-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

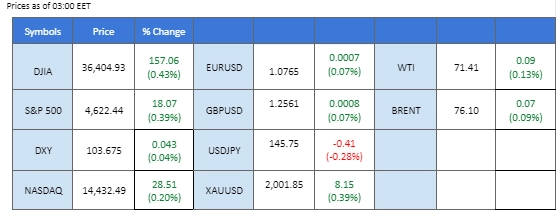

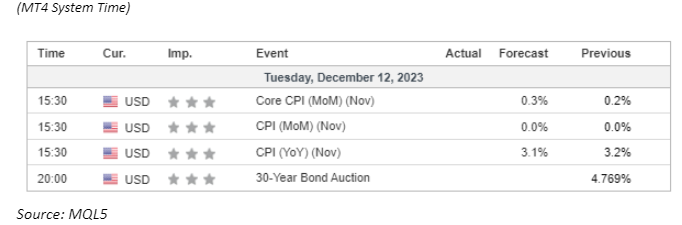

The U.S. Dollar is holding firm above the $103.50 level, buoyed by the positive momentum gained from upbeat U.S. job data released last Friday. Market focus is now trained on the impending U.S. Consumer Price Index (CPI) reading, anticipated to influence the dollar’s trajectory. Concurrently, U.S. equity markets are witnessing a rally in anticipation of the inflation gauge data, with market expectations leaning towards the Federal Reserve maintaining rates. In Japan, the Japanese Yen experienced its most significant drop in months as the strengthening dollar exerted pressure, leading to a weakening of the Yen. This trend coincided with Japan’s producer prices decelerating to their slowest pace in nearly three years. Meanwhile, in the cryptocurrency realm, Bitcoin unexpectedly slid by over 6% at the beginning of the week, resulting in the liquidation of more than $119 million worth of long positions.

Current rate hike bets on 13rd December Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98.0%) VS 25 bps (2%)

The US Dollar sees marginal gains, yet a prevailing sense of caution lingers ahead of pivotal market-moving events scheduled for this week. Investors are on high alert for the release of inflation data and the Federal Reserve’s upcoming monetary policy announcement, anticipating significant implications for dollar-related assets, notably gold. Despite market consensus leaning toward the Federal Reserve concluding its interest rate hike cycle, the recent robust jobs report has injected uncertainties into the economic outlook.

The Dollar Index is trading higher while currently near the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 58, suggesting the index might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 104.45, 105.60

Support level: 103.55, 102.65

Gold experiences a sharp decline, breaching the psychologically significant level of $2,000, propelled by an unexpectedly positive jobs report from the United States. With the spotlight on today’s Consumer Price Index (CPI) data and upcoming economic events, including the Producer Price Index (PPI) and the Federal Reserve’s final interest rate decision of the year, investors brace for heightened volatility in the precious metal market.

Gold prices are trading lower following the prior breakout below the support level. However, MACD has illustrated diminishing bearish momentum, while RSi is at 32, suggesting the commodity might enter oversold territory.

Resistance level: 2010.00, 2030.00

Support level: 1980.00, 1935.00

The GBP/USD pair has shown a departure from its recent bearish trend and is currently trading sideways, eagerly anticipating a catalyst for the next directional move. While the dollar gained strength last Friday, buoyed by positive job data, its impact on the Cable has been somewhat tempered. Investor attention is currently fixed on the upcoming U.S. Consumer Price Index (CPI) release scheduled for later today. Simultaneously, the Sterling is gathering bullish momentum in anticipation of Thursday’s Bank of England (BoE) interest rate decision.

GBP/USD has eased from its downtrend pattern and is supported at near 1,2530 level. The RSI is flowing below 50-level while the MACD has crossed below the zero line, suggesting a neutral signal for the pair.

Resistance level: 1.2630, 1.2730

Support level: 1.2530, 1.2435

The EUR/USD pair witnessed a decline exceeding 1% in the previous week, but the bearish trend appears to be easing in the current week. Market focus is now directed towards the upcoming U.S. CPI release scheduled for later today, with expectations of potential fluctuations in the pair. Simultaneously, traders closely monitor interest rate decisions from both central banks later this week. However, recent economic indicators from Europe present a mixed picture. The European CPI fell short of expectations, and a decline in Retail Sales implies that the European Central Bank (ECB) might opt to maintain its current interest rate levels.

EUR/USD has found support at near 1.0745 from its downtrend pattern. The RSI has rebounded from the oversold zone while the MACD has crossed below zero, which suggests a potential trend reversal for the pair.

Resistance level: 1.0866, 1.0955

Support level: 1.0700, 1.0630

The Japanese Yen experienced its most significant decline in a month, as the U.S. dollar gained strength on the heels of positive job data. This trend coincided with a less-than-optimistic Japan Producer Price Index (PPI) reading. However, Yen’s upward momentum eased, remaining below the crucial pivotal level of 147.00. Adding to the softening of the Japanese Yen, the Bank of Japan (BoJ) indicated that they have not yet observed sufficient evidence of wage growth supporting sustainable inflation. This stance suggests that the central bank is not ready to abandon its negative interest rate policy.

The USD/JPY experienced a technical rebound but is still kept below its critical, pivotal level at 146.75, suggesting the long-term bearish trend remained. The RSI has rebounded strongly while the MACD has crossed and is approaching the zero line from below, suggesting the bearish trend is drastically diminished.

Resistance level: 146.75, 148.65

Support level: 143.80, 141.65

The US equity market continues its upward trajectory, closing at new highs for the year as investors anticipate potential shifts in monetary policy. CME’s FedWatch Tool indicates widespread expectations for the central bank to maintain rates at Wednesday’s announcement. However, questions linger regarding the timing of the first rate cut, with March and May emerging as focal points for potential adjustments. The prospect of concluding the tightening monetary policy cycle signals optimism, further boosting confidence in the equity market.

The Dow is trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum. However, RSI is at 77, suggesting the index might enter overbought territory.

Resistance level: 36490.00, 36955.00

Support level: 35930.00, 35465.00

Crude oil prices experience a modest rebound, settling slightly higher on Monday in anticipation of major events unfolding this week. With several central banks poised for monetary policy meetings, economists predict a potential shift from tightening to expansionary cycles. The expectation of dovish statements and rate cut considerations looms large. A collective move toward less aggressive tightening by central banks could amplify market optimism, propelling oil demand higher.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 50, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 72.15, 74.85

Support level: 68.90, 66.65

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!