-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

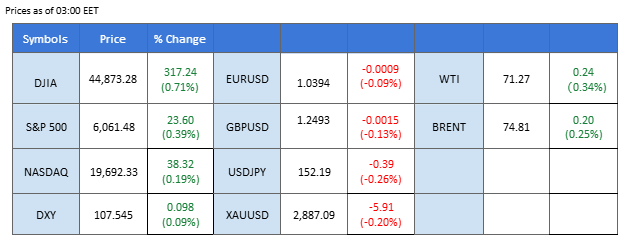

Market Summary

The Japanese yen has emerged as a top performer against the U.S. dollar, capitalizing on the greenback’s recent struggles amid heightened uncertainty. The yen has reached its strongest level in three months against major currencies, particularly after the Bank of Japan raised interest rates last week. Meanwhile, despite a temporary boost from stronger-than-expected PMI readings, the dollar remains near its lowest levels in two weeks, reflecting lingering concerns over U.S. economic stability.

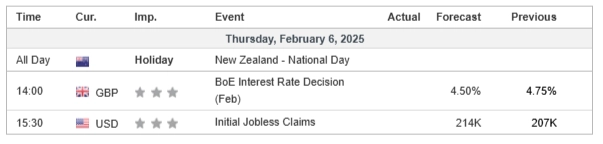

In the currency market, while the pound sterling has shown resilience in recent sessions, traders are closely watching the Bank of England’s interest rate decision today. Expectations of a rate cut could weigh on the pound, potentially erasing some of its recent gains.

In the commodities space, gold has surged over 8% in 2025, reaching record highs as market uncertainty continues to drive demand for safe-haven assets. The impending implementation of Chinese retaliatory tariffs on the U.S., set to take effect on Monday, could further fuel gold’s rally. Conversely, fears of an escalating trade war between the two economic giants have put significant pressure on oil prices, dragging them to their lowest levels this year.

In the cryptocurrency market, bearish sentiment appears to be easing, with both Bitcoin and Ethereum rebounding from their recent downtrend. While BTC and ETH have yet to establish a clear bullish breakout, their recovery signals renewed investor confidence in the digital asset space.

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool0 bps (100.0%) VS -25 bps (0%)

Market Overview

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

The lack of progress in the U.S.-China trade negotiations continues to weigh on market sentiment, with investors adopting a wait-and-see approach. The Dollar Index (DXY) traded flat as mixed U.S. economic data kept dollar movements in check. The ISM Non-Manufacturing PMI came in at 52.8, missing expectations of 54.2, leading to a slight dip in U.S. Treasury yields. However, losses in the dollar were limited by better-than-expected ADP Nonfarm Employment Change (183K vs. 148K expected) and S&P Global Services PMI (52.9 vs. 52.8 expected).

The Dollar Index is trading flat while currently near the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 40, suggesting the index might extend its gains since the RSI rebounded from oversold territory.

Resistance level: 107.85, 108.75

Support level: 107.05, 106.15

Gold prices remained elevated, nearing record highs as the U.S.-China trade tensions fueled safe-haven demand. The 10% tariffs imposed by the U.S. on China took effect on Tuesday, prompting retaliatory measures from Beijing, including import tariffs, export controls, and restrictions on U.S. firms such as Google. Additionally, Trump’s proposal to take over Gaza and relocate Palestinians drew sharp criticism, further escalating geopolitical risks and supporting bullion’s appeal.

Gold prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bearish momentum, while RSI is at 58, suggesting the commodity might experience technical correction since the RSI retreated from overbought territory.

Resistance level: 2885.00, 2895.00

Support level: 2860.00, 2840.00

The pound sterling has softened ahead of the Bank of England’s interest rate decision scheduled for today, with markets already pricing in a 25-basis-point rate cut, dampening the currency’s strength. Meanwhile, the U.S. dollar gained traction following an upbeat PMI reading yesterday, exerting downward pressure on the GBP/USD pair. Traders will now turn their attention to the U.S. initial jobless claims data set for release today, which could introduce further volatility to the pair’s price action.

The GBPUSD faced strong resistance at the near 1.2515 mark, which could incur a technical retracement at such a level. A break below the 1.2450 mark would be a solid bearish signal for the pair. The RSI remained above the 50 level, while the MACD continued to edge higher, suggesting that the pair remained trading with bullish momentum.

Resistance level: 1.2620, 1.2700

Support level: 1.2408, 1.2310

The EUR/USD pair initially broke above the short-term resistance level at 1.0400 but failed to sustain its position above that mark, showing signs of weakness and a potential trend reversal. As the pair retreats from its recent high, traders are closely watching the U.S. Initial Jobless Claims data due today. A stronger-than-expected reading could bolster the dollar, further weighing on the euro and reinforcing the bearish outlook for the pair.

The EUR/USD faced strong resistance at near 1.0400 and failed to break above the previous high at 1.0425, suggesting a potential trend reversal for the pair. The RSI remained sustained at above 50, while the MACD has broken above the zero line, suggesting that the pair remains trading with bullish momentum.

Resistance level: 1.0458, 1.0530

Support level: 1.0345, 1.0232

The Japanese yen has emerged as one of the strongest currencies in the market, with the JXY index reaching a three-month high. The yen’s strength has been driven by mounting uncertainties surrounding the U.S. dollar, largely due to policies from the Trump administration. As investors seek safe-haven assets, the yen has become a market favorite, further supported by last week’s interest rate hike by the Bank of Japan, which has reinforced the currency’s resilience.

USD/JPY is currently trading in a lower-low price pattern. A break below the downtrend support level suggests that the pair is now trading with extremely strong bearish momentum. The RSI is breaking into the oversold zone while the MACD is edging lower and diverging, suggesting that the bearish momentum is gaining.

Resistance level: 154.20, 1560.00

Support level: 150.60, 148.50

U.S. stock indexes closed higher on Wednesday, supported by a decline in Treasury yields after weaker PMI data signaled some cooling in the U.S. economy. NVIDIA (NASDAQ: NVDA), which had been under pressure in recent weeks due to concerns over AI capital expenditures, rebounded strongly. The rally was driven by continued Capex spending by hyperscalers and the launch of its new Blackwell chip, reinforcing investor confidence in NVIDIA’s AI dominance despite growing competition from China’s AI upstart, DeepSeek.

Nasdaq is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 56, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 21820.00, 22140.00

Support level: 21070.00, 20575.00

Bitcoin has shaken off its previous bearish sentiment after briefly dipping below the $92,000 mark and is now trading above its uptrend support level. The renewed optimism comes as BlackRock, the leading BTC ETF issuer, prepares to list an ETF in Europe, a move that could potentially boost institutional demand for Bitcoin and drive prices higher in the future.

BTC is now forming an asymmetric triangle pattern after previously dipping below the $92,000 mark. A rebound from the current level would be a bullish signal for BTC. The RSI remains below the 50 level, while the MACD is flowing flat below the zero line, suggesting that BTC is still lacking bullish momentum.

Resistance level: 98730.00, 102,000.00

Support level: 94,650.00, 91430.00

Oil prices fell for a second session, pressured by a larger-than-expected U.S. crude inventory build. The Energy Information Administration (EIA) reported a surge in crude stockpiles to 8.664M barrels, significantly exceeding market expectations of 2.4M barrels. The strong supply data weighed on oil prices, overshadowing geopolitical risks and OPEC+ production cuts.

Crude oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 39, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 75.05, 77.60

Support level: 71.00, 68.45

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!