-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

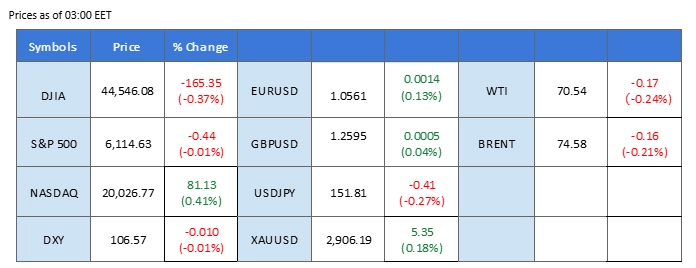

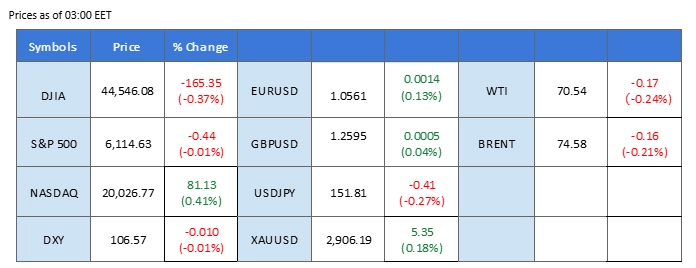

Market Summary

Wall Street struggled for direction as risk appetite remained muted, with several asset classes trading subdued. However, Hong Kong’s Hang Seng Index bucked the trend, surging over 300 points at the start of the week as capital poured into the local equity market, fueled by DeepSeek euphoria.

In the forex market, the U.S. dollar remained under heavy downside pressure, pushing the Dollar Index to a fresh two-month low. Last Friday’s weaker-than-expected Retail Sales data added to the dollar’s woes, reinforcing market concerns about slowing economic momentum. Traders now shift their focus to the upcoming RBA and RBNZ interest rate decisions, scheduled for Tuesday and Wednesday, respectively. The Reserve Bank of Australia is widely expected to initiate its easing cycle with a 25 bps rate cut, a move that could weigh on the Australian dollar.

In the commodity market, gold prices plunged more than 1.5% last Friday, retreating from their all-time highs. Beyond profit-taking, sentiment was further dampened by the peace talks in Saudi Arabia, which could lead to a resolution of the prolonged Russia-Ukraine conflict. Meanwhile, oil prices struggled to find traction, with WTI hovering near $70.35. Crude prices remain sensitive to geopolitical developments and could react sharply to any progress in the Saudi-led peace negotiations.

In the crypto space, Bitcoin (BTC) and Ethereum (ETH) continued to trade sideways amid a lack of clear catalysts. However, XRP surged 14% last week after the U.S. SEC acknowledged that XRP ETF applications are under review, fueling optimism about potential institutional adoption.

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98%) VS -25 bps (2%)

Market Overview

(MT4 System Time)

N/A

Source: MQL5

Market Movements

Global risk appetite improved as markets closely monitored the potential for a ceasefire deal between Russia and Ukraine. Former U.S. President Donald Trump commented that he and Russian President Vladimir Putin had agreed to initiate negotiations for peace, suggesting a shift in geopolitical expectations. This development led to a retreat in safe-haven assets such as the U.S. dollar, as investors shifted their focus toward higher-risk assets.

The Dollar Index is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 26, suggesting the index might enter oversold territory.

Resistance level: 107.95, 108.90

Support level: 107.05, 106.45

Gold prices dropped sharply, driven by speculation over a potential ceasefire deal between Russia and Ukraine. As investors moved toward higher-risk assets, demand for gold waned. However, the outlook remains uncertain, with key risks such as potential tariffs by President Trump and upcoming market-moving events, including Fed meeting minutes and Trump’s speeches, keeping the possibility of a gold rebound alive.

Gold prices are trading lower while currently testing the support level. Nonetheless, MACD has illustrated diminishing bearish momentum, while RSI is at 42, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 2915.00, 2935.00

Support level: 2880.00, 2855.00

The British pound extended its gains against the softening U.S. dollar, with GBP/USD surging to its highest level in 2025. Sterling’s strength was underpinned by stronger-than-expected GDP and Retail Sales data, reinforcing optimism about the UK economy’s resilience. Meanwhile, the dollar came under renewed pressure as shifting market sentiment eroded confidence in the greenback. Persistent concerns over U.S. economic stability and the prospect of a less hawkish Fed further weighed on the dollar, paving the way for GBP/USD to sustain its upward trajectory in the near term.

GBP/USD surged sharply after the pair traded above its critical resistance level at 1.2500. The RSI continued to gain, while the MACD edged higher after breaking above the zero line, suggesting that the pair’s bullish momentum remained strong.

Resistance level: 1.2730, 1.2850

Support level: 1.2485, 1.2375

EUR/USD extended its rally, climbing above the 1.0500 mark to reach its highest level in February, fueled by stronger-than-expected eurozone GDP data released last Friday. The upbeat growth figures reinforced confidence in the euro, providing further momentum for the pair. Meanwhile, the U.S. dollar struggled after retail sales data fell short of market expectations, dampening bullish sentiment on the greenback. With euro strength intact and dollar weakness persisting, EUR/USD remains on a firm bullish trajectory in the near term.

EUR/USD has gained more than 1% after the pair firmly broke above its long-term downtrend resistance level, suggesting a bullish bias for the pair. The RSI and MACD continue to climb, suggesting that the bullish momentum has been gaining.

Resistance level: 1.0595, 1.0688

Support level: 1.0454, 1.0353

The Japanese yen remained strong after Japan’s GDP growth for the fourth quarter exceeded expectations. The economy expanded by 0.7% quarter-on-quarter, surpassing the forecasted 0.3% growth, driven by a recovery in exports that offset sluggish private consumption. The stronger-than-expected economic data boosted the yen, reinforcing its position as a favored safe-haven currency.

USD/JPY is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 34, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 153.25, 154.35

Support level: 151.30, 149.30

AUD/USD surged to a fresh two-month high, capitalizing on broad-based U.S. dollar weakness while drawing support from revived optimism over China’s economic outlook. The Chinese government’s retaliatory tariffs on the U.S. and the DeepSeek-driven AI euphoria have bolstered sentiment around the Aussie dollar, given Australia’s strong trade ties with China. However, traders are bracing for the Reserve Bank of Australia’s (RBA) rate decision tomorrow, with markets widely expecting a 25 bps rate cut. If confirmed, this could weigh on the Aussie, potentially capping further gains in AUD/USD.

The AUD/USD pair has traded to new highs in 2025, suggesting a bullish bias for the pair. The RSI has been hovering above the 50 level while the MACD has rebounded and is diverging above the zero line, suggesting that the bullish momentum is gaining.

Resistance level: 0.6420, 0.6500

Support level: 0.6340, 0.6275

The Hang Seng Index (HSI) extended its rally, inching closer to the 23,000 mark, a level not seen since October 2024. The surge was fueled by the DeepSeek AI euphoria, with reports that Tencent is integrating DeepSeek into WeChat’s search function, sending the stock to a three-year high. Meanwhile, Alibaba Inc. saw its shares soar over 40% this month amid speculation that it is collaborating with Apple Inc. on AI research, further bolstering sentiment around Hong Kong’s tech-heavy equity market.

The HSI has been trading in an uptrend trajectory after the index dipped below the 19,000 mark in January. The RSI remains flowing close to the overbought zone, while the MACD continues to edge higher, suggesting that the bullish momentum remains firm, which could bolster the index’s surge higher.

Resistance level: 23550.00, 24500.00

Support level: 21850.00, 21200.00

Crude oil prices continued to extend losses as the potential for a ceasefire deal between Russia and Ukraine reduced concerns about supply disruptions. The easing of geopolitical tensions weighed on oil prices, further contributing to the ongoing declines in the crude market. Nonetheless, oil prices might extend its losses as trade concerns, particularly in major economies like the U.S. and China, have led to reduced expectations for oil demand.

Crude oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 36, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 72.55, 75.05

Support level: 70.35, 68.45

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Market Summary

Wall Street struggled for direction as risk appetite remained muted, with several asset classes trading subdued. However, Hong Kong’s Hang Seng Index bucked the trend, surging over 300 points at the start of the week as capital poured into the local equity market, fueled by DeepSeek euphoria.

In the forex market, the U.S. dollar remained under heavy downside pressure, pushing the Dollar Index to a fresh two-month low. Last Friday’s weaker-than-expected Retail Sales data added to the dollar’s woes, reinforcing market concerns about slowing economic momentum. Traders now shift their focus to the upcoming RBA and RBNZ interest rate decisions, scheduled for Tuesday and Wednesday, respectively. The Reserve Bank of Australia is widely expected to initiate its easing cycle with a 25 bps rate cut, a move that could weigh on the Australian dollar.

In the commodity market, gold prices plunged more than 1.5% last Friday, retreating from their all-time highs. Beyond profit-taking, sentiment was further dampened by the peace talks in Saudi Arabia, which could lead to a resolution of the prolonged Russia-Ukraine conflict. Meanwhile, oil prices struggled to find traction, with WTI hovering near $70.35. Crude prices remain sensitive to geopolitical developments and could react sharply to any progress in the Saudi-led peace negotiations.

In the crypto space, Bitcoin (BTC) and Ethereum (ETH) continued to trade sideways amid a lack of clear catalysts. However, XRP surged 14% last week after the U.S. SEC acknowledged that XRP ETF applications are under review, fueling optimism about potential institutional adoption.

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98%) VS -25 bps (2%)

Market Overview

(MT4 System Time)

N/A

Source: MQL5

Market Movements

Global risk appetite improved as markets closely monitored the potential for a ceasefire deal between Russia and Ukraine. Former U.S. President Donald Trump commented that he and Russian President Vladimir Putin had agreed to initiate negotiations for peace, suggesting a shift in geopolitical expectations. This development led to a retreat in safe-haven assets such as the U.S. dollar, as investors shifted their focus toward higher-risk assets.

The Dollar Index is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 26, suggesting the index might enter oversold territory.

Resistance level: 107.95, 108.90

Support level: 107.05, 106.45

Gold prices dropped sharply, driven by speculation over a potential ceasefire deal between Russia and Ukraine. As investors moved toward higher-risk assets, demand for gold waned. However, the outlook remains uncertain, with key risks such as potential tariffs by President Trump and upcoming market-moving events, including Fed meeting minutes and Trump’s speeches, keeping the possibility of a gold rebound alive.

Gold prices are trading lower while currently testing the support level. Nonetheless, MACD has illustrated diminishing bearish momentum, while RSI is at 42, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 2915.00, 2935.00

Support level: 2880.00, 2855.00

The British pound extended its gains against the softening U.S. dollar, with GBP/USD surging to its highest level in 2025. Sterling’s strength was underpinned by stronger-than-expected GDP and Retail Sales data, reinforcing optimism about the UK economy’s resilience. Meanwhile, the dollar came under renewed pressure as shifting market sentiment eroded confidence in the greenback. Persistent concerns over U.S. economic stability and the prospect of a less hawkish Fed further weighed on the dollar, paving the way for GBP/USD to sustain its upward trajectory in the near term.

GBP/USD surged sharply after the pair traded above its critical resistance level at 1.2500. The RSI continued to gain, while the MACD edged higher after breaking above the zero line, suggesting that the pair’s bullish momentum remained strong.

Resistance level: 1.2730, 1.2850

Support level: 1.2485, 1.2375

EUR/USD extended its rally, climbing above the 1.0500 mark to reach its highest level in February, fueled by stronger-than-expected eurozone GDP data released last Friday. The upbeat growth figures reinforced confidence in the euro, providing further momentum for the pair. Meanwhile, the U.S. dollar struggled after retail sales data fell short of market expectations, dampening bullish sentiment on the greenback. With euro strength intact and dollar weakness persisting, EUR/USD remains on a firm bullish trajectory in the near term.

EUR/USD has gained more than 1% after the pair firmly broke above its long-term downtrend resistance level, suggesting a bullish bias for the pair. The RSI and MACD continue to climb, suggesting that the bullish momentum has been gaining.

Resistance level: 1.0595, 1.0688

Support level: 1.0454, 1.0353

The Japanese yen remained strong after Japan’s GDP growth for the fourth quarter exceeded expectations. The economy expanded by 0.7% quarter-on-quarter, surpassing the forecasted 0.3% growth, driven by a recovery in exports that offset sluggish private consumption. The stronger-than-expected economic data boosted the yen, reinforcing its position as a favored safe-haven currency.

USD/JPY is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 34, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 153.25, 154.35

Support level: 151.30, 149.30

AUD/USD surged to a fresh two-month high, capitalizing on broad-based U.S. dollar weakness while drawing support from revived optimism over China’s economic outlook. The Chinese government’s retaliatory tariffs on the U.S. and the DeepSeek-driven AI euphoria have bolstered sentiment around the Aussie dollar, given Australia’s strong trade ties with China. However, traders are bracing for the Reserve Bank of Australia’s (RBA) rate decision tomorrow, with markets widely expecting a 25 bps rate cut. If confirmed, this could weigh on the Aussie, potentially capping further gains in AUD/USD.

The AUD/USD pair has traded to new highs in 2025, suggesting a bullish bias for the pair. The RSI has been hovering above the 50 level while the MACD has rebounded and is diverging above the zero line, suggesting that the bullish momentum is gaining.

Resistance level: 0.6420, 0.6500

Support level: 0.6340, 0.6275

The Hang Seng Index (HSI) extended its rally, inching closer to the 23,000 mark, a level not seen since October 2024. The surge was fueled by the DeepSeek AI euphoria, with reports that Tencent is integrating DeepSeek into WeChat’s search function, sending the stock to a three-year high. Meanwhile, Alibaba Inc. saw its shares soar over 40% this month amid speculation that it is collaborating with Apple Inc. on AI research, further bolstering sentiment around Hong Kong’s tech-heavy equity market.

The HSI has been trading in an uptrend trajectory after the index dipped below the 19,000 mark in January. The RSI remains flowing close to the overbought zone, while the MACD continues to edge higher, suggesting that the bullish momentum remains firm, which could bolster the index’s surge higher.

Resistance level: 23550.00, 24500.00

Support level: 21850.00, 21200.00

Crude oil prices continued to extend losses as the potential for a ceasefire deal between Russia and Ukraine reduced concerns about supply disruptions. The easing of geopolitical tensions weighed on oil prices, further contributing to the ongoing declines in the crude market. Nonetheless, oil prices might extend its losses as trade concerns, particularly in major economies like the U.S. and China, have led to reduced expectations for oil demand.

Crude oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 36, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 72.55, 75.05

Support level: 70.35, 68.45

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.