-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

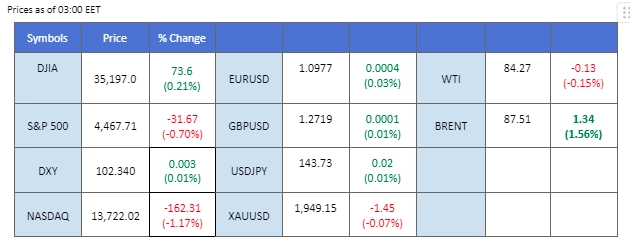

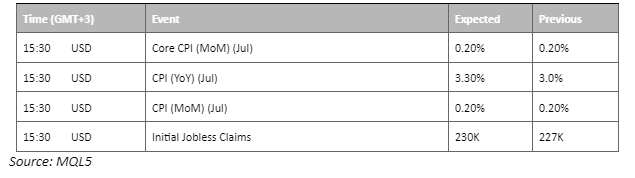

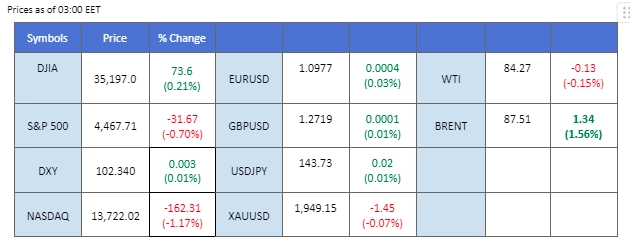

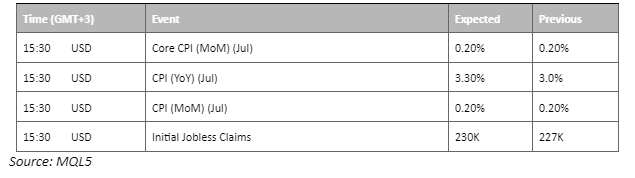

As the anticipation builds for releasing the Consumer Price Index (CPI) today, the U.S. equity markets maintain their downward trajectory. The market speculation is rife, with expectations suggesting a modest uptick in U.S. CPI figures from the previous reading of 3% to 3.3% for July. Amidst this backdrop, the U.S. dollar exhibited a sideways movement, seemingly poised for the impending data’s impact. In contrast, the lustrous appeal of gold took a hit, as its prices descended to mark a low for the month. Meanwhile, oil prices surged to their most elevated point since last December. This remarkable ascent is underpinned by a landscape of tightening oil supply. Despite the unexpected rise in U.S. oil inventories, a shadow was cast by the escalating tensions between Russia and Ukraine, diverting attention from the inventory dynamics.

Current rate hike bets on 20th September Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (86%) VS 25 bps (14%)

The US Dollar extended its gains, with investors gravitating towards the Dollar market ahead of the awaited inflation report. Economist projections for the upcoming Consumer Price Index (CPI) release suggest a likely upswing compared to the previous reading. This anticipated rise could amplify the probability of Fed interest rate hikes, subsequently bolstering the appeal of the Dollar.

The dollar index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 57, suggesting the index might be traded lower as technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 102.60, 103.40

Support level: 102.05, 101.45

Gold markets continued their downward trajectory. Escalated inflation projections and future Fed rate hike expectations have spurred a Dollar demand, exerting pressure on gold denominated in the Dollar. All eyes are on the forthcoming CPI data, a critical determinant for shaping future trading signals in the gold market.

Gold prices are trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 30, suggesting the commodity might enter oversold territory.

Resistance level: 1930.00, 1945.00

Support level: 1910.00, 1890.00

The Japanese Yen persists in its sluggish trading pattern against the U.S. dollar, with the currency pair poised to reach the 144 level. Despite the Bank of Japan’s adjustment to its Yield Curve Control (YCC), the Yen’s vigour remains subdued. This tweak has failed to amplify the Yen’s strength and left investors grappling with uncertainties surrounding the central bank’s monetary policy direction. In a parallel context, all eyes are trained on the impending release of the U.S. CPI. As anticipation mounts, the market is rife with speculation of a potential uptick in the inflation rate for July. If this projection rings true, it’s plausible that the U.S. dollar could witness further strengthening, which could propel the currency pair to trade at elevated levels.

The Japanese Yen continues to trade softly against the strong dollar. The RSI is moving toward the overbought zone while the MACD rebounded above the zero line suggesting the bullish momentum is strong.

Resistance level: 144.75, 146.00

Support level: 143.25, 142.00

The Pound Sterling displayed a diminished level of volatility compared to prior trading sessions. Market participants are maintaining a keen watch over a range of crucial economic data that holds the potential to sway Cable’s trajectory. One significant event on the horizon is the imminent release of the U.S. Consumer Price Index (CPI). The expectations for a surge in the figures from their previous reading could potentially invigorate the U.S. dollar, consequently exerting pressure on the Pound Sterling. Turning to the next day, investor attention remains fixed on the unveiling of the U.K.’s Gross Domestic Product (GDP) data. A positive signal indicating an expansion of the country’s economy would likely fuel a strengthening of the Sterling, leading it to trade more favourably against the U.S. dollar.

GBP/USD is trading lower following the prior retracement from the resistance level. The RSI has been flowing in the lower region and the MACD flows below the zero line suggesting the bearish momentum is still intact with the Cable.

Resistance level: 1.2865, 1.2990

Support level: 1.2605, 1.2500

Elevated global market volatility was the backdrop as investors braced for Thursday’s inflation report. Seeking refuge from high-risk equities, many shifted portfolios to safer assets, imparting bearish momentum to the US equity market. Nasdaq experienced declines of 1.2%. Nasdaq bore the brunt compared to other US major equity index due to its sensitivity to interest rate shifts, especially impactful given the potential ramifications of inflation data on Fed policy decisions.

Nasdaq is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 33, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 15885.00, 16545.00

Support level: 15005.00, 14275.00

A complex picture emerged from China’s inflation landscape, adding layers of uncertainty to the nation’s economic prospects. China’s Consumer Price Index (CPI) for the last month outperformed expectations at 0.20%, indicating resilient demand. However, the Producer Price Index (PPI) revealed a 4.40% contraction in July, exceeding market predictions. This dichotomy left investors grappling for directional cues, particularly prompting the Chinese-proxy currencies, such as AUD/USD, to be traded flat.

AUD/USD is trading flat while currently testing the support level. However, MACD has illustrated increasing bullish momentum, while RSI is at 46, suggesting the pair might be traded higher since the RSI rebounded from its oversold territory.

Resistance level: 0.6615, 0.6725

Support level: 0.6520, 0.6460

Despite recent downbeat inventory figures, the oil market achieved a three-year peak, propelled by resolute optimism around OPEC+ production cuts. Bullish sentiment persists, as investors digest the upcoming OPEC+ production cut scheduled for September, announced earlier. Notably, this bullish momentum for the oil market is limited by the recent inventory data, which revealed a significant 5.851 million barrel increase in US oil inventories for the week ending August 4th, far surpassing market expectations.

Oil prices are trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 69, suggesting the commodity might enter overbought territory.

Resistance level: 86.10, 89.25

Support level: 83.20, 78.90

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

As the anticipation builds for releasing the Consumer Price Index (CPI) today, the U.S. equity markets maintain their downward trajectory. The market speculation is rife, with expectations suggesting a modest uptick in U.S. CPI figures from the previous reading of 3% to 3.3% for July. Amidst this backdrop, the U.S. dollar exhibited a sideways movement, seemingly poised for the impending data’s impact. In contrast, the lustrous appeal of gold took a hit, as its prices descended to mark a low for the month. Meanwhile, oil prices surged to their most elevated point since last December. This remarkable ascent is underpinned by a landscape of tightening oil supply. Despite the unexpected rise in U.S. oil inventories, a shadow was cast by the escalating tensions between Russia and Ukraine, diverting attention from the inventory dynamics.

Current rate hike bets on 20th September Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (86%) VS 25 bps (14%)

The US Dollar extended its gains, with investors gravitating towards the Dollar market ahead of the awaited inflation report. Economist projections for the upcoming Consumer Price Index (CPI) release suggest a likely upswing compared to the previous reading. This anticipated rise could amplify the probability of Fed interest rate hikes, subsequently bolstering the appeal of the Dollar.

The dollar index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 57, suggesting the index might be traded lower as technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 102.60, 103.40

Support level: 102.05, 101.45

Gold markets continued their downward trajectory. Escalated inflation projections and future Fed rate hike expectations have spurred a Dollar demand, exerting pressure on gold denominated in the Dollar. All eyes are on the forthcoming CPI data, a critical determinant for shaping future trading signals in the gold market.

Gold prices are trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 30, suggesting the commodity might enter oversold territory.

Resistance level: 1930.00, 1945.00

Support level: 1910.00, 1890.00

The Japanese Yen persists in its sluggish trading pattern against the U.S. dollar, with the currency pair poised to reach the 144 level. Despite the Bank of Japan’s adjustment to its Yield Curve Control (YCC), the Yen’s vigour remains subdued. This tweak has failed to amplify the Yen’s strength and left investors grappling with uncertainties surrounding the central bank’s monetary policy direction. In a parallel context, all eyes are trained on the impending release of the U.S. CPI. As anticipation mounts, the market is rife with speculation of a potential uptick in the inflation rate for July. If this projection rings true, it’s plausible that the U.S. dollar could witness further strengthening, which could propel the currency pair to trade at elevated levels.

The Japanese Yen continues to trade softly against the strong dollar. The RSI is moving toward the overbought zone while the MACD rebounded above the zero line suggesting the bullish momentum is strong.

Resistance level: 144.75, 146.00

Support level: 143.25, 142.00

The Pound Sterling displayed a diminished level of volatility compared to prior trading sessions. Market participants are maintaining a keen watch over a range of crucial economic data that holds the potential to sway Cable’s trajectory. One significant event on the horizon is the imminent release of the U.S. Consumer Price Index (CPI). The expectations for a surge in the figures from their previous reading could potentially invigorate the U.S. dollar, consequently exerting pressure on the Pound Sterling. Turning to the next day, investor attention remains fixed on the unveiling of the U.K.’s Gross Domestic Product (GDP) data. A positive signal indicating an expansion of the country’s economy would likely fuel a strengthening of the Sterling, leading it to trade more favourably against the U.S. dollar.

GBP/USD is trading lower following the prior retracement from the resistance level. The RSI has been flowing in the lower region and the MACD flows below the zero line suggesting the bearish momentum is still intact with the Cable.

Resistance level: 1.2865, 1.2990

Support level: 1.2605, 1.2500

Elevated global market volatility was the backdrop as investors braced for Thursday’s inflation report. Seeking refuge from high-risk equities, many shifted portfolios to safer assets, imparting bearish momentum to the US equity market. Nasdaq experienced declines of 1.2%. Nasdaq bore the brunt compared to other US major equity index due to its sensitivity to interest rate shifts, especially impactful given the potential ramifications of inflation data on Fed policy decisions.

Nasdaq is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 33, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 15885.00, 16545.00

Support level: 15005.00, 14275.00

A complex picture emerged from China’s inflation landscape, adding layers of uncertainty to the nation’s economic prospects. China’s Consumer Price Index (CPI) for the last month outperformed expectations at 0.20%, indicating resilient demand. However, the Producer Price Index (PPI) revealed a 4.40% contraction in July, exceeding market predictions. This dichotomy left investors grappling for directional cues, particularly prompting the Chinese-proxy currencies, such as AUD/USD, to be traded flat.

AUD/USD is trading flat while currently testing the support level. However, MACD has illustrated increasing bullish momentum, while RSI is at 46, suggesting the pair might be traded higher since the RSI rebounded from its oversold territory.

Resistance level: 0.6615, 0.6725

Support level: 0.6520, 0.6460

Despite recent downbeat inventory figures, the oil market achieved a three-year peak, propelled by resolute optimism around OPEC+ production cuts. Bullish sentiment persists, as investors digest the upcoming OPEC+ production cut scheduled for September, announced earlier. Notably, this bullish momentum for the oil market is limited by the recent inventory data, which revealed a significant 5.851 million barrel increase in US oil inventories for the week ending August 4th, far surpassing market expectations.

Oil prices are trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 69, suggesting the commodity might enter overbought territory.

Resistance level: 86.10, 89.25

Support level: 83.20, 78.90

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.