-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

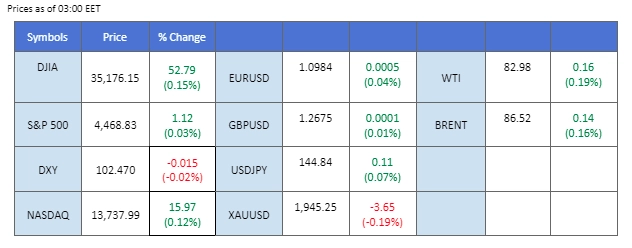

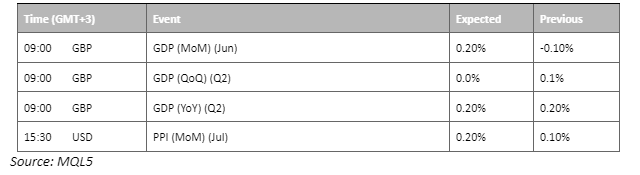

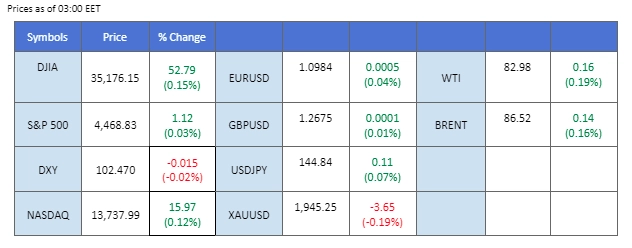

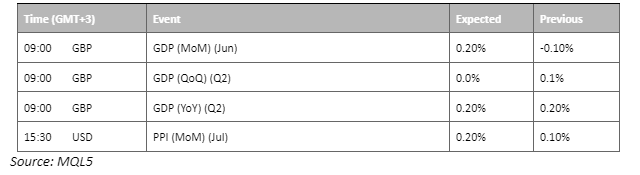

The U.S. Consumer Price Index (CPI) was unveiled in the previous night’s session, yielding a mixed outcome. While the reading showed an increase compared to the earlier figures, indicating a rise in inflation, it fell short of the forecasted numbers. This outcome failed to muster the strength needed to drive the U.S. dollar upwards. Concurrently, market participants remain attentive to the impending release of the U.K.’s Gross Domestic Product (GDP) figures, scheduled for later today. This data holds the key to assessing the resilience of Sterling in the face of global economic dynamics. Elsewhere, the trajectory of oil prices witnessed a slight retracement following their ascent to a yearly peak. However, the potential for disruptions in oil supply due to geopolitical tensions could serve as a potent force propelling oil prices higher, infusing the market with added volatility and uncertainty.

Current rate hike bets on 20th September Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (86%) VS 25 bps (14%)

Key US consumer prices increased slightly for a second consecutive month, bolstering hopes that the Federal Reserve can navigate inflation without resorting to aggressive monetary tightening. The US Bureau of Labor Statistics reported the Consumer Price Index (CPI) YoY inched up from 3.0% to 3.2%, falling short of market expectations of 3.30%. Following the inflation data, the US Dollar underwent a sharp retreat. However, initial drops in US Treasury yields were eventually reversed. Amid this, certain investors engaged in dip-buying within the US Dollar market, seizing an opportunity after significant depreciation

The dollar index is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 62, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 102.60, 103.45

Support level: 102.05, 101.45

The gold market initially surged in response to a lacklustre US inflation report, only to retrace gains as investors grapple with the Federal Reserve’s future rate hike prospects. Despite inflation showing moderation, lingering expectations among certain investors for the Fed to maintain its robust monetary tightening strategy persist, driven by inflation readings surpassing the central bank’s 2% target.

Gold prices are trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 31, suggesting the commodity might enter oversold territory.

Resistance level: 1930.00, 1945.00

Support level: 1910.00, 1890.00

The USD/JPY pair continues to exhibit a bullish trajectory, with the Japanese Yen experiencing a further easing of approximately 0.1% during the past night’s trading session. The U.S. Consumer Price Index (CPI) increased by 3.2% compared to the previous reading. However, the figure fell short of the market consensus of 3.3%, prompting substantial fluctuations in the dollar index. Meanwhile, the Japanese Yen encountered sluggish trading patterns against its currency counterparts. This can be attributed to investors’ apprehensions regarding potential intervention by the Bank of Japan (BoJ) in the foreign currency market, should the pair approach the 145 level. Amidst these concerns, profit-taking activities gained prominence, generating heightened selling pressure on the Yen.

The USD.JPY pair has already gained more than 2% in this week and is currently testing its crucial psychological resistance level at 145.00. The RSI has broken into the overbought zone while the MACD continues to move upward, suggesting a bullish bias for the pair.

Resistance level: 145.00, 146.00

Support level: 143.25, 142.00

Sterling exhibited lateral movement within a broader range over the past few trading sessions. The unveiling of the U.S. Consumer Price Index (CPI) yesterday failed to provide a definitive indication of the Cable’s impending price direction. The dollar index initially experienced a decline as the CPI figures fell below market expectations. However, the sentiment prompted speculation that the Federal Reserve might adopt a more assertive approach in its monetary policy, and the dollar rebounded. Concurrently, market participants maintain a watchful eye on the release of the U.K.’s GDP figures, scheduled for later today. This data release carries the potential to influence the resilience of the Sterling, creating ripples in the currency market. Amidst these uncertainties, the Pound Sterling’s trajectory remains tethered to economic indicators and global dynamics.

GBP/USD continues to be subdued and is trading in the range between 1.2780 to 1.267. The RSI hovers in the lower region while the MACD failed to break above the zero line suggesting a bearish bias for the Cable.

Resistance level: 1.2740, 1.2860

Support level: 1.2605, 1.2500

The US equity market experienced subdued trading as investors grappled with reevaluating the US inflation landscape and the Federal Reserve’s forthcoming monetary decisions. While inflation rates have slightly abated, investor confidence in future Fed interest rate hikes endures due to lingering divergence from the central bank’s 2% inflation goal. Additionally, Walt Disney’s plans to hike prices for its ad-free streaming tier lifted investor spirits and contributed to a rise in the Dow.

The Dow is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 45, suggesting the index might extend its losses as the RSI stays below the midline.

Resistance level: 35640.00, 36415.00

Support level: 34575.00, 33675.00

The rekindling of tensions between the US and China had a ripple effect on Chinese-proxy currencies, including antipodeans such as the Aussie Dollar. President Joe Biden’s executive order restricted US investments in sensitive Chinese tech sectors, including semiconductors, quantum technologies, and certain AI systems. This move adds to the ongoing political complexities influencing market dynamics in the US and China relationship.

AUD/USD is trading lower while currently testing thes support level. MACD has illustrated diminishing bearish momentum, while RSI is at 39, suggesting the pair might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 0.6615, 0.6725

Support level: 0.6510, 0.6460

Oil’s winning streak saw a setback due to concerns stemming from China’s economic outlook. Despite optimistic OPEC+ production cut plans, apprehensions over China’s economic data pointing towards deflation dampened oil demand. Nonetheless, OPEC’s monthly report maintained a positive long-term outlook, expecting a healthy oil market for the remainder of the year and projecting robust oil demand in 2024 amid improving global economic prospects.

Oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 46, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 86.10, 89.25

Support level: 83.75, 78.90

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

The U.S. Consumer Price Index (CPI) was unveiled in the previous night’s session, yielding a mixed outcome. While the reading showed an increase compared to the earlier figures, indicating a rise in inflation, it fell short of the forecasted numbers. This outcome failed to muster the strength needed to drive the U.S. dollar upwards. Concurrently, market participants remain attentive to the impending release of the U.K.’s Gross Domestic Product (GDP) figures, scheduled for later today. This data holds the key to assessing the resilience of Sterling in the face of global economic dynamics. Elsewhere, the trajectory of oil prices witnessed a slight retracement following their ascent to a yearly peak. However, the potential for disruptions in oil supply due to geopolitical tensions could serve as a potent force propelling oil prices higher, infusing the market with added volatility and uncertainty.

Current rate hike bets on 20th September Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (86%) VS 25 bps (14%)

Key US consumer prices increased slightly for a second consecutive month, bolstering hopes that the Federal Reserve can navigate inflation without resorting to aggressive monetary tightening. The US Bureau of Labor Statistics reported the Consumer Price Index (CPI) YoY inched up from 3.0% to 3.2%, falling short of market expectations of 3.30%. Following the inflation data, the US Dollar underwent a sharp retreat. However, initial drops in US Treasury yields were eventually reversed. Amid this, certain investors engaged in dip-buying within the US Dollar market, seizing an opportunity after significant depreciation

The dollar index is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 62, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 102.60, 103.45

Support level: 102.05, 101.45

The gold market initially surged in response to a lacklustre US inflation report, only to retrace gains as investors grapple with the Federal Reserve’s future rate hike prospects. Despite inflation showing moderation, lingering expectations among certain investors for the Fed to maintain its robust monetary tightening strategy persist, driven by inflation readings surpassing the central bank’s 2% target.

Gold prices are trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 31, suggesting the commodity might enter oversold territory.

Resistance level: 1930.00, 1945.00

Support level: 1910.00, 1890.00

The USD/JPY pair continues to exhibit a bullish trajectory, with the Japanese Yen experiencing a further easing of approximately 0.1% during the past night’s trading session. The U.S. Consumer Price Index (CPI) increased by 3.2% compared to the previous reading. However, the figure fell short of the market consensus of 3.3%, prompting substantial fluctuations in the dollar index. Meanwhile, the Japanese Yen encountered sluggish trading patterns against its currency counterparts. This can be attributed to investors’ apprehensions regarding potential intervention by the Bank of Japan (BoJ) in the foreign currency market, should the pair approach the 145 level. Amidst these concerns, profit-taking activities gained prominence, generating heightened selling pressure on the Yen.

The USD.JPY pair has already gained more than 2% in this week and is currently testing its crucial psychological resistance level at 145.00. The RSI has broken into the overbought zone while the MACD continues to move upward, suggesting a bullish bias for the pair.

Resistance level: 145.00, 146.00

Support level: 143.25, 142.00

Sterling exhibited lateral movement within a broader range over the past few trading sessions. The unveiling of the U.S. Consumer Price Index (CPI) yesterday failed to provide a definitive indication of the Cable’s impending price direction. The dollar index initially experienced a decline as the CPI figures fell below market expectations. However, the sentiment prompted speculation that the Federal Reserve might adopt a more assertive approach in its monetary policy, and the dollar rebounded. Concurrently, market participants maintain a watchful eye on the release of the U.K.’s GDP figures, scheduled for later today. This data release carries the potential to influence the resilience of the Sterling, creating ripples in the currency market. Amidst these uncertainties, the Pound Sterling’s trajectory remains tethered to economic indicators and global dynamics.

GBP/USD continues to be subdued and is trading in the range between 1.2780 to 1.267. The RSI hovers in the lower region while the MACD failed to break above the zero line suggesting a bearish bias for the Cable.

Resistance level: 1.2740, 1.2860

Support level: 1.2605, 1.2500

The US equity market experienced subdued trading as investors grappled with reevaluating the US inflation landscape and the Federal Reserve’s forthcoming monetary decisions. While inflation rates have slightly abated, investor confidence in future Fed interest rate hikes endures due to lingering divergence from the central bank’s 2% inflation goal. Additionally, Walt Disney’s plans to hike prices for its ad-free streaming tier lifted investor spirits and contributed to a rise in the Dow.

The Dow is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 45, suggesting the index might extend its losses as the RSI stays below the midline.

Resistance level: 35640.00, 36415.00

Support level: 34575.00, 33675.00

The rekindling of tensions between the US and China had a ripple effect on Chinese-proxy currencies, including antipodeans such as the Aussie Dollar. President Joe Biden’s executive order restricted US investments in sensitive Chinese tech sectors, including semiconductors, quantum technologies, and certain AI systems. This move adds to the ongoing political complexities influencing market dynamics in the US and China relationship.

AUD/USD is trading lower while currently testing thes support level. MACD has illustrated diminishing bearish momentum, while RSI is at 39, suggesting the pair might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 0.6615, 0.6725

Support level: 0.6510, 0.6460

Oil’s winning streak saw a setback due to concerns stemming from China’s economic outlook. Despite optimistic OPEC+ production cut plans, apprehensions over China’s economic data pointing towards deflation dampened oil demand. Nonetheless, OPEC’s monthly report maintained a positive long-term outlook, expecting a healthy oil market for the remainder of the year and projecting robust oil demand in 2024 amid improving global economic prospects.

Oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 46, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 86.10, 89.25

Support level: 83.75, 78.90

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.