-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

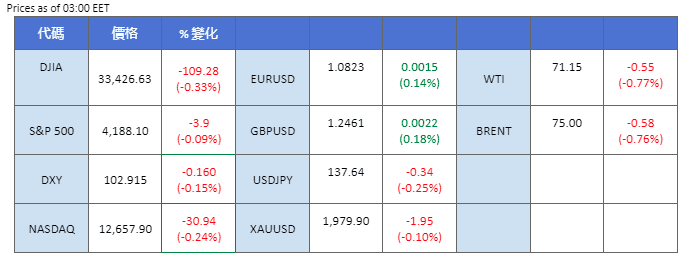

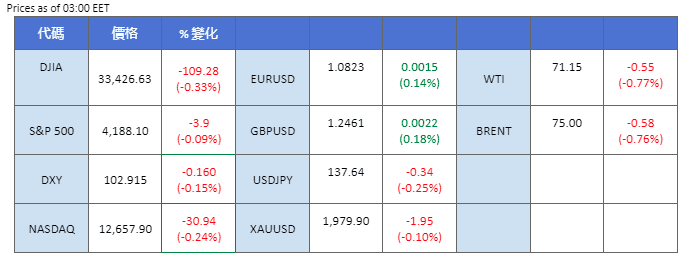

President Biden is scheduled to resume discussions on the debt limit with House Speaker Kevin McCarthy on Monday, following his participation in the G-7 Summit. The dollar index reached its highest level since March before experiencing a subsequent retreat, while investors, in search of safer alternatives, have shown interest in currencies such as the Japanese Yen and Swiss Franc. Meanwhile, equity markets have remained relatively stable, exhibiting sideways movement. In contrast, the oil market has witnessed a consecutive three-session decline. Elsewhere, Asian equity markets have shown signs of growth after President Biden expressed optimism about an imminent improvement in the relationship between the United States and China during his interactions with reporters after the G-7 summit held in Japan over the weekend.

Current rate hike bets on 14th June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (88%) VS 25 bps (12%)

The US dollar witnessed a modest retreat as investors engaged in profit-taking activities, seeking to secure gains ahead of the highly anticipated address by Federal Reserve Chair Jerome Powell. Uncertainties surrounding the debt ceiling agreements continued to fuel further selling pressure on the currency. As staff-level discussions between the White House and congressional Republicans resumed on Sunday, significant disagreements persist on key fiscal decisions, according to the White House officials. Consequently, investors remain vigilant, seeking trading signals within the debt ceiling updates that could influence the direction of the US dollar.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 54, suggesting the index might extend its losses toward support level as the RSI retreated sharply from overbought territory.

Resistance level: 103.30, 104.20

Support level: 102.40, 101.10

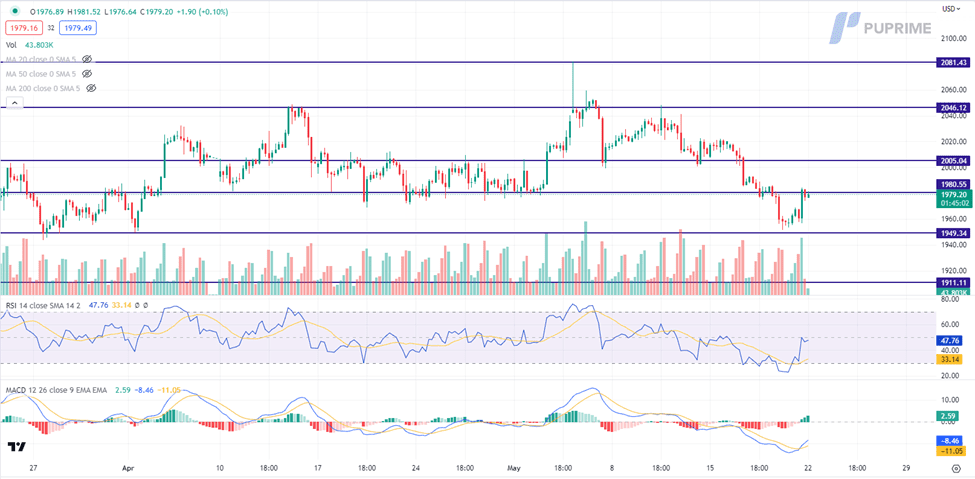

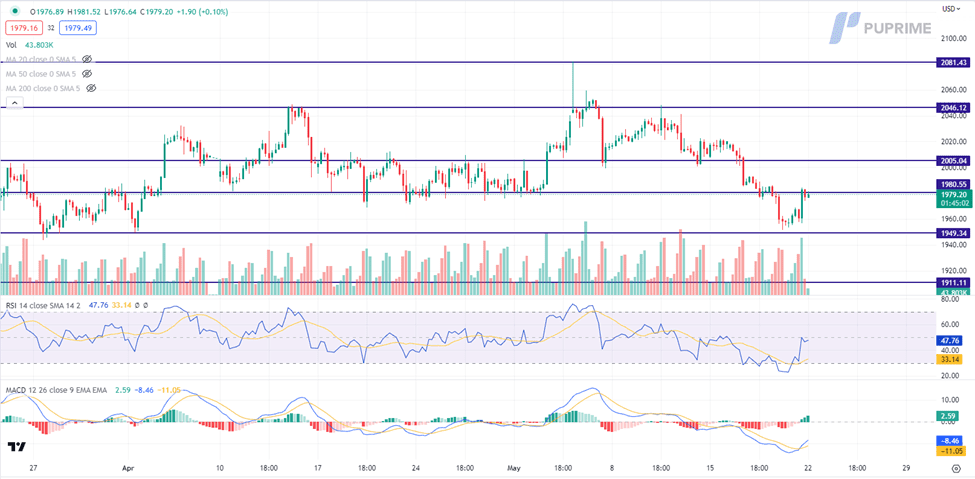

Gold prices experienced a notable rebound, weighed by the depreciation of the US dollar amidst profit-taking activities ahead of an eagerly awaited address by Federal Reserve Chair Jerome Powell. The lingering impasse regarding the “debt-ceiling” between the White House and congressional Republicans intensified market volatilities, prompting a shift in sentiment towards the precious metal. US President Joe Biden and House Minority Leader Kevin McCarthy reiterated the absence of an agreement on crucial fiscal decisions, further heightening concerns on the global financial market.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 48, suggesting the commodity might extend its gains after breakout since the RSI rebounded sharply from overbought territory.

Resistance level: 1980.00, 2005.00

Support level: 1950.00, 1910.00

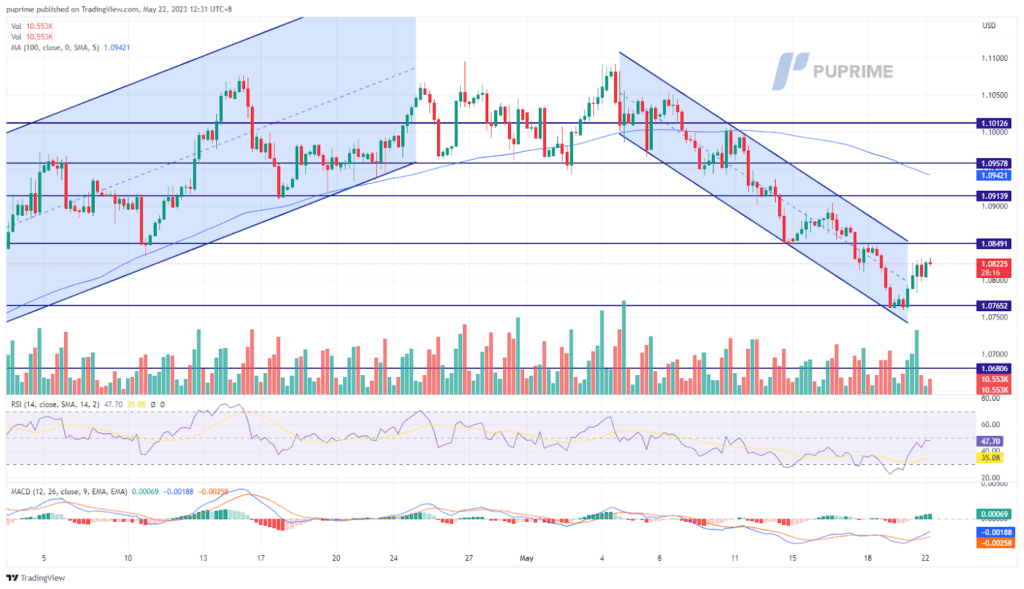

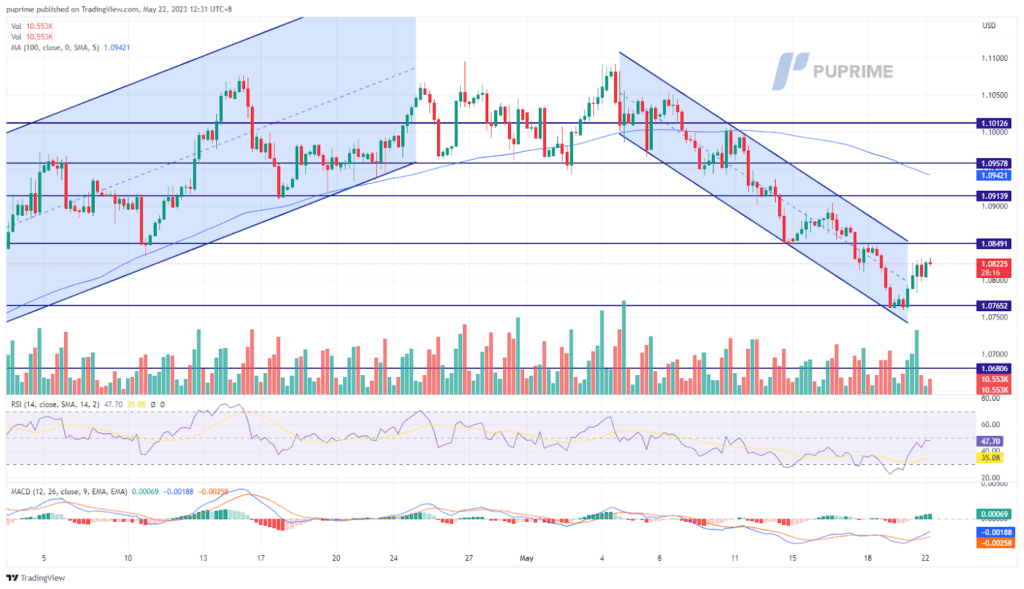

The dollar continued to gain and hit its highest level since March before it retraced as investors sought for alternative safe-haven currencies Japanese Yen and Swiss Franc. On Monday, President Biden is expected to resume the meeting on the debt-limit issue with the country’s house speaker Kevin McCarthy, a piece of progressive news from the meeting perhaps may boost the dollar to trade higher. On the other hand, the ECB continues to signal for more rate hikes in the future to tame stubborn inflation with the clear target of 2% inflation rate to achieve.

The euro has rebounded from another crucial support level at 1.0765 while still trading in bearish momentum in May. The RSI and the MACD on the other hand, show signs of a trend reversal with the RSI rebounding from the oversold zone and the MACD has converged.

Resistance level: 1.0850, 1.0914

Support level: 1.0765, 1.0681

USD/JPY experienced a slight retracement, primarily driven by the depreciation of the US Dollar. However, the overall long-term trend for the Japanese Yen remained weak, largely influenced by the unwavering commitment of the Bank of Japan (BoJ) to maintain an ultra-loose monetary policy. Furthermore, the BoJ emphasised that the recent uptick in Japanese inflation, surpassing the 2% target, is primarily attributed to cost-push factors rather than robust domestic demand. The central bank expressed concerns that responding to these price increases with tighter monetary policy would pose a threat to the economy, cementing their dovish approach.

USD/JPY is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 53, suggesting the pair might extend its losses toward the support level since the RSI retreated sharply from overbought territory.

Resistance level: 138.10, 142.35

Support level: 133.70, 129.95

On Friday, the pound experienced a notable rise, climbing by 0.54% to $1.2461. This increase can be attributed to the dollar’s weakening in the market. As concerns surrounding the debt ceiling continue to grow, investors have been selling the dollar and turning to other national currencies. The key factor that could heavily influence price movements today is the highly anticipated debt ceiling meeting between McCarthy and Biden, scheduled for later in the day. Investors are advised to exercise caution and await further updates before making significant market moves.

The price movement for the pound is expected to remain within a narrow range as investors await the outcome of the debt ceiling meeting between McCarthy and Biden. With uncertainty surrounding the meeting, The pound is likely to experience limited volatility until there is clarity on the developments from the meeting. Traders and investors are closely monitoring the situation and eagerly awaiting any updates that could potentially impact the pound’s value in the market.

Resistance level: 1.2540, 1.2680

Support level: 1.2345, 1.2145

Amid mounting uncertainties surrounding the ongoing debt ceiling talks, the Dow experienced a slight downturn. The allure of riskier assets waned as the White House and congressional Republicans resumed staff-level discussions on Sunday, revealing persistent disagreements on crucial fiscal decisions, as reported by White House officials. Looking ahead, market participants eagerly await key economic data and events in the United States, such as the release of FOMC meeting minutes, updates on the US debt ceiling talks, and crucial indicators like GDP and inflation data.

The Dow is trading lower while currently near the support level. MACD has illustrated increasing bullish momentum, while RSI is at 50, suggesting the index might trade higher as technical correction since the RSI rebounded sharply from the overbought territory.

Resistance level: 34210, 35450

Support level: 32950, 31660

Investor concerns are mounting as President Joe Biden and House Speaker Kevin McCarthy are set to meet today to discuss the ongoing debt ceiling negotiations, which have recently resumed. The uncertainty surrounding the debt ceiling deal is further heightened by Treasury Secretary Janet Yellen’s warning that the U.S. may face difficulties in meeting its financial obligations by mid-June. Given the lack of clarity and potential repercussions, investors are advised to exercise caution and wait for a clearer decision regarding the debt ceiling before making significant moves in the oil market. The current ambiguity surrounding the debt ceiling situation has left the oil market without a clear direction, making it prudent for investors to monitor developments and be prepared for potential market fluctuations closely.

With the unresolved debt ceiling issue casting a shadow of uncertainty over the market, investors are advised to monitor developments closely and await a definitive outcome before making significant moves in the oil trading arena.

Resistance level: 74.05, 76.60

Support level: 71.55, 69.45

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

President Biden is scheduled to resume discussions on the debt limit with House Speaker Kevin McCarthy on Monday, following his participation in the G-7 Summit. The dollar index reached its highest level since March before experiencing a subsequent retreat, while investors, in search of safer alternatives, have shown interest in currencies such as the Japanese Yen and Swiss Franc. Meanwhile, equity markets have remained relatively stable, exhibiting sideways movement. In contrast, the oil market has witnessed a consecutive three-session decline. Elsewhere, Asian equity markets have shown signs of growth after President Biden expressed optimism about an imminent improvement in the relationship between the United States and China during his interactions with reporters after the G-7 summit held in Japan over the weekend.

Current rate hike bets on 14th June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (88%) VS 25 bps (12%)

The US dollar witnessed a modest retreat as investors engaged in profit-taking activities, seeking to secure gains ahead of the highly anticipated address by Federal Reserve Chair Jerome Powell. Uncertainties surrounding the debt ceiling agreements continued to fuel further selling pressure on the currency. As staff-level discussions between the White House and congressional Republicans resumed on Sunday, significant disagreements persist on key fiscal decisions, according to the White House officials. Consequently, investors remain vigilant, seeking trading signals within the debt ceiling updates that could influence the direction of the US dollar.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 54, suggesting the index might extend its losses toward support level as the RSI retreated sharply from overbought territory.

Resistance level: 103.30, 104.20

Support level: 102.40, 101.10

Gold prices experienced a notable rebound, weighed by the depreciation of the US dollar amidst profit-taking activities ahead of an eagerly awaited address by Federal Reserve Chair Jerome Powell. The lingering impasse regarding the “debt-ceiling” between the White House and congressional Republicans intensified market volatilities, prompting a shift in sentiment towards the precious metal. US President Joe Biden and House Minority Leader Kevin McCarthy reiterated the absence of an agreement on crucial fiscal decisions, further heightening concerns on the global financial market.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 48, suggesting the commodity might extend its gains after breakout since the RSI rebounded sharply from overbought territory.

Resistance level: 1980.00, 2005.00

Support level: 1950.00, 1910.00

The dollar continued to gain and hit its highest level since March before it retraced as investors sought for alternative safe-haven currencies Japanese Yen and Swiss Franc. On Monday, President Biden is expected to resume the meeting on the debt-limit issue with the country’s house speaker Kevin McCarthy, a piece of progressive news from the meeting perhaps may boost the dollar to trade higher. On the other hand, the ECB continues to signal for more rate hikes in the future to tame stubborn inflation with the clear target of 2% inflation rate to achieve.

The euro has rebounded from another crucial support level at 1.0765 while still trading in bearish momentum in May. The RSI and the MACD on the other hand, show signs of a trend reversal with the RSI rebounding from the oversold zone and the MACD has converged.

Resistance level: 1.0850, 1.0914

Support level: 1.0765, 1.0681

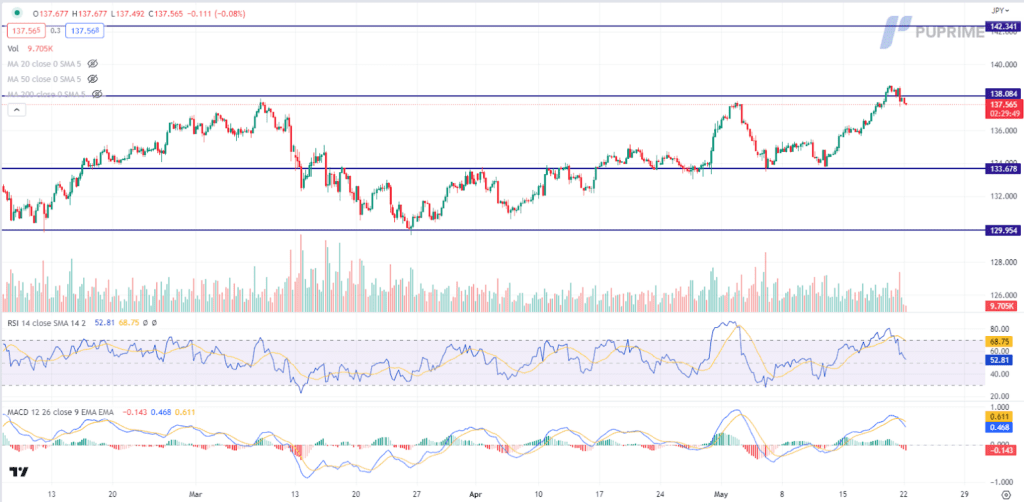

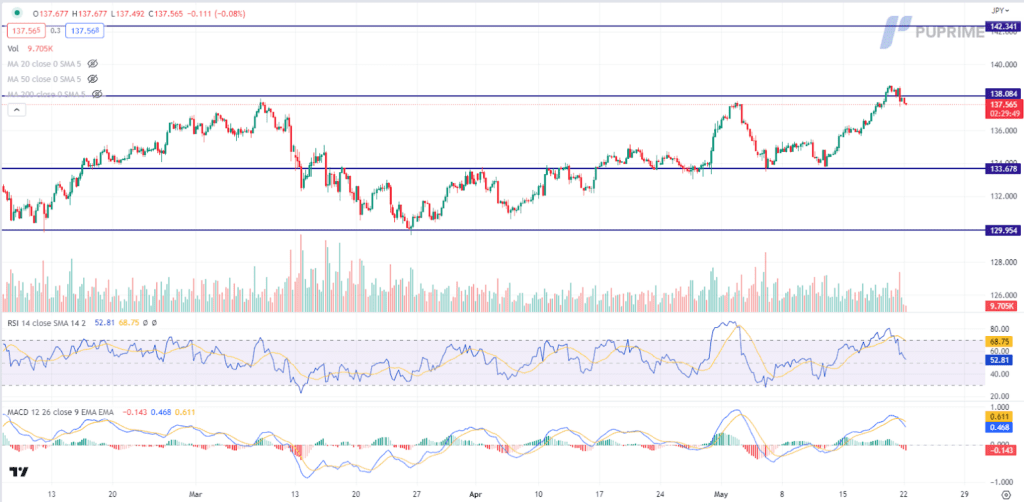

USD/JPY experienced a slight retracement, primarily driven by the depreciation of the US Dollar. However, the overall long-term trend for the Japanese Yen remained weak, largely influenced by the unwavering commitment of the Bank of Japan (BoJ) to maintain an ultra-loose monetary policy. Furthermore, the BoJ emphasised that the recent uptick in Japanese inflation, surpassing the 2% target, is primarily attributed to cost-push factors rather than robust domestic demand. The central bank expressed concerns that responding to these price increases with tighter monetary policy would pose a threat to the economy, cementing their dovish approach.

USD/JPY is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 53, suggesting the pair might extend its losses toward the support level since the RSI retreated sharply from overbought territory.

Resistance level: 138.10, 142.35

Support level: 133.70, 129.95

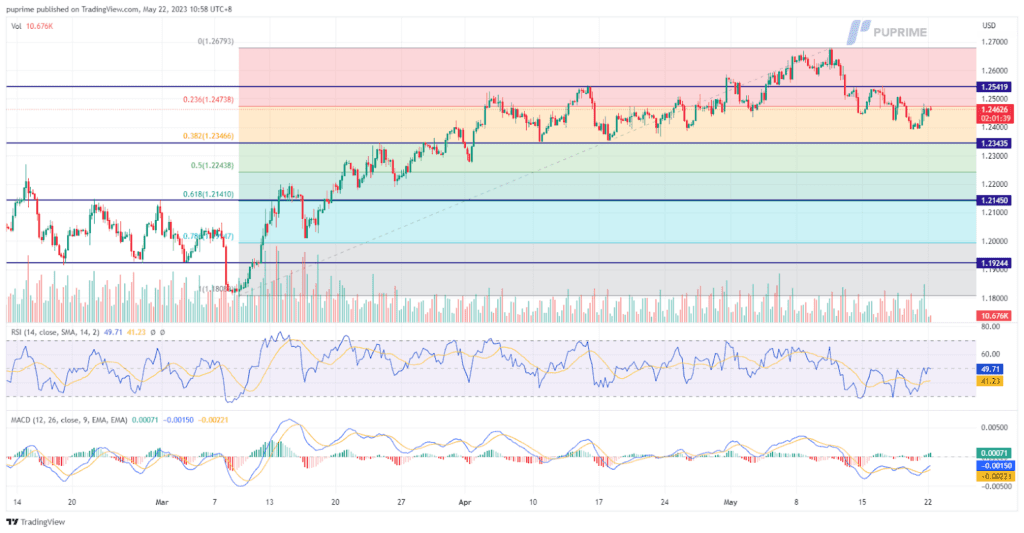

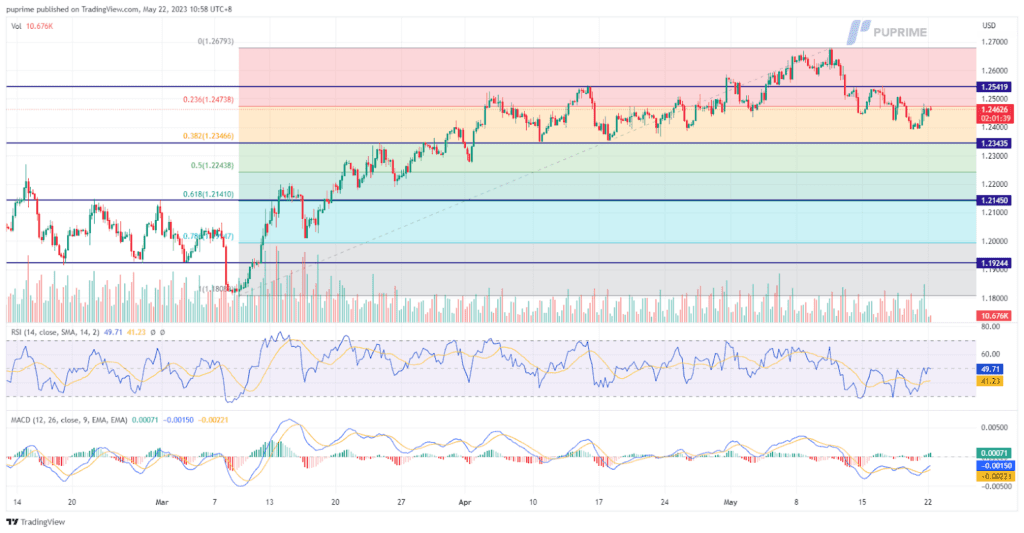

On Friday, the pound experienced a notable rise, climbing by 0.54% to $1.2461. This increase can be attributed to the dollar’s weakening in the market. As concerns surrounding the debt ceiling continue to grow, investors have been selling the dollar and turning to other national currencies. The key factor that could heavily influence price movements today is the highly anticipated debt ceiling meeting between McCarthy and Biden, scheduled for later in the day. Investors are advised to exercise caution and await further updates before making significant market moves.

The price movement for the pound is expected to remain within a narrow range as investors await the outcome of the debt ceiling meeting between McCarthy and Biden. With uncertainty surrounding the meeting, The pound is likely to experience limited volatility until there is clarity on the developments from the meeting. Traders and investors are closely monitoring the situation and eagerly awaiting any updates that could potentially impact the pound’s value in the market.

Resistance level: 1.2540, 1.2680

Support level: 1.2345, 1.2145

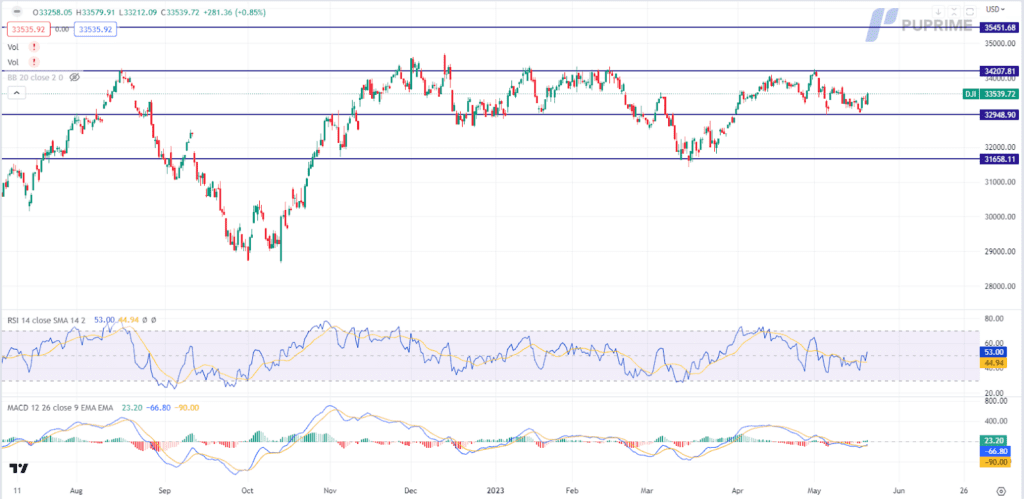

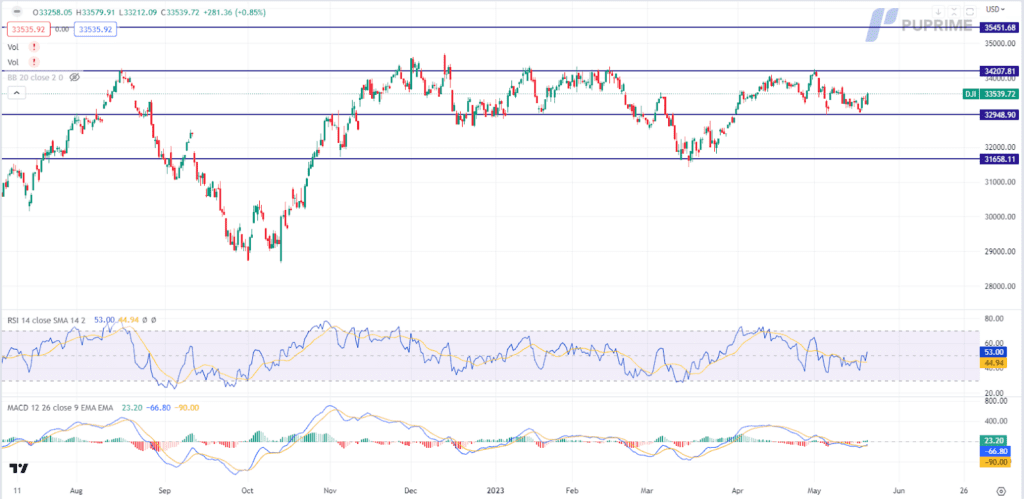

Amid mounting uncertainties surrounding the ongoing debt ceiling talks, the Dow experienced a slight downturn. The allure of riskier assets waned as the White House and congressional Republicans resumed staff-level discussions on Sunday, revealing persistent disagreements on crucial fiscal decisions, as reported by White House officials. Looking ahead, market participants eagerly await key economic data and events in the United States, such as the release of FOMC meeting minutes, updates on the US debt ceiling talks, and crucial indicators like GDP and inflation data.

The Dow is trading lower while currently near the support level. MACD has illustrated increasing bullish momentum, while RSI is at 50, suggesting the index might trade higher as technical correction since the RSI rebounded sharply from the overbought territory.

Resistance level: 34210, 35450

Support level: 32950, 31660

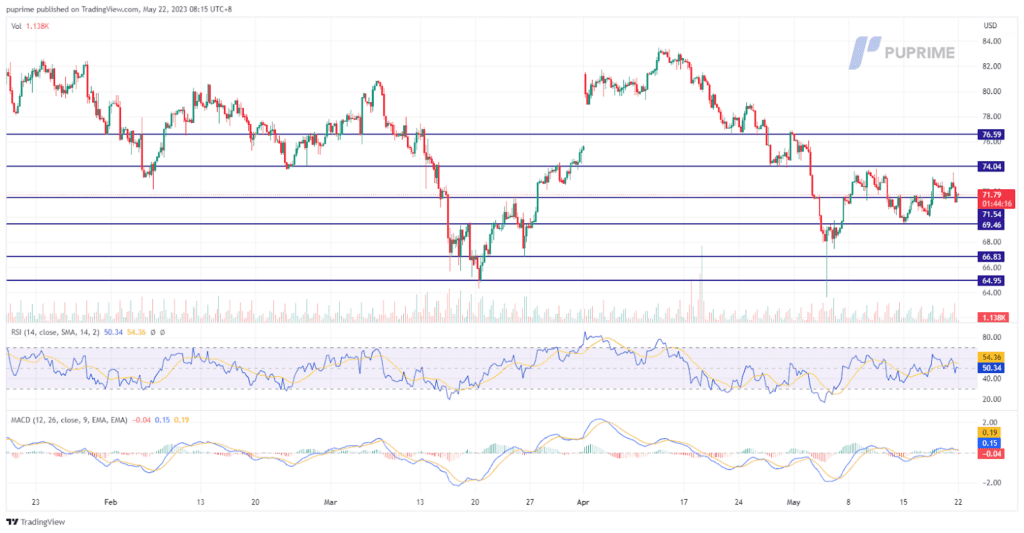

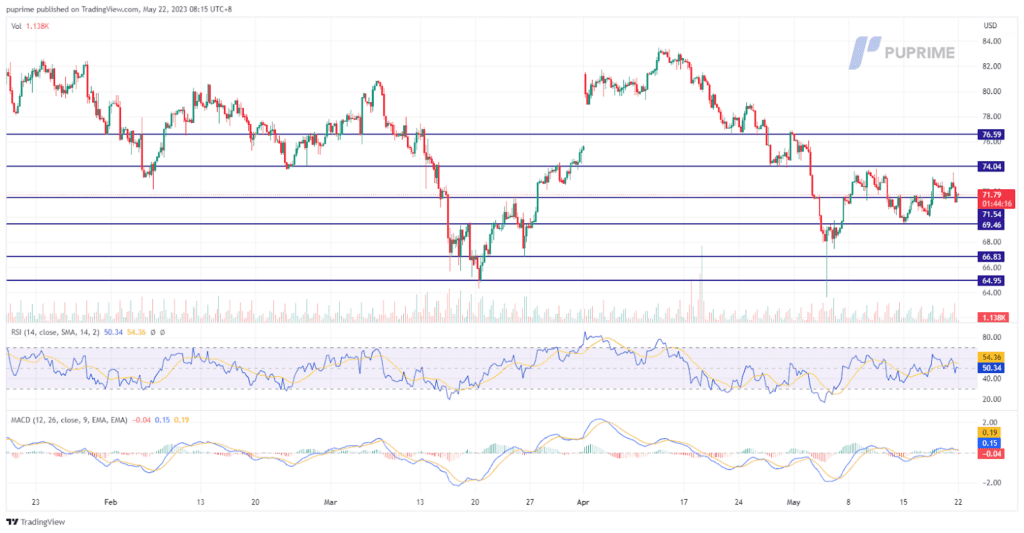

Investor concerns are mounting as President Joe Biden and House Speaker Kevin McCarthy are set to meet today to discuss the ongoing debt ceiling negotiations, which have recently resumed. The uncertainty surrounding the debt ceiling deal is further heightened by Treasury Secretary Janet Yellen’s warning that the U.S. may face difficulties in meeting its financial obligations by mid-June. Given the lack of clarity and potential repercussions, investors are advised to exercise caution and wait for a clearer decision regarding the debt ceiling before making significant moves in the oil market. The current ambiguity surrounding the debt ceiling situation has left the oil market without a clear direction, making it prudent for investors to monitor developments and be prepared for potential market fluctuations closely.

With the unresolved debt ceiling issue casting a shadow of uncertainty over the market, investors are advised to monitor developments closely and await a definitive outcome before making significant moves in the oil trading arena.

Resistance level: 74.05, 76.60

Support level: 71.55, 69.45

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.