-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

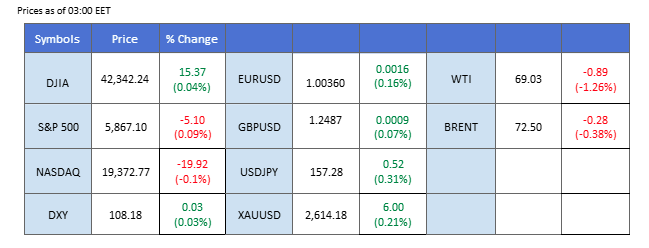

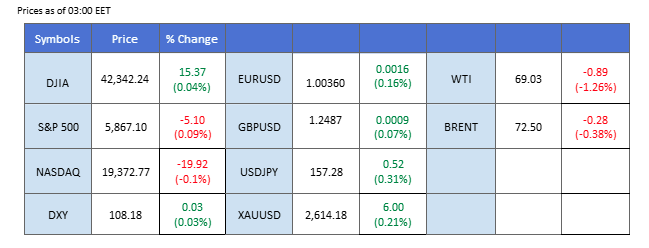

Market Summary

Following the hawkish remarks from the Fed on Wednesday after the interest rate decision, the upbeat U.S. economic indicators released yesterday have further boosted the U.S. dollar, driving it to a two-year high and suggesting a bullish outlook for the greenback. Additionally, the U.S. long-term treasury yield is nearing the 4.6% level, which could also support the dollar.

In contrast, Wall Street remains under pressure as the market digests the Fed’s upcoming monetary policy, with all three major indices staying near their recent lows, indicating strong downside pressure. Similarly, gold has faced pressure from the strengthening dollar and the hawkish Fed stance, trading firmly below the $2,600 level, signaling a bearish bias for the precious metal.

In the forex market, attention is on the UK’s retail sales data, with expectations for a soft reading that could weigh on the Pound Sterling, potentially driving it lower against its peers. Meanwhile, the Japanese Yen has found some support after the Bank of Japan’s hawkish remarks following its interest rate decision.

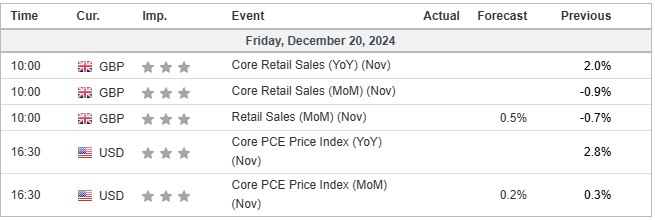

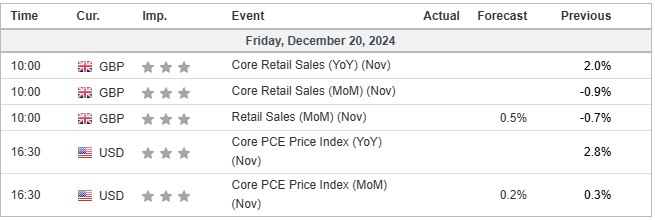

Current rate hike bets on 29th January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (93.6%) VS -25 bps (6.4%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The U.S. Dollar extended its rally, approaching the next resistance level at 108.60, marking a two-year high. Supporting this strength, U.S. long-term Treasury yields climbed further, reaching 4.6%. Additionally, robust U.S. GDP growth and strong job data released yesterday amplified the bullish momentum for the greenback.

The Dollar Index remains bullish and has gained over 1.3% in 2 sessions. The RSI remain in the overbought zone while the MACD continues to surge, suggesting that the bullish momentum remains strong.

Resistance level: 108.60, 109.50

Support level: 107.60, 106.75

Gold remains under pressure from the strengthening U.S. Dollar, especially following yesterday’s robust U.S. economic indicators, which highlighted the resilience of the U.S. economy. This has dampened demand for the safe-haven asset.

Gold, despite a technical rebound in the last session, remains trading in a downtrend trajectory and is hovering at its recent low levels. The RSI remains close to the oversold zone while the MACD is edging lower, suggesting that the bearish momentum remains strong.

Resistance level: 2612.50, 2656.00

Support level: 2556.00, 2485.65

The GBP/USD pair, after a technical rebound that filled the Fair Value Gap (FVG) from the previous session, continues to trade within its bearish trend, indicating a negative outlook for the pair. The Bank of England’s dovish stance following the interest rate decision announced yesterday has further exerted downside pressure on the Pound Sterling, contributing to the pair’s decline.

GBP/USD has traded to its 3-week low and has broken from its critical support level at the 1.2505 mark, suggesting a bearish bias for the pair. The RSI is breaking into the overbought zone while the MACD is diverging, suggesting that the bearish momentum is gaining.

Resistance level: 1.2620, 1.2700

Support level:1.2410, 1.2310

The EUR/USD pair, despite a brief rebound, quickly saw its gains erased and is now trading at recent low levels, indicating a bearish outlook for the pair. The European Central Bank remains relatively dovish, expressing concerns about the region’s economic growth. Meanwhile, the U.S. dollar continues to strengthen, supported by strong economic indicators and a hawkish stance from the Federal Reserve, further weighing on the pair.

The EUR/USD heading lower after a technical rebound, a break below from its recent low at 1.0345 mark shall be a bearish signal for the pair. The RSI remains near to the oversold zone while the MACD continues to edge lower, suggesting that the bearish momentum is gaining.

Resistance level: 1.0444, 1.0608

Support level: 1.0324, 1.0238

The USD/JPY pair has surged to new highs and is approaching the 158.00 mark, with a break above this level signaling a potential bullish trend for the pair. However, the Japanese Yen took a brief respite from its bearish trend yesterday, following hints from the Bank of Japan about a potential rate hike early next year. Additionally, the upbeat Japanese CPI reading provided support for the Yen, offering some buoyancy amid the strength of the U.S. dollar.

The pair has surged to a new high, but the bullish momentum has eased slightly; a break below the FVG shall be seen as a trend-reversal signal for the pair. The RSI remains in the overbought zone while the MACD continues to climb, suggesting that the bullish momentum remains strong.

Resistance level:160.00, 163.80

Support level: 153.75, 151.55

The strong U.S. dollar has weighed heavily on oil prices, which dropped to their recent low in the last session, indicating a bearish bias for the commodity. The expensive dollar and the hawkish stance from the Fed are dampening the demand outlook for oil, further pressuring its prices.

Oil prices have traded to a new recent low, suggesting a bearish bias for the oil. The RSI is edging lower while the MACD is poised to break below the zero line, suggesting that the bearish is forming.

Resistance level: 69.90, 72.30

Support level: 68.25, 67.00

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Market Summary

Following the hawkish remarks from the Fed on Wednesday after the interest rate decision, the upbeat U.S. economic indicators released yesterday have further boosted the U.S. dollar, driving it to a two-year high and suggesting a bullish outlook for the greenback. Additionally, the U.S. long-term treasury yield is nearing the 4.6% level, which could also support the dollar.

In contrast, Wall Street remains under pressure as the market digests the Fed’s upcoming monetary policy, with all three major indices staying near their recent lows, indicating strong downside pressure. Similarly, gold has faced pressure from the strengthening dollar and the hawkish Fed stance, trading firmly below the $2,600 level, signaling a bearish bias for the precious metal.

In the forex market, attention is on the UK’s retail sales data, with expectations for a soft reading that could weigh on the Pound Sterling, potentially driving it lower against its peers. Meanwhile, the Japanese Yen has found some support after the Bank of Japan’s hawkish remarks following its interest rate decision.

Current rate hike bets on 29th January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (93.6%) VS -25 bps (6.4%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The U.S. Dollar extended its rally, approaching the next resistance level at 108.60, marking a two-year high. Supporting this strength, U.S. long-term Treasury yields climbed further, reaching 4.6%. Additionally, robust U.S. GDP growth and strong job data released yesterday amplified the bullish momentum for the greenback.

The Dollar Index remains bullish and has gained over 1.3% in 2 sessions. The RSI remain in the overbought zone while the MACD continues to surge, suggesting that the bullish momentum remains strong.

Resistance level: 108.60, 109.50

Support level: 107.60, 106.75

Gold remains under pressure from the strengthening U.S. Dollar, especially following yesterday’s robust U.S. economic indicators, which highlighted the resilience of the U.S. economy. This has dampened demand for the safe-haven asset.

Gold, despite a technical rebound in the last session, remains trading in a downtrend trajectory and is hovering at its recent low levels. The RSI remains close to the oversold zone while the MACD is edging lower, suggesting that the bearish momentum remains strong.

Resistance level: 2612.50, 2656.00

Support level: 2556.00, 2485.65

The GBP/USD pair, after a technical rebound that filled the Fair Value Gap (FVG) from the previous session, continues to trade within its bearish trend, indicating a negative outlook for the pair. The Bank of England’s dovish stance following the interest rate decision announced yesterday has further exerted downside pressure on the Pound Sterling, contributing to the pair’s decline.

GBP/USD has traded to its 3-week low and has broken from its critical support level at the 1.2505 mark, suggesting a bearish bias for the pair. The RSI is breaking into the overbought zone while the MACD is diverging, suggesting that the bearish momentum is gaining.

Resistance level: 1.2620, 1.2700

Support level:1.2410, 1.2310

The EUR/USD pair, despite a brief rebound, quickly saw its gains erased and is now trading at recent low levels, indicating a bearish outlook for the pair. The European Central Bank remains relatively dovish, expressing concerns about the region’s economic growth. Meanwhile, the U.S. dollar continues to strengthen, supported by strong economic indicators and a hawkish stance from the Federal Reserve, further weighing on the pair.

The EUR/USD heading lower after a technical rebound, a break below from its recent low at 1.0345 mark shall be a bearish signal for the pair. The RSI remains near to the oversold zone while the MACD continues to edge lower, suggesting that the bearish momentum is gaining.

Resistance level: 1.0444, 1.0608

Support level: 1.0324, 1.0238

The USD/JPY pair has surged to new highs and is approaching the 158.00 mark, with a break above this level signaling a potential bullish trend for the pair. However, the Japanese Yen took a brief respite from its bearish trend yesterday, following hints from the Bank of Japan about a potential rate hike early next year. Additionally, the upbeat Japanese CPI reading provided support for the Yen, offering some buoyancy amid the strength of the U.S. dollar.

The pair has surged to a new high, but the bullish momentum has eased slightly; a break below the FVG shall be seen as a trend-reversal signal for the pair. The RSI remains in the overbought zone while the MACD continues to climb, suggesting that the bullish momentum remains strong.

Resistance level:160.00, 163.80

Support level: 153.75, 151.55

The strong U.S. dollar has weighed heavily on oil prices, which dropped to their recent low in the last session, indicating a bearish bias for the commodity. The expensive dollar and the hawkish stance from the Fed are dampening the demand outlook for oil, further pressuring its prices.

Oil prices have traded to a new recent low, suggesting a bearish bias for the oil. The RSI is edging lower while the MACD is poised to break below the zero line, suggesting that the bearish is forming.

Resistance level: 69.90, 72.30

Support level: 68.25, 67.00

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.