

The dollar rose strongly by more than 0.6% last Friday, driven by the hawkish form of the Fed’s officials claiming the inflation in the country is still high. The euro continues to stagnant and loses its crucial psychological support level at 1.0900 due to the strengthened dollar. Meanwhile, the U.S. president and the country’s congressional leaders are expected to meet on Tuesday to talk about the debt ceiling bill. The development of the event will have an impact on the dollar.

The euro has dropped below its price consolidation range and crucial psychological support level at 1.0900. The RSI has broken into the oversold zone while the MACD continues to move lower, both suggesting that the euro is trading on a bearish momentum.

Resistance level: 1.0914, 1.0958

Support level: 1.0765, 1.0681

The latest economic data from China has cast a shadow of uncertainty over the prospects of Chinese-proxy currencies, with the Australian Dollar experiencing a significant slump. China’s National Bureau of Statistics recently reported that consumer inflation in the country hit a two-year low of 0.1% in April, while producer prices witnessed a steep decline of 3.6%. These figures have exceeded market expectations in terms of their severity, triggering a downturn in market optimism towards China’s economic recovery and subsequently putting pressure on its trading partner, Australia.

AUD/USD is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 35, suggesting the pair might enter oversold territory.

Resistance level: 0.6750, 0.6815

Support level: 0.6650, 0.6580

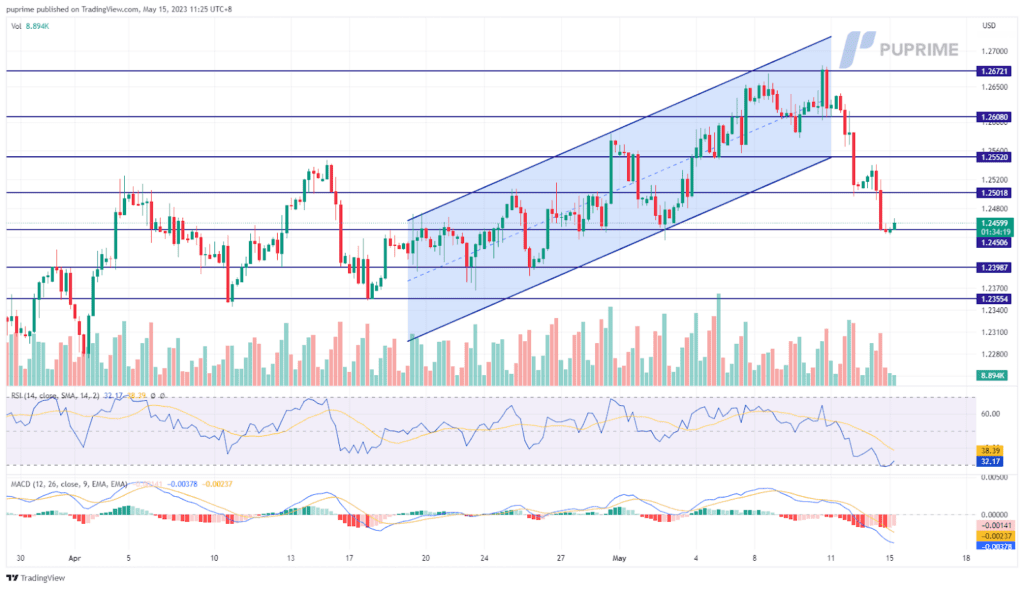

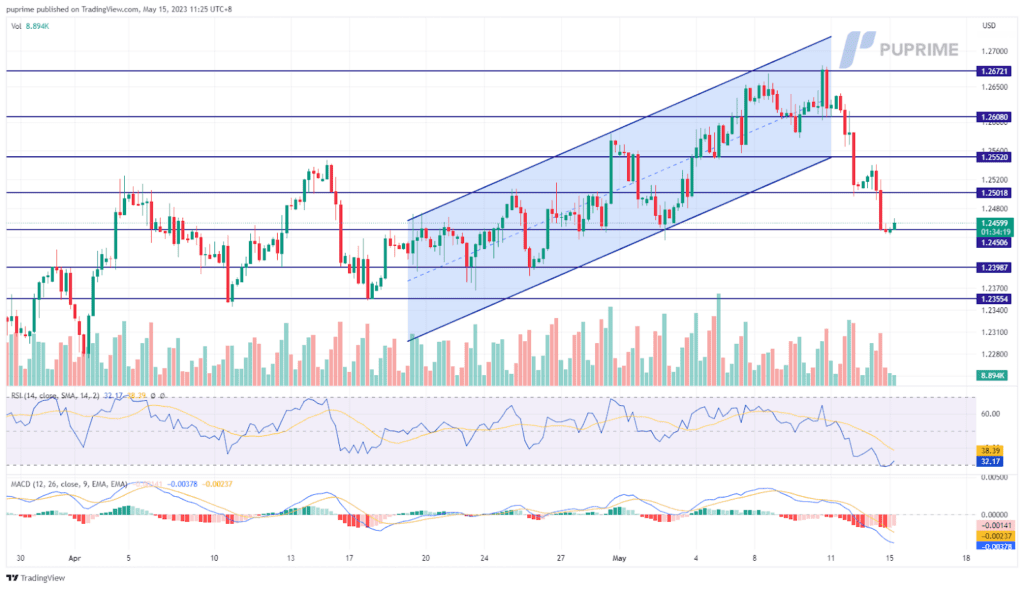

The British pound has lost its bullish momentum and dropped by more than 1% for the past 2 sessions. On the one hand, the cable was hammered down by a strengthened U.S. dollar which was stimulated by the Hawkish comment from the Fed’s officials; on the other hand, the poorer-than-expected U.K.’s economic data hindered the Sterling from trading higher. The country’s GDP as well as the trade balance, did not meet market forecasts which made BoE harder for the BoE to implement a hawkish monetary policy to tame inflation.

The sterling has had a trend reversal and dropped drastically for the past 2 sessions, driven by macroeconomic events. The RSI moves toward the oversold zone while the MACD diverges below the zero line.

Resistance level: 1.2502, 1.2552

Support level: 1.2400, 1.2355

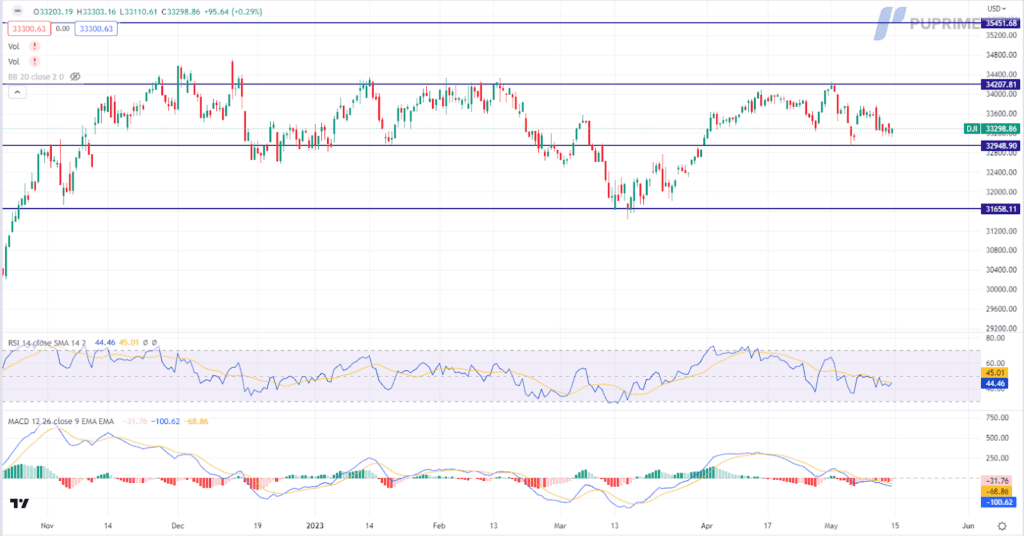

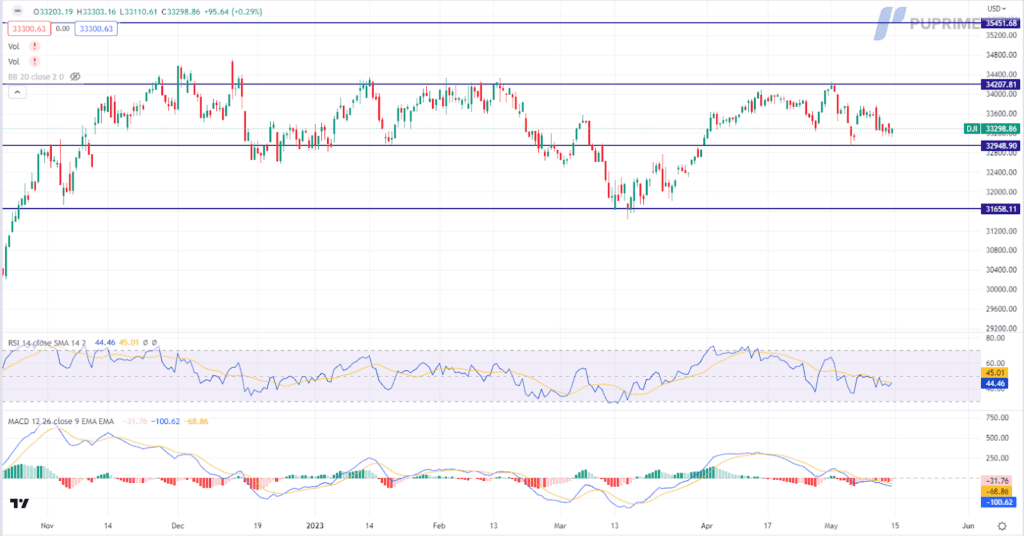

The US equity market remains under pressure as short-term Treasury yields climb higher following the Federal Reserve’s adoption of a more hawkish stance. This shift in monetary policy has led to a slight retracement in the Dow Jones Industrial Average. During an interview, Chicago Fed President Austan Goolsbee expressed concerns over persistently high inflation levels but emphasised that the Fed can tighten its monetary policy without plunging the economy into a recession. Notably, the yields on two-year Treasuries, regarded as a crucial indicator of market sentiment, soared to 3.99%.

The Dow is trading lower while currently near the support level. MACD has illustrated increasing bearish momentum, while RSI is at 45, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 34210, 35450

Support level: 32950, 31660

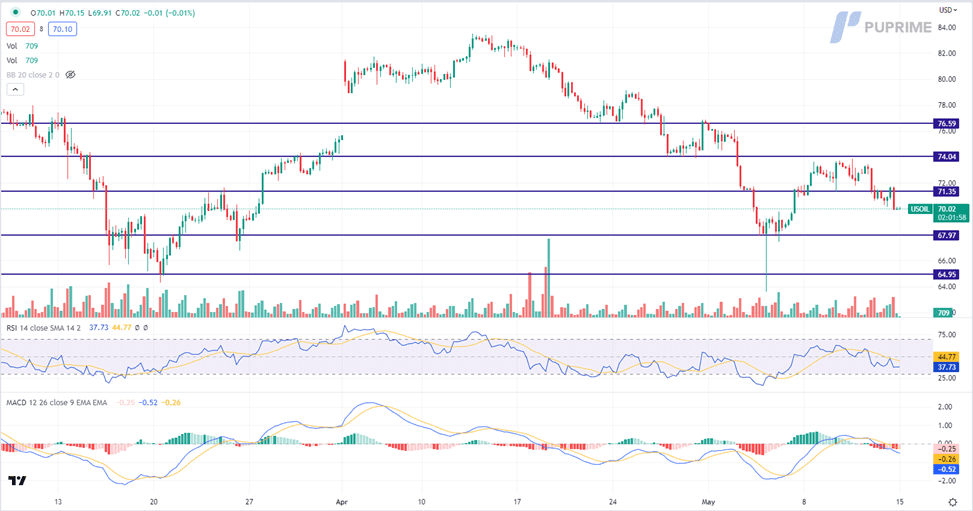

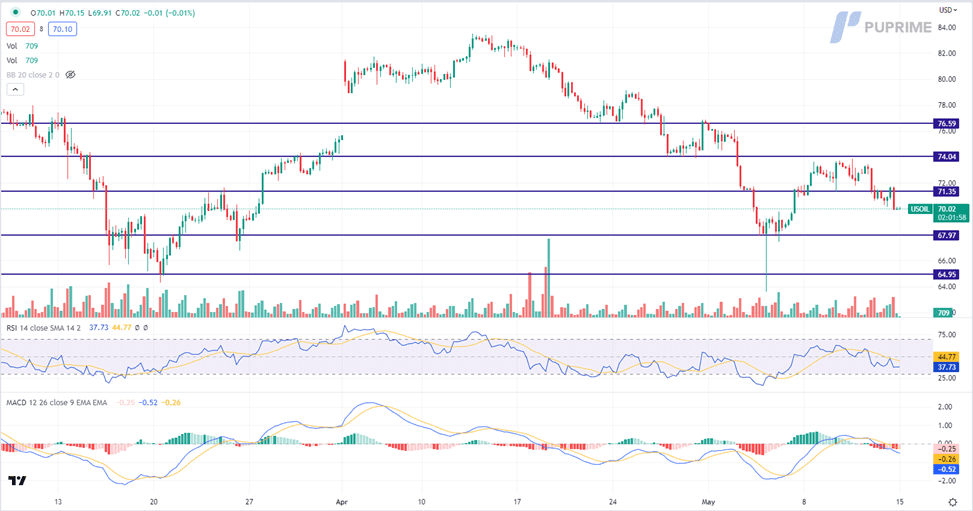

Oil prices faced ongoing weekly losses as worries over the US economy and China’s sluggish recovery weighed on market sentiment. The Federal Reserve’s hawkish stance has sparked market uncertainty, particularly regarding the economic landscape. Higher borrowing costs would burden consumer spending, intensifying pressure on oil demand. China, a vital player in the global oil market, released mixed economic data. Consumer inflation in April showed minimal growth, indicating subdued consumer demand, while producer inflation dropped to its lowest level since the peak of the pandemic in 2020.

Oil prices are trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 38, suggesting the commodity might trade lower as the RSI stays below the midline.

Resistance level: 71.35, 74.05

Support level: 67.95, 64.95

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Equity markets were stagnant while the dollar has strengthened, driven by hawkish comments from various Fed officials stressing high inflation in the U.S. On the other hand, President Joe Biden and the country’s congressional leaders are going to meet on Tuesday as the national debt ceiling bill has yet to reach a consensus. The U.S. Treasury Secretary has voiced the urgency that the country will run out of money as soon as 1st of June. Elsewhere, oil is trading below $70 as concerns over the U.S. economy and China’s slower-than-expected recovery persist. Notwithstanding that, China kept its lending facility rate at 2.75%, in line with the market consensus while injecting more liquidity to the market; this may potentially boost oil demand in the long-run. Meanwhile, the Thai baht rose, fueled by the country’s election as it is reported that the pro-democracy parties are making a comeback since the coup a decade ago.

Current rate hike bets on 14th June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (92.8%) VS 25 bps (7.2%)

Hawkish comments from Federal Reserve officials have added further bullish momentum to the US Dollar. Chicago Fed President Austan Goolsbee stated during an interview that inflation is still too high, but the Fed can continue to tighten its monetary policy without pushing the economy into a recession. The yields on the two-year Treasuries, considered a bellwether of policy sentiment, experienced an ascent to 3.99% on Friday, while the benchmark 10-year yields rose to 3.46%. Consequently, the US Dollar has registered its most substantial weekly gain since February, further bolstering its position in the market.

The Dollar Index is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 77, suggesting the index might enter overbought territory.

Resistance level: 103.05, 103.90

Support level: 102.40, 101.75

Gold prices faced a retreat as the US Dollar strengthened, propelled by hawkish remarks from Federal Reserve officials. Chicago Fed President Austan Goolsbee’s assertion during an interview that inflation remains elevated but manageable without jeopardising the economy bolstered the bullish momentum of the US Dollar. As a result, gold prices encountered headwinds, with investors shifting their focus towards the strengthening US Dollar as a safe-haven asset in the current market landscape.

Gold prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 42, suggesting the commodity might extend its losses toward support level.

Resistance level: 2045.00, 2080.00

Support level: 1980.00, 1940.00

The dollar rose strongly by more than 0.6% last Friday, driven by the hawkish form of the Fed’s officials claiming the inflation in the country is still high. The euro continues to stagnant and loses its crucial psychological support level at 1.0900 due to the strengthened dollar. Meanwhile, the U.S. president and the country’s congressional leaders are expected to meet on Tuesday to talk about the debt ceiling bill. The development of the event will have an impact on the dollar.

The euro has dropped below its price consolidation range and crucial psychological support level at 1.0900. The RSI has broken into the oversold zone while the MACD continues to move lower, both suggesting that the euro is trading on a bearish momentum.

Resistance level: 1.0914, 1.0958

Support level: 1.0765, 1.0681

The latest economic data from China has cast a shadow of uncertainty over the prospects of Chinese-proxy currencies, with the Australian Dollar experiencing a significant slump. China’s National Bureau of Statistics recently reported that consumer inflation in the country hit a two-year low of 0.1% in April, while producer prices witnessed a steep decline of 3.6%. These figures have exceeded market expectations in terms of their severity, triggering a downturn in market optimism towards China’s economic recovery and subsequently putting pressure on its trading partner, Australia.

AUD/USD is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 35, suggesting the pair might enter oversold territory.

Resistance level: 0.6750, 0.6815

Support level: 0.6650, 0.6580

The British pound has lost its bullish momentum and dropped by more than 1% for the past 2 sessions. On the one hand, the cable was hammered down by a strengthened U.S. dollar which was stimulated by the Hawkish comment from the Fed’s officials; on the other hand, the poorer-than-expected U.K.’s economic data hindered the Sterling from trading higher. The country’s GDP as well as the trade balance, did not meet market forecasts which made BoE harder for the BoE to implement a hawkish monetary policy to tame inflation.

The sterling has had a trend reversal and dropped drastically for the past 2 sessions, driven by macroeconomic events. The RSI moves toward the oversold zone while the MACD diverges below the zero line.

Resistance level: 1.2502, 1.2552

Support level: 1.2400, 1.2355

The US equity market remains under pressure as short-term Treasury yields climb higher following the Federal Reserve’s adoption of a more hawkish stance. This shift in monetary policy has led to a slight retracement in the Dow Jones Industrial Average. During an interview, Chicago Fed President Austan Goolsbee expressed concerns over persistently high inflation levels but emphasised that the Fed can tighten its monetary policy without plunging the economy into a recession. Notably, the yields on two-year Treasuries, regarded as a crucial indicator of market sentiment, soared to 3.99%.

The Dow is trading lower while currently near the support level. MACD has illustrated increasing bearish momentum, while RSI is at 45, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 34210, 35450

Support level: 32950, 31660

Oil prices faced ongoing weekly losses as worries over the US economy and China’s sluggish recovery weighed on market sentiment. The Federal Reserve’s hawkish stance has sparked market uncertainty, particularly regarding the economic landscape. Higher borrowing costs would burden consumer spending, intensifying pressure on oil demand. China, a vital player in the global oil market, released mixed economic data. Consumer inflation in April showed minimal growth, indicating subdued consumer demand, while producer inflation dropped to its lowest level since the peak of the pandemic in 2020.

Oil prices are trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 38, suggesting the commodity might trade lower as the RSI stays below the midline.

Resistance level: 71.35, 74.05

Support level: 67.95, 64.95

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.