-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

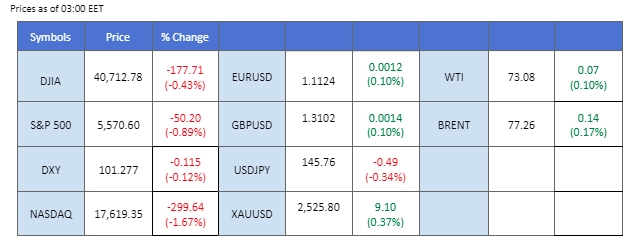

Market Summary

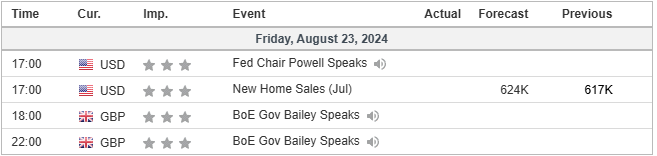

The Bank of Japan (BoJ) remains on course with its monetary tightening policy, according to the BoJ Chief, following his hearing at the Japan Lower House. However, he emphasised that there is no rush for the next rate hike, as the central bank continues to monitor global economic conditions. This hawkish stance has strengthened the Japanese Yen in the Tokyo session. Meanwhile, several Federal Reserve officials have suggested a slower pace for rate cuts, despite a downward revision of the Non-Farm Payroll (NFP) numbers and easing inflation in the U.S. The Fed’s cautious approach led to a decline in the U.S. equity markets, while the dollar found support above the $101 mark. Traders are focusing on today’s Jackson Hole Economic Symposium, where both Jerome Powell and the Bank of England’s Andrew Bailey are set to speak. Their comments could provide insights into the timing of rate cuts for their respective central banks.

In the commodity markets, gold failed to hold its critical support level at $2,500, suggesting a potential trend reversal due to a stronger dollar and profit-taking sentiment. In contrast, oil prices have recorded a technical rebound after declining for the past four sessions, signalling a possible recovery from recent losses.

Current rate hike bets on 18th September Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (32.5%) VS -25 bps (67.5%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index, which measures the dollar against a basket of six major currencies, rebounded after two Federal Reserve officials delivered slightly hawkish remarks. According to Bloomberg, these officials suggested that it would be appropriate for the US central bank to lower interest rates at a gradual and methodical pace, rather than cutting aggressively. While market participants widely anticipate a rate cut in September, questions remain on whether the Fed will opt for a 25 or 50 basis point reduction. These comments have left investors uncertain about the future of the Fed’s easing policy.

The Dollar Index is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 31, suggesting the index might enter oversold territory.

Resistance level: 102.35, 103.35

Support level: 100.90, 99.95

Gold prices tumbled following the hawkish tone from some Federal Reserve members who do not support aggressive rate cuts. They emphasised the need to continue monitoring the overall US economy before making any decisions. Some members, like Fed’s Collin, remain optimistic about the US economy, noting that recent data indicate the economy is still in a relatively strong position. Meanwhile, Fed’s Harder stated that more data is needed before deciding on the size of the rate cut. This uncertainty has led to profit-taking among investors after gold recently hit record highs.

Gold prices are trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 45, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 2495.00, 2535.00

Support level: 2465.00, 2445.00

The British pound traded sideways in the last session as both the pound and the dollar lacked strong catalysts, resulting in minimal price movement. The U.S. dollar was buoyed by comments from Federal Reserve officials suggesting that the Fed might adopt a slower pace for interest rate cuts. This cautious approach has provided some support for the otherwise lacklustre dollar. Meanwhile, traders are focused on today’s speech by Bank of England Governor Andrew Bailey at the Jackson Hole Economic Symposium, anticipating insights into the BoE’s upcoming monetary policy moves.

GBP/USD remains within its uptrend trajectory despite the pair’s sideways performance in the last session. The RSI remains in the overbought zone, while the MACD is edging higher, suggesting the pair’s bullish momentum remains strong.

Resistance level: 1.3140, 1.3220

Support level: 1.2985, 1.2915

The EUR/USD pair experienced a technical retracement in the last session, erasing its initial gains. The euro was initially bolstered by an upbeat PMI reading, but it was later pressured down following the release of strong U.S. PMI data. Meanwhile, traders are focused on today’s speech by Federal Reserve Chair Jerome Powell to assess the potential strength of the dollar and its implications for the EUR/USD pair.

EUR/USD had a technical retracement but remained supported at the above 1.1100 level, suggesting the pair remains trading within the uptrend trajectory. The RSI has dropped out from the overbought zone, while the MACD has a deadly cross on the above, suggesting the bullish momentum has eased.

Resistance level: 1.1180, 1.1230

Support level: 1.1040, 1.0985

The USD/JPY pair remains below its critical liquidity zone near the 147.00 mark, indicating strong selling pressure at this level. Bank of Japan (BoJ) Governor Kazuo Ueda signalled that the Japanese central bank would continue its monetary tightening policy following his appearance at the Japanese Lower House hearing, where he discussed the direction of the BoJ’s monetary policy. This hawkish stance from the BoJ chief has strengthened the Japanese yen, which may exert further downside pressure on the pair.

The USD/JPY was rejected once again at near the 147.00 mark, suggesting a bearish bias for the pair. The RSI is below the 50 level, while the MACD remains below the zero line, suggesting bearish momentum is forming.

Resistance level: 146.00, 149.20

Support level: 143.45, 141.40

US equity markets retreated slightly after several Federal Reserve members unexpectedly adopted a more hawkish tone, expressing scepticism about the appropriateness of aggressive rate cuts at this time. US Treasury yields rebounded, and investors are now focusing on Fed Chair Jerome Powell’s upcoming speech at the Jackson Hole Symposium later today.

Nasdaq is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 56, suggesting the index might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 20015.00, 20705.00

Support level: 19035.00, 17865.00

Oil prices rebounded slightly after hitting a strong support level, driven primarily by bargain buying and a bullish EIA crude oil inventory report. However, the long-term trend for the oil market remains bearish due to easing Middle East tensions and economic uncertainties. Israeli negotiators have arrived in Cairo for talks aimed at solidifying a ceasefire agreement in Gaza, which could de-escalate tensions in the crude-producing region. The US oil benchmark has nearly erased its year-to-date gains as concerns over China’s economic outlook overshadow the effects of OPEC+ supply cuts. Additionally, US manufacturing activity contracted at the fastest pace this year, adding to concerns about the US economy.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 45, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 73.50, 75.45

Support level: 71.75, 70.40

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!