-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

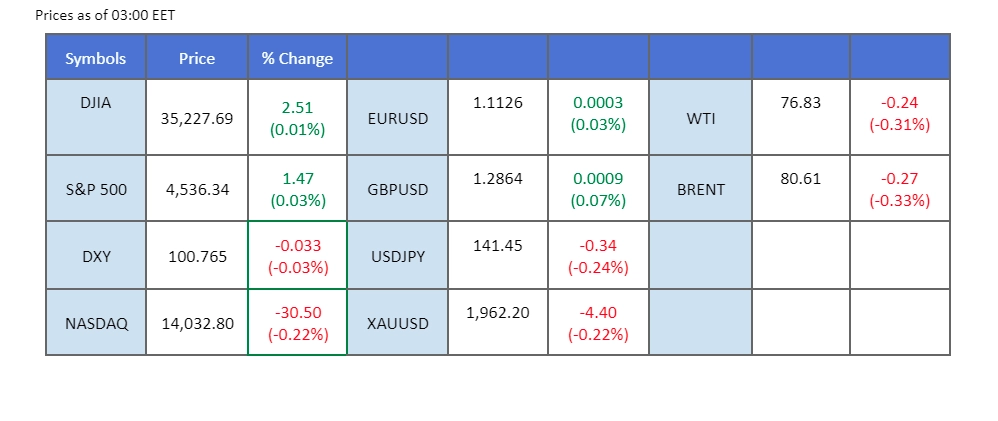

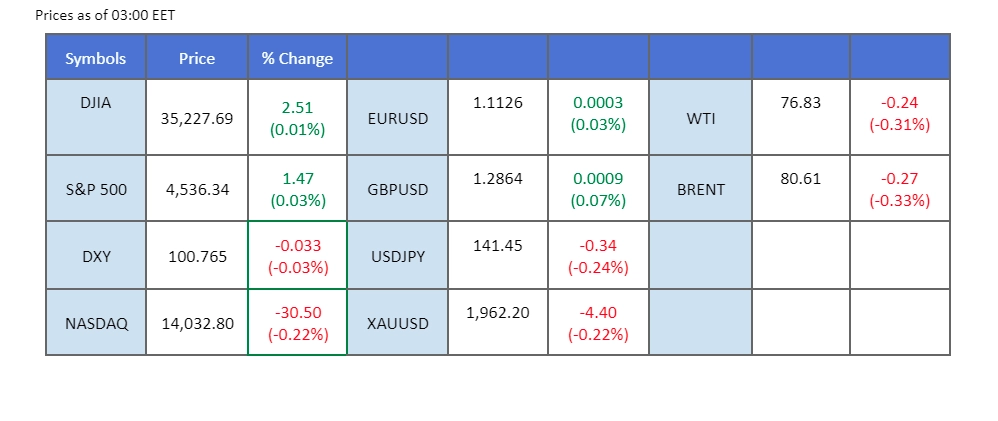

This week, major central bank decisions will be in focus, including the Fed’s rate announcement on Wednesday and the ECB’s on the following day. Investors will closely watch the CB Consumer Confidence released on Tuesday for insights into the Fed’s monetary policy. On the other hand, the Japanese yen appears to be weakening as Japanese officials have stated that the government has no immediate plans to modify its current ultra-loose monetary policy. They are opting to wait for further macroeconomic data before deciding on their next moves. Elsewhere, oil prices edged up but faced resistance near $77 due to supply disruptions caused by wildfire outbreaks in Southern Washington, impacting the oil market.

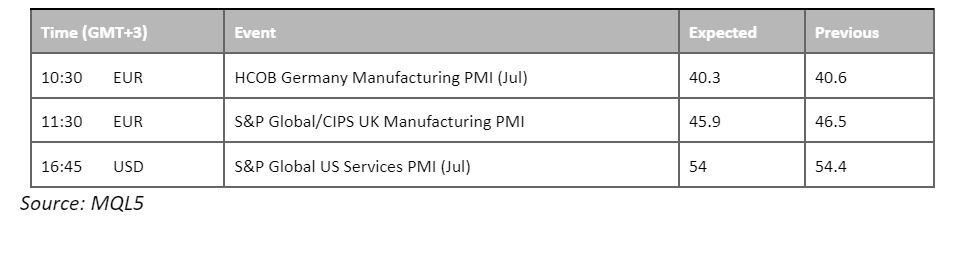

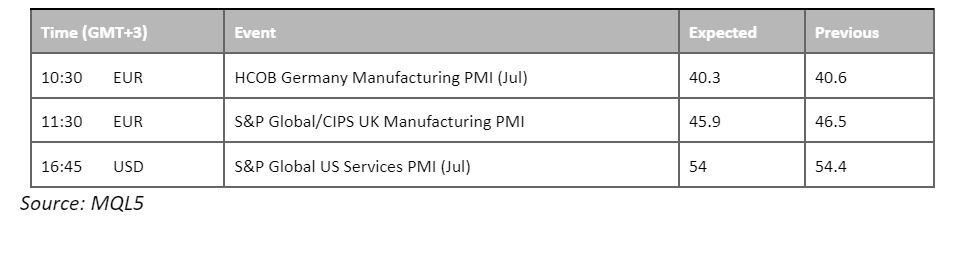

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (0.2%) VS 25 bps (99.8%)

The US Dollar experienced a marginal rebound ahead of the highly anticipated Federal Open Market Committee (FOMC) meeting. Market participants have overwhelmingly priced in a 25-basis points interest rate increase on Wednesday. However, prevailing uncertainty regarding the long-term monetary outlook has left investors divided. Consequently, all eyes are on the Fed’s monetary statement for clues that may shed light on the potential conclusion of its tightening cycle.

The dollar index is higher following the prior breakout above the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 67, suggesting the index might enter overbought territory.

Resistance level: 101.50, 102.05

Support level: 100.80, 99.65

As major central bank meetings draw near and expectations of interest rate hikes intensify, investors have initiated a selloff in gold. Market participants might potentially shift towards government bonds to capitalise on higher yields in the prevailing tightening monetary cycle. Nevertheless, the monetary statements from central banks have left room for interpretation, leading to sustained volatilities in the gold market.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 42 suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 1980.00, 2000.00

Support level: 1955.00, 1930.00

The Euro remains in a holding pattern as traders await the ECB’s forthcoming meeting. Expectations are widespread for another 25-basis points rate hike, mirroring the Federal Reserve’s actions. Market sentiment leans towards a more hawkish stance from the ECB, given the Eurozone’s persistent inflation resilience, with December data showing a peak of 10.6%, well above the ECB’s target.

EUR/USD is trading flat while currently near the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 60, suggesting the pair might extend its losses after breakout since the RSI retreated sharply from overbought territory.

Resistance level: 1.1455, 1.1720

Support level: 1.1060, 1.0675

Last week, the Pound Sterling experienced one of its most significant weekly losses this year, primarily due to the UK’s CPI showing a softer-than-expected number. As a result, investors are cautious about making aggressive bullish bets, as they believe the Bank of England (BoE) is unlikely to implement tighter monetary policy despite the CPI reading is still far from its targeted 2%. Meanwhile, investor attention is now focused on the upcoming Federal Reserve interest rate decision, scheduled for this Wednesday.

GBP/USD has dropped more than 1.8% last week but the bearish momentum has eased at near the 1.2850 support level. The RSI has the tendency to rebound from the oversold zone while the MACD is about to cross at below zero line suggesting a trend reversal might happen.

Resistance level: 1.2940, 1.3012

Support level: 1.2840, 1.2750

Last week, the Dow surged over 2%, driven by impressive earnings reports from key components such as IBM and JNJ, surpassing expectations. With the ongoing earnings season, many more reports are yet to be released, and they could influence the index’s volatility. Investors are currently speculating that the July rate hike might be the last in the current Fed’s monetary tightening cycle. This dovish outlook on monetary policy is seen as favourable for the equity market, which could act as a bullish catalyst for the Dow.

Last week, the Dow successfully surpassed its formidable resistance level at 34,500, and also conquered another resistance, exhibiting a robust bullish momentum. The RSI has entered the overbought territory, indicating heightened buying interest, while the MACD continues to surge, further affirming the index’s current bullish momentum.

Resistance level: 35400.00, 35850.00

Support level: 34900.00, 34500.00

The Japanese yen experienced significant selling pressure ahead of the BoJ meeting amid heightened volatilities. The Bank of Japan’s imminent decision is under scrutiny amid ongoing speculations about adjustments to its ultra-loose monetary stance due to elevated price pressures. Core inflation data released last Friday indicated that Japan’s inflation has consistently stayed above the central bank’s 2% target for 15 consecutive months.

USD/JPY is trading flat while currently near the support level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 64, suggesting the pair might enter overbought territory.

Resistance level: 142.10, 143.30

Support level: 141.25, 140.40

In southern Washington state’s Krickitt County, a fast-growing wildfire has sparked worries about oil supply. The emergency officials have reported that the fire has already caused damage to several structures, including a natural gas pipeline. Such events amplify concerns over potential disruptions in oil availability, adding to existing market uncertainties. In addition, The Group of 20 (G20) major economies’ meeting failed to reach a consensus on phasing down fossil fuels, particularly in relation to the intended tripling of renewable energy capacities by 2030. This disagreement casts doubt on the timeline for the shift from non-renewable energy sources to renewable alternatives. Consequently, expectations persist for solid oil demand in the near term.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 59, suggesting the commodity might extend its gains after breakout the resistance level since the RSI stays above the midline.

Resistance level: 76.90, 79.90

Resistance level: 74.25, 71.80

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

This week, major central bank decisions will be in focus, including the Fed’s rate announcement on Wednesday and the ECB’s on the following day. Investors will closely watch the CB Consumer Confidence released on Tuesday for insights into the Fed’s monetary policy. On the other hand, the Japanese yen appears to be weakening as Japanese officials have stated that the government has no immediate plans to modify its current ultra-loose monetary policy. They are opting to wait for further macroeconomic data before deciding on their next moves. Elsewhere, oil prices edged up but faced resistance near $77 due to supply disruptions caused by wildfire outbreaks in Southern Washington, impacting the oil market.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (0.2%) VS 25 bps (99.8%)

The US Dollar experienced a marginal rebound ahead of the highly anticipated Federal Open Market Committee (FOMC) meeting. Market participants have overwhelmingly priced in a 25-basis points interest rate increase on Wednesday. However, prevailing uncertainty regarding the long-term monetary outlook has left investors divided. Consequently, all eyes are on the Fed’s monetary statement for clues that may shed light on the potential conclusion of its tightening cycle.

The dollar index is higher following the prior breakout above the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 67, suggesting the index might enter overbought territory.

Resistance level: 101.50, 102.05

Support level: 100.80, 99.65

As major central bank meetings draw near and expectations of interest rate hikes intensify, investors have initiated a selloff in gold. Market participants might potentially shift towards government bonds to capitalise on higher yields in the prevailing tightening monetary cycle. Nevertheless, the monetary statements from central banks have left room for interpretation, leading to sustained volatilities in the gold market.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 42 suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 1980.00, 2000.00

Support level: 1955.00, 1930.00

The Euro remains in a holding pattern as traders await the ECB’s forthcoming meeting. Expectations are widespread for another 25-basis points rate hike, mirroring the Federal Reserve’s actions. Market sentiment leans towards a more hawkish stance from the ECB, given the Eurozone’s persistent inflation resilience, with December data showing a peak of 10.6%, well above the ECB’s target.

EUR/USD is trading flat while currently near the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 60, suggesting the pair might extend its losses after breakout since the RSI retreated sharply from overbought territory.

Resistance level: 1.1455, 1.1720

Support level: 1.1060, 1.0675

Last week, the Pound Sterling experienced one of its most significant weekly losses this year, primarily due to the UK’s CPI showing a softer-than-expected number. As a result, investors are cautious about making aggressive bullish bets, as they believe the Bank of England (BoE) is unlikely to implement tighter monetary policy despite the CPI reading is still far from its targeted 2%. Meanwhile, investor attention is now focused on the upcoming Federal Reserve interest rate decision, scheduled for this Wednesday.

GBP/USD has dropped more than 1.8% last week but the bearish momentum has eased at near the 1.2850 support level. The RSI has the tendency to rebound from the oversold zone while the MACD is about to cross at below zero line suggesting a trend reversal might happen.

Resistance level: 1.2940, 1.3012

Support level: 1.2840, 1.2750

Last week, the Dow surged over 2%, driven by impressive earnings reports from key components such as IBM and JNJ, surpassing expectations. With the ongoing earnings season, many more reports are yet to be released, and they could influence the index’s volatility. Investors are currently speculating that the July rate hike might be the last in the current Fed’s monetary tightening cycle. This dovish outlook on monetary policy is seen as favourable for the equity market, which could act as a bullish catalyst for the Dow.

Last week, the Dow successfully surpassed its formidable resistance level at 34,500, and also conquered another resistance, exhibiting a robust bullish momentum. The RSI has entered the overbought territory, indicating heightened buying interest, while the MACD continues to surge, further affirming the index’s current bullish momentum.

Resistance level: 35400.00, 35850.00

Support level: 34900.00, 34500.00

The Japanese yen experienced significant selling pressure ahead of the BoJ meeting amid heightened volatilities. The Bank of Japan’s imminent decision is under scrutiny amid ongoing speculations about adjustments to its ultra-loose monetary stance due to elevated price pressures. Core inflation data released last Friday indicated that Japan’s inflation has consistently stayed above the central bank’s 2% target for 15 consecutive months.

USD/JPY is trading flat while currently near the support level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 64, suggesting the pair might enter overbought territory.

Resistance level: 142.10, 143.30

Support level: 141.25, 140.40

In southern Washington state’s Krickitt County, a fast-growing wildfire has sparked worries about oil supply. The emergency officials have reported that the fire has already caused damage to several structures, including a natural gas pipeline. Such events amplify concerns over potential disruptions in oil availability, adding to existing market uncertainties. In addition, The Group of 20 (G20) major economies’ meeting failed to reach a consensus on phasing down fossil fuels, particularly in relation to the intended tripling of renewable energy capacities by 2030. This disagreement casts doubt on the timeline for the shift from non-renewable energy sources to renewable alternatives. Consequently, expectations persist for solid oil demand in the near term.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 59, suggesting the commodity might extend its gains after breakout the resistance level since the RSI stays above the midline.

Resistance level: 76.90, 79.90

Resistance level: 74.25, 71.80

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.