-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

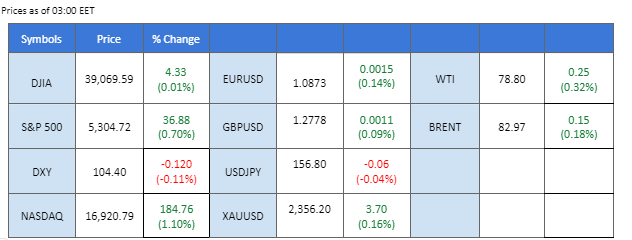

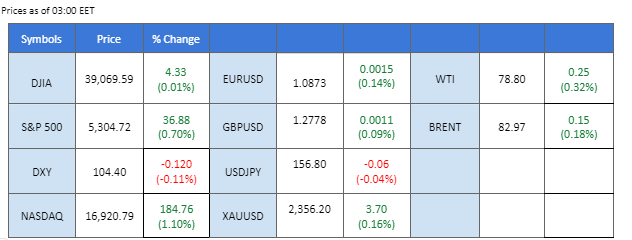

The market saw muted activity as both the U.S. and the U.K. observed public holidays in yesterday’s session. The dollar index (DXY) edged lower, failing to hold above the 104.50 level. This decline comes as the market anticipates signs of cooling U.S. inflation ahead of the PCE reading due on Friday. Meanwhile, the U.S. Securities and Exchange Commission (SEC) announced a reduction in Wall Street settlement times, aiming to complete transactions in a single day. This move is expected to mitigate potential financial risks, enhance market liquidity, and potentially boost the U.S. equity market when trading resumes on Tuesday.

Meanwhile, Gold prices edged higher, supported by the easing dollar and heightened geopolitical tensions in the Middle East. Continuous airstrikes by Israel, resulting in significant casualties, pushed oil prices up by more than 1% in the last session. The ongoing conflict has raised concerns about oil supply disruptions, contributing to the rise in oil prices.

In addition, The EUR/USD pair remained firm above its crucial psychological support level at 1.0800, indicating sustained bullish momentum. However, the euro’s strength was hindered by dovish comments from ECB Governing Council member François Villeroy, who suggested that the ECB should consider a rate cut in June or July. Such an easing in monetary policy could exert downside pressure on the euro.

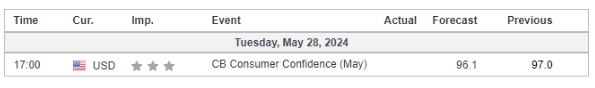

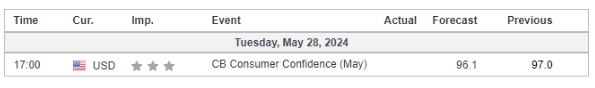

Current rate hike bets on 12nd June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98.8%) VS -25 bps (1.2%)

(MT4 System Time)

Source: MQL5

The Dollar Index continued to extend its losses despite US holidays, as investors took profits ahead of critical events this week. Major inflation data releases from the US, Europe, and Japan are expected to provide direction for global interest rates. The spotlight is on Friday’s US Core Personal Consumption Expenditures (PCE) price index, the Federal Reserve’s preferred inflation measure, with economists anticipating a steady month-on-month reading. Additionally, market participants will be closely listening to speeches from several Fed officials, including Governor Michelle Bowman, Cleveland Fed President Loretta Mester, Governor Lisa Cook, New York Fed President John Williams, and Atlanta Fed President Raphael Bostic.

The Dollar Index is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 38, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 104.65, 105.25

Support level: 103.90, 103.15

Gold prices remained flat due to US holidays but gained slight bullish momentum amid a weakening US Dollar. Profit-taking has led the dollar to retrace from a crucial resistance level. The gold market is expected to experience high volatility ahead of key inflation reports due later this week. Investors should continue to monitor global inflation data for further trading signals and trend clarifications in the gold market.

Gold prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 45, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 2365.00, 2395.00

Support level: 2335.00, 2285.00

The GBP/USD pair has surged past its strong resistance level at 1.2760, signalling a bullish bias for the pair. This upward momentum is primarily driven by market speculation that Friday’s PCE data may show signs of easing U.S. inflation, thereby exerting pressure on the dollar. Despite this bullish breakout, mixed economic indicators from the UK last week have created uncertainty for Sterling traders, dampening the strength of the Sterling. This divergence has left traders in a dilemma as they navigate the conflicting signals from the UK’s economic landscape.

GBP/USD’s break above its strong resistance level suggests a bullish bias for the pair. The RSI has broken into the overbought zone, while the MACD has crossed above the zero line and edged higher, suggesting that bullish momentum is gaining.

Resistance level: 1.2850, 1.2940

Support level: 1.2660, 1.2600

The EUR/USD pair extended its gains, buoyed by the depreciation of the US Dollar. However, Euro traders should remain cautious ahead of the European Central Bank’s (ECB) upcoming monetary policy meeting. ECB Chief Economist Philip Lane recently indicated that the ECB is considering cutting interest rates from the current high of 4% at its next meeting, given that Eurozone inflation is nearing the 2% target. Market participants are betting on a 25 basis point cut at the June 6 meeting, which could diminish demand for the Euro.

EUR/USD is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 62, suggesting the pair might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 1.0875, 1.0935

Support level: 1.0810, 1.0735

The AUD/USD pair has surged strongly since last Friday, forming a higher high level that suggests a potential trend reversal. Although today’s Australian Retail Sales figures came in lower than market expectations, the pair remains buoyed by strong selling pressure on the U.S. dollar. This pressure stems from market anticipation of a lower PCE reading on Friday, which is impacting the dollar and supporting the AUD/USD pair.

The AUD.USD has broken its resistance level and formed a higher high suggesting a trend reversal for the pair. The RSI has rebounded and the MACD is on the brink of breaking above the zero line suggesting a fresh bullish momentum is forming.

Resistance level: 0.6677, 0.6730

Support level: 0.6640, 0.6590

The GBP/JPY pair has broken above its crucial psychological resistance level at the 200 mark, indicating a bullish bias for the pair. This surge has propelled the pair to its highest level since 2008, driven by the ongoing struggles of the Japanese Yen and the buoyancy of the Pound Sterling. Last week’s high UK CPI reading suggests the Bank of England may maintain its monetary tightening policy for an extended period, further supporting the strength of the Sterling.

The pair has broken the crucial 200 mark and is currently traded at above such a level, suggesting a bullish signal for the pair. The RSI remains in the overbought zone, while the MACD flows flat at the elevated level, suggesting the bullish momentum remains intact.

Resistance level: 200.60, 201.15

Support level:199.95, 199.00

Oil prices extended gains as investors anticipated the upcoming OPEC+ meeting later this week. The market expects OPEC+ to consider production cuts in response to recent price dips. However, uncertainties remain, including key inflation reports due this week, which could limit gains in the volatile oil market. Investors are advised to monitor the EIA oil inventories report and outcomes from the OPEC+ meeting for further trading signals.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 59, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 79.85, 82.00

Support level: 76.90, 75.55

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

The market saw muted activity as both the U.S. and the U.K. observed public holidays in yesterday’s session. The dollar index (DXY) edged lower, failing to hold above the 104.50 level. This decline comes as the market anticipates signs of cooling U.S. inflation ahead of the PCE reading due on Friday. Meanwhile, the U.S. Securities and Exchange Commission (SEC) announced a reduction in Wall Street settlement times, aiming to complete transactions in a single day. This move is expected to mitigate potential financial risks, enhance market liquidity, and potentially boost the U.S. equity market when trading resumes on Tuesday.

Meanwhile, Gold prices edged higher, supported by the easing dollar and heightened geopolitical tensions in the Middle East. Continuous airstrikes by Israel, resulting in significant casualties, pushed oil prices up by more than 1% in the last session. The ongoing conflict has raised concerns about oil supply disruptions, contributing to the rise in oil prices.

In addition, The EUR/USD pair remained firm above its crucial psychological support level at 1.0800, indicating sustained bullish momentum. However, the euro’s strength was hindered by dovish comments from ECB Governing Council member François Villeroy, who suggested that the ECB should consider a rate cut in June or July. Such an easing in monetary policy could exert downside pressure on the euro.

Current rate hike bets on 12nd June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98.8%) VS -25 bps (1.2%)

(MT4 System Time)

Source: MQL5

The Dollar Index continued to extend its losses despite US holidays, as investors took profits ahead of critical events this week. Major inflation data releases from the US, Europe, and Japan are expected to provide direction for global interest rates. The spotlight is on Friday’s US Core Personal Consumption Expenditures (PCE) price index, the Federal Reserve’s preferred inflation measure, with economists anticipating a steady month-on-month reading. Additionally, market participants will be closely listening to speeches from several Fed officials, including Governor Michelle Bowman, Cleveland Fed President Loretta Mester, Governor Lisa Cook, New York Fed President John Williams, and Atlanta Fed President Raphael Bostic.

The Dollar Index is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 38, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 104.65, 105.25

Support level: 103.90, 103.15

Gold prices remained flat due to US holidays but gained slight bullish momentum amid a weakening US Dollar. Profit-taking has led the dollar to retrace from a crucial resistance level. The gold market is expected to experience high volatility ahead of key inflation reports due later this week. Investors should continue to monitor global inflation data for further trading signals and trend clarifications in the gold market.

Gold prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 45, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 2365.00, 2395.00

Support level: 2335.00, 2285.00

The GBP/USD pair has surged past its strong resistance level at 1.2760, signalling a bullish bias for the pair. This upward momentum is primarily driven by market speculation that Friday’s PCE data may show signs of easing U.S. inflation, thereby exerting pressure on the dollar. Despite this bullish breakout, mixed economic indicators from the UK last week have created uncertainty for Sterling traders, dampening the strength of the Sterling. This divergence has left traders in a dilemma as they navigate the conflicting signals from the UK’s economic landscape.

GBP/USD’s break above its strong resistance level suggests a bullish bias for the pair. The RSI has broken into the overbought zone, while the MACD has crossed above the zero line and edged higher, suggesting that bullish momentum is gaining.

Resistance level: 1.2850, 1.2940

Support level: 1.2660, 1.2600

The EUR/USD pair extended its gains, buoyed by the depreciation of the US Dollar. However, Euro traders should remain cautious ahead of the European Central Bank’s (ECB) upcoming monetary policy meeting. ECB Chief Economist Philip Lane recently indicated that the ECB is considering cutting interest rates from the current high of 4% at its next meeting, given that Eurozone inflation is nearing the 2% target. Market participants are betting on a 25 basis point cut at the June 6 meeting, which could diminish demand for the Euro.

EUR/USD is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 62, suggesting the pair might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 1.0875, 1.0935

Support level: 1.0810, 1.0735

The AUD/USD pair has surged strongly since last Friday, forming a higher high level that suggests a potential trend reversal. Although today’s Australian Retail Sales figures came in lower than market expectations, the pair remains buoyed by strong selling pressure on the U.S. dollar. This pressure stems from market anticipation of a lower PCE reading on Friday, which is impacting the dollar and supporting the AUD/USD pair.

The AUD.USD has broken its resistance level and formed a higher high suggesting a trend reversal for the pair. The RSI has rebounded and the MACD is on the brink of breaking above the zero line suggesting a fresh bullish momentum is forming.

Resistance level: 0.6677, 0.6730

Support level: 0.6640, 0.6590

The GBP/JPY pair has broken above its crucial psychological resistance level at the 200 mark, indicating a bullish bias for the pair. This surge has propelled the pair to its highest level since 2008, driven by the ongoing struggles of the Japanese Yen and the buoyancy of the Pound Sterling. Last week’s high UK CPI reading suggests the Bank of England may maintain its monetary tightening policy for an extended period, further supporting the strength of the Sterling.

The pair has broken the crucial 200 mark and is currently traded at above such a level, suggesting a bullish signal for the pair. The RSI remains in the overbought zone, while the MACD flows flat at the elevated level, suggesting the bullish momentum remains intact.

Resistance level: 200.60, 201.15

Support level:199.95, 199.00

Oil prices extended gains as investors anticipated the upcoming OPEC+ meeting later this week. The market expects OPEC+ to consider production cuts in response to recent price dips. However, uncertainties remain, including key inflation reports due this week, which could limit gains in the volatile oil market. Investors are advised to monitor the EIA oil inventories report and outcomes from the OPEC+ meeting for further trading signals.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 59, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 79.85, 82.00

Support level: 76.90, 75.55

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.